The Reaction Of Consumer Spending And Debt To Tax Rebates Evidence From Consumer Credit Data Spending rose most for consumers who were initially most likely to be liquidity constrained whereas debt declined most so saving rose most for unconstrained consumers We use a

We use a new panel dataset of credit card accounts to analyze how consumers responded to the 2001 Federal income tax rebates We estimate the monthly response of credit card payments We use a new panel dataset of credit card accounts to analyze how consumer responded to the 2001 Federal income tax rebates We estimate the monthly response of

The Reaction Of Consumer Spending And Debt To Tax Rebates Evidence From Consumer Credit Data

The Reaction Of Consumer Spending And Debt To Tax Rebates Evidence From Consumer Credit Data

https://www.gannett-cdn.com/-mm-/a053e4dafbfbe5e5c179777ff8e79efb9a7a0cde/c=0-269-4578-2855&r=x1683&c=3200x1680/local/-/media/2016/06/29/USATODAY/USATODAY/636027920470313375-AP-Consumer-Spending.jpg

PDF The Reaction Of Consumer Spending And Debt To Tax Rebates

https://i1.rgstatic.net/publication/45133605_The_reaction_of_consumer_spending_and_debt_to_tax_rebates_Evidence_from_consumer_credit_data/links/544437660cf2a76a3ccd6d07/largepreview.png

:strip_icc()/consumer-spending-definition-and-determinants-3305917_color-97ebeaf3c72f452eae6bf3e91cd4cc88.png)

Consumer Spending And Its Impact On The Economy

https://www.thebalance.com/thmb/rC7ZrapQMi93A0QVWk9E1vo65S0=/950x0/filters:max_bytes(150000):strip_icc()/consumer-spending-definition-and-determinants-3305917_color-97ebeaf3c72f452eae6bf3e91cd4cc88.png

Analyze how consumers respond to lumpy increases in income like tax rebates Specifically to what extent did consumers use the 2001 Federal income tax rebates to increase spending We use a new panel dataset of credit card accounts to analyze how consumers responded to the 2001 Federal income tax rebates We estimate the monthly response of

Analyze how consumers respond to lumpy increases in income like tax rebates Specifically to what extent did consumers use the 2001 Federal income tax rebates to increase spending We use a new panel dataset of credit card accounts to analyze how consumer responded to the 2001 Federal income tax rebates We estimate the monthly response of credit card payments

Download The Reaction Of Consumer Spending And Debt To Tax Rebates Evidence From Consumer Credit Data

More picture related to The Reaction Of Consumer Spending And Debt To Tax Rebates Evidence From Consumer Credit Data

Consumer Spending Drops As Income Stalls

https://i2.cdn.turner.com/money/dam/assets/121130011003-consumer-spending-113012-tablet-large.jpg

