Taxable Income Child Care Rebate Web If you have a partner their adjusted taxable income can also affect your payment Taxable income This applies to family assistance payments Carer Allowance and the

Web total net investment losses certain tax free pensions and benefits target foreign income We ll use your adjusted taxable income for the last relevant year not the current year Web The rebate is 30 of your out of pocket expenses for approved child care you had to pay in the previous year of income This means that for the 2005 06 income year you can

Taxable Income Child Care Rebate

Taxable Income Child Care Rebate

https://i.pinimg.com/originals/a3/58/24/a35824fc6d11236aaa9eca09b9fe7fb1.jpg

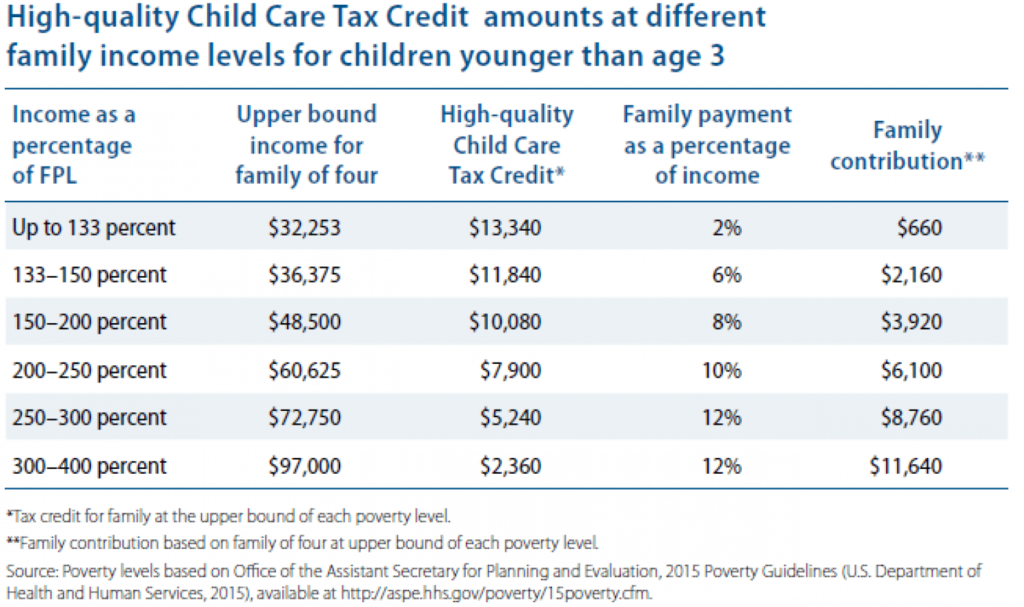

Promise The Children 2016 Child Care For All Promise The Children

https://www.promisethechildren.org/wp-content/uploads/child-care-tax-credit-1024x607.png

How Canada s Revamped Universal Child Care Benefit Affects You

https://images.huffingtonpost.com/2015-08-25-1440530964-2318919-Blog54_UCCB_table.png

