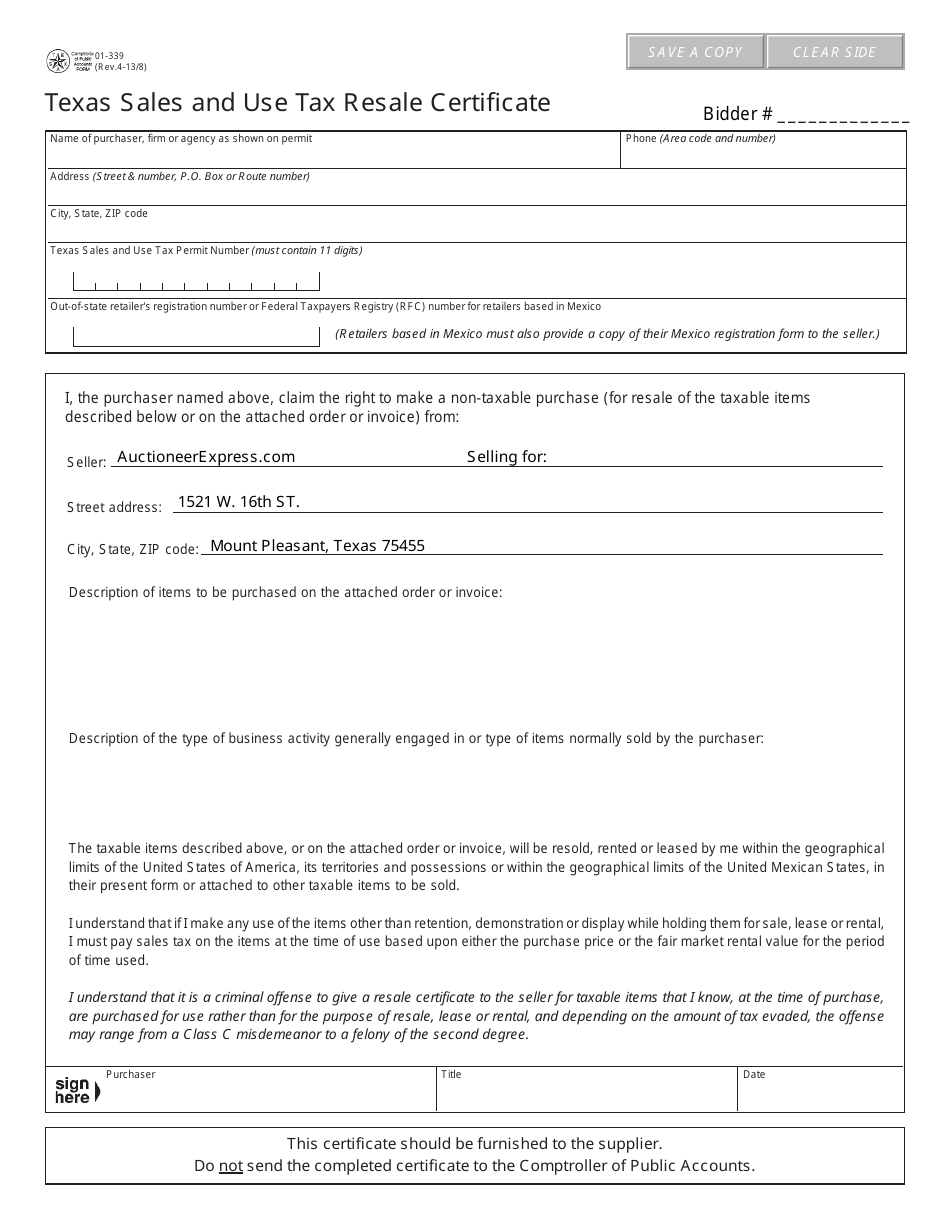

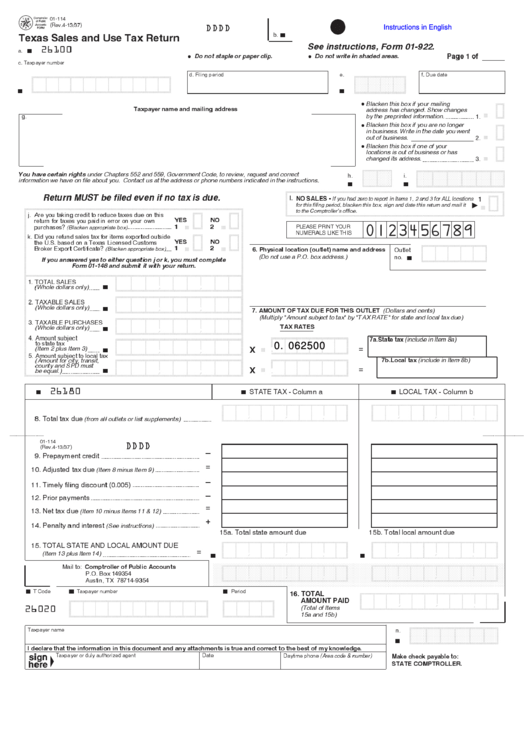

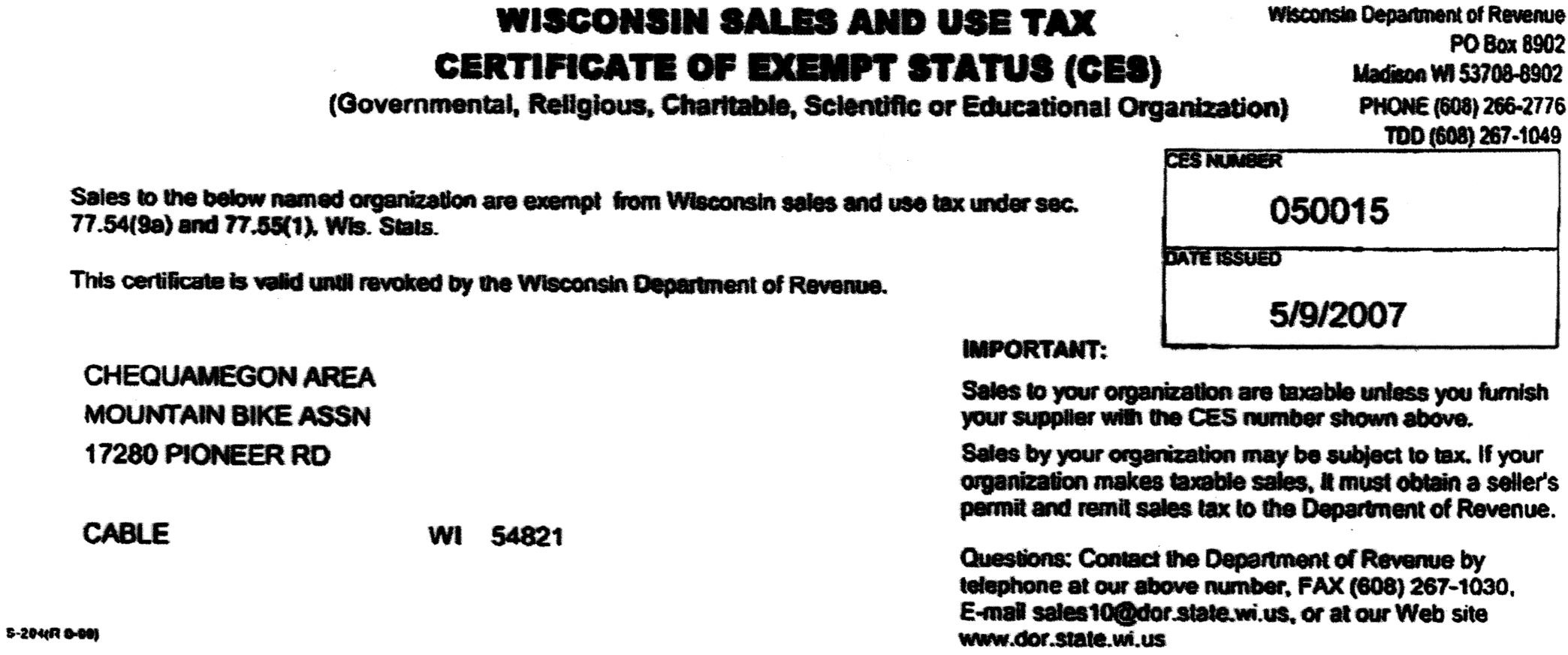

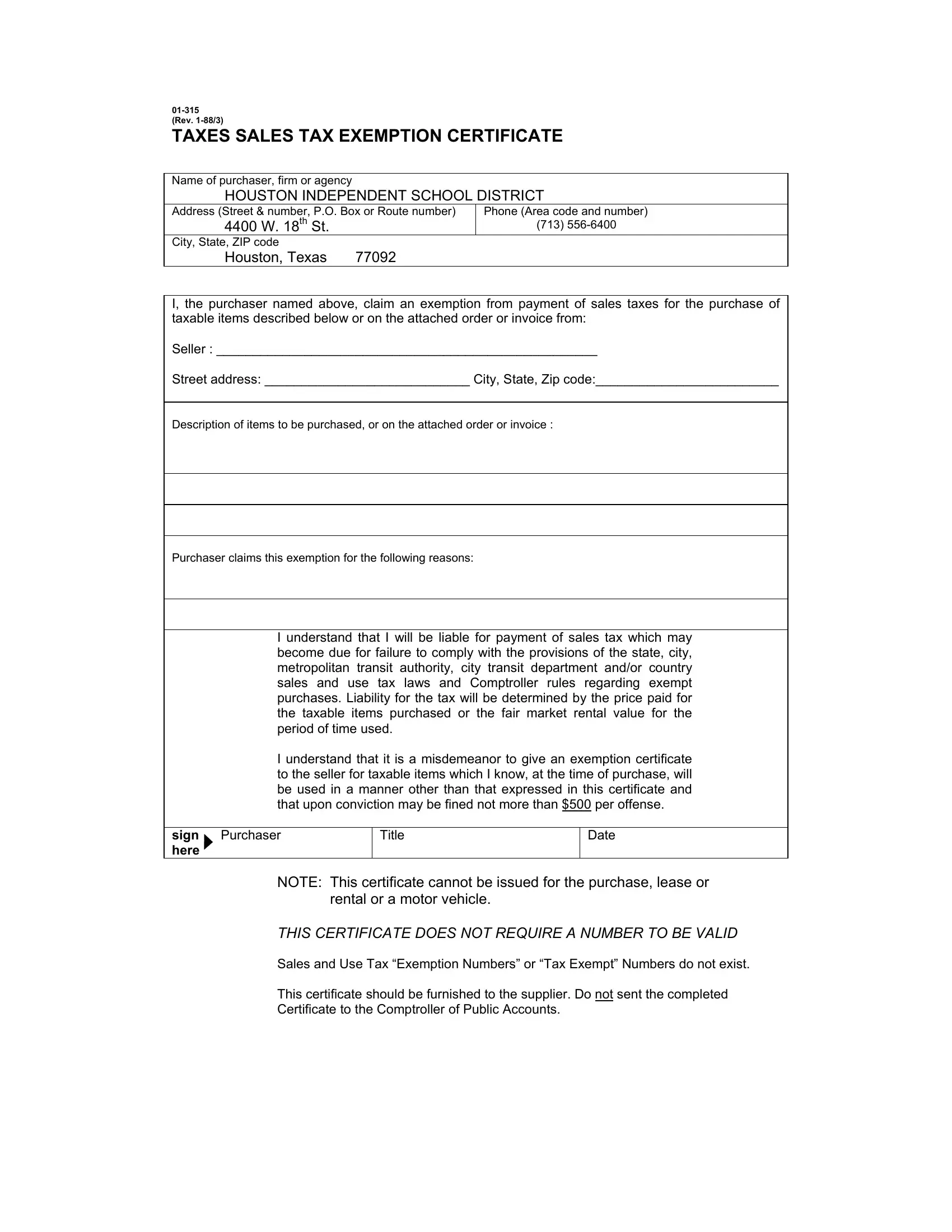

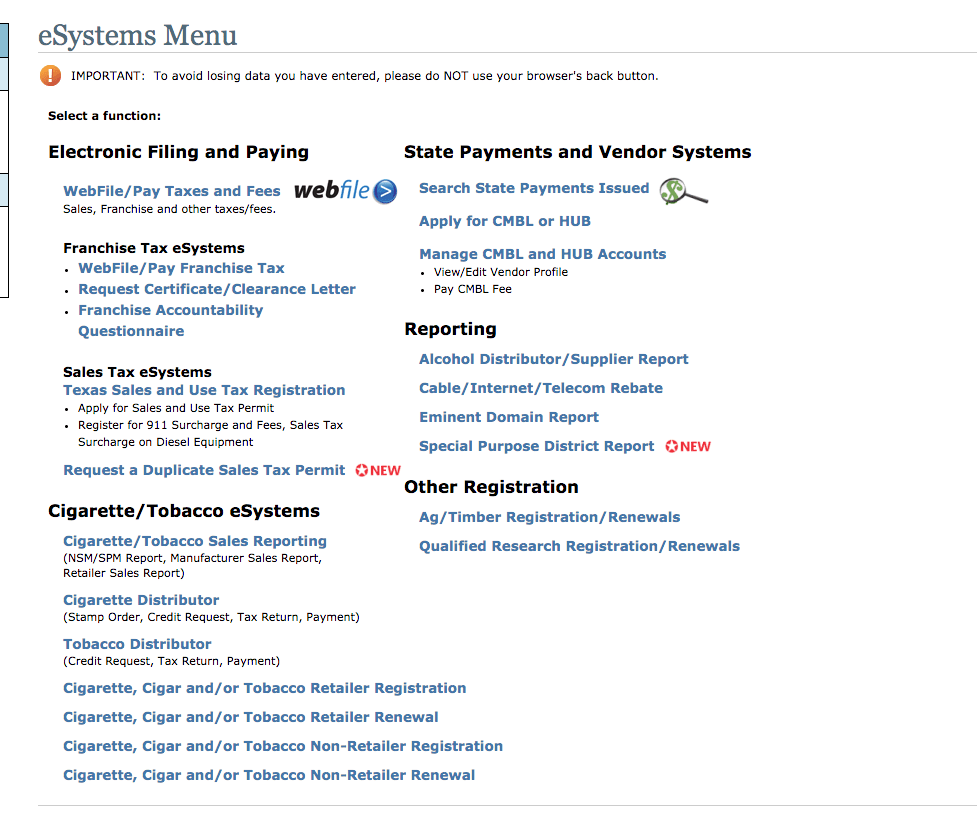

