Transport Allowance Exemption In Income Tax Transport allowance is taxable in the hands of the employee since it is added to their gross salaries However employees can claim tax exemption for transport allowance as per the

Transportation allowance of an employee is exempted from income tax when an employee and an employer have an agreement between them which their agreement is clearly defined on the Transportation allowance of an employee is exempted from income tax when an employee and an employer have an agreement between them which their agreement is

Transport Allowance Exemption In Income Tax

Transport Allowance Exemption In Income Tax

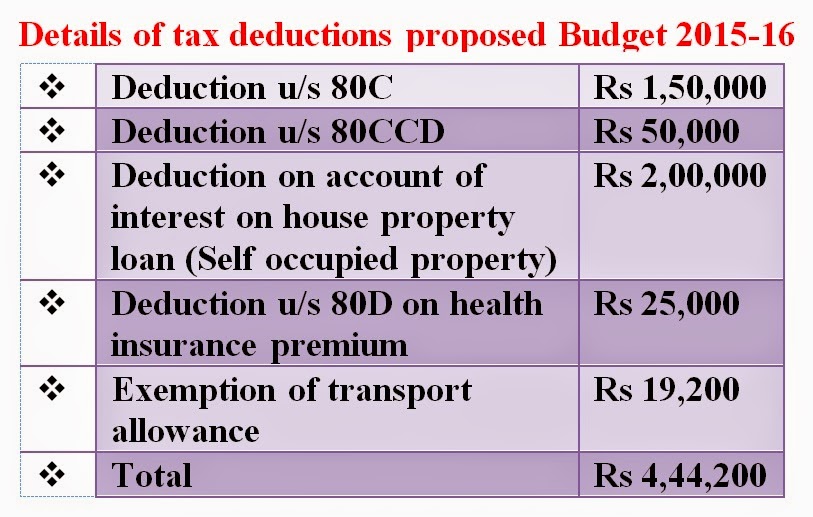

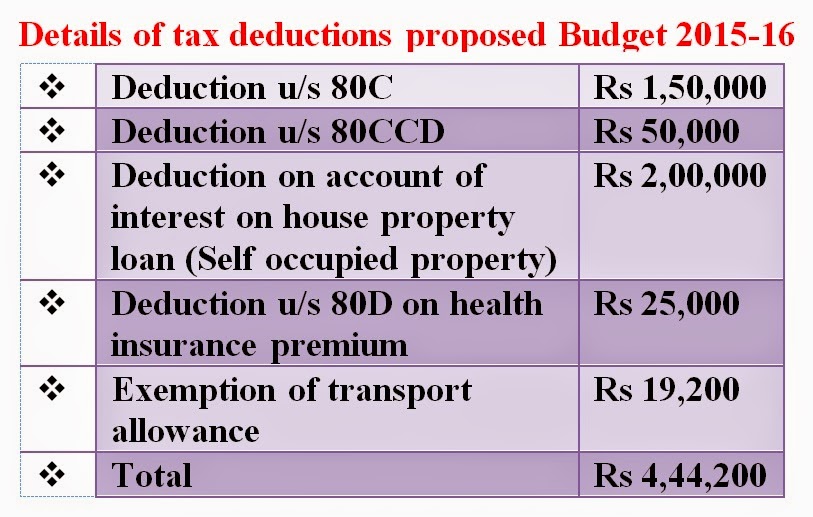

https://www.staffnews.in/wp-content/uploads/2015/02/Itax.jpg

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

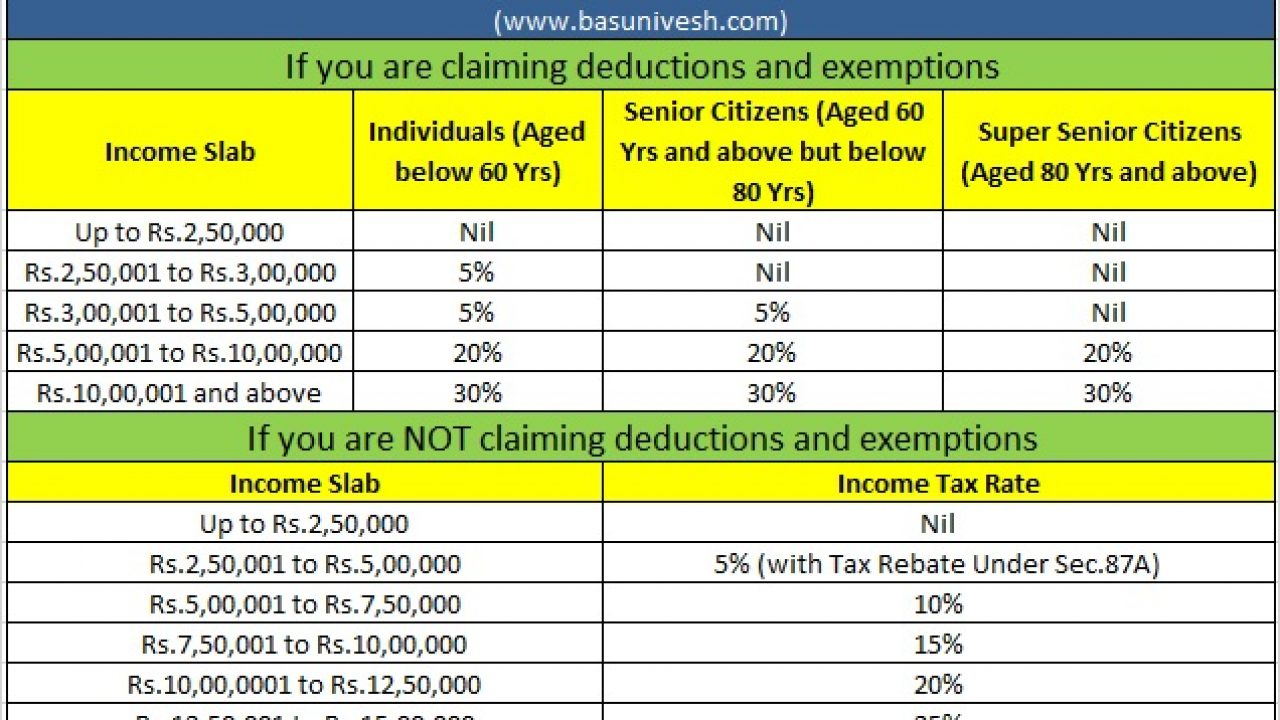

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-13.jpg

TRANSPORT ALLOWANCE RULES AND TAX EXEMPTION Indian Railways Employees

https://1.bp.blogspot.com/-_WLjsbD516k/Wy4MqU7tLYI/AAAAAAAAASY/prTfJlCLRh4Xj8lWQ8dSoLK9azpgD5zAwCLcBGAs/s1600/Transport-Allowance-Rules-Tax-exemption-1.jpg

What are the exemption for income tax 2020 21 The maximum tax exempt allowance is currently set at 2 200 Birr US 81 per month but the allowance cannot exceed HRA is exempt based on the least of actual HRA received 40 of salary 50 in major cities or rent paid minus 10 of salary Other allowances like transport and

When deducting TDS from your salary your employer usually makes sure you benefit from the tax exemption on travel allowance Then all you need to do is fill in the PDF 1 6 2410 0 obj endobj xref 2410 41 0000000016 00000 n 0000001869 00000 n 0000001995 00000 n 0000002480 00000 n 0000002632 00000 n 0000002808 00000 n

