Tennessee Estate Tax Exemption 2023 Though Tennessee has no estate tax there is a federal estate tax that may apply to you if your estate is of sufficient value There is a

Estate Tax Exemption Basic Exclusion Amount 12 920 000 Applicable Credit Amount 5 113 800 Generation Skipping Transfer GST Tax Exemption Critically you won t owe any estate taxes in Tennessee since there aren t any Tennessee estate taxes but you will owe Federal estate taxes as the federal gift

Tennessee Estate Tax Exemption 2023

Tennessee Estate Tax Exemption 2023

https://static.twentyoverten.com/5e78ba71d62eee51f5ffc2d0/FSOghNwDjT/IRS-update.jpg

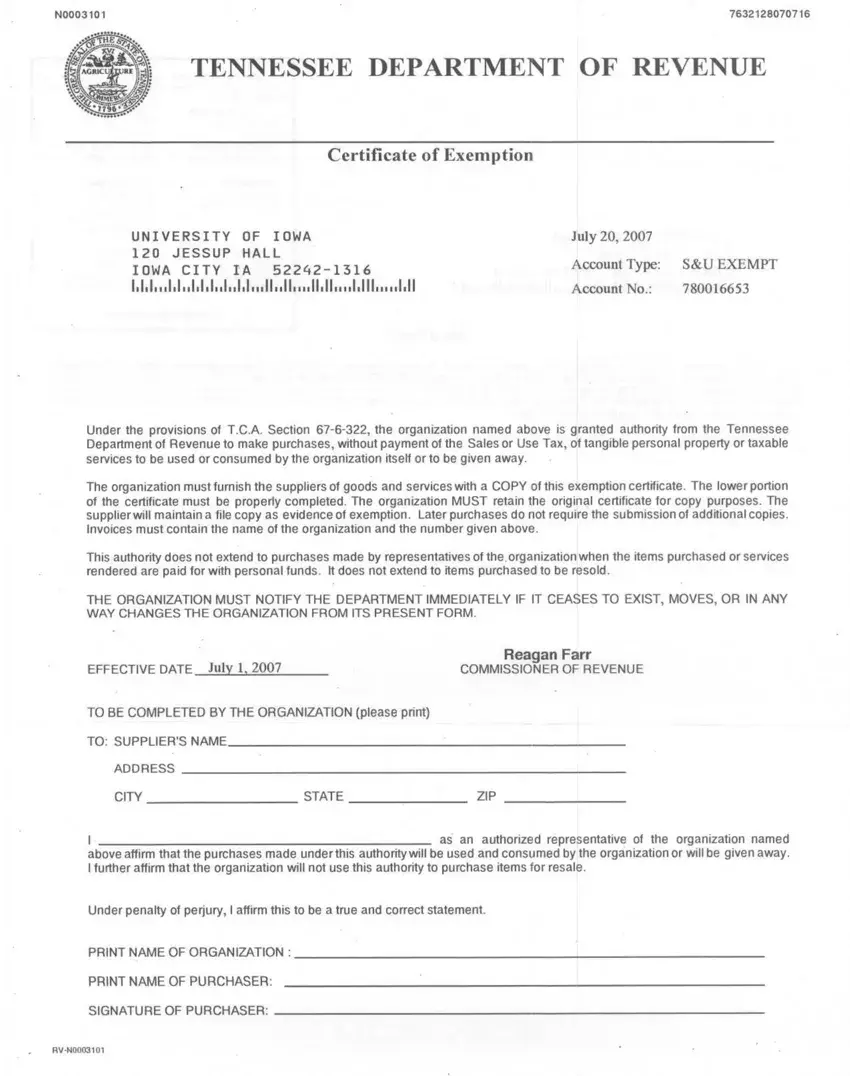

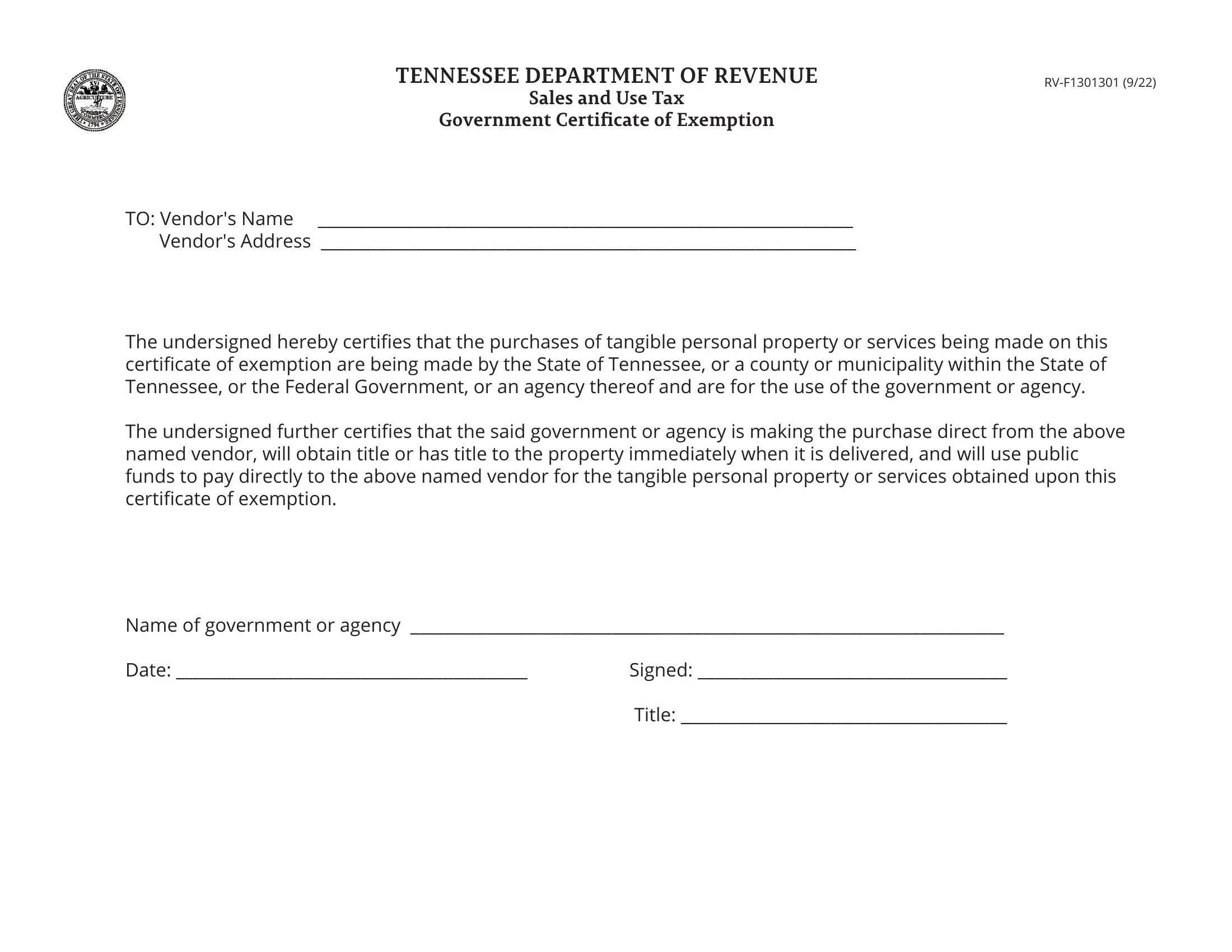

Sstgb Form F0003 Exemption Certificate 2019 State Of Tennessee Fill

https://www.pdffiller.com/preview/0/138/138571/large.png

Tennessee Exemption Certificate PDF Form FormsPal

https://formspal.com/pdf-forms/other/tennessee-exemption-certificate/tennessee-exemption-certificate-preview.webp

Estates of Tennessee residents with a gross value in excess of the exemption allowed for the year of death must file an inheritance tax return Form INH 301 Also estates of A Guide to Tennessee Inheritance and Estate Taxes We last updated the A Guide to Tennessee Inheritance and Estate Taxes in February 2024 so this is the latest version

No Tennessee is an inheritance tax and estate tax free state Those who handle your estate following your death though do have some other tax returns to take care of such as Final individual federal Inheritance tax is imposed on the value of the decedent s estate that exceeds the exemption amount applicable to the decedent s year of death The net

Download Tennessee Estate Tax Exemption 2023

More picture related to Tennessee Estate Tax Exemption 2023

Massachusetts Estate Tax Table Brokeasshome

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-EstateTax-Napkin-12-14-20-v06.jpg

Federal Estate Tax Exemption Sunset The Sun Is Still Up But It s

https://monumentwealthmanagement.com/wp-content/uploads/2022/08/Federal-Estate-Tax-Exemption-Sunset-scaled.jpg

Tennessee Estate Tax

https://s.yimg.com/ny/api/res/1.2/bls.i4_c0_R6kffZEhwvzg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTM1Mg--/https://media.zenfs.com/en-US/smartasset_475/3699bc4760d7cd72ef0481b91d88d33e

