Texas Tax Rebate Checks 2024 Tax Relief for American Families and Workers Act of 2024 Individual Tax Understanding the Tax Relief for American Families and Workers Act of 2024 Thomson Reuters Tax Accounting January 22 2024 5 minute read

Residents should be eligible based on their 2023 2024 property taxes if their property qualifies as a homestead and they meet other criteria The amount available depends on several factors but S everal states are expected to send out stimulus checks to residents in 2024 with payments ranging from a few hundred dollars to over 1 000 Many are issuing property tax rebates or

Texas Tax Rebate Checks 2024

Texas Tax Rebate Checks 2024

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1f1Mcw.img?w=1920&h=1280&m=4&q=79

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

https://assets.site-static.com/userFiles/3705/image/dis-vet-tax-do.jpg

When Will We Get The Extra Tax Rebate Checks In Montana Details

https://townsquare.media/site/990/files/2023/03/attachment-032923-MT-Tax-Rebate-.jpg?w=980&q=75

The Internal Revenue Service IRS has clarified that for the 2023 tax year most state stimulus payments won t be taxable on federal returns but exceptions may apply particularly for itemized Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

Texas hasn t announced plans to send inflation relief checks just yet but will have an extra 27 billion to spend in 2023 We have all the details People all around the U S are busy trying to Given the complexity of the new provision and the large number of individual taxpayers affected the IRS is planning for a threshold of 5 000 for tax year 2024 as part of a phase in to implement the 600 reporting threshold enacted under the American Rescue Plan ARP

Download Texas Tax Rebate Checks 2024

More picture related to Texas Tax Rebate Checks 2024

When Is Alabam Initiating Distribution 300usd Tax Rebate Checks

https://www.lamansiondelasideas.com/wp-content/uploads/2023/08/Alabama-Tax-Rebate-Checks.jpg

Ny Property Tax Rebate Checks 2023 RebateCheck

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/tax-rebate-checks-come-early-this-year-yonkers-times-7.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Federal income tax returns are due April 15 Texas is one of a small group of states that do not impose a state income tax so this means there is one less deadline to worry about To file for an Currently 1 600 of the 2 000 credit per child is refundable The credit s phaseout threshold is 400 000 for married earners filing jointly and 200 000 for head or single households At the

The Inflation Reduction Act IRA provides support for clean energy through these programs Inflation Reduction Act Rebates Rebates from the Home Energy Performance Based Whole House HOMES Rebate program and the Home Electrification and Application HEAR Rebate program funded through the Inflation Reduction Act are not currently available The Texas Legislature has introduced a significant benefit for TRS annuitants in the form of one time stipends designed to provide immediate financial assistance to eligible retirees Here are the key details Eligibility Based on Age Annuitants aged 75 and older as of August 31 2023 are eligible for a 7 500 stipend