Download Transport Allowance Exemption In Income Tax

More picture related to Transport Allowance Exemption In Income Tax

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

HRA Exemption Calculator For Income Tax Benefits Calculation And

https://educationalstuff.in/wp-content/uploads/2023/04/Tue_11_04_2023_15_27_40.png

Income Tax Appellate Tribunal Recruitment Https www itat gov in

https://www.tamilbrains.com/wp-content/uploads/2021/04/Income-Tax-Recruitment-2021.jpg

There are limits on tax exemption depending on your tax situation These are Transport Allowance of Rs 1 600 per month is tax free for a salaried employee Any amount Any extra amount above that collected as Transportation Allowance is taxable as per your income slab If your company provides a means for office transport the transport

[desc-10] [desc-11]

Special Cash Allowance To Avail Benefit Of Leave Travel Allowance

https://www.taxmann.com/post/wp-content/uploads/2021/05/Special-Cash-allowance_Blog_Sep21-1.jpg

Transport Allowance And Exemption For 2018 19 Legoesk

https://legodesk.com/wp-content/uploads/2018/12/TransportAlowance-LD-xb0-1024x482.jpg

https://cleartax.in › transport-allowance

Transport allowance is taxable in the hands of the employee since it is added to their gross salaries However employees can claim tax exemption for transport allowance as per the

https://www.2merkato.com › articles › tax › types

Transportation allowance of an employee is exempted from income tax when an employee and an employer have an agreement between them which their agreement is clearly defined on the

