Texas Property Tax Homestead Exemption Trust Today we are discussing the property tax exemption only Section 11 13 of the Texas Tax Code provides for the homestead property tax exemption generally In order for property owned by a trust to qualify for the homestead property tax exemption the trust must be considered a Qualifying Trust

A general homestead exemption in Texas can save you money on property taxes by lowering the taxable value of your home by up to 100 000 for school taxes Senior homeowners disabled homeowners disabled veterans and military or first responder spouses can claim additional exemptions Maintaining Homestead Tax Exemptions through a Qualifying Trust A revocable living trust needs to contain express language specific to homestead protections prescribed by Texas law That means that the trust document itself must state that The property shall be protected against execution on a judgment as per Texas Constitution

Texas Property Tax Homestead Exemption Trust

Texas Property Tax Homestead Exemption Trust

https://i.ytimg.com/vi/1EcmMvUwEp8/maxresdefault.jpg

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

How To Fill Out Texas Homestead Exemption Form 50 114 The Complete

https://res.cloudinary.com/agiliti/image/upload/v1669104038/texas-homestead-exemption-form-section-1.webp

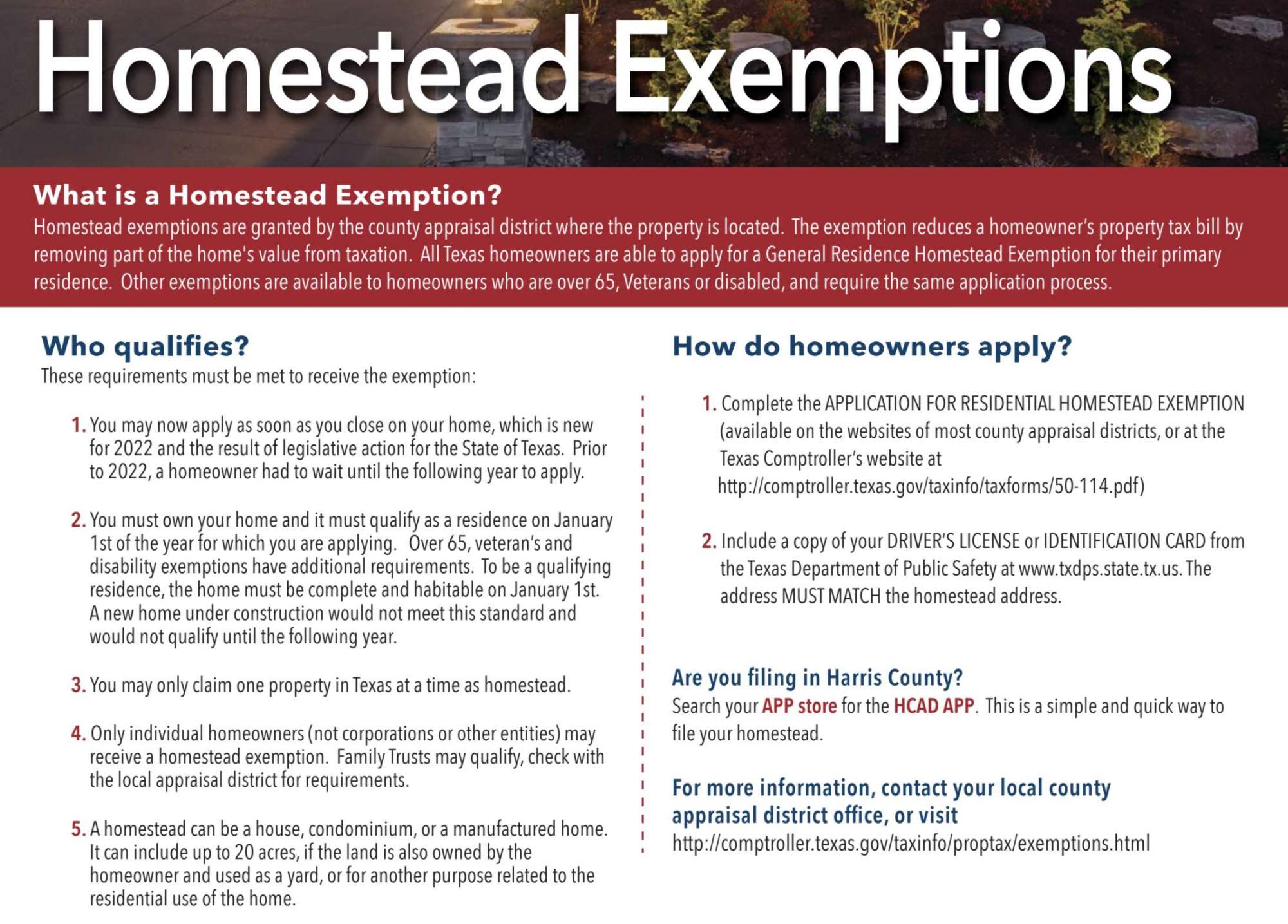

Do I as a homeowner get a tax break from property taxes Do all homes qualify for residence homestead exemptions What is a residence homestead What residence homestead exemptions are available How do I get a general 40 000 residence homestead exemption What is the deadline for filing a residence homestead exemption There is a new provision that now makes a Trust Will Trust a qualifying Trust for Texas homestead purposes This allows estate planners to preserve this important exemption that can save them thousands of dollars on property taxes and remove their primary residence from the probate process

