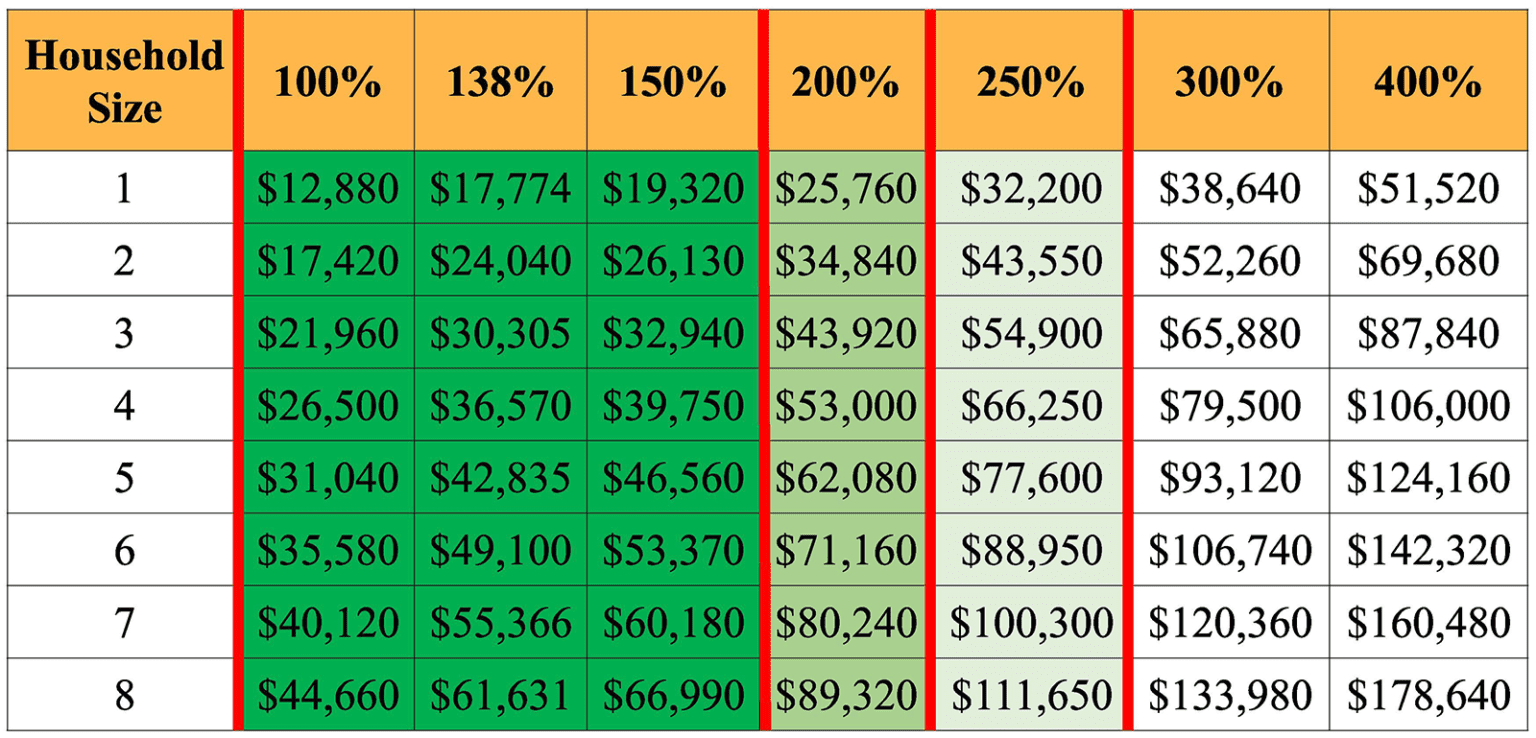

Tesla Tax Credit Income Limit 2023 Under the Inflation Reduction Act certain electric vehicles qualify for a 7 500 tax credit For additional details visit the IRS website Your Adjusted Gross Income AGI cannot exceed a

