Tesla Tax Credit Rebate Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses

Your 2023 Clean Vehicle Report IRS form 15400 is available by request through your Tesla Account You will need this document to claim your 2023 EV tax credit To request your Clean Vehicle Report document follow these steps Go to tesla contactus Sign in using your Tesla Account email address and password As of April 2024 the following fully electric and plug in hybrid vehicles may be eligible for either a full or partial tax credit if delivered on or after Jan 1 2024 The IRS urges taxpayers

Tesla Tax Credit Rebate

Tesla Tax Credit Rebate

https://media.valuethemarkets.com/img/Whatisataxcredit__685660f27b96fbc6e0edb67eb5c59039.jpg

Tesla s Genius Pricing Plan To Save You Thousands My Tech Methods

https://mytechmethods.com/wp-content/uploads/2021/09/tesla-tax-credit-2021-copy-2.jpg

Tesla Tax Credit 2021 Colorado Remona Gass

https://tflcar.com/wp-content/uploads/2021/01/tesla-model-s-scaled.jpeg

Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only Now the tax credit applies to clean vehicles rather than plug in vehicles allowing a credit for hydrogen fuel cell EVs as well as plug in hybrid and battery EVs

A Model 3 starts at 40 240 and the price may fall to 25 240 when the 7 500 federal tax credit and another 7 500 from the California tax rebate kick in depending on income and other requirements The Internal Revenue Service allows for a clean vehicle tax credit of up to 7 500 for 2023 Tesla has several qualifying models including Tesla Model 3 Standard Range Rear Wheel Drive

Download Tesla Tax Credit Rebate

More picture related to Tesla Tax Credit Rebate

Tesla Says All New Model 3s Now Qualify For Full 7 500 Tax Credit

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1c4DLg.img

Tesla Model 3 Becomes A 31k Car With CA s CVRP Rebate

https://www.teslarati.com/wp-content/uploads/2023/01/tesla-model-3-profile-1024x683.jpeg

Tesla Stock Surges As All Model 3 Sedans Now Qualifies For Full EV Tax

https://s.yimg.com/ny/api/res/1.2/A4a.LVlBNDtzFQ1v2kxpyw--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MA--/https://s.yimg.com/os/creatr-uploaded-images/2023-06/f48fc560-04a2-11ee-be3b-3d6e4f95f27b