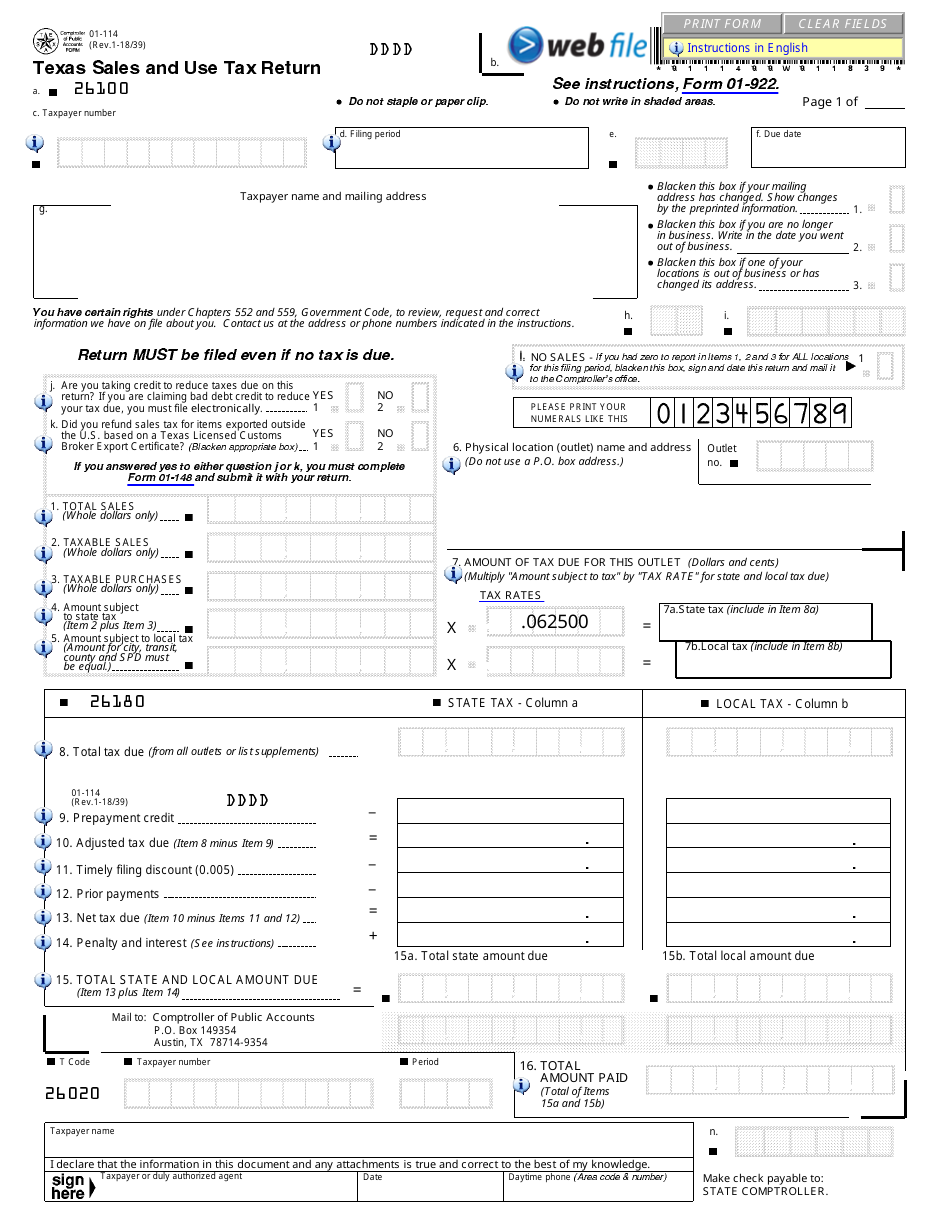

Texas Sales Tax Return Instructions Verkko Sales and Use Tax Returns and Instructions 01 117 Texas Sales and Use Tax Return Short Form PDF 01 114 Texas Sales and Use Tax Return PDF 01 115 Texas Sales and Use Tax Return Outlet Supplement PDF 01 116 Texas Sales and Use Tax Return List Supplement PDF 01 148 Texas Sales and Use Tax Return