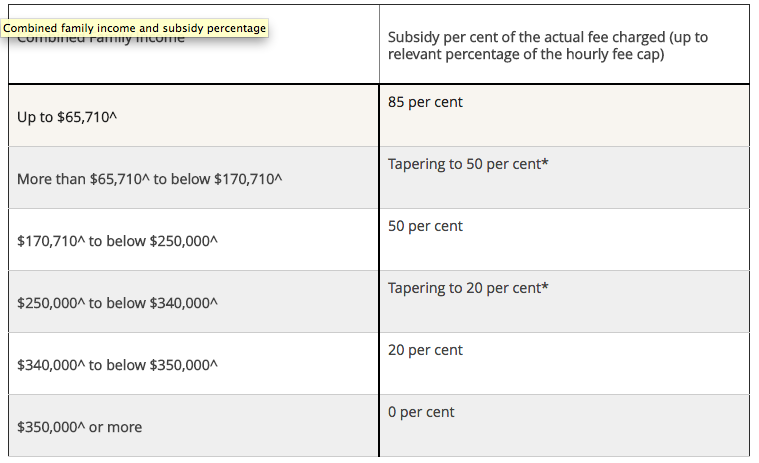

Web 10 juil 2023 nbsp 0183 32 The income cap for eligibility has been increased from 356 756 to 530 000 That will mean more higher income families will be eligible Caregivers don t need to do anything to get the increased rate Web If a family earns more than 189 390 per year and less than 353 680 then the total amount of CCS they can receive in 2020 21 is 10 560 per child the annual cap Families earning less than 189 390 per year do

Web The overpayment is 2 750 for FTB and Child Care Subsidy We ll use the 1 300 we withheld to reduce the amount of Child Care Subsidy owed They ll still have to pay back Web 7 janv 2020 nbsp 0183 32 4 3 3 50 Income from Child Care Work related child care rebate Income from child care includes money earned informally from baby sitting in the carer s home

Download Taxable Income Child Care Rebate

More picture related to Taxable Income Child Care Rebate

New Childcare Rebates And What They Mean For You Ellaslist Ellaslist

https://www.ellaslist.com.au/ckeditor_assets/pictures/1682/content_family_income_subsidy_childcare.png

Child Care Rebate Changes 2017 What It Means For You

https://cdn.newsapi.com.au/image/v1/30e248ff2877200e614bc2ca3adf011b

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

Web 10 juil 2023 nbsp 0183 32 The type of child care service your child attends We expand on each of these factors below 1 Combined family income The percentage of subsidy you are Web To do this you and your partner need to either lodge a tax return tell us if you don t need to lodge a tax return You must confirm your family income by 30 June of the following

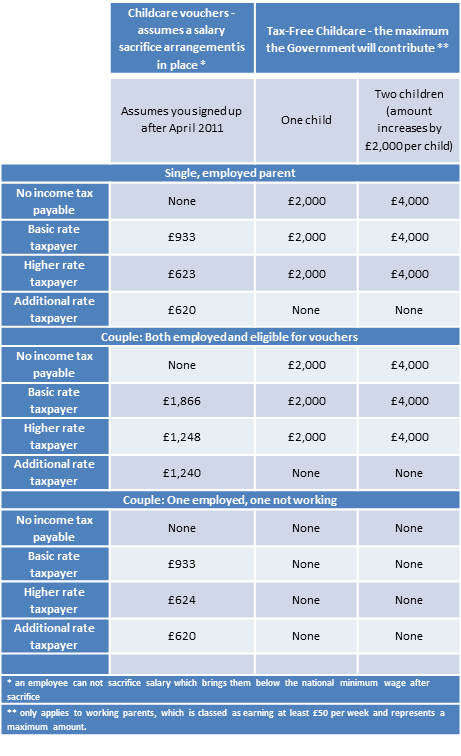

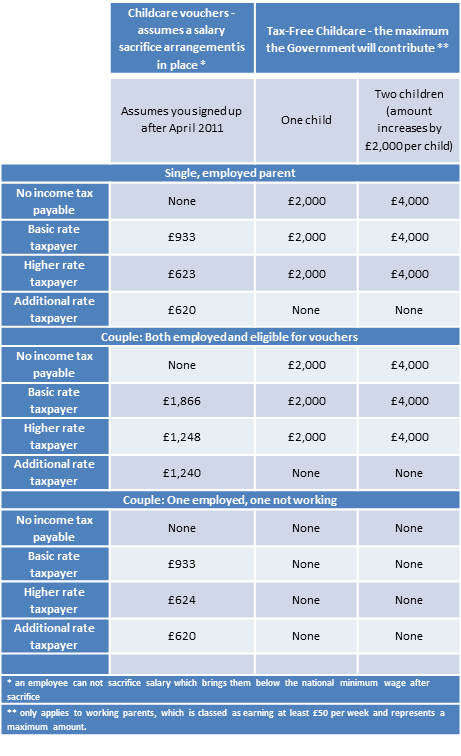

Web Families with more than one child aged 5 or younger may be eligible for a higher Child Care Subsidy CCS Changes to Child Care Subsidy From 10 July 2023 there are Web You can get up to 163 500 every 3 months up to 163 2 000 a year for each of your children to help with the costs of childcare This goes up to 163 1 000 every 3 months if a child is

