Term Insurance Rebate In Income Tax Web 3 ao 251 t 2021 nbsp 0183 32 The premiums that you pay can be deducted from your taxable income allowing for significant tax savings What s more the payout and maturity benefits you receive from your insurance plan are

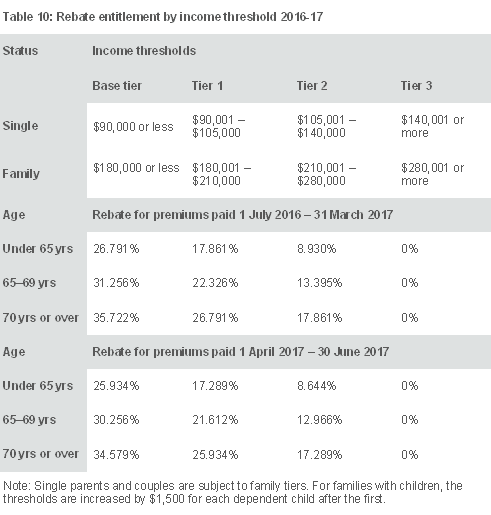

Web 16 mars 2023 nbsp 0183 32 Generally tax benefit on a term insurance plan is claimed under the following three 3 sections of the Income Tax Act Term Web You can claim term insurance tax benefit 80D when you file for returns for tax

Term Insurance Rebate In Income Tax

Term Insurance Rebate In Income Tax

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

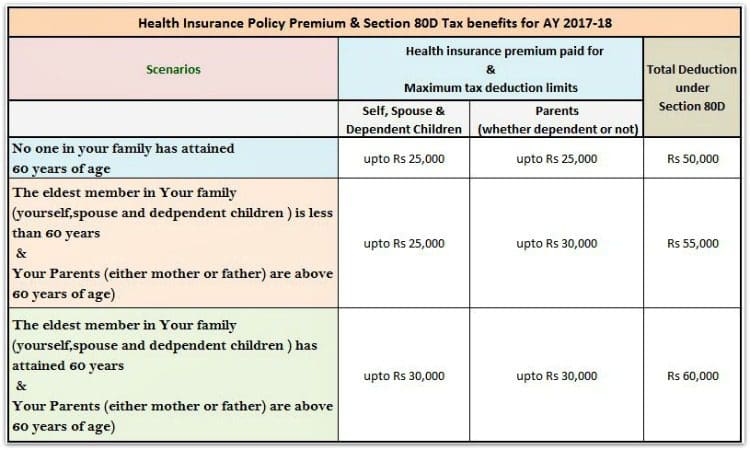

Medicare Levy Surcharge Private Health Insurance What s The Link

https://www.blgba.com.au/hs-fs/hubfs/Imported_Blog_Media/Table-10.png?width=609&height=639&name=Table-10.png

Rebating Meaning In Insurance What Is Insurance Rebating The

https://economictimes.indiatimes.com/img/60155156/Master.jpg

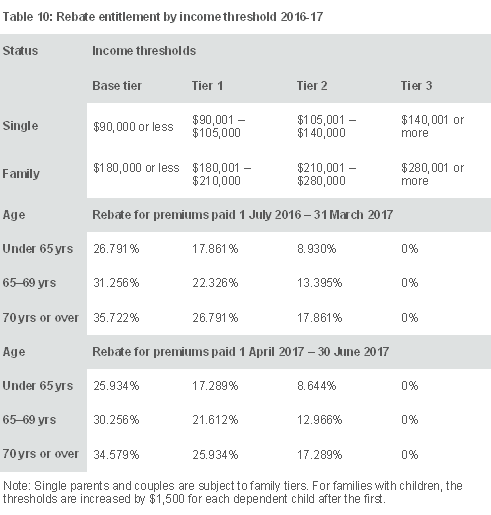

Web Choosing term insurance gives you tax benefits under Section 80C and 10 10D of the Income Tax Act 1961 the Act subject to provisions stated therein Under Section 80C you can claim a deduction of up to Rs 1 5 Web 6 sept 2023 nbsp 0183 32 When it comes to Term Life Insurance you can claim tax rebates under 3

