Texas Property Tax Return Due Date This calendar shows important property tax deadlines for appraisal districts taxing units and property owners Unless otherwise noted all sections are Tax Code citations

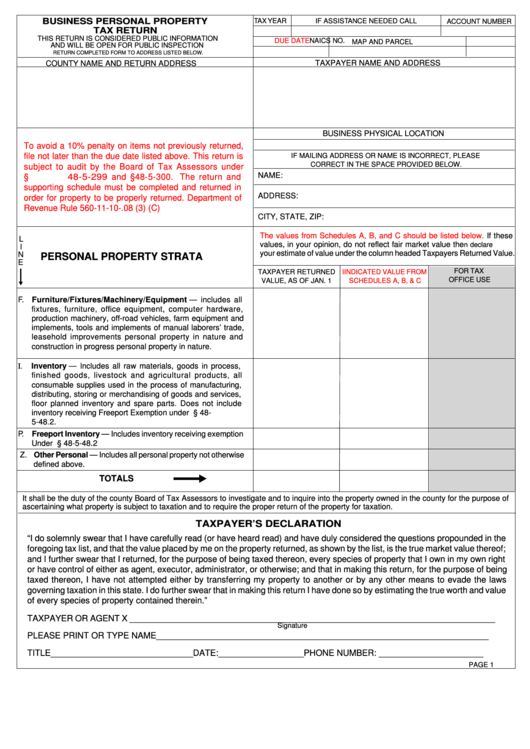

For applicable taxes quarterly reports are due in April July October and January Note When a reporting due date happens to fall on Saturday Sunday or a federal legal Texas requires filing an annual business personal property tax return that lists all assessable personal property owned by a business as of January 1 The return

Texas Property Tax Return Due Date

Texas Property Tax Return Due Date

https://loganmartinrealtypros.com/wp-content/uploads/2021/04/177543769_313969630174178_2688524765217555803_n.jpg