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/child-care-tax-credit-payment-dates-2022-drift-hestia-bloger.jpg

https://www.servicesaustralia.gov.au/what-adjusted-taxable-income?...

Web If you have a partner their adjusted taxable income can also affect your payment Taxable income This applies to family assistance payments Carer Allowance and the

https://www.servicesaustralia.gov.au/how-we-use-adjusted-taxable...

Web total net investment losses certain tax free pensions and benefits target foreign income We ll use your adjusted taxable income for the last relevant year not the current year

Child Care Expenses Tax Credit Colorado Free Download

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Child Care Rebate Income Tax Return 2022 Carrebate

Child Care Rebate Form 3 Free Templates In PDF Word Excel Download

Child Care Expenses Tax Credit Colorado Free Download

New Tax free Childcare Is It The End Of Salary Sacrifice For

New Tax free Childcare Is It The End Of Salary Sacrifice For

Child Care Rebate Changes 2017 What It Means For You

College Tuition Check High Resolution Stock Photography And Images Alamy

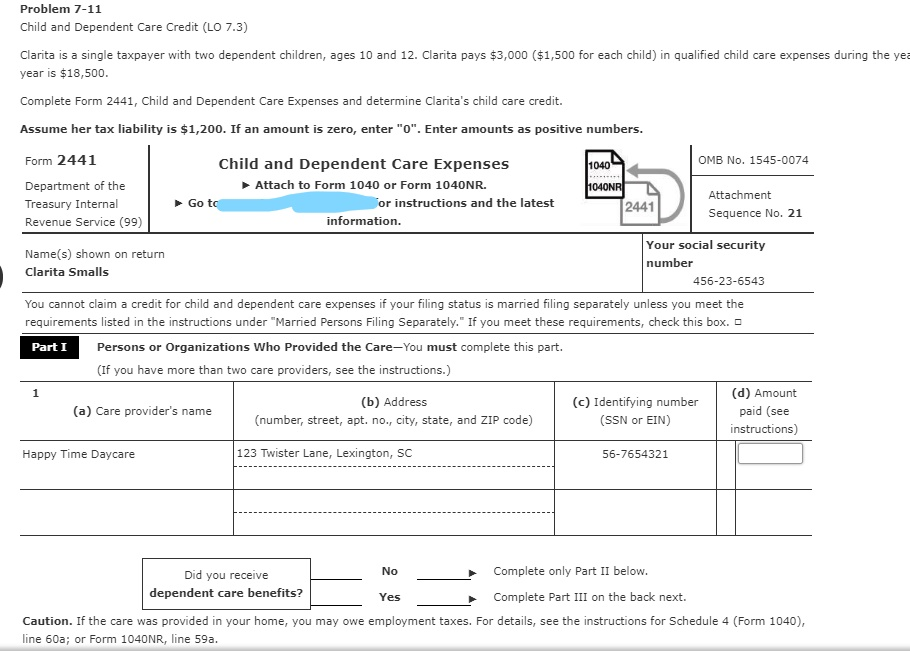

Problem 7 11 Child And Dependent Care Credit LO 7 3 Chegg

Taxable Income Child Care Rebate - Web Zero rate Further entitlement after the end of the financial year Child Care Rebate Child Care Rebate for CCB reduced fee customers Child Care Rebate for CCB Lump sum