Texas Sales Tax Deduction Find out how much sales tax you can deduct when you itemize on your tax return Enter your filing status income dependents and sales tax paid on large purchases to

It s possible to deduct Texas sales tax from your federal income tax return if you itemize and take the SALT deduction This deduction allows you to write off up to You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code The calculator will show you the total sales tax amount as well as

Texas Sales Tax Deduction

Texas Sales Tax Deduction

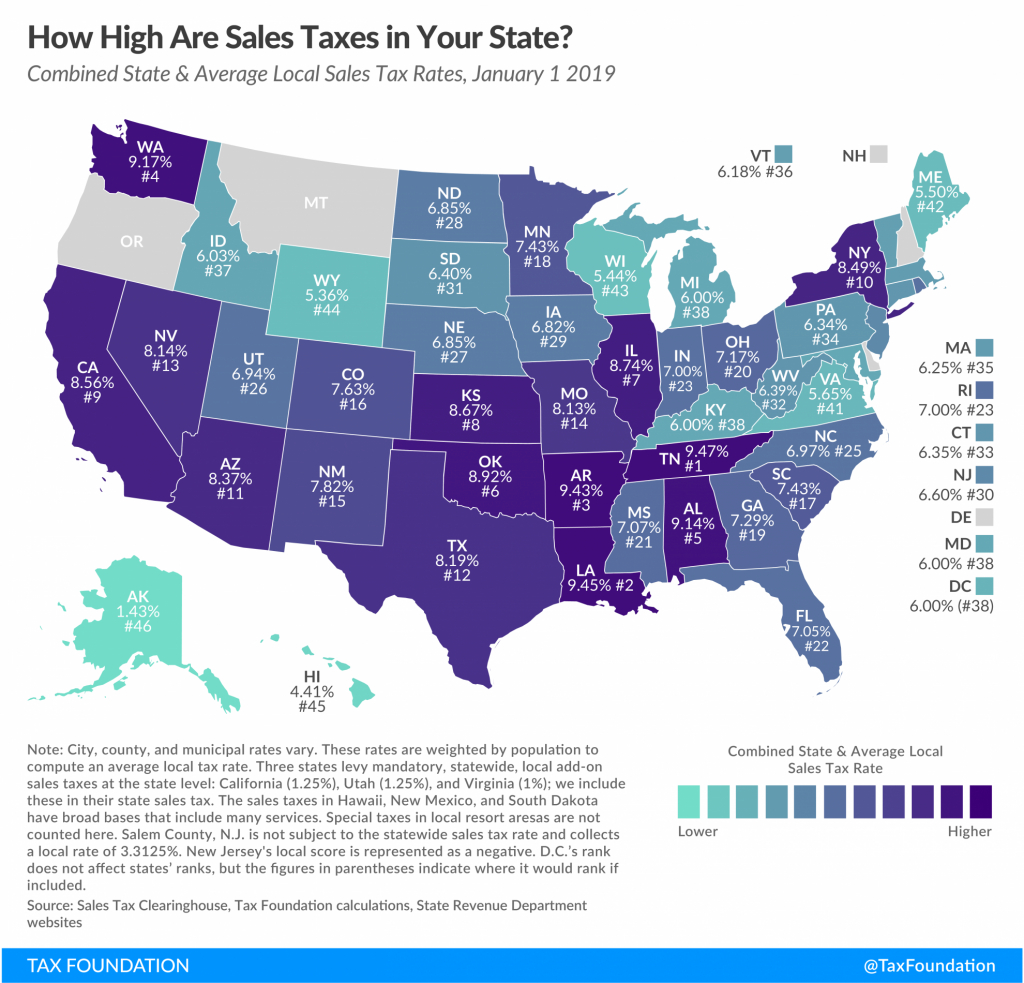

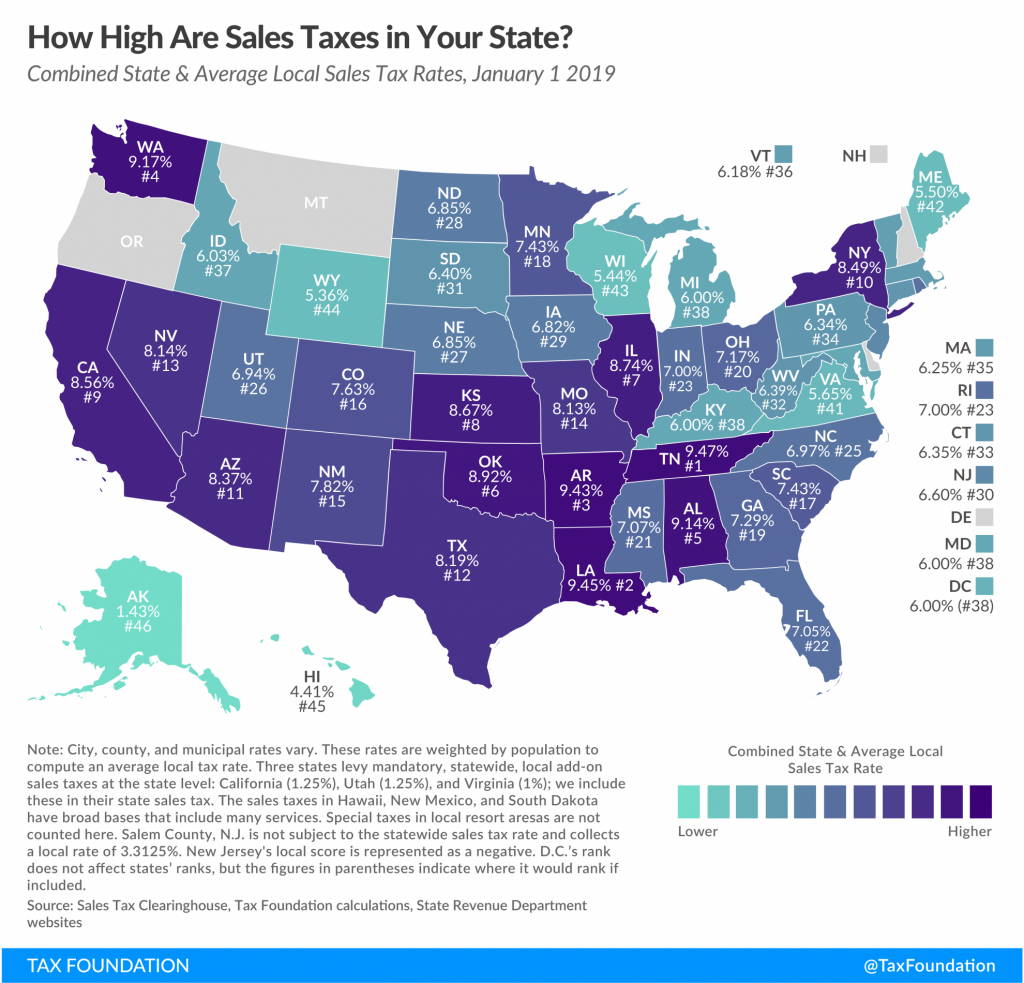

https://printablemapaz.com/wp-content/uploads/2019/07/state-and-local-sales-tax-rates-2019-tax-foundation-texas-sales-tax-map.png

