Term Plan Tax Rebate Web 3 ao 251 t 2021 nbsp 0183 32 Since term plans today also offer some health cover you can also enjoy term plan tax benefits under this section You can claim an additional amount of INR 25 000 under Section 80D of the Income

Web 26 sept 2017 nbsp 0183 32 Section 80 C of the Income Tax Act 1961 allows tax exemption up to Rs 1 5 lakhs p a on your Term Insurance plan or Moneyback plan But who can avail this Web 26 juil 2022 nbsp 0183 32 When it comes to Term Life Insurance you can claim tax rebates under 3 sections Section 80C Section 80D amp Section 10 10D You can claim up to 1 5 lakhs

Term Plan Tax Rebate

Term Plan Tax Rebate

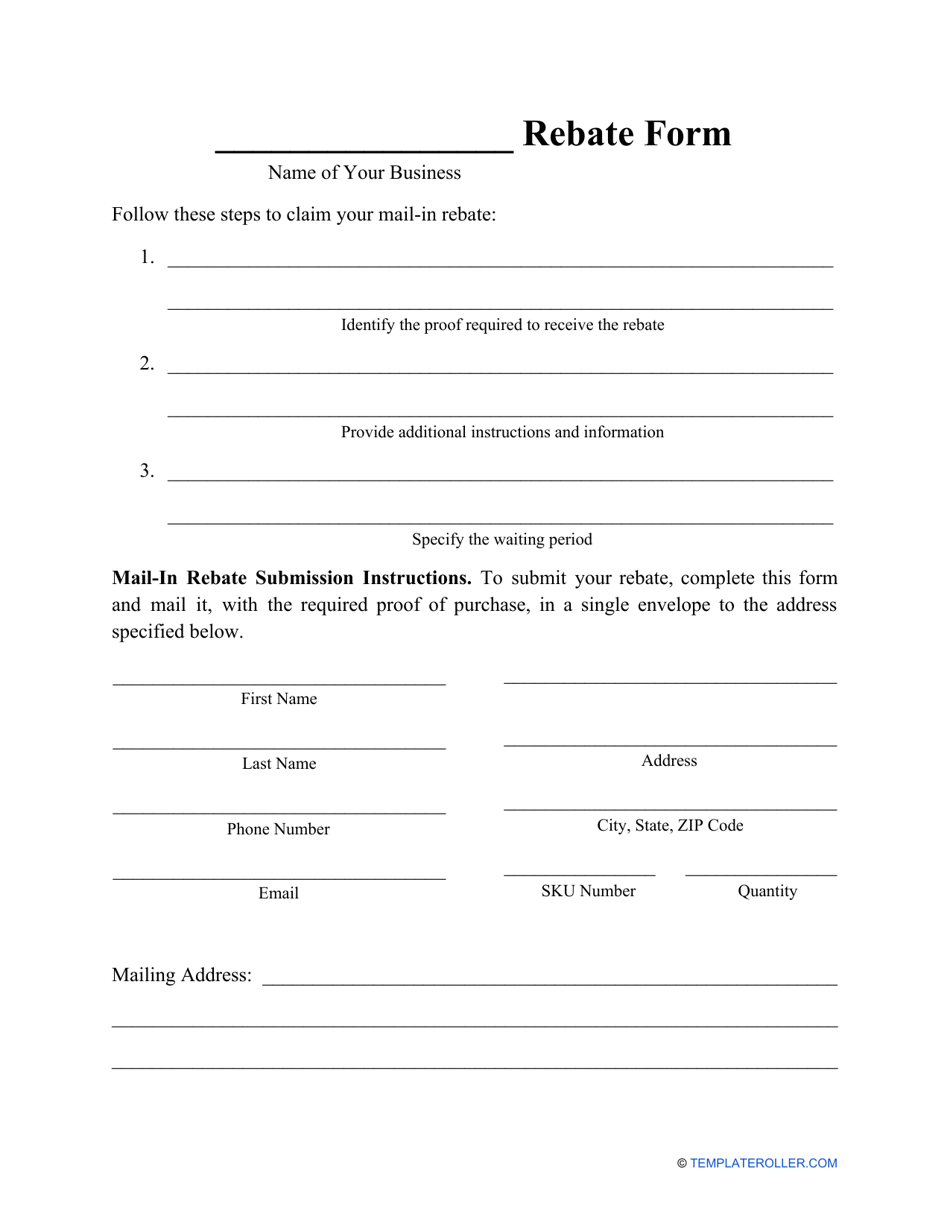

https://data.templateroller.com/pdf_docs_html/2100/21003/2100371/rebate-form_print_big.png

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Web Under Section 80C you can claim a deduction of up to Rs 1 5 lakh annually on the premiums you have paid Under Section 10 10D the death benefit of your term insurance policy is exempt from income tax so long as the Web You can get a tax deduction of up to 1 5 lakhs under Section 80C for the premiums you pay towards your term insurance plan This Section offers a deduction for all the listed investments like PPF EPF ULIP and ELSS