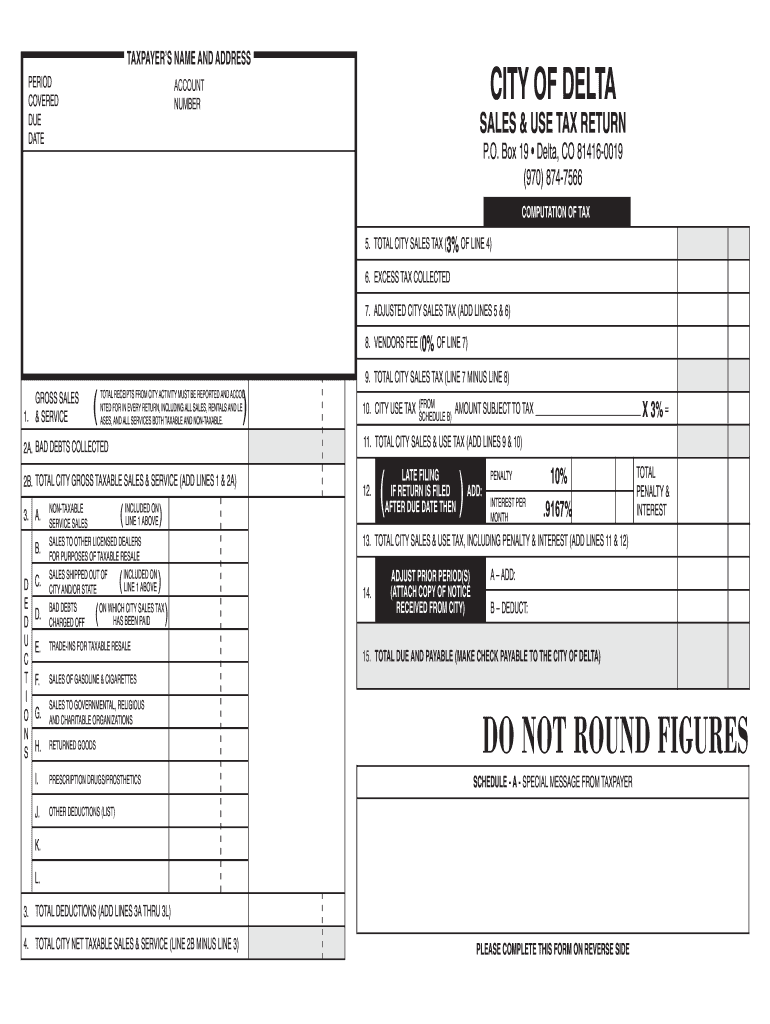

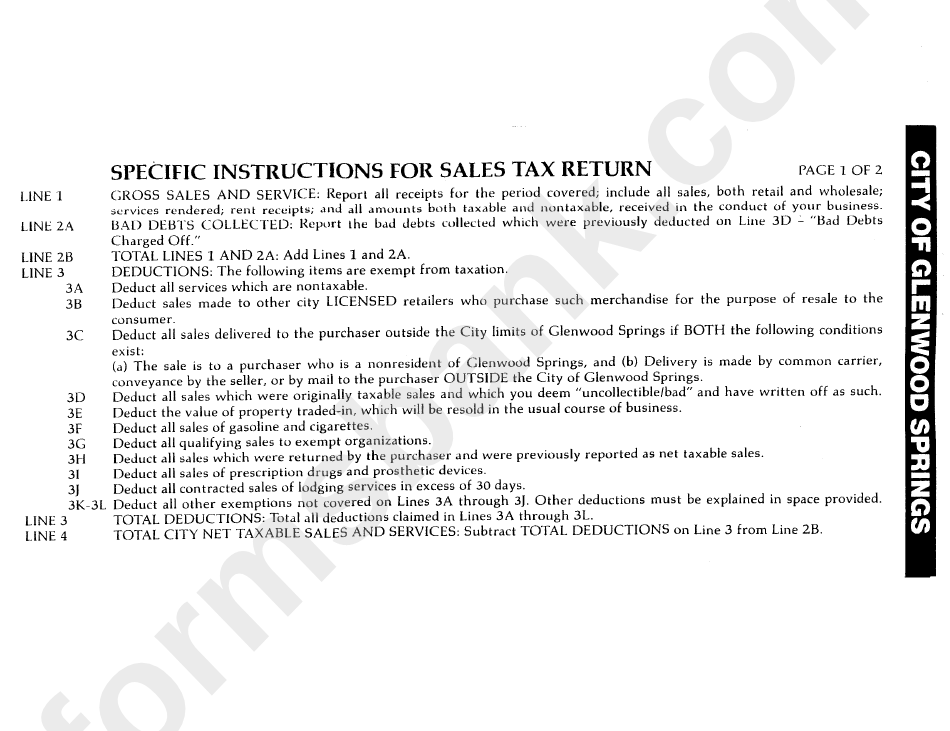

Verkko taxes Requirements for Reporting and Paying Texas Sales and Use Tax Select the amount of taxes you paid in the preceding state fiscal year Sept 1 Aug 31 to find the reporting and payment methods to use Less than 10 000 10 000 49 999 50 000 499 999 500 000 or more Verkko b 26180 b STATE TAX Column a b LOCAL TAX Column b 8 Total tax due from all outlets or list supplements 01 114 Rev 4 19 40 DDDD 9 Prepayment credit 10 Adjusted tax due Item 8 minus Item 9 11 Timely filing discount 0 005 12 Prior payments 13 Net tax due Item 10 minus Items 11 and 12 14 Penalty and