Web For term insurance plans issued before March 31 2012 the term insurance benefits in income tax are applicable if the annual premium is under twenty percent of the sum assured Section 80D However it also Web Typically all term insurance policies offer customers tax deductions under Section 80C

Download Term Insurance Rebate In Income Tax

More picture related to Term Insurance Rebate In Income Tax

ISelect What You Need To Know Tax Rebates On Health Insurance And

https://www.iselect.com.au/content/uploads/2017/06/Rebates-Table.jpg

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Web With effect from 1 April 2023 if traditional policy policies including term insurance Web 2 mai 2023 nbsp 0183 32 A resident individual with taxable income up to Rs 5 00 000 will be eligible for a tax rebate of Rs 12 500 or the amount of tax payable whichever is lower Under the new income tax regime the amount of

Web Term insurance is one such tax saving tool Aside from the tax benefits of term Web 19 avr 2023 nbsp 0183 32 Term Insurance Tax Benefits Under Sections 80C and 10 10D With your

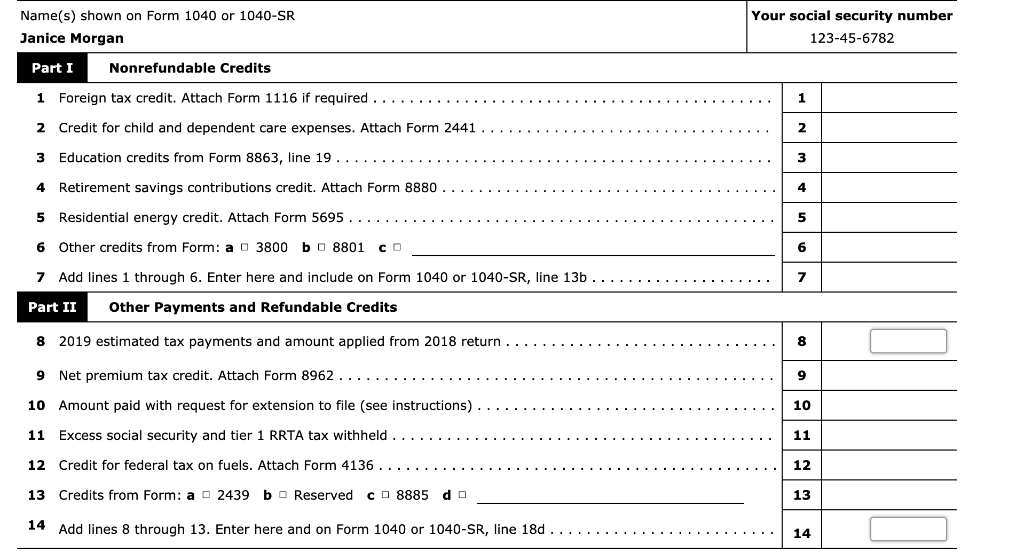

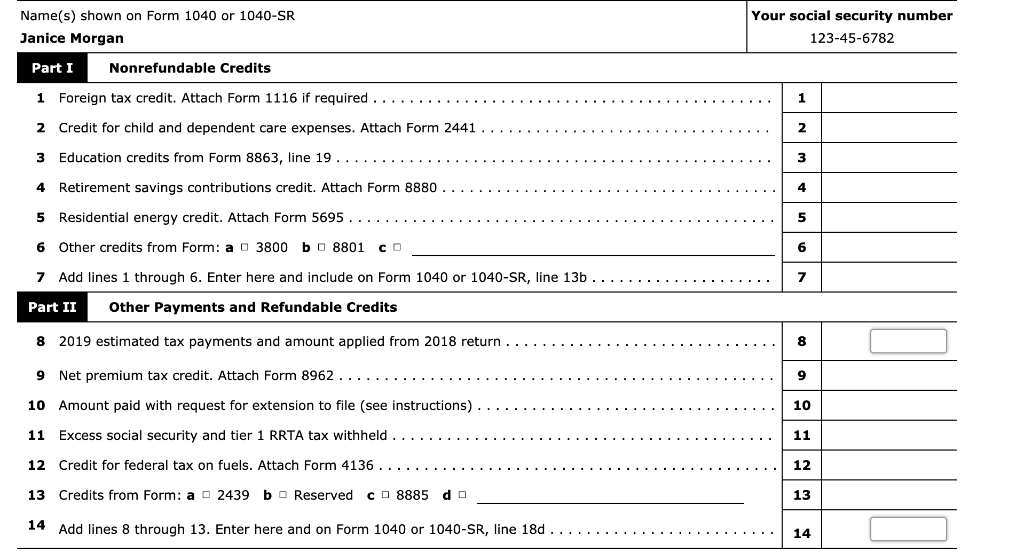

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

https://www.hdfclife.com/insurance-knowledg…

Web 3 ao 251 t 2021 nbsp 0183 32 The premiums that you pay can be deducted from your taxable income allowing for significant tax savings What s more the payout and maturity benefits you receive from your insurance plan are

https://www.canarahsbclife.com/term-insuran…

Web 16 mars 2023 nbsp 0183 32 Generally tax benefit on a term insurance plan is claimed under the following three 3 sections of the Income Tax Act Term

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

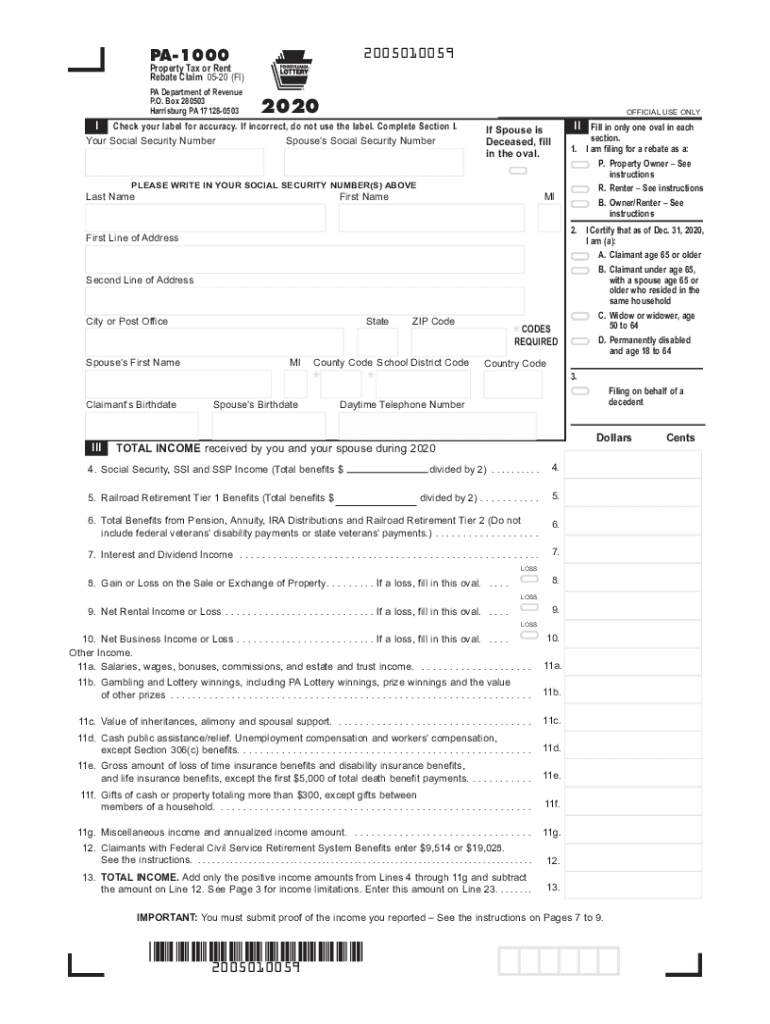

2020 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Term Insurance Rebate In Income Tax - Web 6 sept 2023 nbsp 0183 32 When it comes to Term Life Insurance you can claim tax rebates under 3