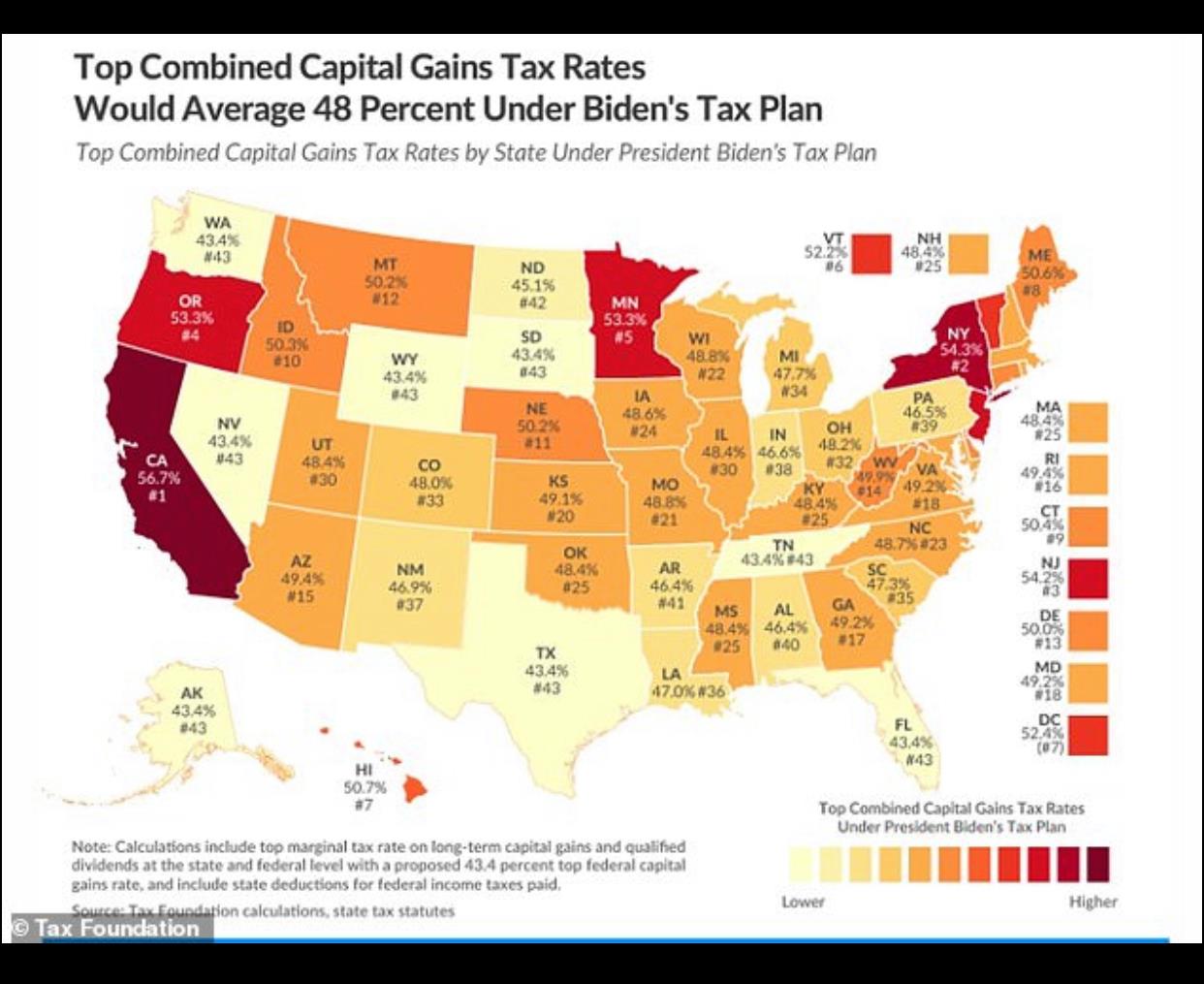

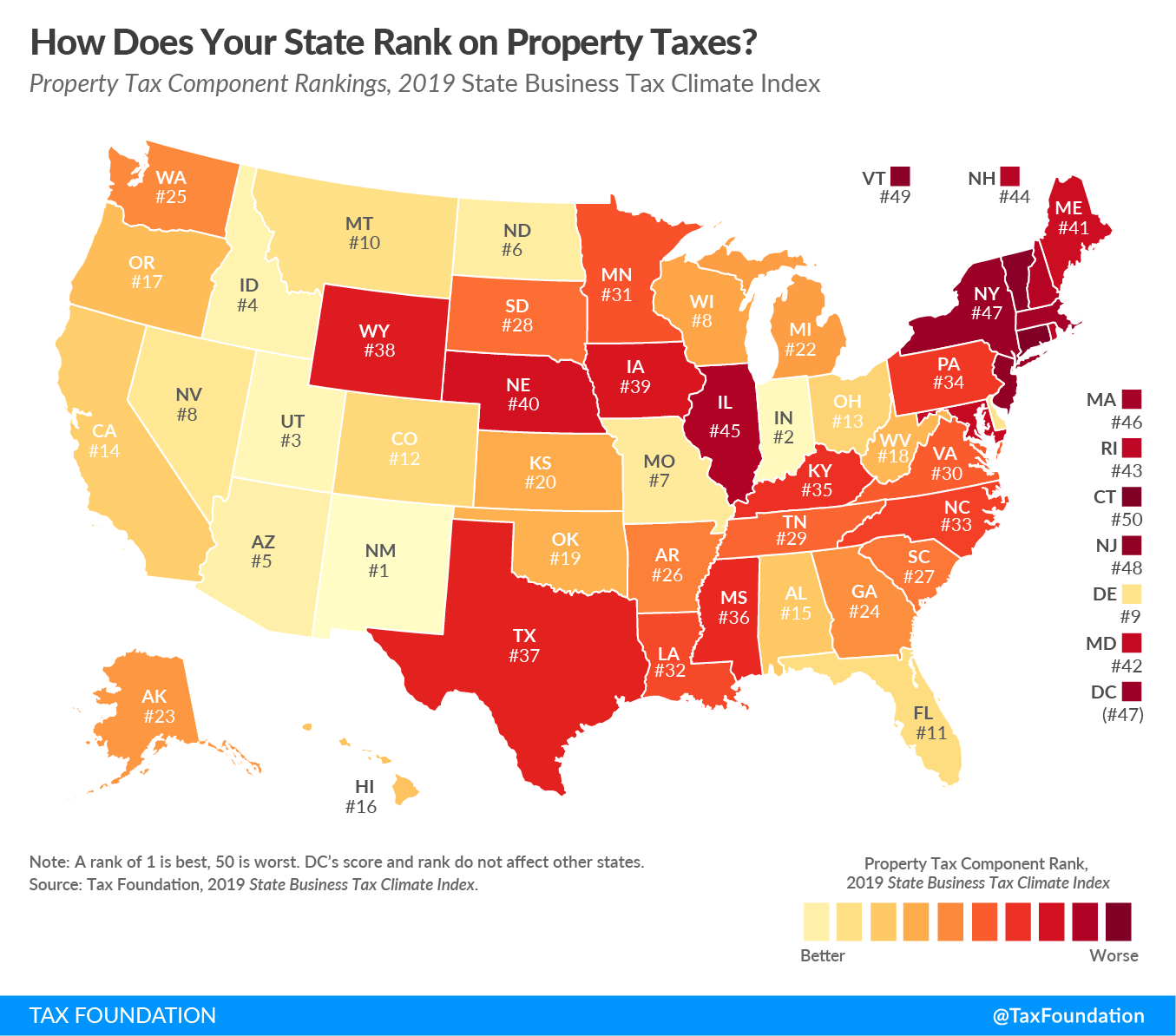

The Kiplinger Tax Map Guide To