Texas Sales Tax Credits Web AB CD 01 148 Rev 5 19 9 b 0114800W051909 b c Taxpayer number Page of Texas Sales and Use Tax Return d Filing period b e f Due date Credits and Customs Broker Schedule g I Taxpayer name and mailing address Make corrections next to any incorrect information Do n t s aple or pa er clip I

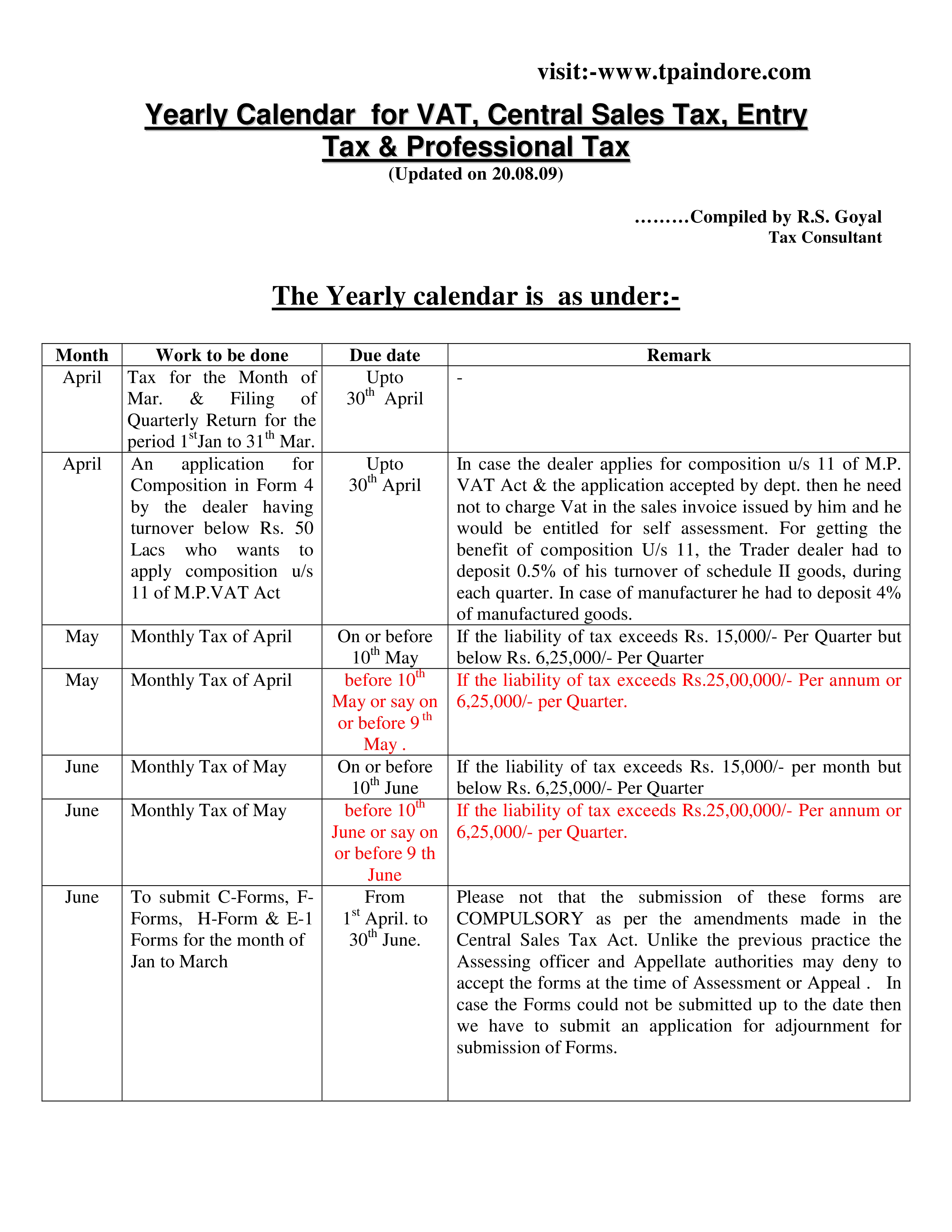

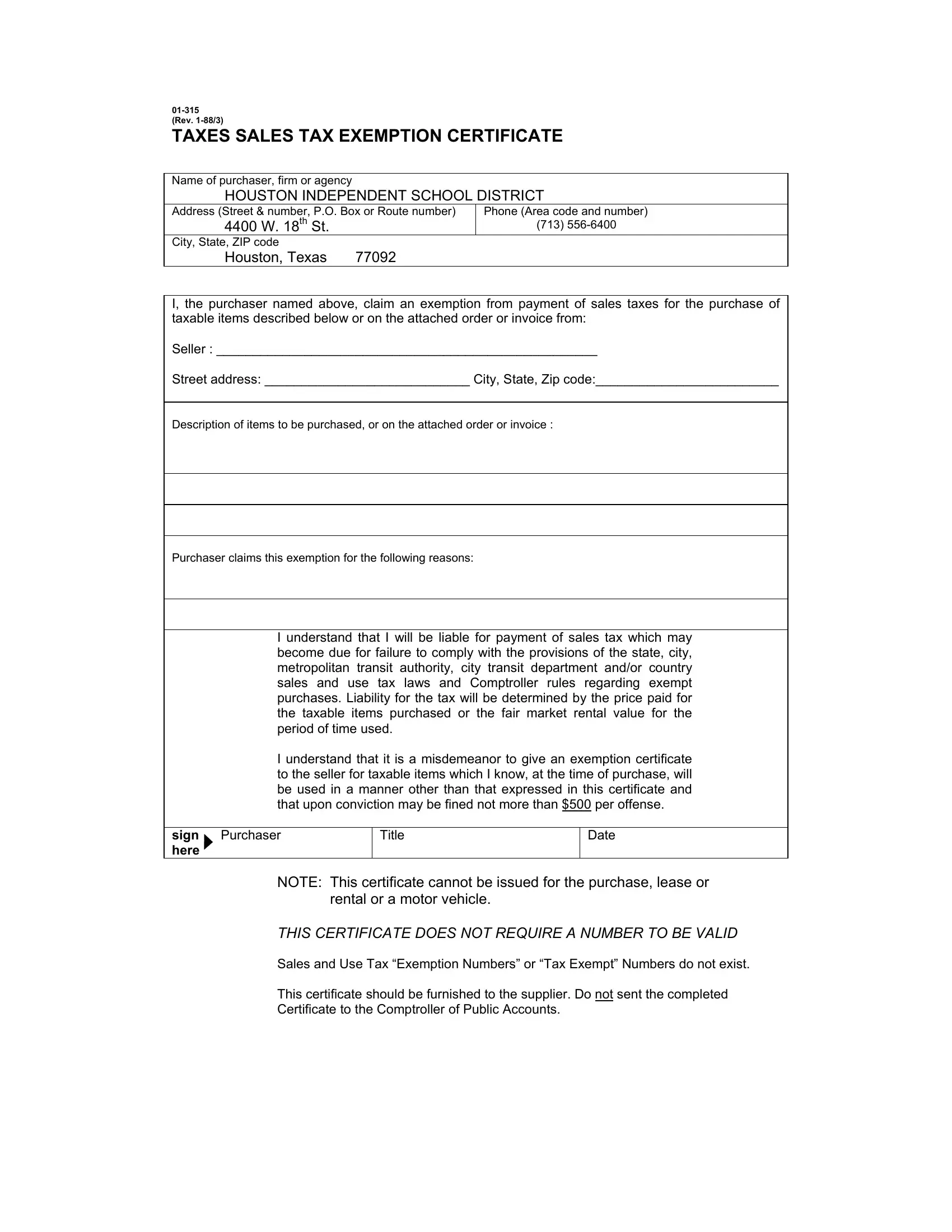

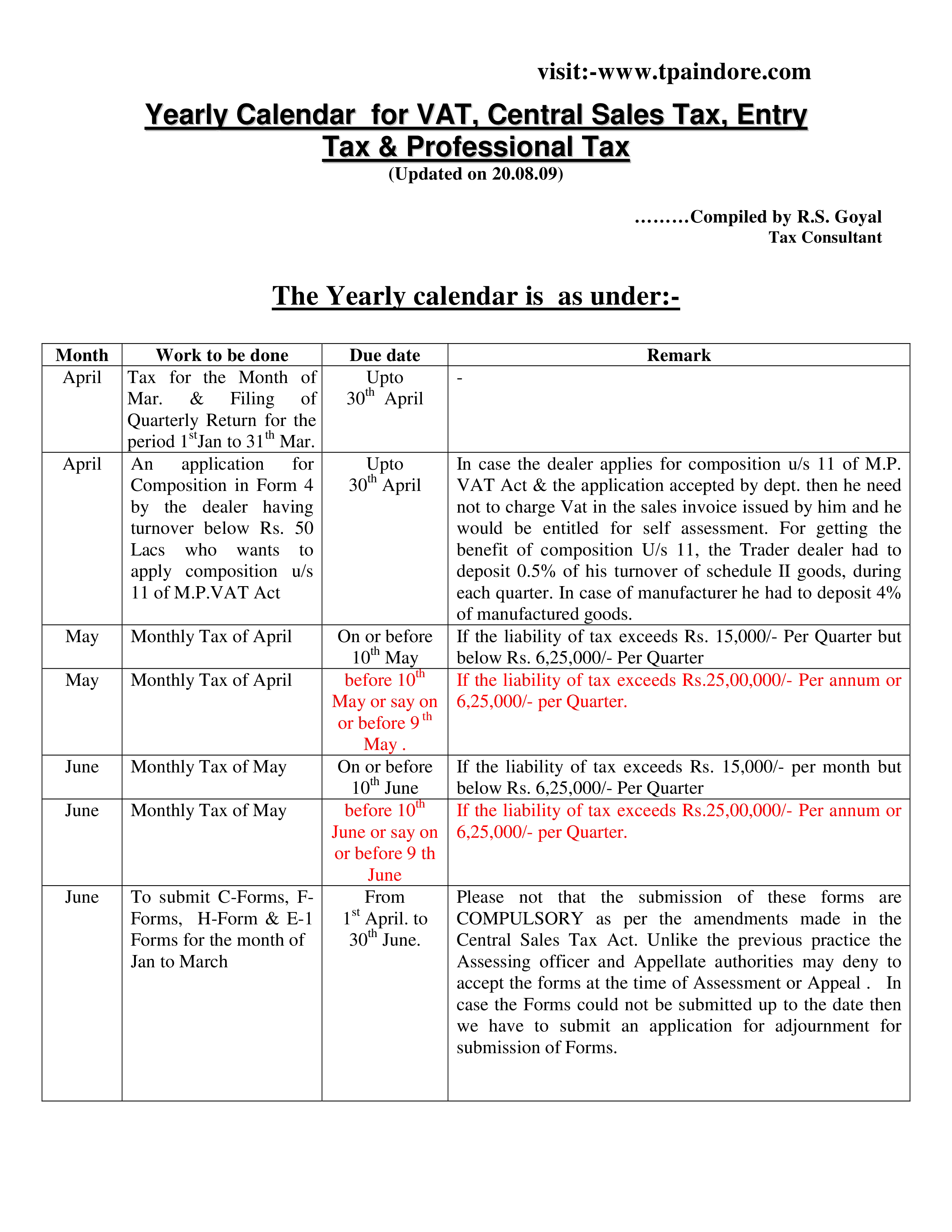

Web Texas imposes a 6 25 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 8 25 percent Web Taxes Incentives Business Details Texas economic development incentives and low tax burden let businesses like yours grow their workforce and boost their bottom line