Web You can claim tax deductions of up to Rs 75 000 under section 80D of the Income Tax Act This section is only applicable to term insurance with health riders included in the plan Web Tax benefits of term Insurance Plan Check all the benefits offered by term insurance and protect your family by providing financial stability in case of early demise Find out the term plan tax benefits as well on Max Life

Download Term Plan Tax Rebate

More picture related to Term Plan Tax Rebate

Menards 11 Rebate 4468 Purchases 8 19 18 8 25 18

https://i0.wp.com/struggleville.net/wp-content/uploads/2018/08/MenardsRebate4468.jpg?w=1400&ssl=1

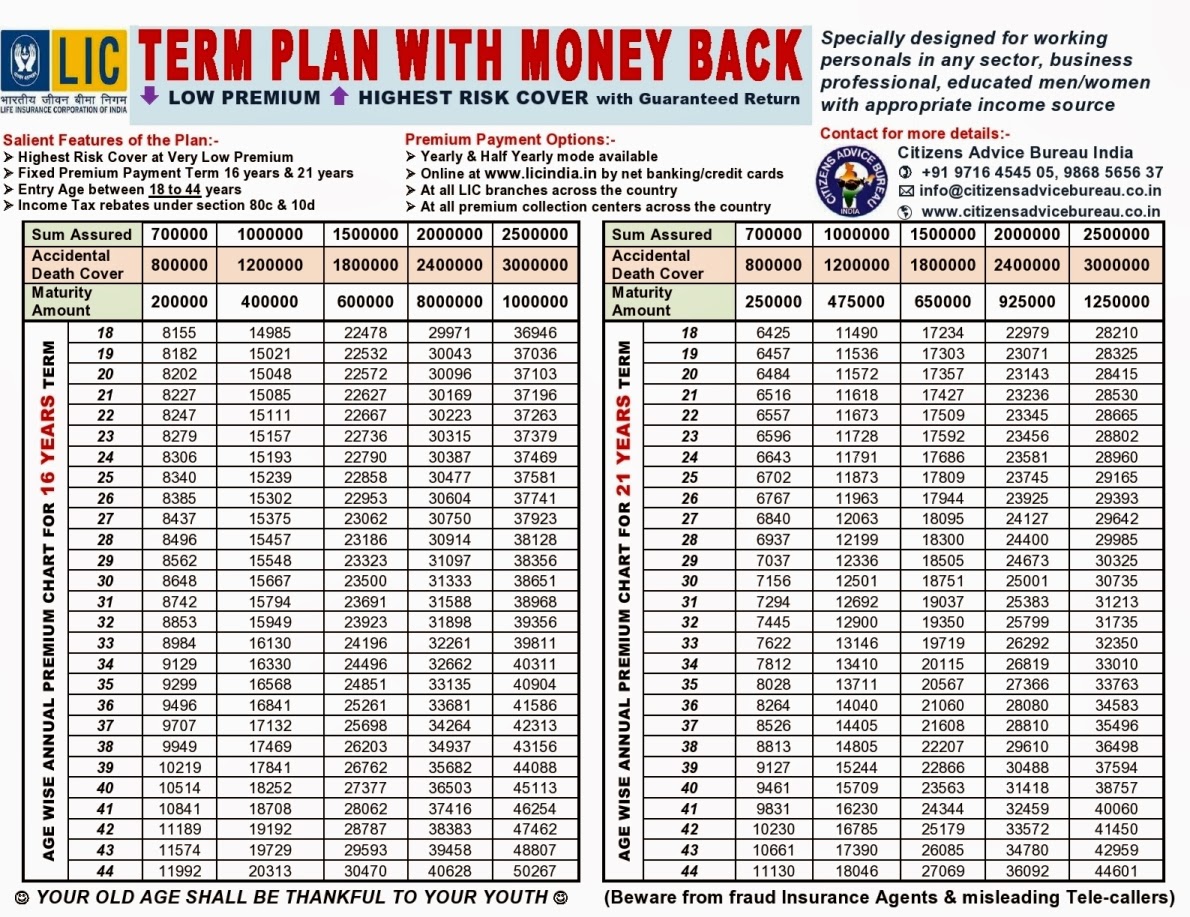

Citizens Advice Knowledge Centre

http://2.bp.blogspot.com/-K0JGhsxI_F4/UvkF3s1VIjI/AAAAAAAAATM/UkItTH-Xq8s/s1600/LIC+Term+Plan+with+Money+Back.jpg

Tax Rebates Made Simple YouTube

https://i.ytimg.com/vi/EFZn93RDFJI/maxresdefault.jpg

Web Term Insurance Tax Rebates Under Section 80C of ITA Section 80C under the Income Tax Act is the most widely used tool to save tax by individuals The section allows the Web Typically all term insurance policies offer customers tax deductions under Section 80C of the Income Tax Act 1961 along with further deductions up to an amount of Rs 1 5 lakhs

Web Get Term Plan Coverage of 1 Crore Starting From Just 16 Day Tax Benefit Up to 1 50 000 Claim Support Everyday 10AM 7PM 45 Lacs Happy Customers Standard Web 1 How can I maximise term insurance tax benefits You can maximise your term insurance tax benefits by opting for suitable riders Riders are optional and can be