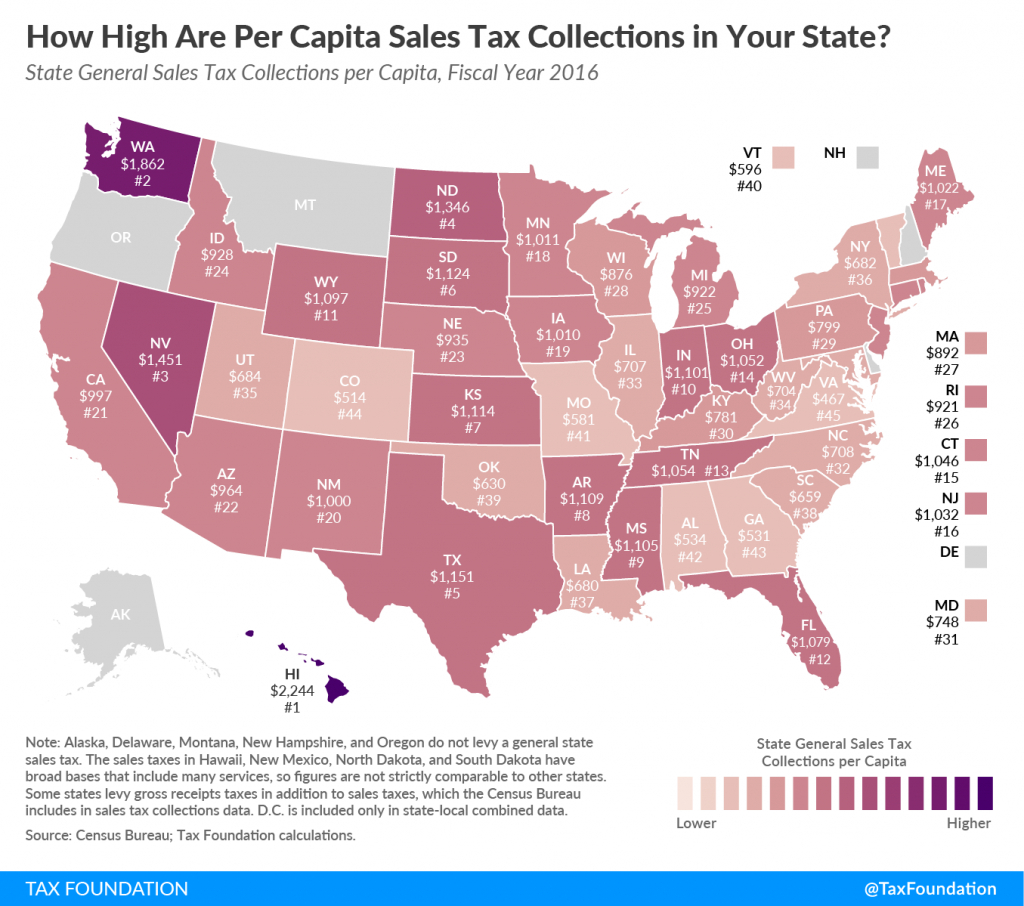

Ranking State And Local Sales Taxes Tax Foundation Texas Sales Tax

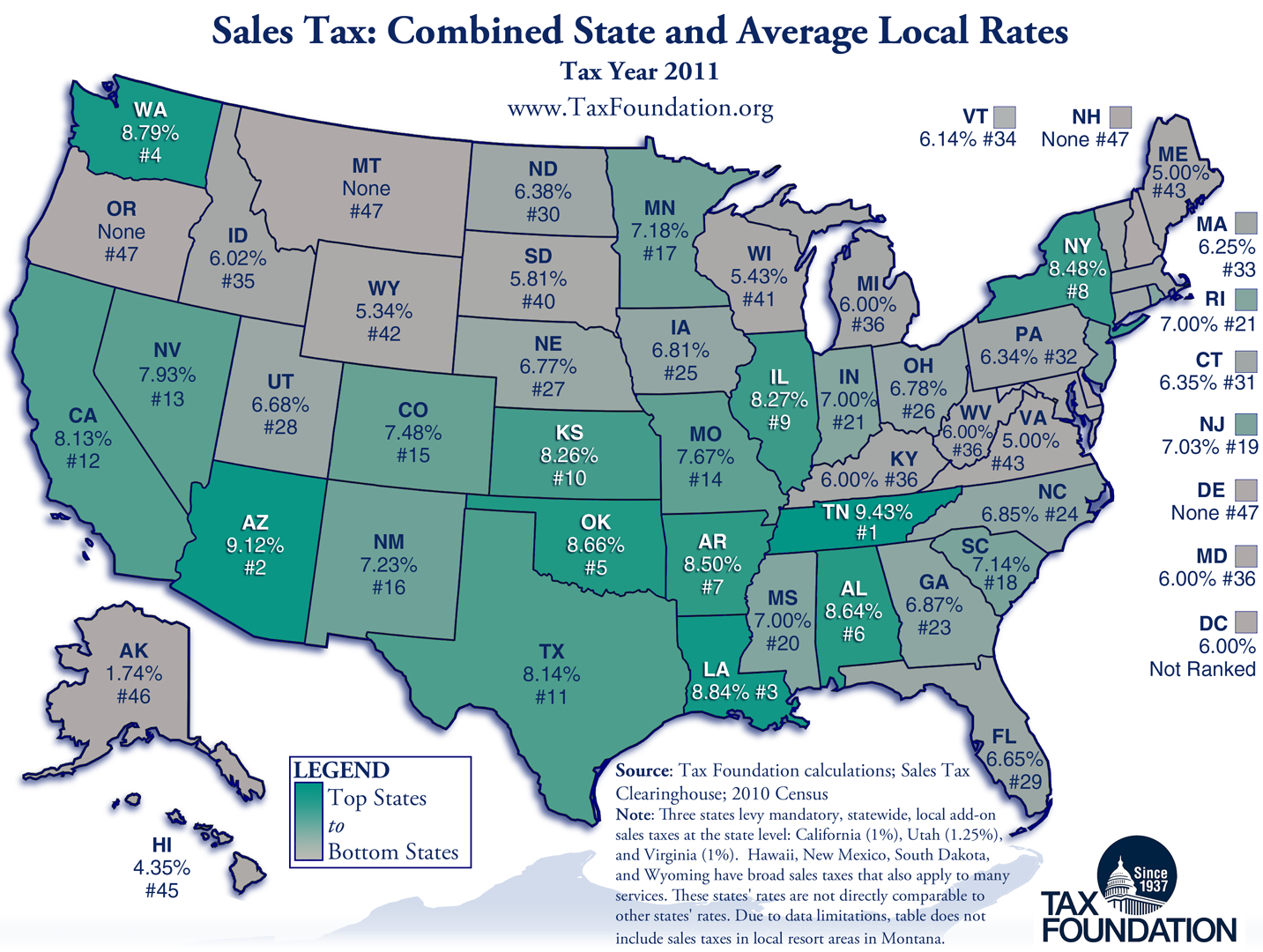