The following table lists federal estate tax rates based on the taxable amount which is the value of the estate minus the 12 92 million exclusion Data source Tennessee stopped imposing an inheritance tax after December 31 2015 However it s important to note that a federal estate tax may apply if the value of the deceased

If you pass away in Tennessee with an estate less than 1 million there is no inheritance tax The executor will determine which form is necessary and go from there Appraisals What is the Inheritance Tax in Tennessee Since Tennessee is not a state that imposes an inheritance tax the inheritance tax in 2024 is 0 zero As a result you

Estate Tax Exemption Changes Coming In 2026 Estate Planning

https://i0.wp.com/legacygroupny.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-03-at-11.32.59-PM.png?w=758&ssl=1

Tn Exemption Form Fill Out Printable PDF Forms Online

https://formspal.com/pdf-forms/other/tn-exemption-form/tn-exemption-form-preview.webp

https://smartasset.com/.../tennessee-es…

Though Tennessee has no estate tax there is a federal estate tax that may apply to you if your estate is of sufficient value There is a

https://www.tennlaw.com/04/2023-estate-and-gift-tax-exemptions

Estate Tax Exemption Basic Exclusion Amount 12 920 000 Applicable Credit Amount 5 113 800 Generation Skipping Transfer GST Tax Exemption

Historical Estate Tax Exemption Amounts And Tax Rates

Estate Tax Exemption Changes Coming In 2026 Estate Planning

IRS Raises 2023 Estate Tax Exclusion To 12 92 Million Up From 12 06

Tennessee Estate Tax

Estate Tax Exemptions After 2025 Info For High Net Worth Families

Which States Have The Lowest Property Taxes Property Tax History

Which States Have The Lowest Property Taxes Property Tax History

Explaining The Federal Estate Tax Exemption 2023 24

House Republicans Reintroduce Bill To Repeal death Tax

Printable Tennessee Sales Tax Exemption Certificate Fill Out Sign

Tennessee Estate Tax Exemption 2023 - No Tennessee is an inheritance tax and estate tax free state Those who handle your estate following your death though do have some other tax returns to take care of such as Final individual federal