Taxable Income Limit For Commonwealth Seniors Health Card Taxable income Customers need to include taxable income whether or not their income is below the tax free threshold or if they are not required to lodge a tax return as a result of an

Taxable income is included irrespective of whether it is above or below the tax free threshold See the Resources page for a link to the Services Australia website for adjusted taxable income To assess your eligibility for the Commonwealth Seniors Health Card Centrelink assess your Adjusted Taxable Income which includes your defined benefit PLUS deemed

Taxable Income Limit For Commonwealth Seniors Health Card

Taxable Income Limit For Commonwealth Seniors Health Card

https://abhahealth.com/wp-content/uploads/2023/03/cshc-1024x576.png

Changes To Eligibility For The Commonwealth Seniors Health Card Is A

https://www.canberratimes.com.au/images/transform/v1/crop/frm/jess.wallace/4b28f2b1-6ac8-4f46-ada2-db0b4040f54b.jpg/r0_0_6865_4577_w1200_h678_fmax.jpg

Commonwealth Seniors Health Card Eligibility Update MP

https://www.mckinleyplowman.com.au/wp-content/uploads/2022/10/Commonwealth-Seniors-Health-Card-–-Eligibility-Update-scaled.jpg

Meet the requirements of an annual income test based on adjusted taxable income plus deemed income from account based income streams refer to the Services Australia website for Since November last year single self funded retirees who have reached the government age pension age of 66 5 years can now qualify for a concessional seniors health card where their annual income

From 1 July 2009 the adjusted taxable income test for the Commonwealth Seniors Health Card CSHC was expanded to include reportable superannuation contributions To qualify for a CSHC the customer must satisfy all of the following criteria Customer does not receive a CSHC from DVA Note Prisoner of War Recognition Supplement from Department

Download Taxable Income Limit For Commonwealth Seniors Health Card

More picture related to Taxable Income Limit For Commonwealth Seniors Health Card

How To Apply For A Commonwealth Seniors Health Card Benefits And

https://retire.com.au/wp-content/uploads/2023/06/marcelo-leal-6pcGTJDuf6M-unsplash-2048x1365.jpg

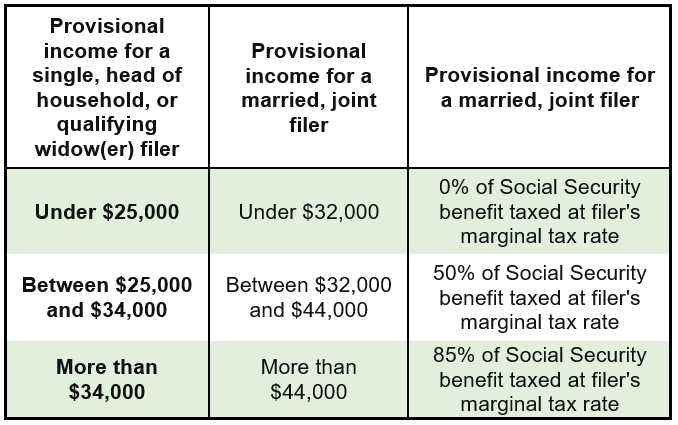

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

https://apprisewealth.com/wp-content/uploads/2021/08/6078d22e880cc80157173540_Provisional-Income-Table.png

Demand For Commonwealth Seniors Health Card CSHC To Surge

https://retirementessentials.com.au/wp-content/uploads/2023/07/commonwealth-seniors-health-card-concierge-service-1024x490.webp

Commonwealth Seniors Health Card continued Income limits You do not need to be retired to be eligible for a Commonwealth Seniors Health Card You may continue working but your total For the CSHC income test your adjusted taxable income includes your taxable income plus any additional income Your taxable income is your gross income such as wages and salary and income from a business or your

From 4 November 2022 the CSHC adjusted taxable income thresholds are 90 000 for singles previously 61 284 144 000 combined for couples previously 98 054 Does the Commonwealth Seniors Health Card singles 90 000 income test include the whole 110 000 or just the untaxed component of 60 000 which is the amount I must

Guide To The Commonwealth Seniors Health Card Catapult Wealth

https://www.catapultwealth.com.au/wp-content/uploads/2021/10/CSHC_Feature2.jpg-1080x675.png

What Concession Cards Are Available For Seniors And Pensioners

https://shakes.com.au/wp-content/uploads/2022/07/Untitled-design-2.png

https://operational.servicesaustralia.gov.au/...