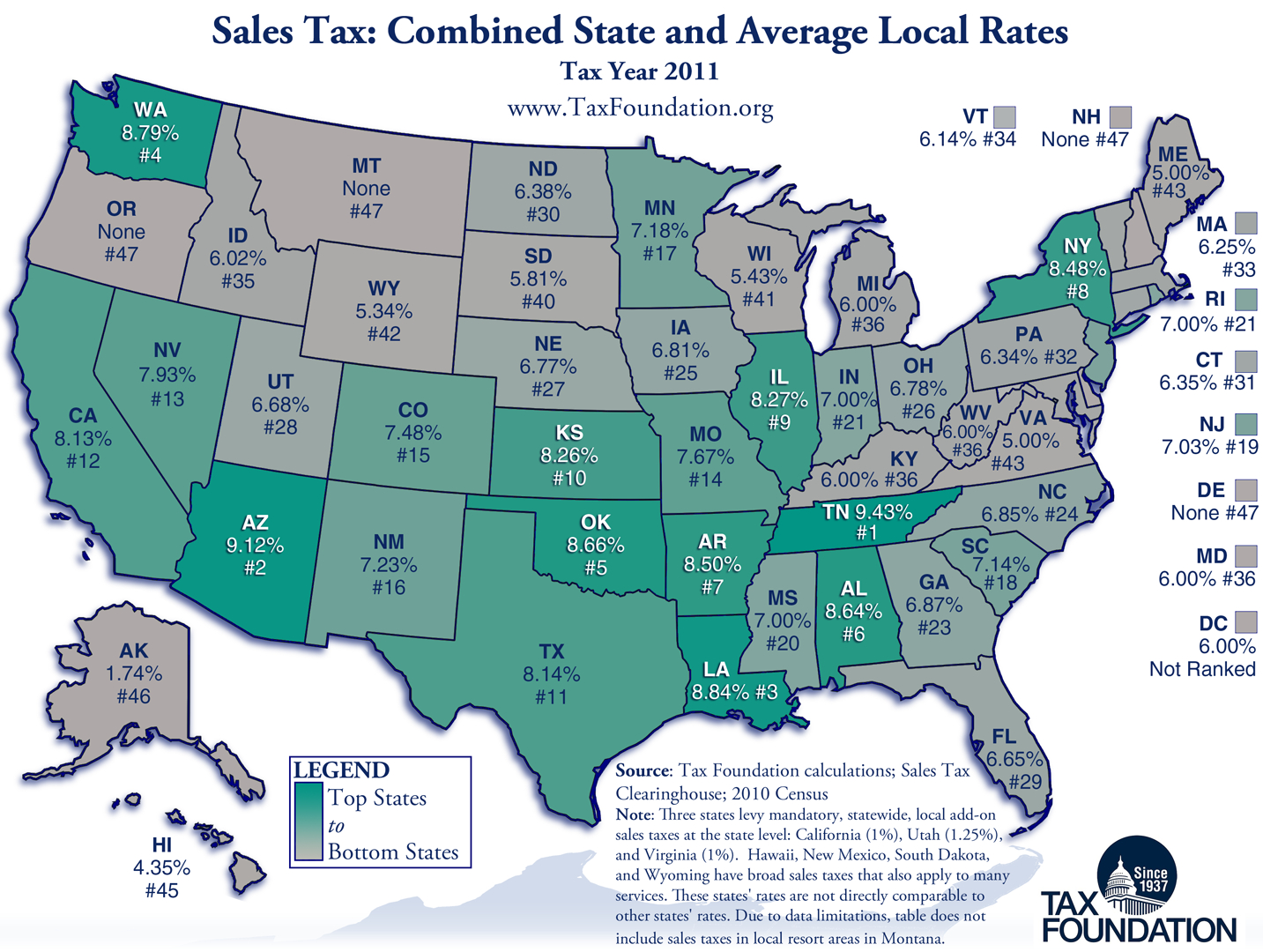

https://printablemapforyou.com/wp-content/uploads/2019/03/ranking-state-and-local-sales-taxes-tax-foundation-texas-sales-tax-map.png