Homestead exemptions can help lower the property taxes on your home Here learn how to claim a homestead exemption You might be able to claim a homestead exemption based on whether you are 65 or older have a disability or are a veteran of the military This article explains how to get a homestead exemption on a property you inherited in Texas Last Updated on January 17 2023 Here you will learn the application process for a homestead exemption as an heir property owner including how to apply when there are multiple heirs

Download Texas Property Tax Homestead Exemption Trust

More picture related to Texas Property Tax Homestead Exemption Trust

PRORFETY Homestead Property Tax Exemption Kissimmee Fl

https://i.ytimg.com/vi/QXPFtfP_0fU/maxresdefault.jpg

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

Texas Homestead Tax Exemption

https://sistaticv2.blob.core.windows.net/rattikin/img/resources/Texas-Homestead-Law-Revision-2023-01-12422513.jpg

They should contain language that 1 claims homestead protections against execution on a judgment pursuant to Texas Constitution Article XVI Section 50 and Property Code Chapters 41 and 42 and 2 preserves any available homestead tax exemption whether currently on file or not Under Texas law a homestead is a structure designed for human residence used by its owner or owners as a main residence These exemptions from assessment in valuation include a homestead exemption as well as an additional exemption for an owner who is 65 or older or disabled

Source Section 41 0021 Homestead in Qualifying Trust https statutes capitol texas gov Docs PR htm PR 41 htm 41 0021 accessed May 18 2024 In this section qualifying trust means an express trust in which the instrument or court order creating the express trust an instrument Texas law provides a variety of property tax exemptions for qualifying property owners Local taxing units offer partial and total exemptions from a qualifying property s appraised value A partial exemption removes a percentage or a fixed dollar amount of a property s value from taxation

Texas Homestead Exemption Form Fill Out Printable PDF Forms Online

https://formspal.com/pdf-forms/other/texas-homestead-exemption-form/texas-homestead-exemption-form-preview.webp

Texas Homeowners Gain Significant Tax Relief With New Homestead

https://bshscampuscrier.com/wp-content/uploads/2024/01/6-1.png

https://www.sprouselaw.com/qualifying-trusts-for...

Today we are discussing the property tax exemption only Section 11 13 of the Texas Tax Code provides for the homestead property tax exemption generally In order for property owned by a trust to qualify for the homestead property tax exemption the trust must be considered a Qualifying Trust

https://www.texasrealestatesource.com/blog/...

A general homestead exemption in Texas can save you money on property taxes by lowering the taxable value of your home by up to 100 000 for school taxes Senior homeowners disabled homeowners disabled veterans and military or first responder spouses can claim additional exemptions