Texas Sales Tax Return Instructions

Texas Sales Tax Return Instructions

https://data.formsbank.com/pdf_docs_html/237/2377/237742/page_1_bg.png

How To Fill Out The Texas Sales And Use Tax Return TAX

https://data.templateroller.com/pdf_docs_html/157/1576/157614/form-01-339-texas-sales-and-use-tax-resale-certificate-texas_print_big.png

Blank Nv Sales And Use Tax Form Kentucky Sales Tax Farm Exemption

https://www.pdffiller.com/preview/22/927/22927837/large.png

Verkko close Texas imposes a 6 25 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 8 25 percent Verkko only Enter quot 0 quot if you have no sales to report Texas Sales are defined as all sales made from a Texas in state location AND all sales made into Texas from an out of state location Item 2 Enter the total amount not including tax of all TAXABLE sales services leases and rentals of tangible personal property including all

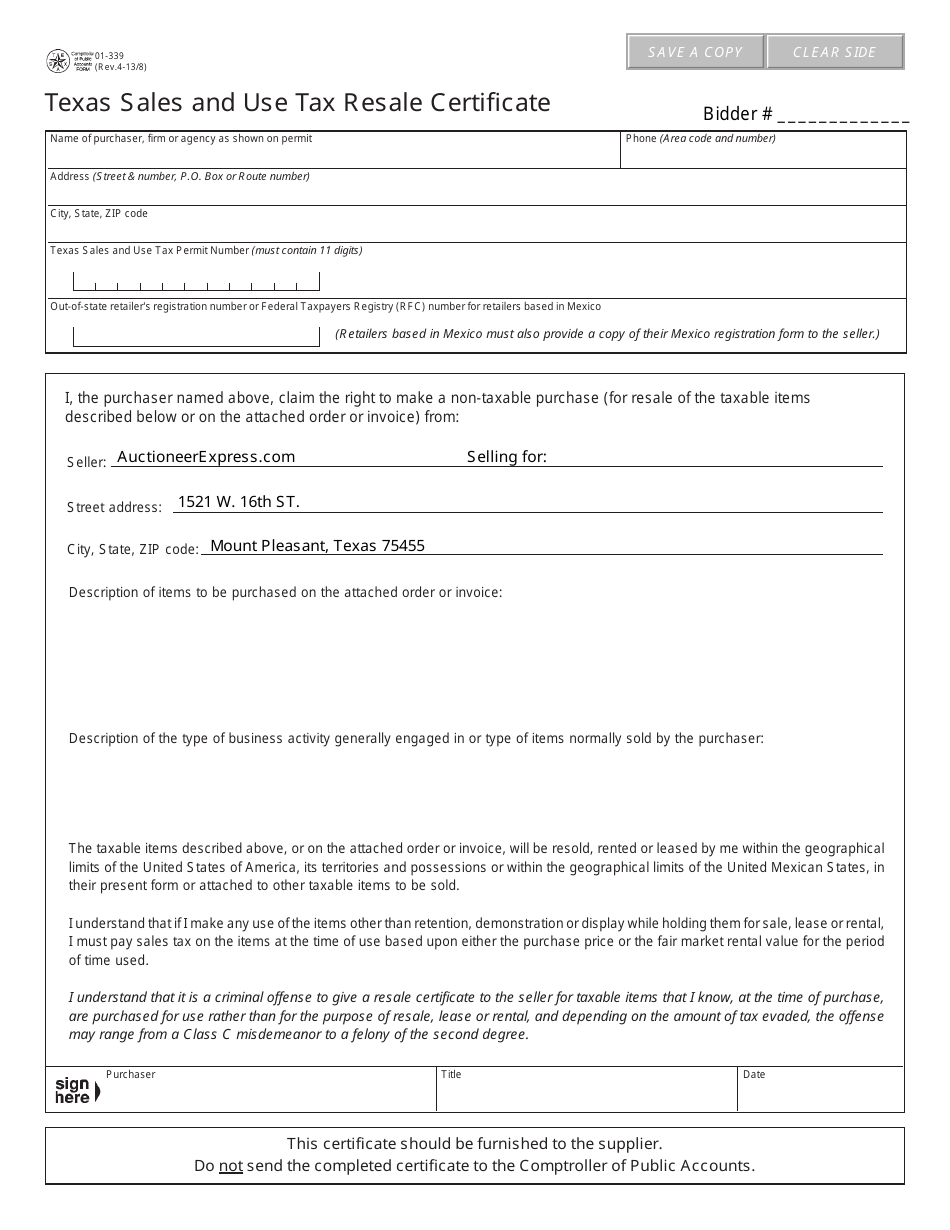

Verkko 23 tammik 2023 nbsp 0183 32 To file a Texas sales and use tax return first file an application for a sales tax permit at the Texas Comptroller s Office website Once you receive your permit in the mail 2 to 3 weeks later record the due dates when you need to pay a sales and use taxes which should be noted in your acceptance notice Verkko 5 jouluk 2023 nbsp 0183 32 Completing a Texas sales tax return is a three step process Businesses must first identify their filing frequency and due dates then prepare the return and finally file and remit sales tax Following this process will help you to prepare for and complete your return smoothly and accurately What s in this article