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

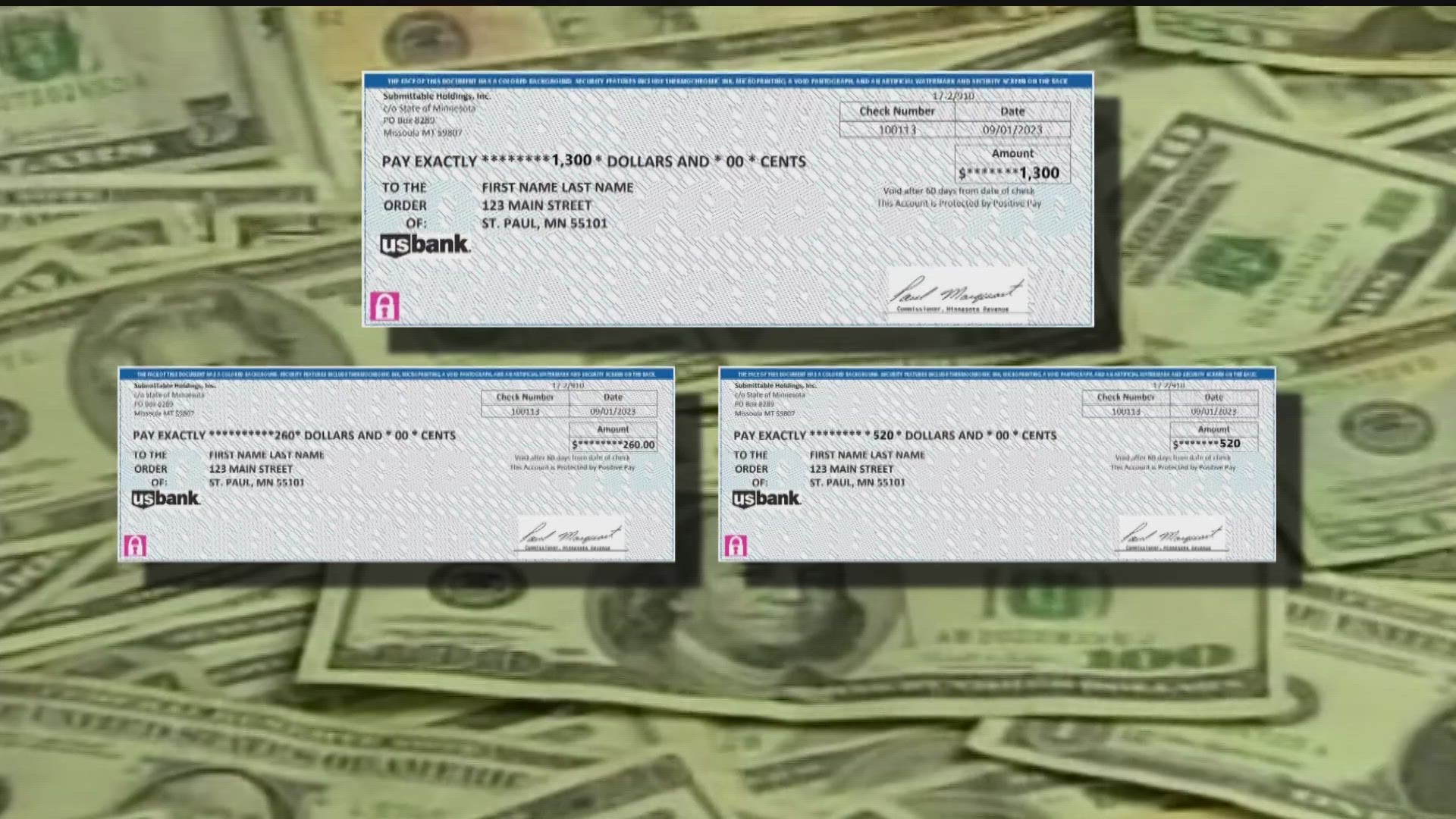

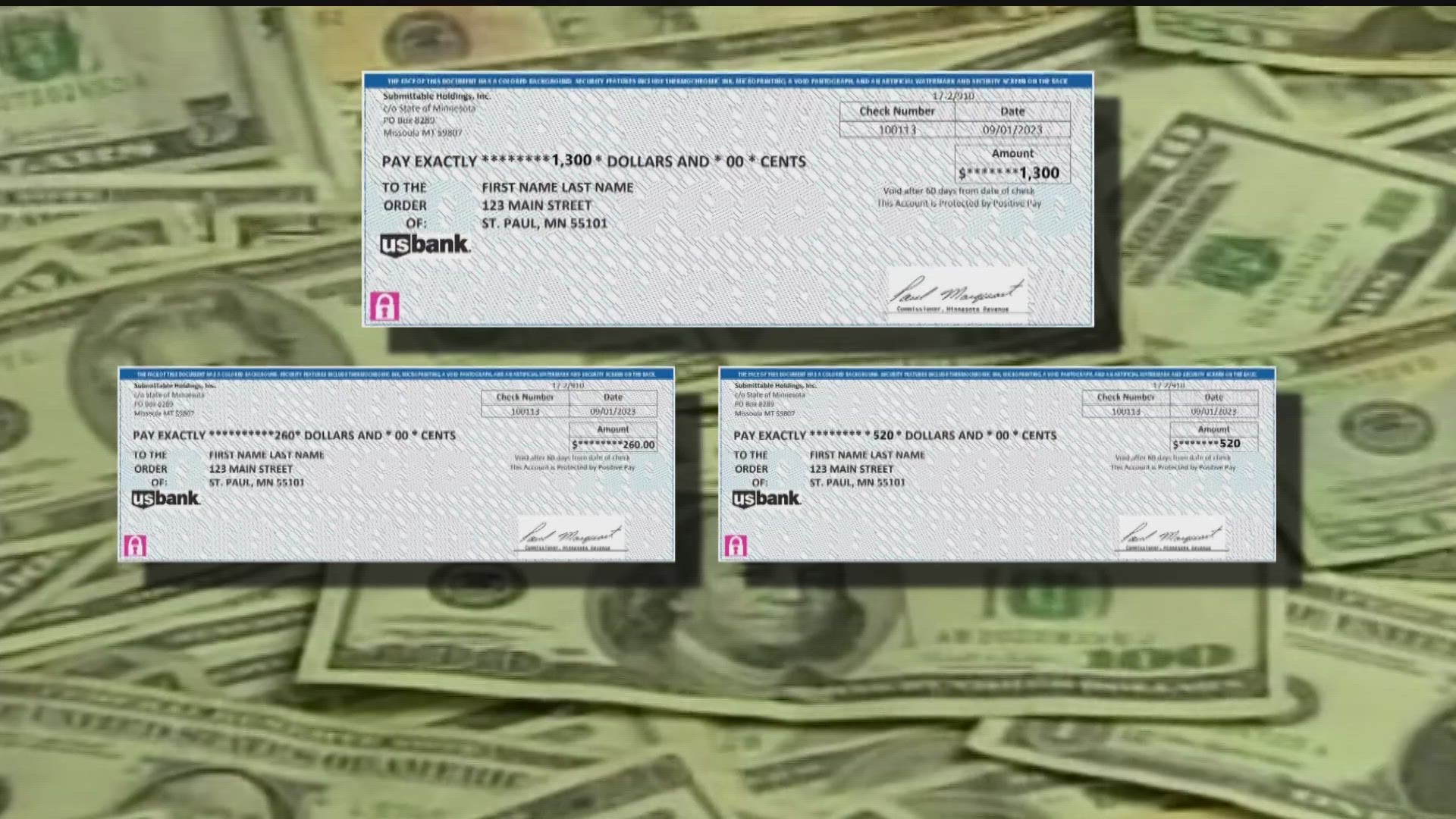

Minnesota Tax Rebate Checks May Look Like Junk Mail

https://images.foxtv.com/static.fox9.com/www.fox9.com/content/uploads/2023/09/1280/720/montana-rebate-checks.jpg?ve=1&tl=1

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

Tax Relief for American Families and Workers Act of 2024 Individual Tax Understanding the Tax Relief for American Families and Workers Act of 2024 Thomson Reuters Tax Accounting January 22 2024 5 minute read

https://www.newsweek.com/will-there-new-stimulus-payment-2024-rebate-1856477

Residents should be eligible based on their 2023 2024 property taxes if their property qualifies as a homestead and they meet other criteria The amount available depends on several factors but

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

Income Tax Rebate Under Section 87A

One time Tax Rebate Checks For Idaho Residents KLEW

500 Virginia Tax Rebate Checks You Still Have 10 Days To Claim It TrendRadars

Tax Rebate Checks What Eligible Recipients Need To Know

Minnesota Tax Rebate Checks From Montana Company Are Legitimate Kare11

Minnesota Tax Rebate Checks From Montana Company Are Legitimate Kare11

State Mailing Out 2 5M Property Tax Rebate Checks Newsday

Two Million Americans Could Get Automatic 970 Checks Under New State Proposal Are You

500 Tax Rebate Checks In The Mail Starting Friday Video NJ Spotlight News

Texas Tax Rebate Checks 2024 - Given the complexity of the new provision and the large number of individual taxpayers affected the IRS is planning for a threshold of 5 000 for tax year 2024 as part of a phase in to implement the 600 reporting threshold enacted under the American Rescue Plan ARP