State Income Taxes State Sales Texas

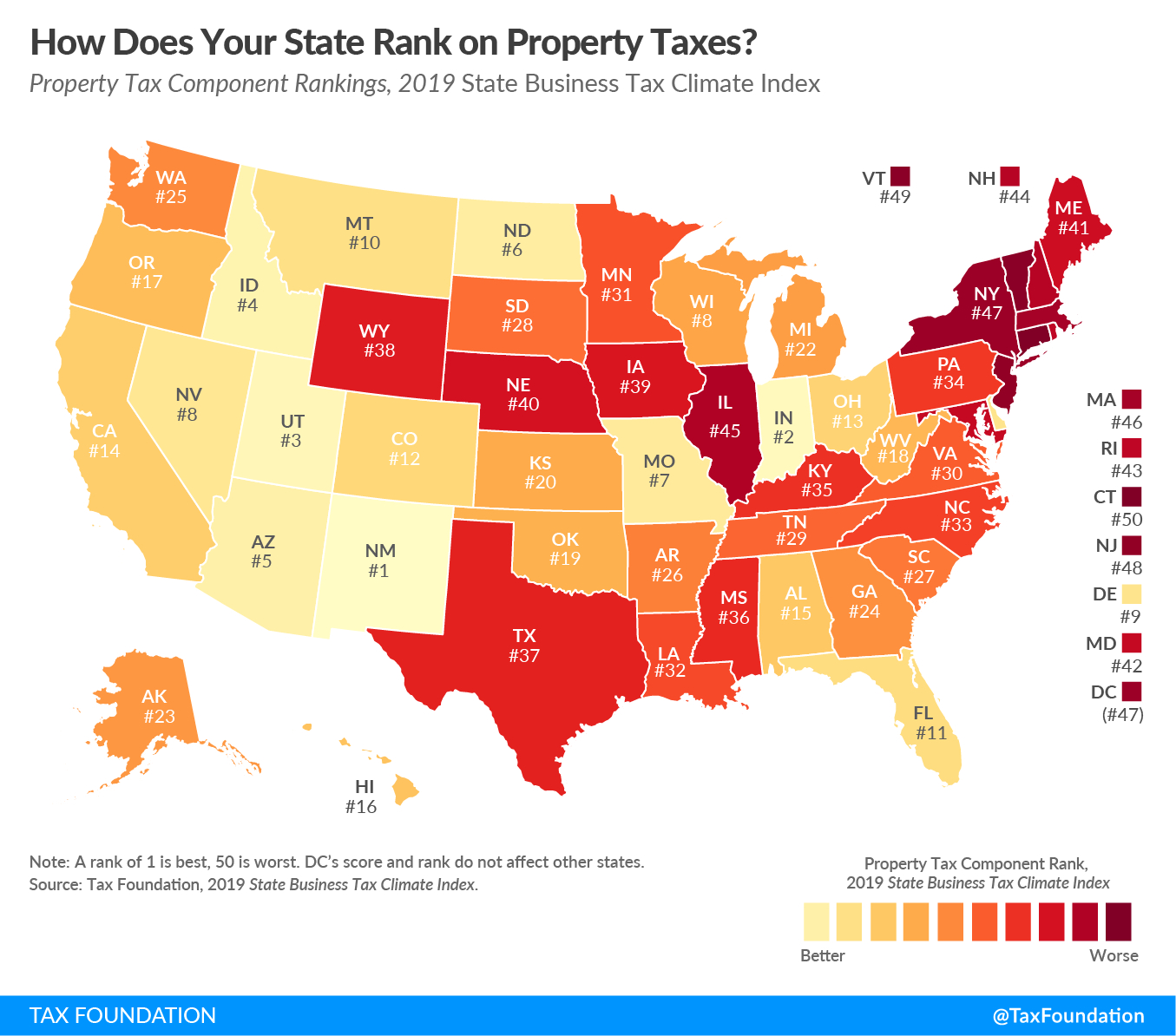

https://printablemapforyou.com/wp-content/uploads/2019/03/how-does-your-state-rank-on-property-taxes-2019-state-rankings-texas-property-tax-map.png