What Is Conveyance Transport Allowance How To Get Exemptions For It

Special Cash Allowance To Avail Benefit Of Leave Travel Allowance

How To Claim Income Tax Exemption On Conveyance Allowance

Income Tax Department Conducts Searches In Maharashtra Faceless

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Strategic Approaches Unleashing The Potential For Tax Savings In

Strategic Approaches Unleashing The Potential For Tax Savings In

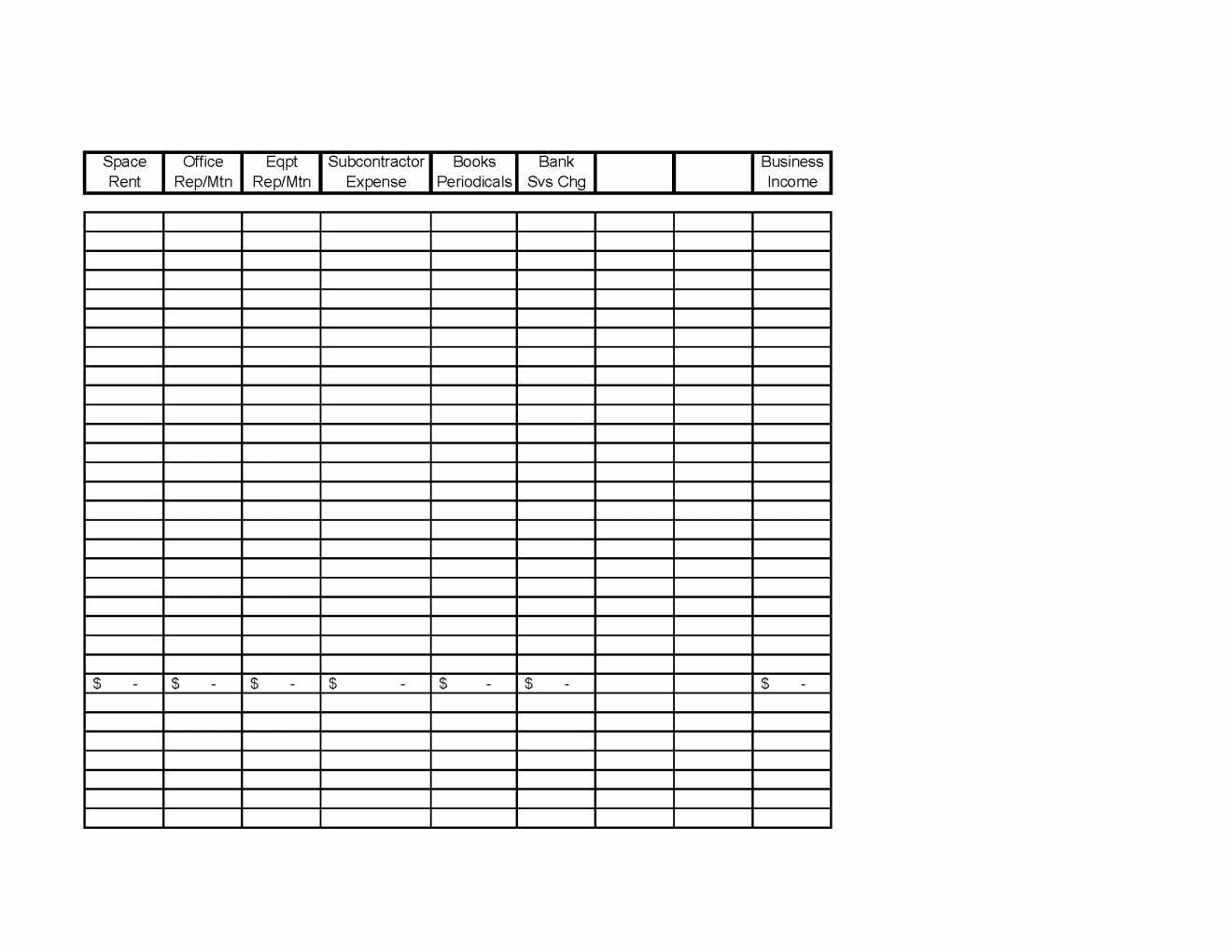

Income Tax Spreadsheet Tax Organizer Worksheet Download New In Income

7th Pay Rates Of Transport Allowance Chart 7th Pay Commission For All

LTA Leave Travel Allowance Calculation And Income Tax Exemption How

Transport Allowance Exemption In Income Tax - [desc-13]