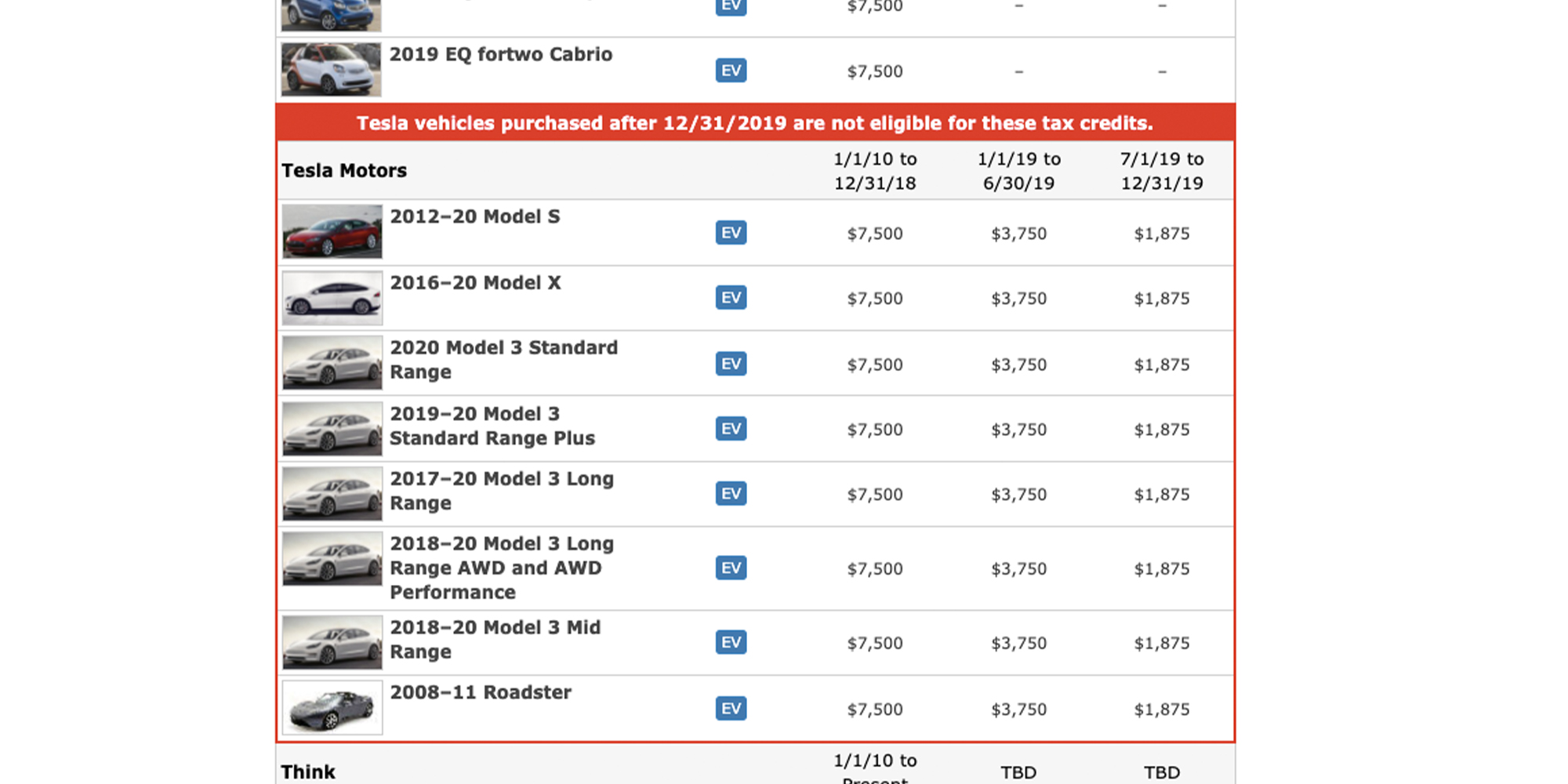

Eligible taxpayers who placed in service an eligible vehicle on or after January 1 2023 may claim the credit on their tax return based on the updated vehicle classification Tesla tax credit Tesla models like the Model Y and all Model 3 versions were eligible for the full 7 500 EV credit through the 2023 tax year However not all Tesla models