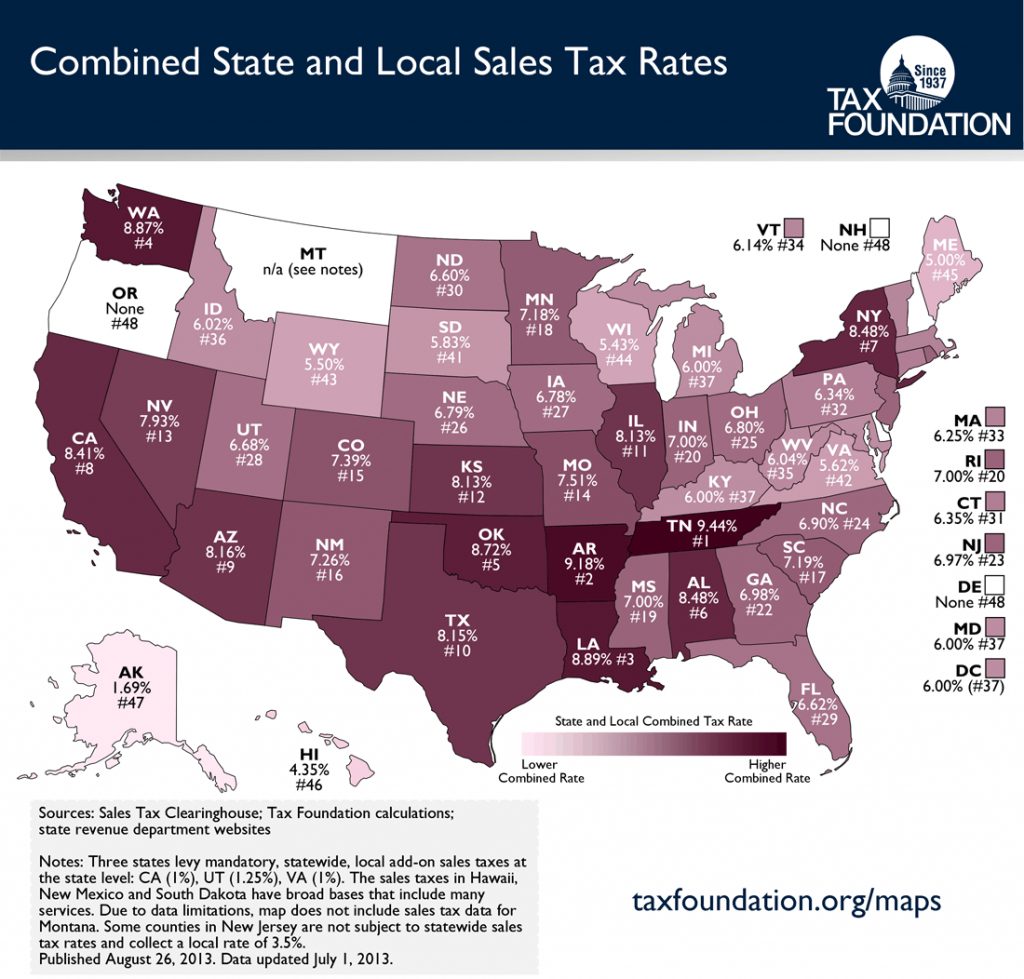

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

https://printablemapaz.com/wp-content/uploads/2019/07/state-and-local-sales-tax-rates-midyear-2013-tax-foundation-texas-sales-tax-map-1024x979.png

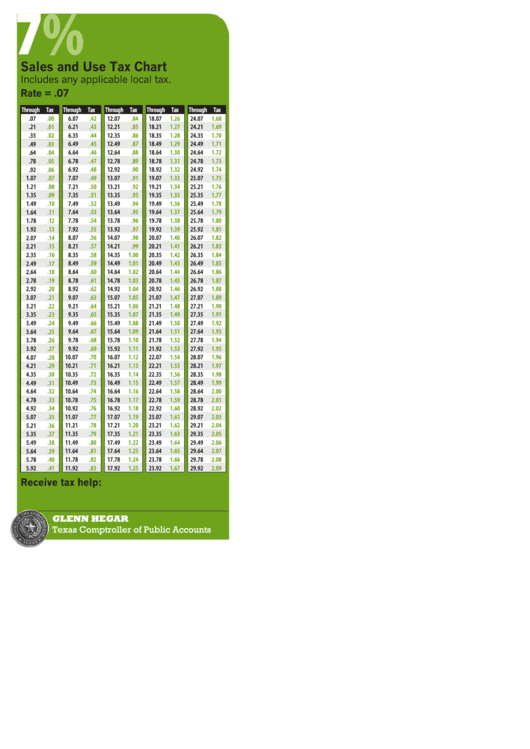