Taxable income Customers need to include taxable income whether or not their income is below the tax free threshold or if they are not required to lodge a tax return as a result of an

https://operational.servicesaustralia.gov.au/...

Taxable income is included irrespective of whether it is above or below the tax free threshold See the Resources page for a link to the Services Australia website for adjusted taxable income

30 What Is The Commonwealth Seniors Health Card Will I Be Entitled To

Guide To The Commonwealth Seniors Health Card Catapult Wealth

Popular Commonwealth Seniors Health Card Now More Accessible

Benefits Of The Commonwealth Seniors Health Card

Retirees To Benefit From Commonwealth Senior s Card Eligibility Change

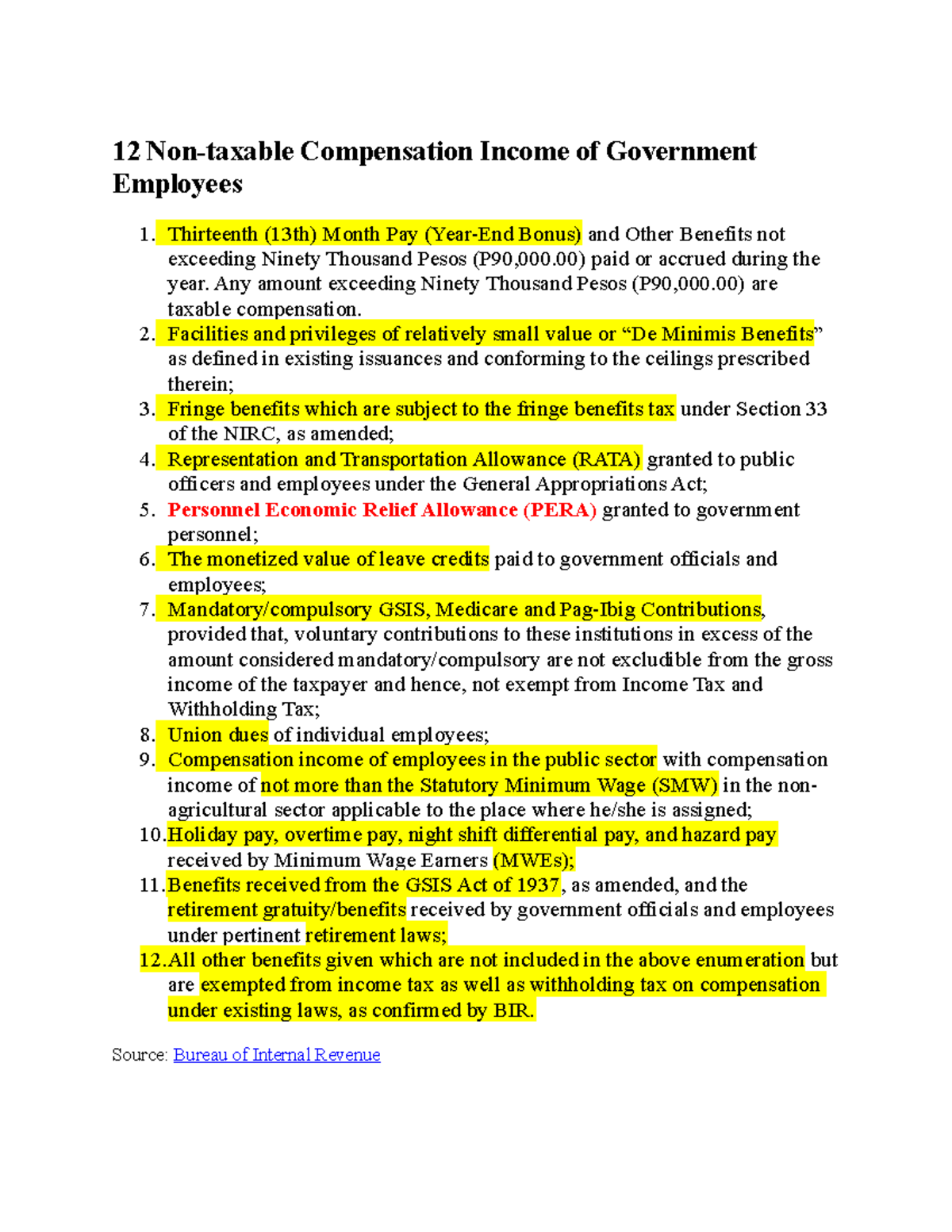

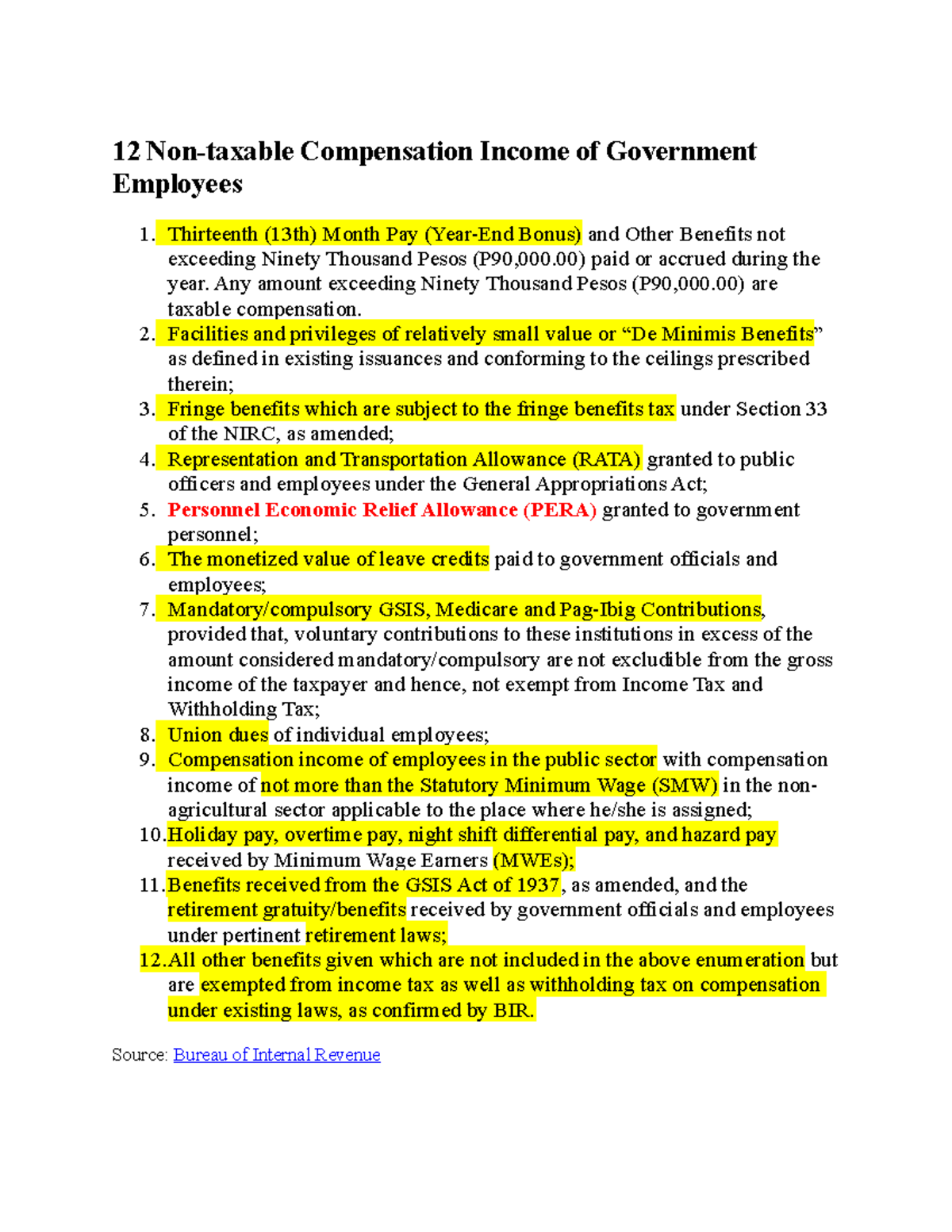

12 Non Taxable Compensation Of Government Employees 12 Non taxable

12 Non Taxable Compensation Of Government Employees 12 Non taxable

Commonwealth Seniors Health Card Gets A Facelift Department Of

Are You Eligible For A Commonwealth Seniors Health Card Crest

Commonwealth Seniors Health Card COTA NT

Taxable Income Limit For Commonwealth Seniors Health Card - Since November last year single self funded retirees who have reached the government age pension age of 66 5 years can now qualify for a concessional seniors health card where their annual income