Tesla Tax Credit Income Limit 2023

Tesla Tax Credit Income Limit 2023

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1c4DLg.img

Congress Passes 1 2 Trillion Infrastructure Bill 12 500 EV Tax

https://electrek.co/wp-content/uploads/sites/3/2021/11/Tesla-Tax-Credits.jpg

.png)

Health Insurance Income Limits For 2023 To Receive ACA Premium S

https://img1.wsimg.com/isteam/ip/cdfbdeb1-9bb8-4d54-828b-6c8a27c8b1f0/image (1).png

Tesla Tax Credit 2023 income limit The Internal Revenue Service allows for a clean vehicle tax credit of up to 7 500 for 2023 Tesla has several qualifying models including Q6 What is the amount of the new clean vehicle credit updated March 31 2023 A6 Beginning Jan 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 The

There are NO income caps on the CURRENT 7 5k EV tax credit a credit which is available on other EV s that have NOT yet reached the 200k sales cap The income limits Assuming you take a standard deduction and you take no other refundable tax credits your income needs to be above the following amounts to get the full 7 500 tax credit 67k if

Download Tesla Tax Credit Income Limit 2023

More picture related to Tesla Tax Credit Income Limit 2023

Maximize Your Paycheck Understanding FICA Tax In 2024

https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png

What Is The Income Limit For Aca Subsidies 2022 2022 Top Virals

https://i2.wp.com/www.financialsamurai.com/wp-content/uploads/2013/10/ACA-income-limit-for-subsidies.png

Earned Income Tax Credit EITC Who Qualifies

https://assets-global.website-files.com/600089199ba28edd49ed9587/63ab2cfeb6ed4e84980e9602_5Q05z7zzxkuPsQXDnaB9jShs6SVdcb0uB84DMBeLXFAIZJwwSAmHnQ4a7WbGqdLfxs9kSpNnGo8K3YMonR0wgBTu--Pgkhfuie7pFBG4XhGd3Kj-sMXIsb9rNoZWGXn0fc0IkJZa7T7C3Hhn3f492M_Gdep5jUnJluN29uavkjwe4XzK-GPA4B6nDNjE00CQKNhoDAt7LA.png

You can use the lower of either the preceding tax year or the current tax year to qualify So if you buy in 2023 and filing taxes in 2024 you can use either 2022 preceding tax year or 2023 current tax year income For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are eligible Click

The federal EV tax credit is worth up to 7 500 for qualifying new electric vehicles and 4 000 for qualifying used electric vehicles Tesla Model 3 up to 7 500 all versions according to the manufacturer as of June 2 2023 confirmed on June 5 2023 Tesla Model X up to 7 500 only the Long Range version

Earned Income Credit Table 2017 Cabinets Matttroy

https://boxelderconsulting.com/wp-content/uploads/2022/11/Screen-Shot-2022-11-17-at-12.22.52-PM.png

How To Qualify For Tesla Tax Credit In 2023 ZiiSaa

https://ziisaa.com/wp-content/uploads/2023/08/How-To-Qualify-for-Tesla-Tax-Credit.jpg

https://www.tesla.com › IRA

Under the Inflation Reduction Act certain electric vehicles qualify for a 7 500 tax credit For additional details visit the IRS website Your Adjusted Gross Income AGI cannot exceed a

https://www.irs.gov › newsroom › topic-b-frequently...

Eligible taxpayers who placed in service an eligible vehicle on or after January 1 2023 may claim the credit on their tax return based on the updated vehicle classification

EV Tax Credit 2024 Credits Zrivo

Earned Income Credit Table 2017 Cabinets Matttroy

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

FAQ WA Tax Credit

ACA Tax Credits To Help Pay Premiums White Insurance Agency

2023 Tax Brackets The Best Income To Live A Great Life

2023 Tax Brackets The Best Income To Live A Great Life

Aca Percentage Of Income 2022 INCOMUNTA

Tesla Passed 200 000 US Electric Car Deliveries In July GM Will Pass

EV Tax Credit 2023 New Rule Changes And What s Ahead Kiplinger

Tesla Tax Credit Income Limit 2023 - There are NO income caps on the CURRENT 7 5k EV tax credit a credit which is available on other EV s that have NOT yet reached the 200k sales cap The income limits