Download Texas Sales Tax Return Instructions

More picture related to Texas Sales Tax Return Instructions

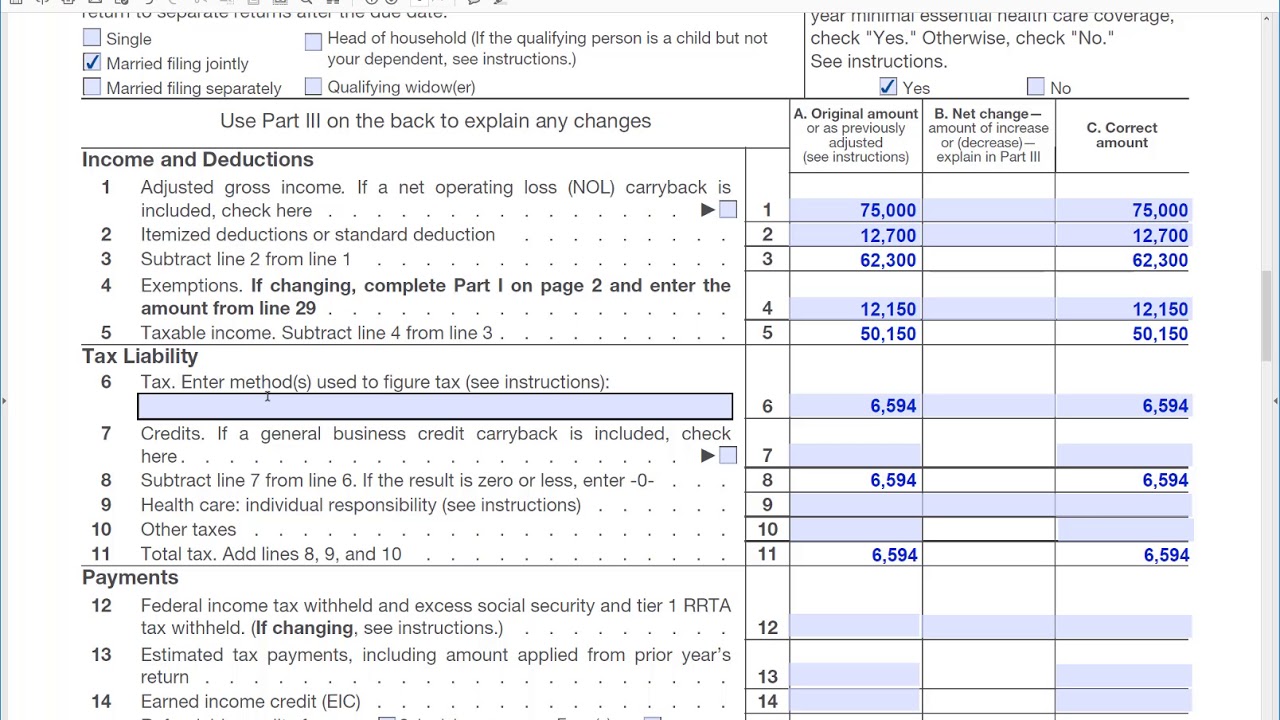

How To Fill Out Form 1040X Amended Tax Return

https://i.ytimg.com/vi/TYJaoyzk0nE/maxresdefault.jpg

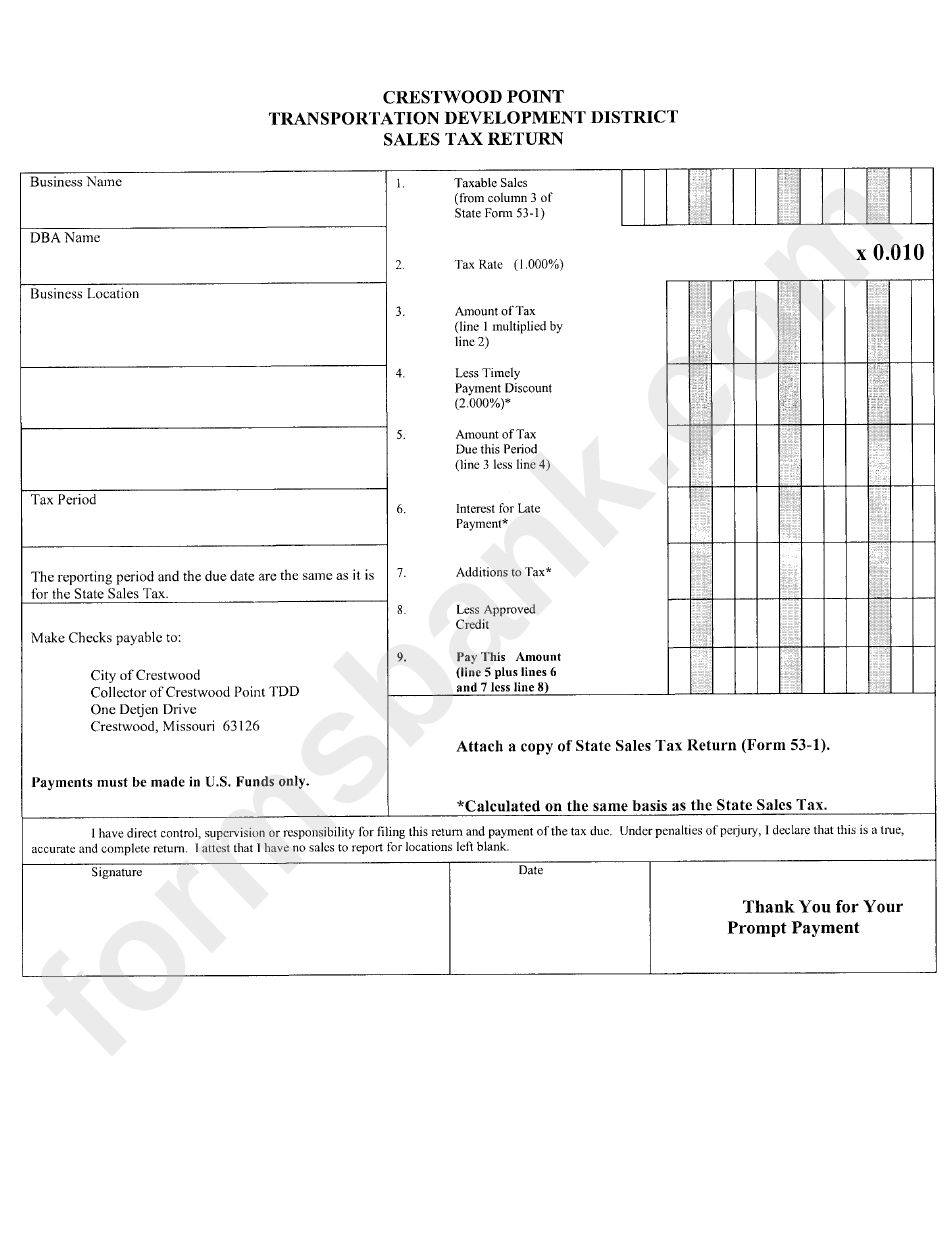

Sales Tax Return Form Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/227/2270/227074/page_1_bg.png