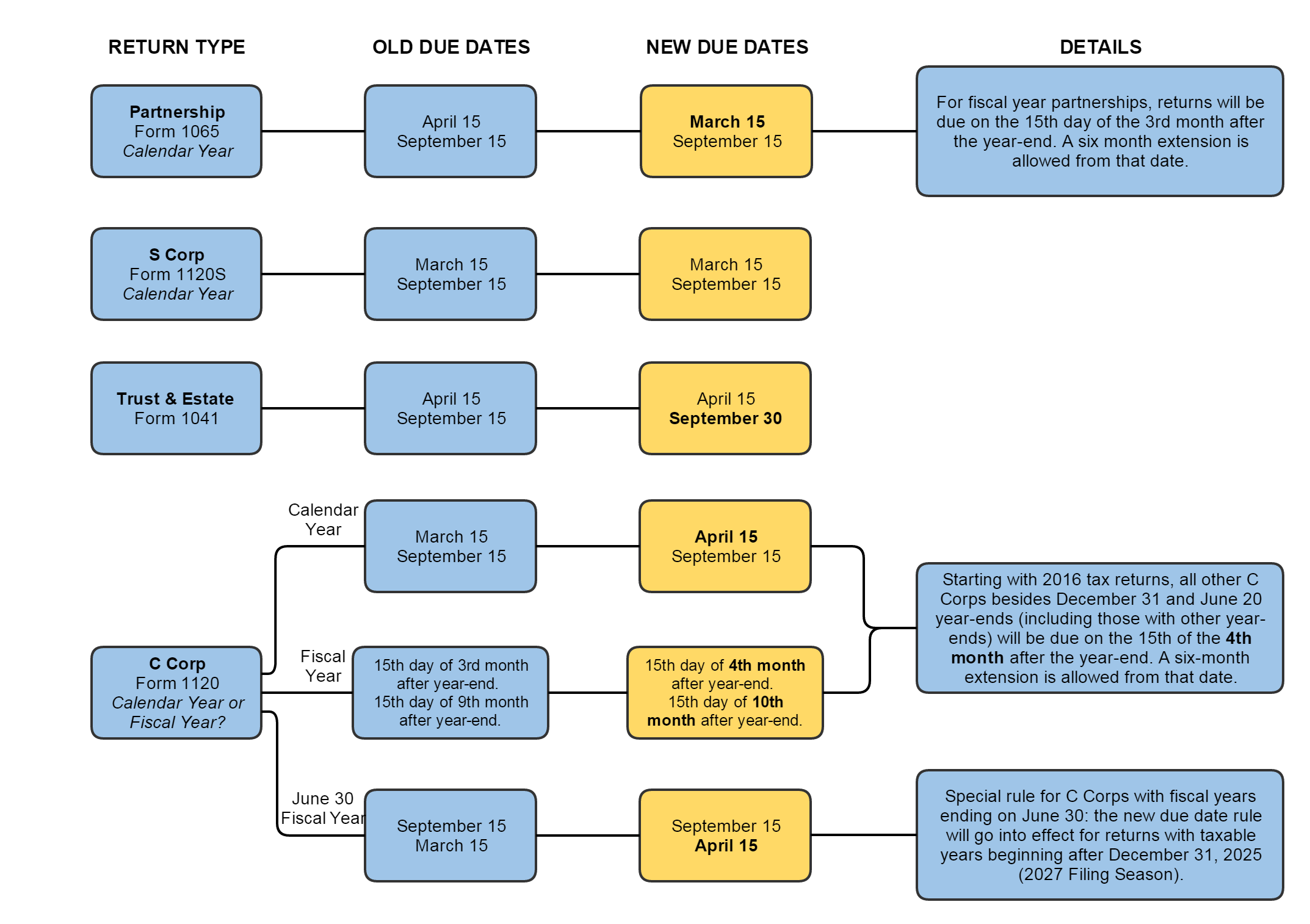

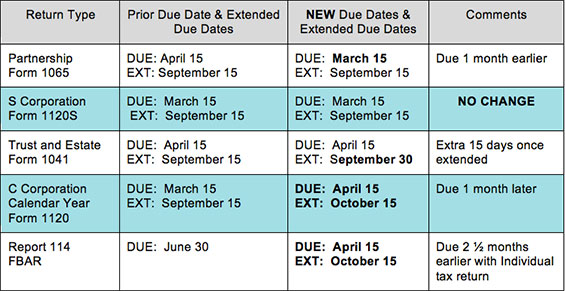

New Tax Return Due Dates Meadows Urquhart Acree And Cook LLP

http://www.muacllp.com/wp-content/uploads/2016/04/new_tax_return_due_dates_1.png

When Are Texas Property Taxes Due Exactly The final Texas property tax due date is January 31st every year Technically your property taxes are due as soon as you When are my property taxes due Taxes are due and payable on October 1 and are delinquent if not paid on or before January 31 State law requires that penalty and

Property Tax Calendar There are numerous important dates and deadlines during the tax year Many such as the January 1 assessment date are specifically stated in the Texas When Are Texas Property Taxes Due Texas property tax bills are typically mailed in October and payment is requested upon receipt However most homeowners

