Td 5 Nsf Fee An overdraft fee 35 is the cost of using our discretionary overdraft services when you need additional funds to cover a transaction We limit daily overdraft charges to 3 overdraft fees per day per account

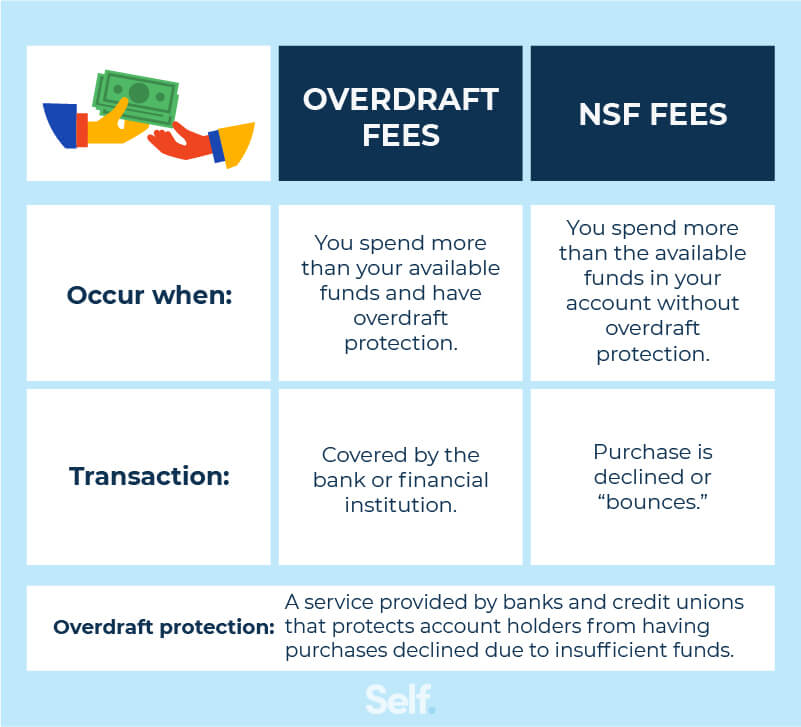

Key Takeaways Non sufficient fund fees or NSF fees are charged when you try to withdraw more money than you have in your account These fees are usually around 30 to 60 depending on your A non sufficient fund NSF fee is charged when your account becomes overdrawn Canada s Big Six banks typically charge between 45 to 48

Td 5 Nsf Fee

Td 5 Nsf Fee

https://images.ctfassets.net/90p5z8n8rnuv/2p0Fhwc6RjjXf0zWUx1yaN/adb880c68013516d1374993fe0c48eca/Non-Sufficient_Funds__NSF__Fees_Asset_-_01.jpg

NSF HSI Conference UPRM

http://uprm.edu/hsi_innovation/img/nsf-logo-1.png

F e

http://recueil-de-png.r.e.pic.centerblog.net/o/5362c10e.png

Overdraft protection can help avoid NSF fees Learn about overdraft fees and interest for TD RBC CIBC BMO Scotiabank and other banks NSF fees can range anywhere from 25 to 50 while overdraft fees can be as high as 35 to 40 NSF fees by Canadian Banks You can expect the following NSF fees in Canada

Non Sufficient Funds NSF fees also known as bounced cheques are charged when you attempt to make a transaction that exceeds the balance in your We would like to show you a description here but the site won t allow us

Download Td 5 Nsf Fee

More picture related to Td 5 Nsf Fee

F e

http://recueil-de-png.r.e.pic.centerblog.net/o/87045f6a.png

Go Electra For NSF

https://cdn.goelectra.com/app/uploads/2019/05/NSF.png

NSF Fees Non Sufficient Funds In Canada How To Avoid Them PiggyBank

https://piggybank.ca/wp-content/uploads/NSF-Fee.png

With TD Bank the NSF fee is 35 If a customer overdraws their account by more than 50 within 24 hours there is an option to return the overdraft fees once the funds in the account are restored Overdraft protection can help you avoid declined transactions late payment charges and non sufficient funds NSF fees Each NSF fee can be around 50 Overdraft protection

A 15 9 million settlement of the suit which focused on whether the bank had properly disclosed that customers could be twice charged the 48 non sufficient Account Related Information and Administration Fees About our Account and Related Services in PDF Format

What s An NSF Fee And Why Do Banks Charge It Credit Karma

https://creditkarma-cms.imgix.net/wp-content/uploads/2020/12/what-is-nsf-fee_1151349840.jpg

Fees Page 5

http://recueil-de-png.r.e.pic.centerblog.net/o/ad14dfa8.png

https://www.td.com/us/en/personal-bank…

An overdraft fee 35 is the cost of using our discretionary overdraft services when you need additional funds to cover a transaction We limit daily overdraft charges to 3 overdraft fees per day per account

https://moneygenius.ca/blog/nsf-fees

Key Takeaways Non sufficient fund fees or NSF fees are charged when you try to withdraw more money than you have in your account These fees are usually around 30 to 60 depending on your

WL2M8dbqyUYmoHtaEUwLmI05jDnIP

What s An NSF Fee And Why Do Banks Charge It Credit Karma

FEE Control Exhibition Menouf

Gif F e

Fair Fee Training And Projects Pty Ltd Rustenburg

About NSF

About NSF

Social Creatures

F e

NSF Fee Lawsuit Lawyers Class Action Lawsuit Investigation

Td 5 Nsf Fee - We would like to show you a description here but the site won t allow us