Texas Sales Tax Rates Thresholds And Registration Guide

https://uploads-ssl.webflow.com/5f50dfefde2d2df9368da112/60d9d21925a9056169cad7f5_6BNxCHP4_L0nE3u2cfKQF-bPTFEy-uSwozcR9rmQql1Lg4H2svZl8BfAahg9--nzGVq2K51Qk0B-Opnfz11da0Vdo8WvDdVFfxhIfr1s2PEOyKRh9XYKgnI9FvCQYA_M3ohhjqS6.png

Verkko A nonpermitted Texas purchaser that does not have a Texas Sales and Use Tax Permit must report and pay any use tax owed to the Comptroller s office on Form 01 156 Texas Use Tax Return PDF A purchaser who owes less than 1 000 of use tax must file and pay no later than Jan 20 of the following year Verkko Your business s sales tax return must be filed by the 20th of the month following reporting period For a list of this year s actual due dates see our calendar of Texas sales tax filing due dates Top Where To File Your Texas Sales Tax Return Filing Your Texas Sales Tax Returns Online

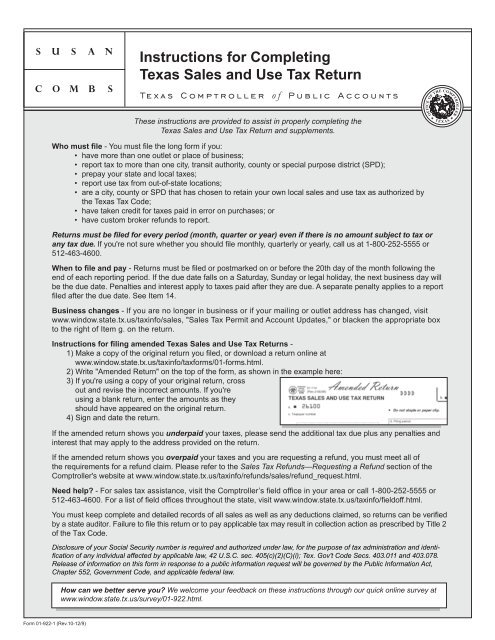

Verkko Filing a Texas sales tax return is a two step process comprised of submitting the required sales data filing the return and remitting the collected tax dollars if any to the Texas Comptroller The filing process forces you to detail your total sales in the state the amount of sales tax collected and the location of each sale Verkko Instructions for Filing an Amended Texas Sales and Use Tax Return Make a copy of the original return you filed or download a blank return from our website at wwwptroller texas gov taxes forms Write quot AMENDED RETURN quot on the

How To Fill Out Form 1040 For 2022 Taxes 2023 Money Instructor

https://i.ytimg.com/vi/dXjHkaNOFBo/maxresdefault.jpg

Fillable Form 01 114 Texas Sales And Use Tax Return Printable Pdf

https://data.formsbank.com/pdf_docs_html/316/3167/316786/page_1_thumb_big.png

https://comptroller.texas.gov/taxes/sales/forms

Verkko Sales and Use Tax Returns and Instructions 01 117 Texas Sales and Use Tax Return Short Form PDF 01 114 Texas Sales and Use Tax Return PDF 01 115 Texas Sales and Use Tax Return Outlet Supplement PDF 01 116 Texas Sales and Use Tax Return List Supplement PDF 01 148 Texas Sales and Use Tax Return

https://comptroller.texas.gov/taxes/sales/filing-requirements.php

Verkko taxes Requirements for Reporting and Paying Texas Sales and Use Tax Select the amount of taxes you paid in the preceding state fiscal year Sept 1 Aug 31 to find the reporting and payment methods to use Less than 10 000 10 000 49 999 50 000 499 999 500 000 or more