Performance Incentive Plan Template Inspirational Sample Bonus Plan

https://i.pinimg.com/736x/0b/d9/03/0bd903400937f51e8b9908ce051df671.jpg

Download Form P87 For Claiming Uniform Tax Rebate DNS Accountants

http://www.dnsassociates.co.uk/assets/img/blog/how-to-fill-the-form-p87.png

https://www.hdfclife.com/insurance-knowledg…

Web 3 ao 251 t 2021 nbsp 0183 32 Since term plans today also offer some health cover you can also enjoy term plan tax benefits under this section You can claim an additional amount of INR 25 000 under Section 80D of the Income

https://www.coverfox.com/term-insurance/articles/term-insurance-tax...

Web 26 sept 2017 nbsp 0183 32 Section 80 C of the Income Tax Act 1961 allows tax exemption up to Rs 1 5 lakhs p a on your Term Insurance plan or Moneyback plan But who can avail this

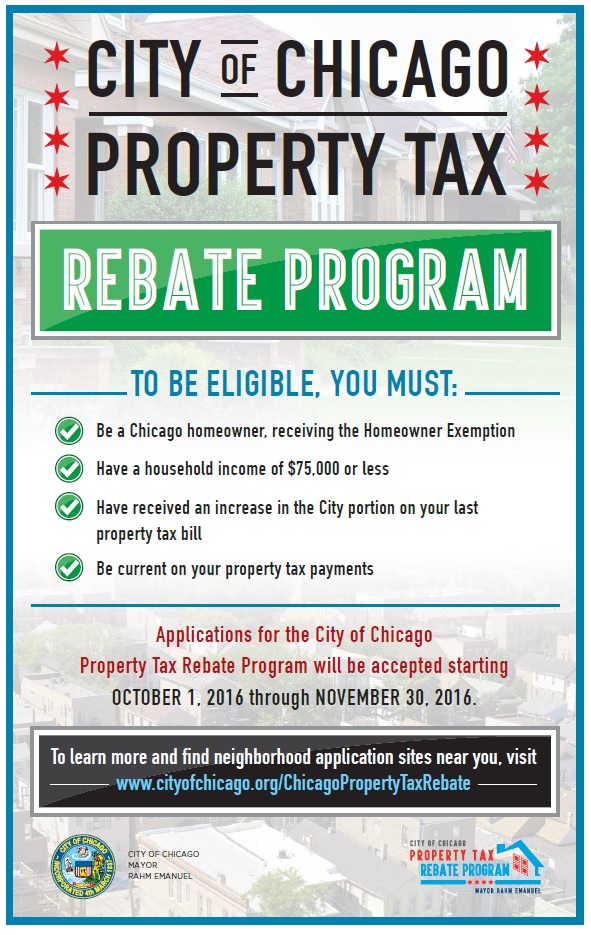

Uptown Update Property Tax Rebate Program Open Through November

Performance Incentive Plan Template Inspirational Sample Bonus Plan

Albertans Will Pay Either Provincial Or Federal Carbon Tax Which Will

Tax Rebate Services Hi res Stock Photography And Images Alamy

Term Insurance Plans By Lic Daily Blog Networks

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

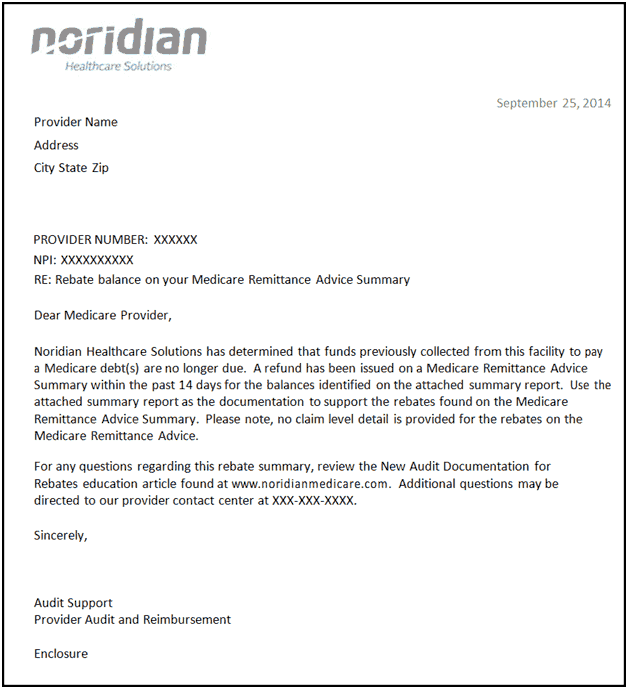

Rebate Summary Letters JE Part A Noridian

Tax Rebates Made Simple YouTube

Special Offer 10 Off Concept Stock Illustration Illustration Of

Term Plan Tax Rebate - Web You can claim tax deductions of up to Rs 75 000 under section 80D of the Income Tax Act This section is only applicable to term insurance with health riders included in the plan