Download Texas Property Tax Return Due Date

More picture related to Texas Property Tax Return Due Date

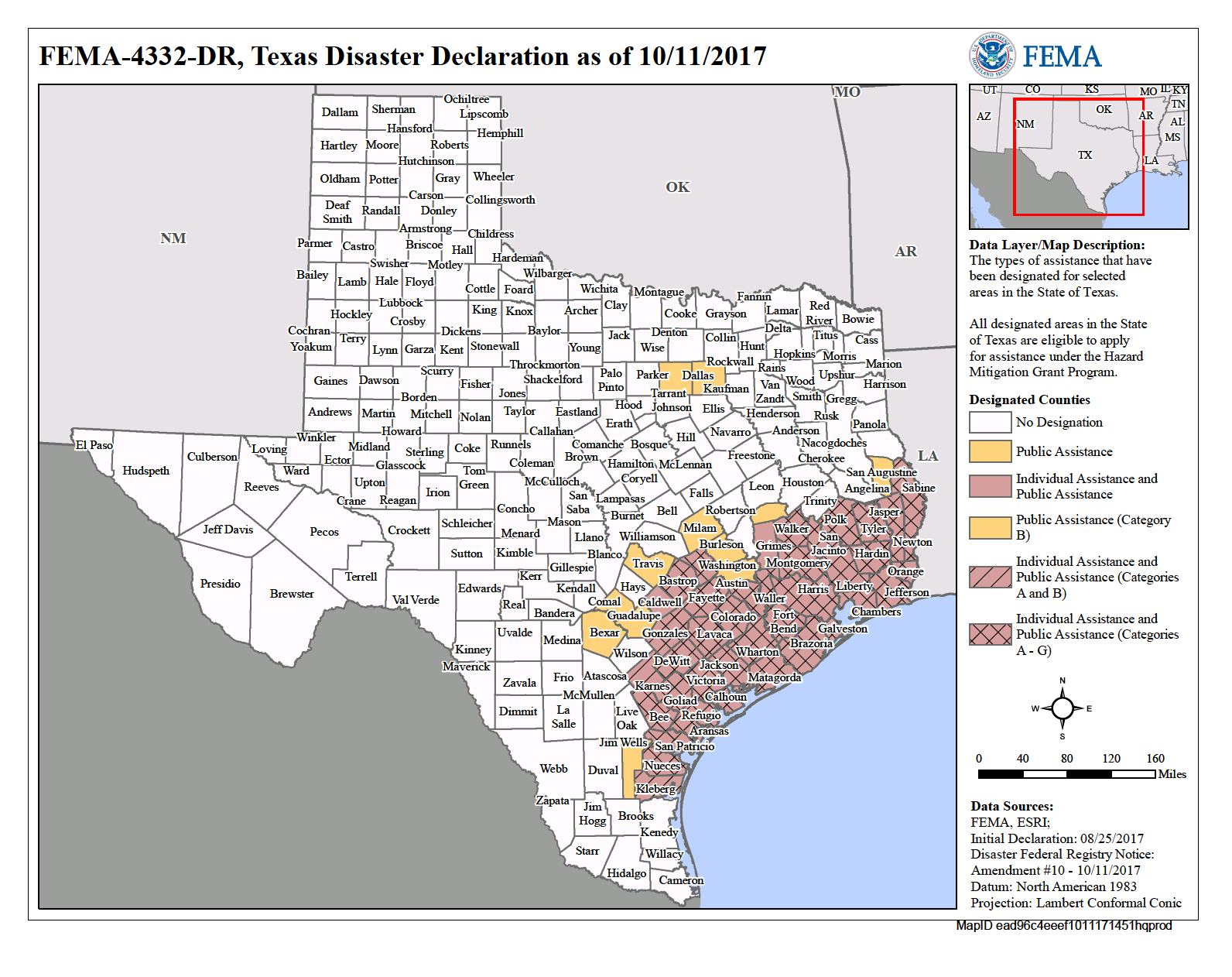

Texas Hurricane Harvey Dr 4332 Fema gov Texas Property Tax Map

https://printablemapforyou.com/wp-content/uploads/2019/03/texas-hurricane-harvey-dr-4332-fema-gov-texas-property-tax-map.png

Income Tax Return Filing Due Dates For FY 2020 21 Last Date

https://blog.saginfotech.com/wp-content/uploads/2021/04/latest-income-tax-tds-due-dates.jpg

Did You Know Certain Tax Return Due Dates Changed This Year

https://www.greensfelder.com/assets/htmlimages/blogs/2017/taxreturn-table_032017-highres.jpg

When are property taxes due Under Section 31 02 of the Texas Tax Code taxes are issued on OCTOBER 1st of each year and are due upon receipt of the tax bill and We are highlighting dates for which we receive the most inquiries A complete tax calendar with references to the Tax Code is available from the Texas Comptroller of Public

3 When are property taxes due Taxes are due in October of each year and must be paid by January 31st In order to be timely payment of taxes must be postmarked on or Key Texas property tax due dates include when taxes are due and when penalties and interest will begin to accrue on any delinquent taxes Continue reading to learn about