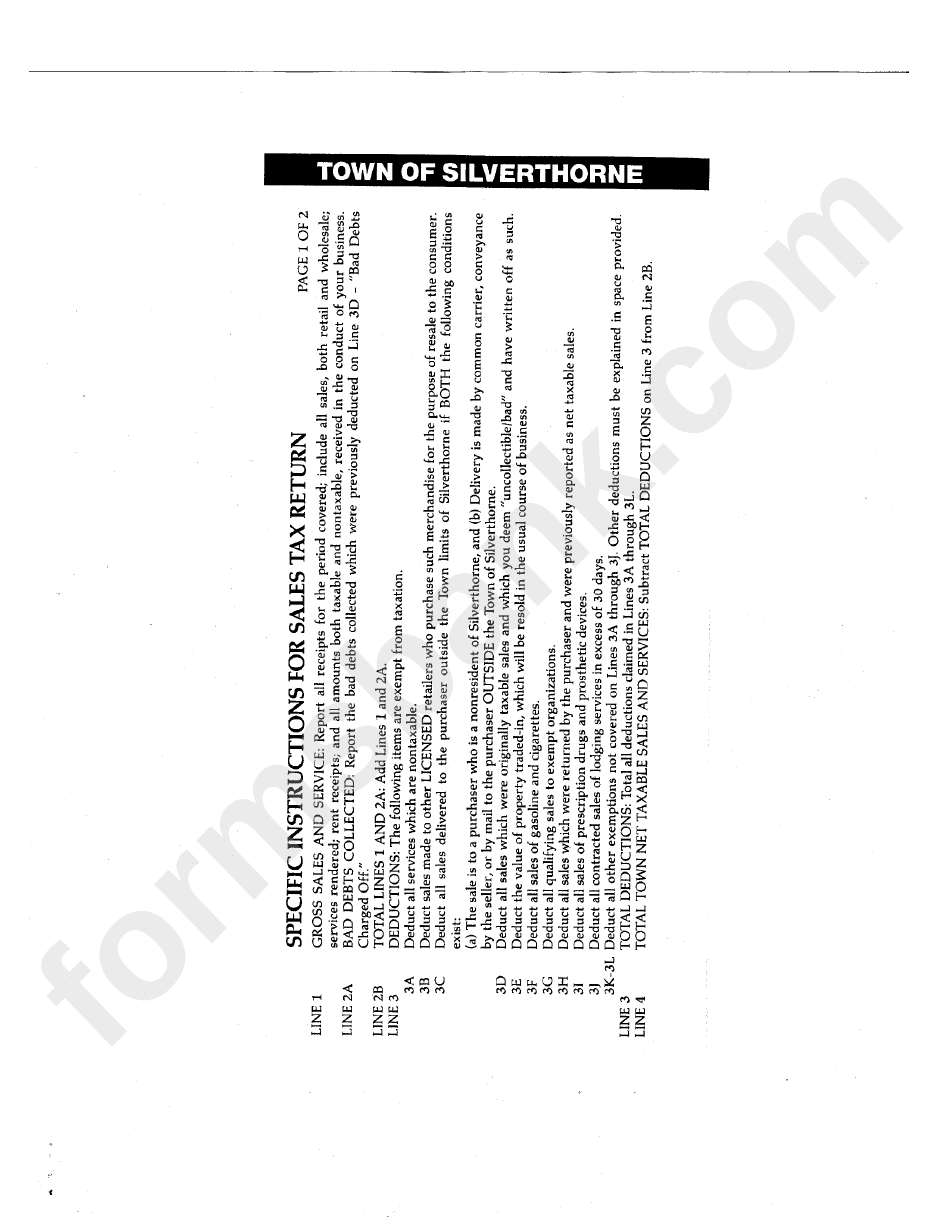

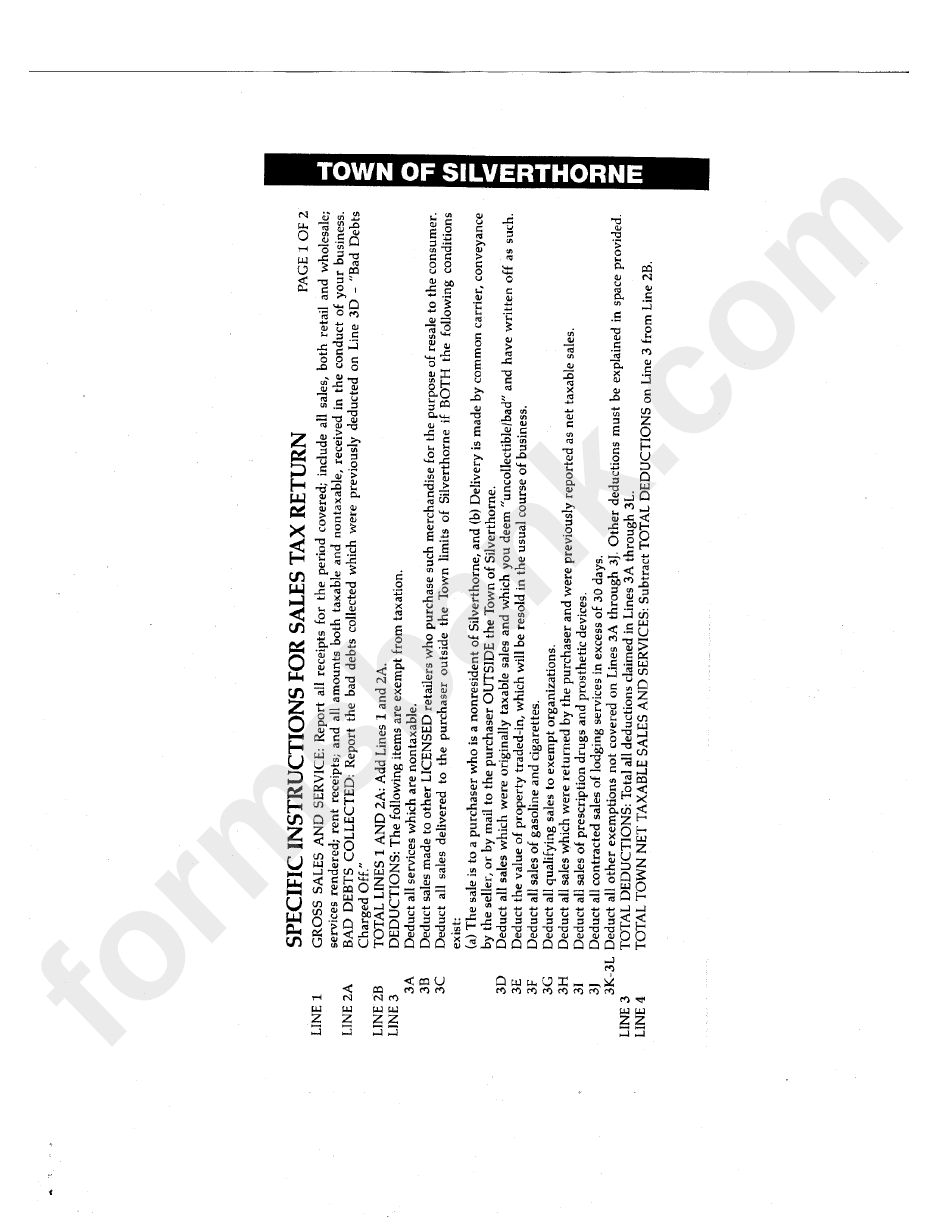

Instructions For Sales Tax Return Printable Pdf Download

How To Fill Out Form 1040 For 2022 Taxes 2023 Money Instructor

Texas Sales And Use Tax Exemption Certification Forms Docs 2023

01 922 Instructions For Completing Texas Sales And Use Tax Return

16 Best Images Of Sales And Use Tax Worksheet Texas Sales And Use Tax

Kansas Retailers Sales Tax Return St 36 Fill Out Sign Online DocHub

Kansas Retailers Sales Tax Return St 36 Fill Out Sign Online DocHub

Texas Sales Tax Exemption Certificate PDF Form FormsPal

How To File And Pay Sales Tax In Texas TaxValet

Lv Sample Sales Tax Semashow

Texas Sales Tax Return Instructions - Verkko 19 tammik 2021 nbsp 0183 32 To get straight to the filing walkthrough instructions skip ahead to the 15 min mark Here are a couple of helpful phone numbers to the Texas State Comptroller 800 252 5555 Sales and