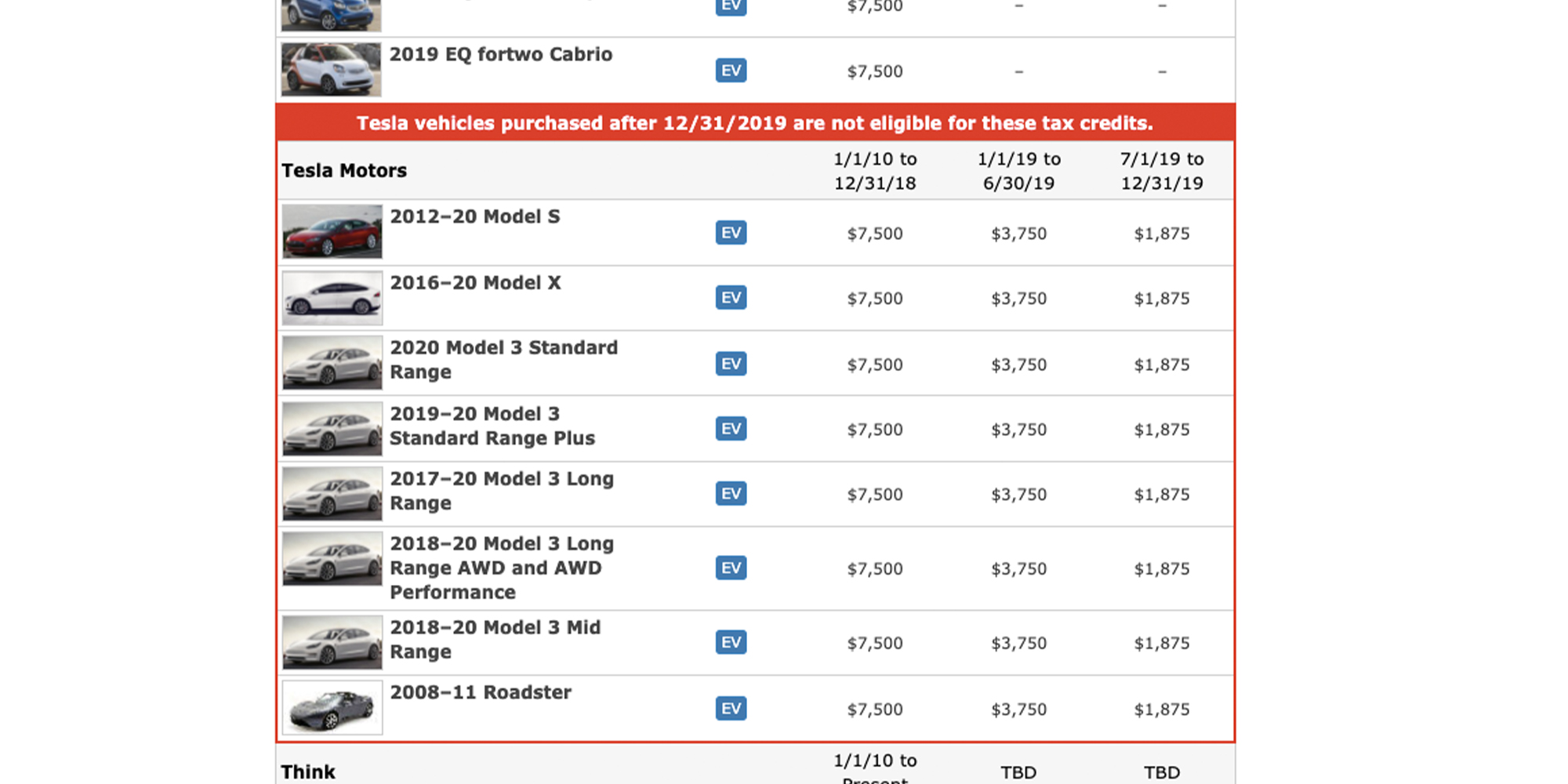

The full 7 500 federal tax credit for Tesla customers ends in less than two weeks and we re doing everything we can to try to ensure those who order a vehicle today can take delivery by December 31st and take advantage of the savings As of January 1 2024 the federal EV tax credit has become a point of sale rebate Go to the dealer agree to purchase an electric or plug in hybrid electric car that qualifies for the

Sasha Lekach Deputy Editor Published Jun 6 2023 Tesla s Model 3 and Model Y lineups get a price cut thanks to a federal tax credit The complete Tesla Model 3 and Y lineup now 134 Comments The IRS has now released its full list of electric vehicle models eligible for the new and updated 7 500 US federal tax credit Here s the list of Tesla models eligible The

Tesla s 7 500 Tax Credit Goes Poof But Buyers May Benefit WIRED

https://media.wired.com/photos/5c2d066ca213105887f0d233/master/w_2400,c_limit/Tesla-1023754606.jpg

Congress Passes 1 2 Trillion Infrastructure Bill 12 500 EV Tax

https://electrek.co/wp-content/uploads/sites/3/2021/11/Tesla-Tax-Credits.jpg

https://www. irs.gov /credits-deductions/credits-for...

Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses

https://www. tesla.com /support/ira-clean-vehicle-report/2023

Your 2023 Clean Vehicle Report IRS form 15400 is available by request through your Tesla Account You will need this document to claim your 2023 EV tax credit To request your Clean Vehicle Report document follow these steps Go to tesla contactus Sign in using your Tesla Account email address and password

Tesla Models Hit Cut Off For Full 7 500 Government Rebate Carscoops

Tesla s 7 500 Tax Credit Goes Poof But Buyers May Benefit WIRED

Tesla Confirms Hitting Federal Tax Credit Threshold 7 500 Credit Cut

Latest EV Tax Credit Status Tesla Motors Club

How To Qualify For Tesla Tax Credit In 2023 ZiiSaa

Cash Or Credit Free Stock Photo Public Domain Pictures

Cash Or Credit Free Stock Photo Public Domain Pictures

Tax Credit Universal Credit Impact Of Announced Changes House Of

3 6 Hours Left To Get A Tesla With 7 500 US Tax Credit

Elon Musk Promises To Repay Tax Credit If Tesla Misses Year End Delivery

Tesla Tax Credit Rebate - Now the tax credit applies to clean vehicles rather than plug in vehicles allowing a credit for hydrogen fuel cell EVs as well as plug in hybrid and battery EVs