TDS Return Filing Due Date Must Be Accompanied With Its Rate Of Tax And

https://i.pinimg.com/originals/92/06/03/920603f3f33d11bc77e32e46611789dd.jpg

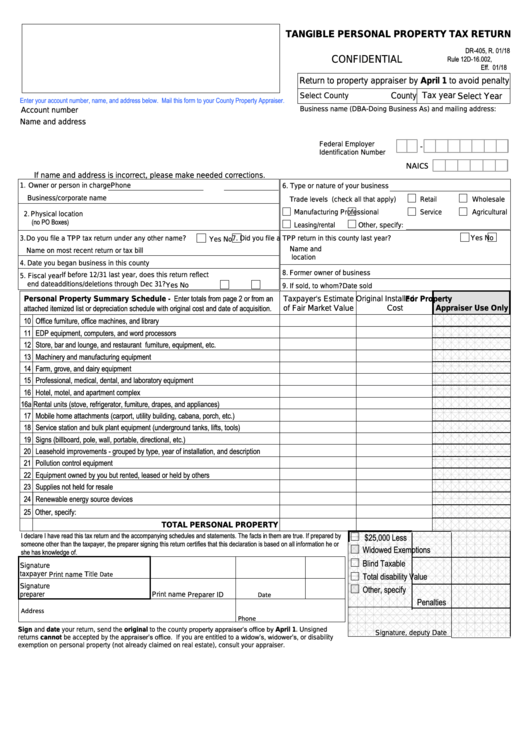

Fillable Business Personal Property Tax Return Form Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/178/1781/178104/page_1_thumb_big.png

https://comptroller.texas.gov/taxes/property-tax/...

This calendar shows important property tax deadlines for appraisal districts taxing units and property owners Unless otherwise noted all sections are Tax Code citations

https://comptroller.texas.gov/taxes/file-pay/due-dates.php

For applicable taxes quarterly reports are due in April July October and January Note When a reporting due date happens to fall on Saturday Sunday or a federal legal

NEWS ALERT Tax Return Due Dates Changes For 2016 Tax Year S J

TDS Return Filing Due Date Must Be Accompanied With Its Rate Of Tax And

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

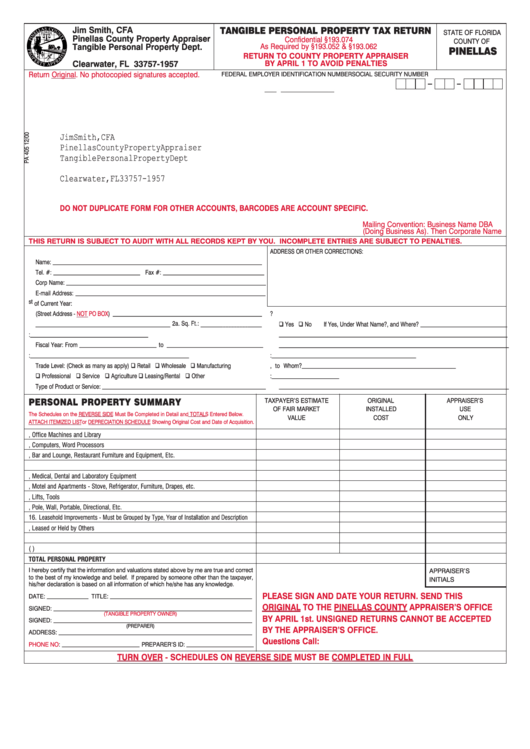

Tangible Personal Property Tax Return Form Printable Pdf Download

Estate Income Tax Return Due Date 2021 Anibal Greenlee

File Your Income Tax Return By 31st July Ebizfiling

File Your Income Tax Return By 31st July Ebizfiling

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

INCOME TAX RETURN DUE DATE FY 2021 22 AY 2022 23 WILL ITR DUE DATE

Texas Personal Property Tax Return Due Date 2021 TAX

Texas Property Tax Return Due Date - When Are Texas Property Taxes Due Texas property tax bills are typically mailed in October and payment is requested upon receipt However most homeowners