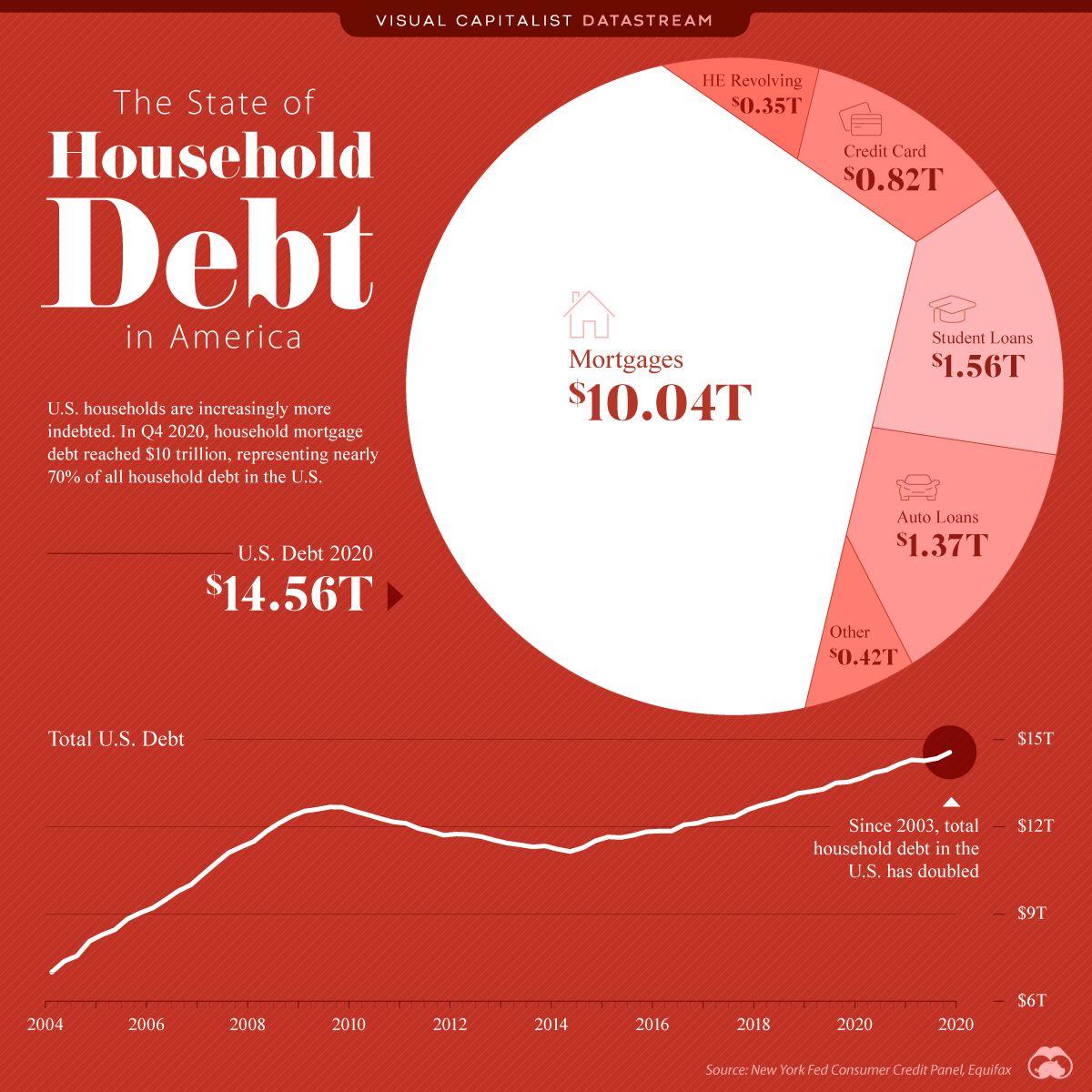

Congress Debt Ceiling Reddit Americanwarmoms

https://www.visualcapitalist.com/wp-content/uploads/2021/05/Household-Total-Debt-Main.jpeg

Harris Poll Survey Forecasts Consumer Spending Rebound In Q4 And 2021

https://www.retailtouchpoints.com/wp-content/uploads/2020/10/Consumer-spending.png

Abstract We use a new panel dataset of credit card accounts to analyze how consumers responded to the 2001 federal income tax rebates We estimate the monthly response of The existing literature on government debt has predominantly focused on its influence on economic growth with relatively limited attention paid to its ecological

Abstract We use a new panel dataset of credit card accounts to analyze how consumers responded to the 2001 Federal income tax rebates We estimate the monthly response of We estimate the monthly response of credit card payments spending and debt exploiting the unique randomized timing of the rebate disbursement We find that on average consumers