Texas Sales Tax Credits

Texas Sales Tax Credits

https://s.hdnux.com/photos/01/23/23/22/21836949/3/rawImage.jpg

Gratis Verkoop Tax pdf

https://www.allbusinesstemplates.com/thumbs/6e659190-6e21-499f-b500-e7f0a3517f93_1.png

Minnesota Tax Credits For Workers And Families

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Web 31 Dez 2016 nbsp 0183 32 Franchise Tax Credits home 187 taxes 187 franchise taxes Franchise Tax Credits There are several ways for entities to earn franchise tax credits Learn more about these options by selecting the links below Note the expiration dates for each credit type Quick Links Franchise Tax Credits FAQs Web Remote Sellers Resale and Exemption Certificates Direct Payment Permit Holders Customs Brokers Maquiladoras Miscellaneous Forms Qualified Research Qualifying Data Centers and Qualifying Large Data Center Projects Rate Change Worksheets for Yearly Filers Refund Forms Sales and Use Tax Rate Charts

Web Credit for Tax Already Paid Texas allows a credit for sales or use tax paid to other states For more information see Rule 3 346 Use Tax Additional Resources Sales and Use Tax Information Sales Tax Locator Use Tax for New Off Highway Vehicles Purchased From Out of State Retailers Web Texas Sales and Use Tax Frequently Asked Questions Purchases Use Tax When is a purchase subject to use tax What is the tax rate for use tax Do I owe tax on goods purchased via mail order catalogs or online How do I report a use tax liability Texas Sales and Use tax FAQs about purchases and use tax

Download Texas Sales Tax Credits

More picture related to Texas Sales Tax Credits

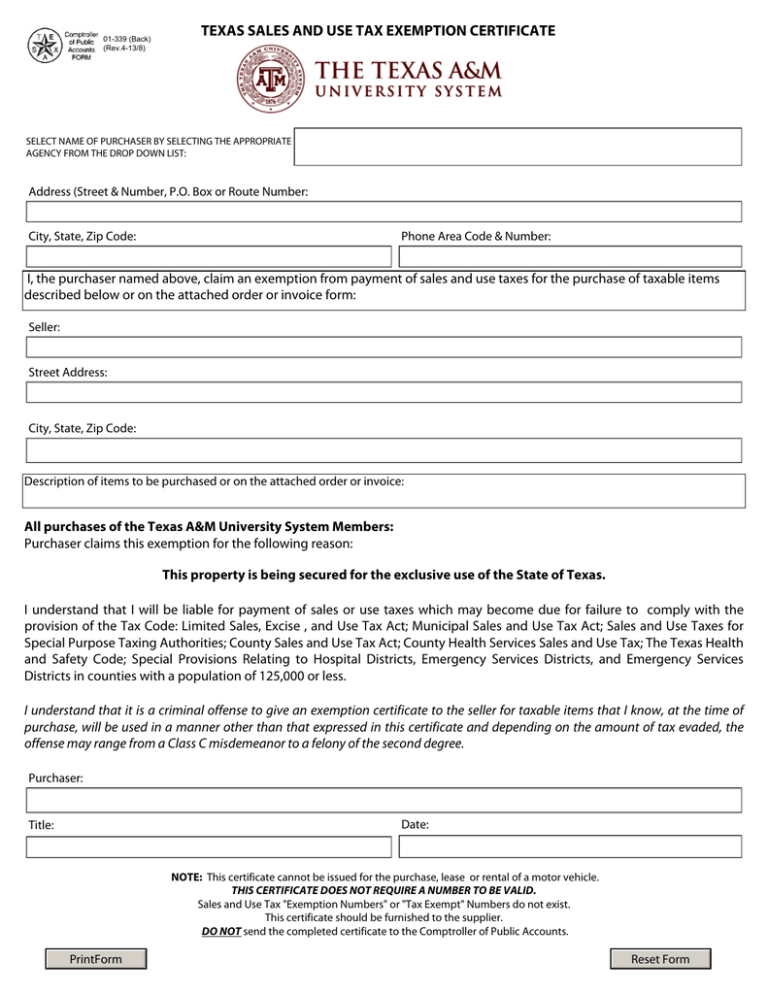

Texas Sales Tax Exemption Certificate PDF Form FormsPal

https://formspal.com/pdf-forms/other/texas-sales-tax-exemption-certificate/texas-sales-tax-exemption-certificate-preview.webp