Life Estate Texas Homestead Exemption Inspire Ideas 2022

Texas Homestead Exemption Form Fill Out Printable PDF Forms Online

Homestead Exemption

Texas Property Tax Exemptions For Seniors Lower Your Taxes

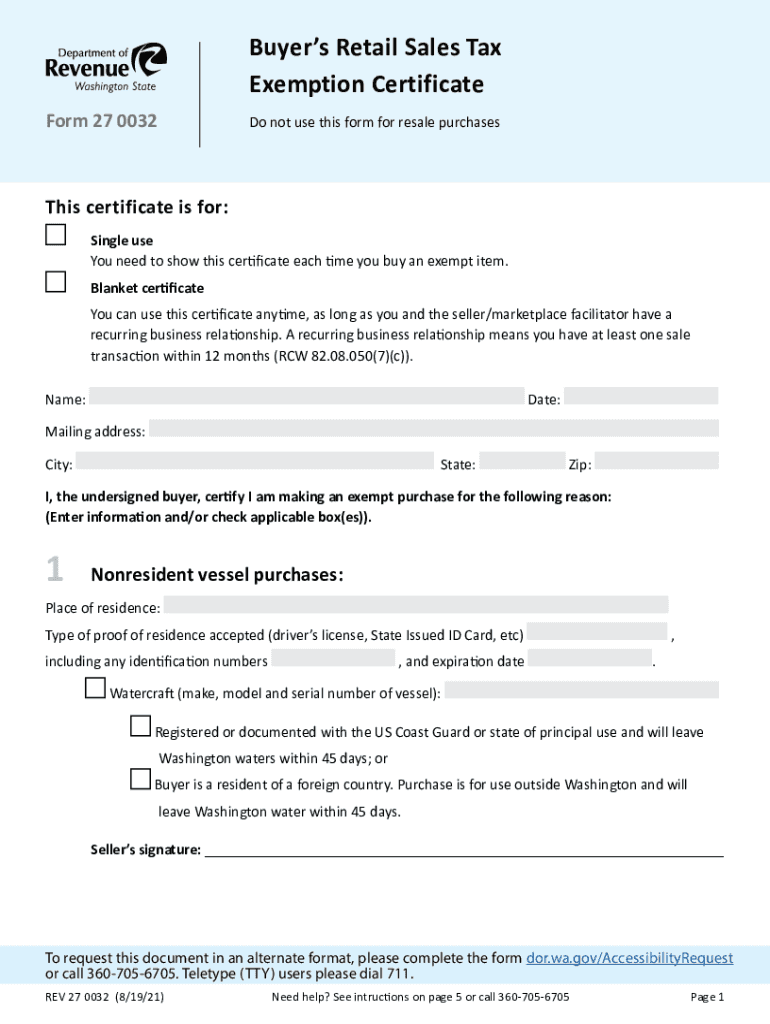

Wa Exemption Certificate Complete With Ease AirSlate SignNow

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

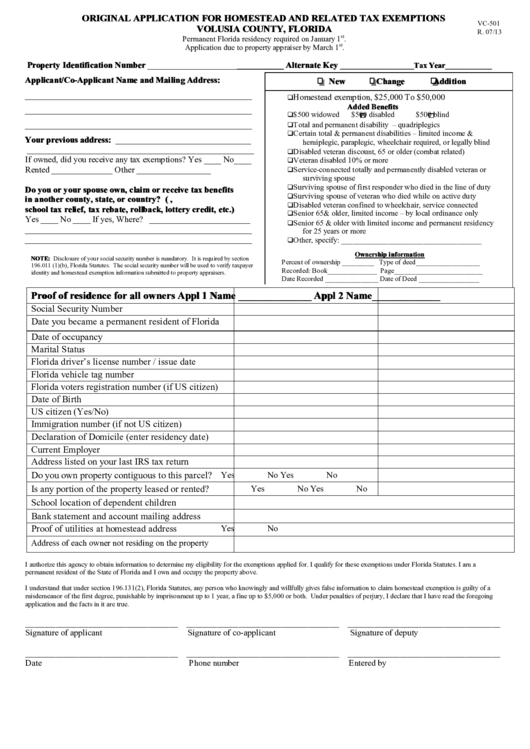

Florida Homestead Tax Exemption Form ExemptForm

Texas Homestead Exemption Explained Houston s Premier Property

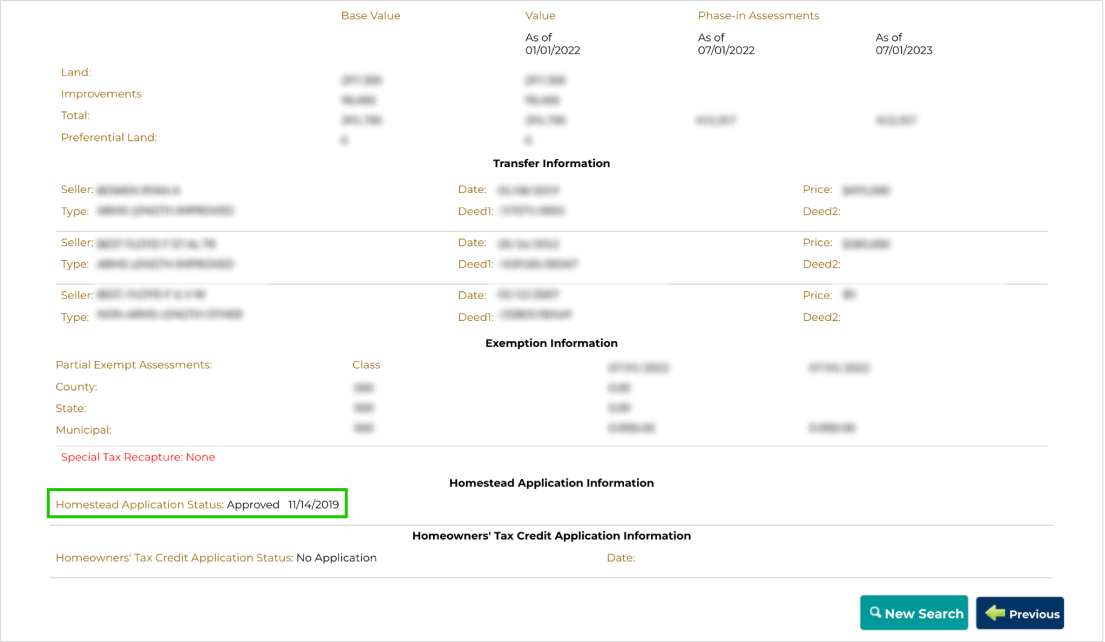

Homestead Tax Credit

Texas Property Tax Homestead Exemption Trust - This article explains how to get a homestead exemption on a property you inherited in Texas Last Updated on January 17 2023 Here you will learn the application process for a homestead exemption as an heir property owner including how to apply when there are multiple heirs