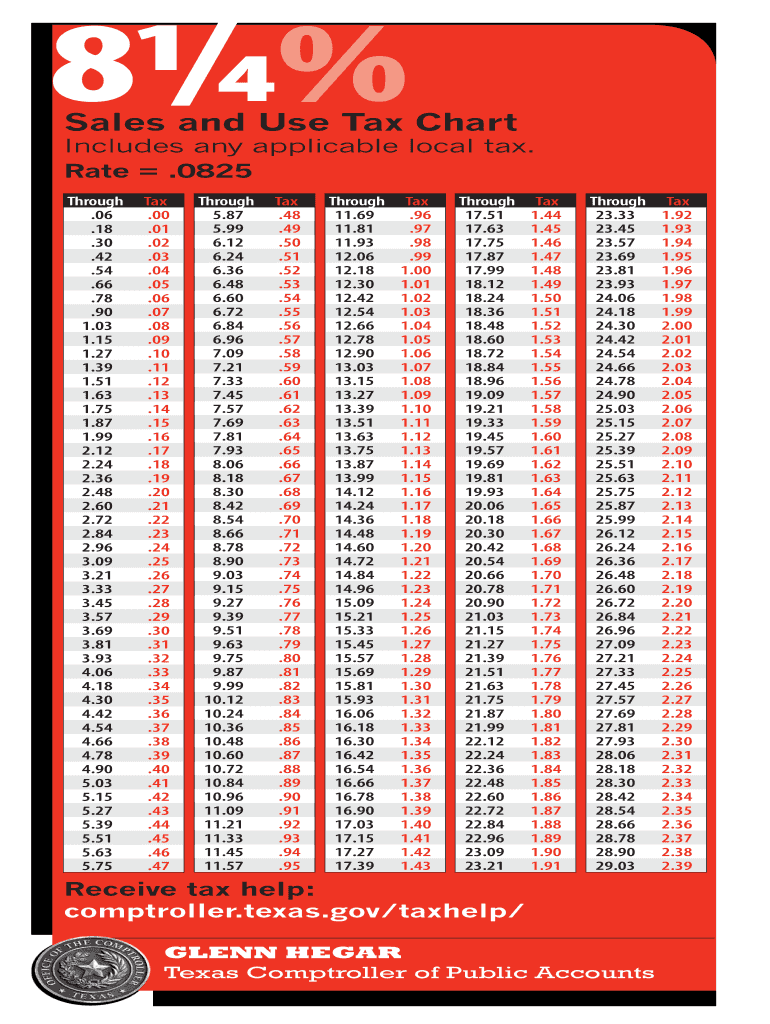

Texas imposes a 6 25 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services Local taxing jurisdictions cities counties Our free online Texas sales tax calculator calculates exact sales tax by state county city or ZIP code