Canceled Texas Sales And Use Taxes Virtual Edition AGC Houston

https://res.cloudinary.com/micronetonline/image/upload/c_crop,h_1080,w_1080,x_0,y_0/f_auto/q_auto:best/v1653487101/tenants/8ecfbe47-8d35-4b34-bc78-813cea65d01a/4dc61b9b984c4fa9818613c513ce095d/1TXSalesUseTax.png

Simplifying The Complexities Of R D Tax Credits TriNet

https://images.contentstack.io/v3/assets/blt9ccc5b591c9e2640/blt64bfb078a74eaa48/643963cd9074ca2928c792b6/RD-Tax-Credits-thumbnail.jpg

Web Vor 2 Tagen nbsp 0183 32 By Tony Gulotta Effective January 6 2022 the Texas Comptroller of Public Accounts Comptroller adopted sweeping revisions to the bad debt provisions of 34 Tex Admin Code 167 3 302 Accounting Methods Credit Sales Bad Debt Deductions Repossessions Interest on Sales Tax and Trade Ins Rule 3 302 Web 23 M 228 rz 2015 nbsp 0183 32 In 2013 Texas adopted into law House Bill 800 HB800 which allowed taxpayers to elect to either claim a sales use tax exemption for the purchase of tangible personal property used for research and development R amp D activities or take an R amp D credit against the franchise tax for qualifying research expenditures

Web 15 Okt 2021 nbsp 0183 32 In brief On October 15 Texas promulgated significant amendments to Texas Admin Code Sec 3 599 concerning the research and development activities franchise tax credit The amendments do not provide a general applicable date Existing franchise tax rule Sec 3 599 applies to franchise tax reports originally due on or after Web 13 Sept 2023 nbsp 0183 32 Types of taxes In addition to regular sales tax businesses must also pay where applicable use tax discretionary sales surtax transient rental taxes and franchise taxes Sales tax The state sales tax rate is 6 25 percent on all retail sales rentals leases taxable services and goods unless that item or service is exempt Use tax

Tax Credits Are Hidden Benefit For Homeowners

https://www.tennessean.com/gcdn/-mm-/c35235dca3494476ea713db1a4eea54b43cda490/c=0-1242-4148-3585/local/-/media/2016/02/08/Nashville/Nashville/635905382793361586-DeniseCreswell.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

https://comptroller.texas.gov/forms/01-148.pdf

Web AB CD 01 148 Rev 5 19 9 b 0114800W051909 b c Taxpayer number Page of Texas Sales and Use Tax Return d Filing period b e f Due date Credits and Customs Broker Schedule g I Taxpayer name and mailing address Make corrections next to any incorrect information Do n t s aple or pa er clip I

https://comptroller.texas.gov/taxes/sales

Web Texas imposes a 6 25 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 8 25 percent

Tax Sales Carroll County Tax Commissioner

Tax Credits Are Hidden Benefit For Homeowners

Texas sales and use tax resale cert Olden Lighting

Sales Tax Vs Use Tax What s The Difference With Table

Geothermal Tax Credits Incentives

How To File A Texas Sales And Use Tax Return 13 Steps

How To File A Texas Sales And Use Tax Return 13 Steps

Texas Sales Tax Exemption Certificate Form ExemptForm

Texas Sales And Use Tax Exemption Certification Forms Docs 2023

Texas Collects Record 2 86 Billion In Sales Tax For July Bond Buyer

Texas Sales Tax Credits - Web Research amp Development Tax Credit Sales Tax Exemptions for Media Productions amp Facilities State Sales and Use Tax Exemption Texas Enterprise Zone Program FINANCING Texas is committed to providing and facilitating funding for companies and communities with expansion and relocation projects in the state