Consumer Spending U S Bureau Of Economic Analysis BEA

https://www.bea.gov/system/files/consumer-spending.jpg

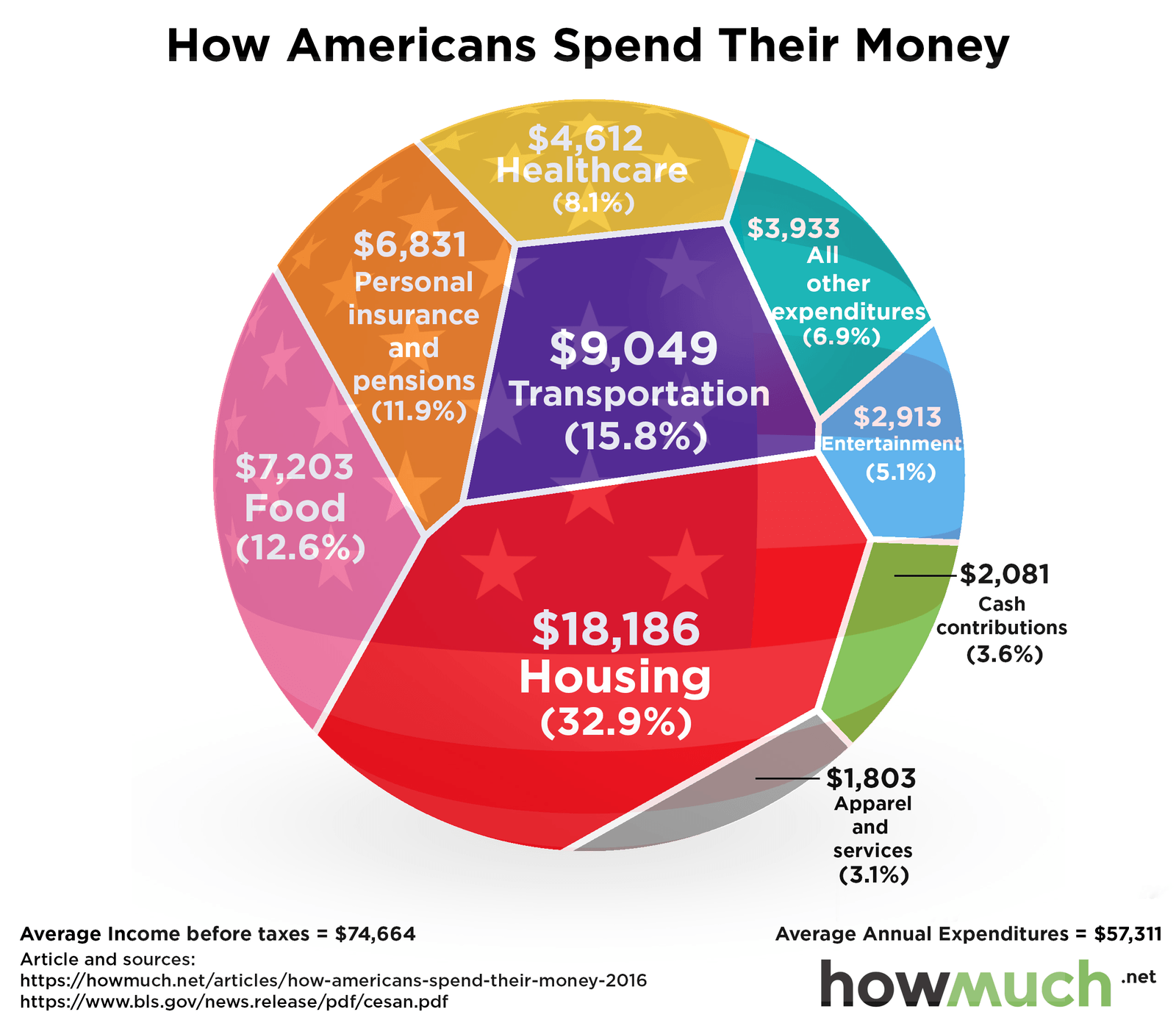

2015 US Consumer Spending Breakdown Infographics

https://lh3.googleusercontent.com/proxy/lIJ96bogc-Oh-awLhCqRuAsU1L3NF1uczvY5h227tMpxxTSDdabpNipkuG0eHe1vSC8=s0-d

https://www.journals.uchicago.edu › doi

Spending rose most for consumers who were initially most likely to be liquidity constrained whereas debt declined most so saving rose most for unconstrained consumers We use a

https://www.nber.org › papers

We use a new panel dataset of credit card accounts to analyze how consumers responded to the 2001 Federal income tax rebates We estimate the monthly response of credit card payments

How Your Spending Habits Compare To The Typical American

Consumer Spending U S Bureau Of Economic Analysis BEA

United States Consumer Spending 1950 2021 Data 2022 2023 Forecast

US Consumer Spending Increases Solidly Income Tepid

U S Consumer Spending Began To Recover As Payments Arrived Equitable

Consumer Spending And Consumer Debt Center For Business And Economic

Consumer Spending And Consumer Debt Center For Business And Economic

Consumer Spending Income Jump In February Cleveland

Weekly Market Trend Higher Rates Create Yield Opportunities

How Debt Consolidation Can Go Wrong

The Reaction Of Consumer Spending And Debt To Tax Rebates Evidence From Consumer Credit Data - Analyze how consumers respond to lumpy increases in income like tax rebates Specifically to what extent did consumers use the 2001 Federal income tax rebates to increase spending