The Texas state sales and use tax is 6 25 percent but local taxing jurisdictions cities counties special purpose districts and transit authorities may also impose sales and Sales Tax Deduction Calculator Estimate your state and local sales tax deduction

Download Texas Sales Tax Deduction

More picture related to Texas Sales Tax Deduction

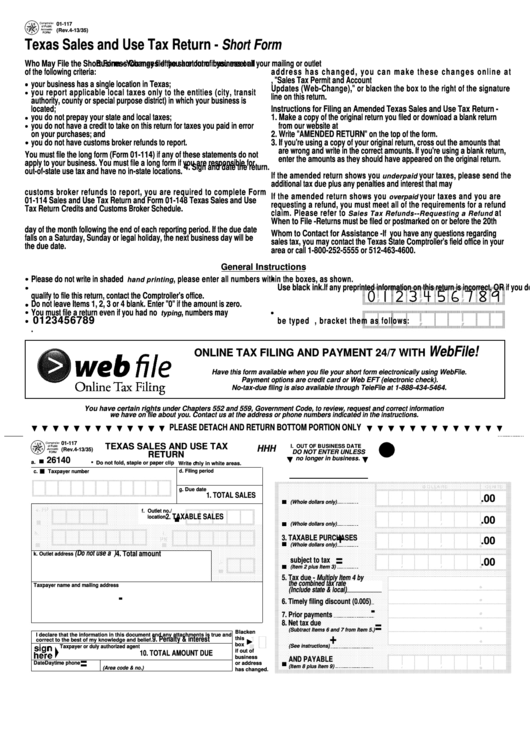

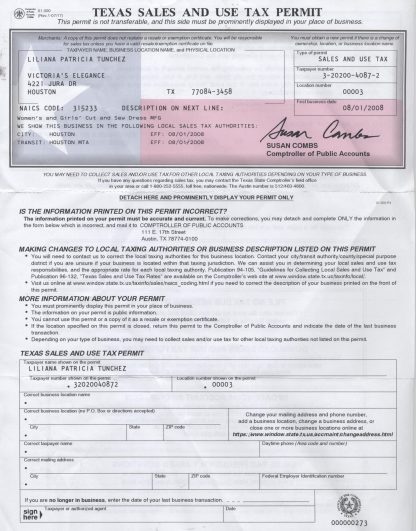

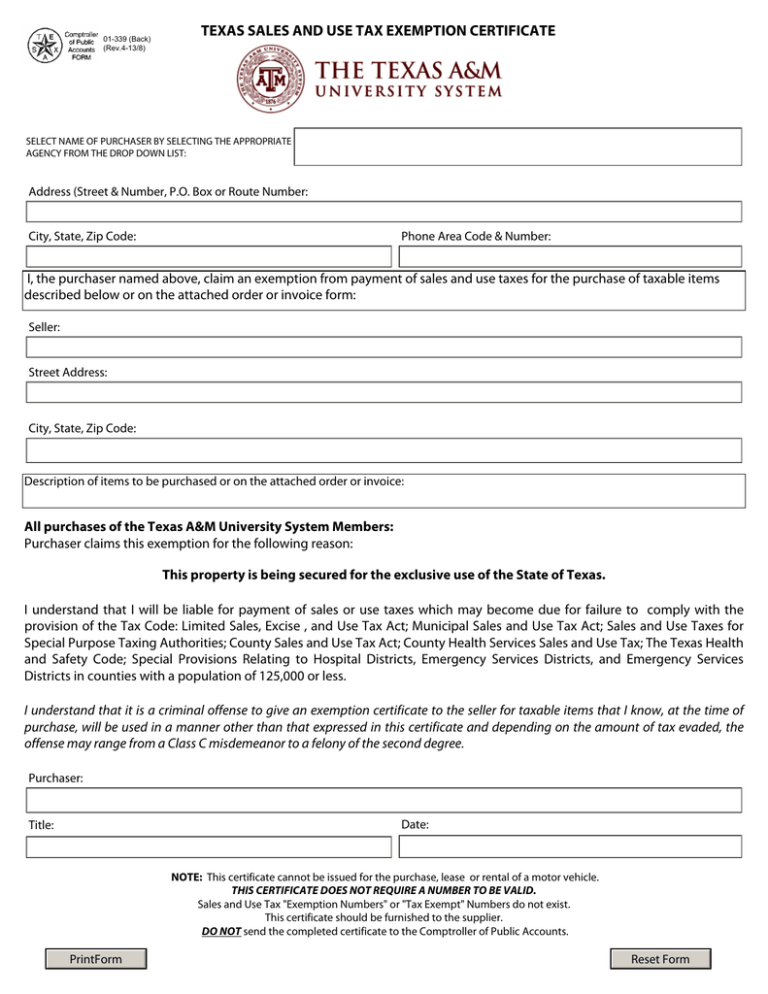

Fillable Texas Sales And Use Tax Form Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/136/1363/136301/page_1_thumb_big.png

Sales Taxes Per Capita How Much Does Your State Collect Texas

https://printablemapjadi.com/wp-content/uploads/2019/07/sales-taxes-per-capita-how-much-does-your-state-collect-texas-property-tax-map.png

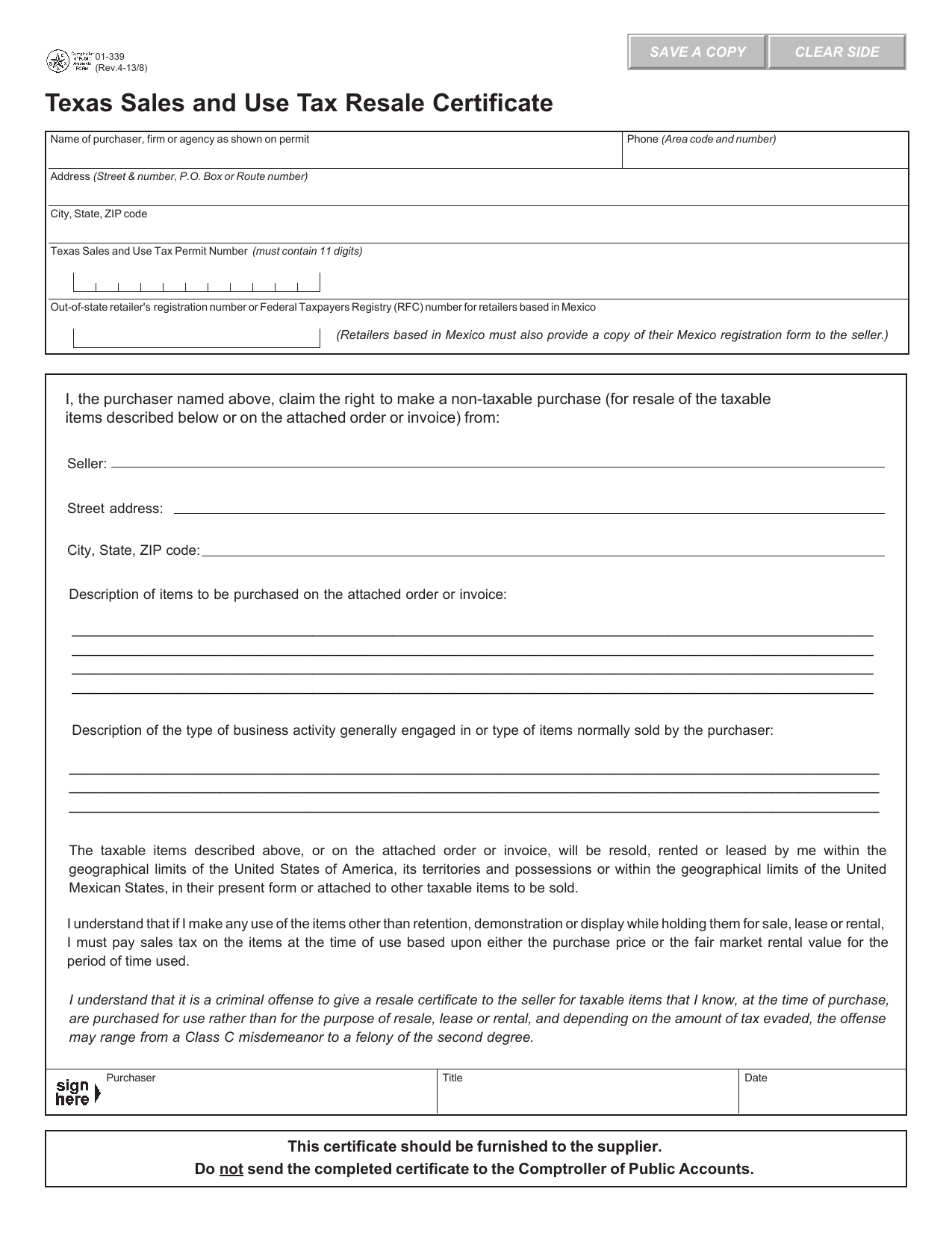

Top 33 Texas Sales Tax Form Templates Free To Download In PDF Format

https://data.formsbank.com/pdf_docs_html/126/1261/126115/page_1_thumb_big.png

Learn how to deduct state and local sales taxes or income taxes paid in 2021 with a 10 000 limit per return Find out which items are deductible how to use the IRS calculator and tables and how to The sales tax rate for Texas sales is 6 25 percent for 2022 How do you calculate sales tax in Texas Add the state sales tax rate of 6 25 percent plus the

In Texas sales tax deductions refer to sales tax allowances you can claim on your federal income tax return This deduction is especially advantageous for state residents who make significant purchases Learn how to claim the state and local tax deduction for federal income tax purposes and how to calculate it based on your sales tax rate and purchases Find out

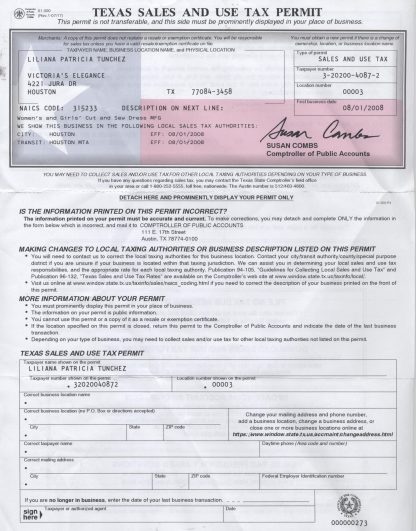

Texas Sales Tax Certificate jpg Eva USA

https://evausacollection.com/wp-content/uploads/2020/03/Texas-Sales-Tax-Certificate-scaled-416x531.jpg

2015 2023 Form TX 98 292Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/423/562/423562213/large.png

https://www.irs.gov/credits-deductions/individuals/...

Find out how much sales tax you can deduct when you itemize on your tax return Enter your filing status income dependents and sales tax paid on large purchases to

https://www.nerdwallet.com/article/taxes/texas-sales-tax

It s possible to deduct Texas sales tax from your federal income tax return if you itemize and take the SALT deduction This deduction allows you to write off up to

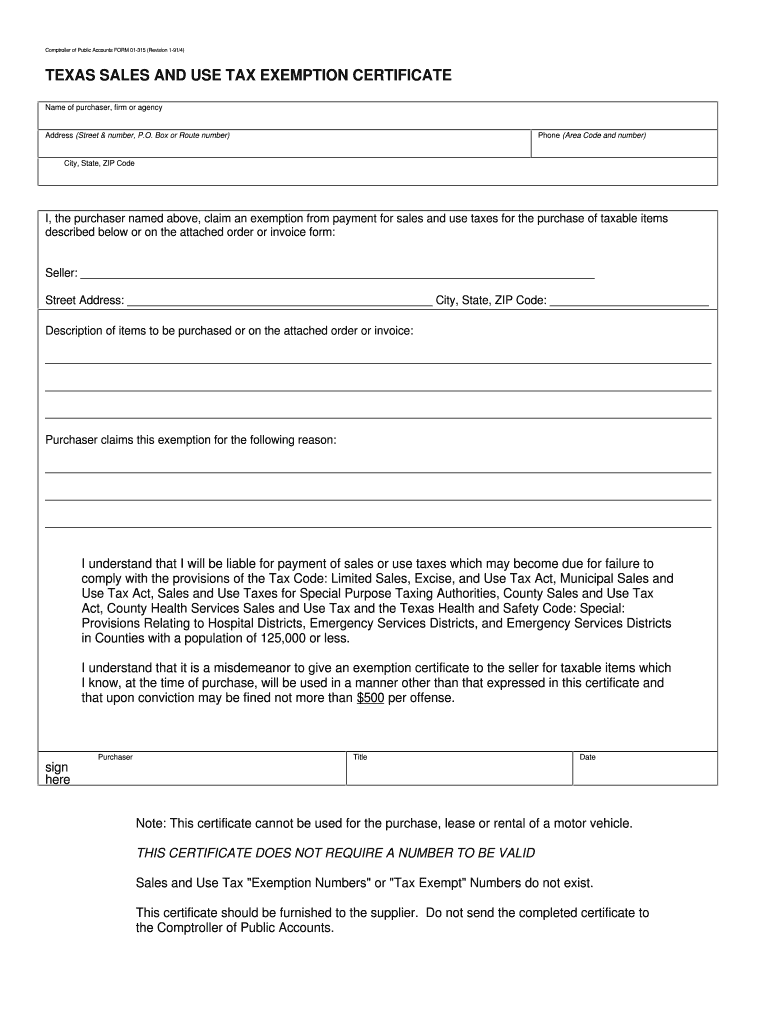

TEXAS SALES AND USE TAX EXEMPTION CERTIFICATE

Texas Sales Tax Certificate jpg Eva USA

Texas Sales and Use Tax permit LEO TakeDown

Texas Tax Exempt PDF 1991 2023 Form Fill Out And Sign Printable PDF

Texas Sales And Use Tax Resale Certificate SAVE A COPY CLEAR SIDE

Texas Sales And Use Tax Exemption Certification Forms Docs 2023

Texas Sales And Use Tax Exemption Certification Forms Docs 2023

Texas Sales Tax Exemption Certificate From The Texas Human Rights

Irs General Sales Tax Deduction Worksheet TUTORE ORG Master Of

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Texas Sales Tax Deduction - The Internal Revenue Service IRS permits you to write off either your state and local income tax or sales taxes when itemizing your deductions People who live in