Transport Allowance Exemption Limit For Ay 2022 23 What is the exemption limit of transport allowance Transportation and transportation allowance up to Rs 1600 per month or Rs 19200 per year could be deducted from your taxable pay income up till FY 2017 18

Up to Rs 300 per month per child up to a maximum of 2 children is exempt Hostel Expenditure Allowance Rs 3 200 per month granted to an employee who is blind or Allowance granted to an employee working in any transport business to meet his personal expenditure during his duty performed in the course of running of such transport from

Transport Allowance Exemption Limit For Ay 2022 23

Transport Allowance Exemption Limit For Ay 2022 23

http://www.sensystechnologies.com/blog/wp-content/uploads/2022/04/20220429_120210.jpg

Conveyance Allowance Exemption For FY 2022 23 AY 23 24

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/05/shutterstock_1096017494-1024x465.jpg

Travelling Allowance To The Officials Deployed For Election Duty

https://www.staffnews.in/wp-content/uploads/2022/09/travelling-allowance-to-the-officials-deployed-for-election-duty-claim-form.jpg

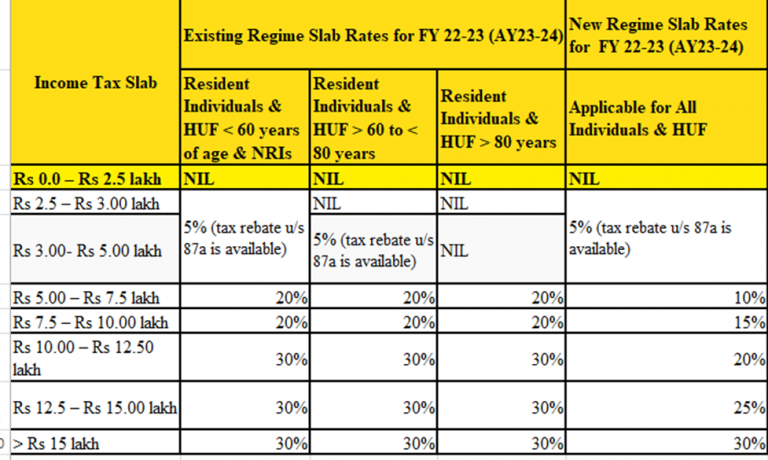

Conveyance Allowance Exemption Limit for AY 2023 24 As per the provisions outlined in Section 10 14 ii of the Income Tax Act and Rule 2BB of the Income Tax Rules people who get a salary are eligible to avail an Under the New tax regime you can claim tax exemption for the following Transport allowances in case of a specially abled person Conveyance allowance received to

Some of the Popular Limits are Tax Rates Conveyance Allowance HRA Home Loan Interest Deduction Under Section 80C Leave Encashment Gratuity Medical Reimbursement etc Under the New tax regime you can claim tax exemption for the following Salary Transport allowances in case of a specially abled person Conveyance allowance received to

Download Transport Allowance Exemption Limit For Ay 2022 23

More picture related to Transport Allowance Exemption Limit For Ay 2022 23

Rs 50000 Standard Deduction From FY 2019 20 AY 2020 21 Impact

https://www.relakhs.com/wp-content/uploads/2019/07/Rs-50000-Standard-Deduction-FY-2019-20-AY-2020-21-impact-on-your-net-salary-income-how-much-tax-can-you-save.jpg

Income Tax Slabs New Old Tax Rates FY 2022 23 AY 2023 24 Janani

https://jananiservices.com/blog/wp-content/uploads/2022/08/image-2-768x460.png

Transport Allowance And Exemption For 2018 19 Legoesk

https://legodesk.com/wp-content/uploads/2018/12/TransportAlowance-LD-xb0-1024x482.jpg

Conveyance Allowance Allows for the deduction of expenses incurred for travel as part of your employment Travel Compensation Any compensation received for travel expenses during tours or transfers is Exemption Limit Transport allowance exemption is provided in Section 10 14 ii of the Income Tax Act and Rule 2BB of Income tax Rules Transport allowance is exempt to the extent to Rs 1 600 per month i e upto

Exemption limit if places of origin of journey and destination are connected by rail but the journey is performed by any other mode of transport Air conditioned first class rail The tax exemption limit for transport allowance was Rs 1 600 per month Rs 19 200 annually based on previous regulations If the received amount is above this exemption limit the

Income Tax Slabs FY 2023 24 And AY 2024 25 New Old Regime Tax Rates

https://assets1.cleartax-cdn.com/finfo/wg-utils/retool/c783e14b-0e27-4b10-a784-40bd925acdda.png

Medical Allowance Exemption Limit Calculation

https://www.bankbazaar.com/images/india/infographic/health-insurance-waiting-period-full.png

https://www.taxbuddy.com › blog › transpor…

What is the exemption limit of transport allowance Transportation and transportation allowance up to Rs 1600 per month or Rs 19200 per year could be deducted from your taxable pay income up till FY 2017 18

https://gttaxsolution.com › ...

Up to Rs 300 per month per child up to a maximum of 2 children is exempt Hostel Expenditure Allowance Rs 3 200 per month granted to an employee who is blind or

No Exemption For Transport Allowance And Medical Allowance U s 10 For

Income Tax Slabs FY 2023 24 And AY 2024 25 New Old Regime Tax Rates

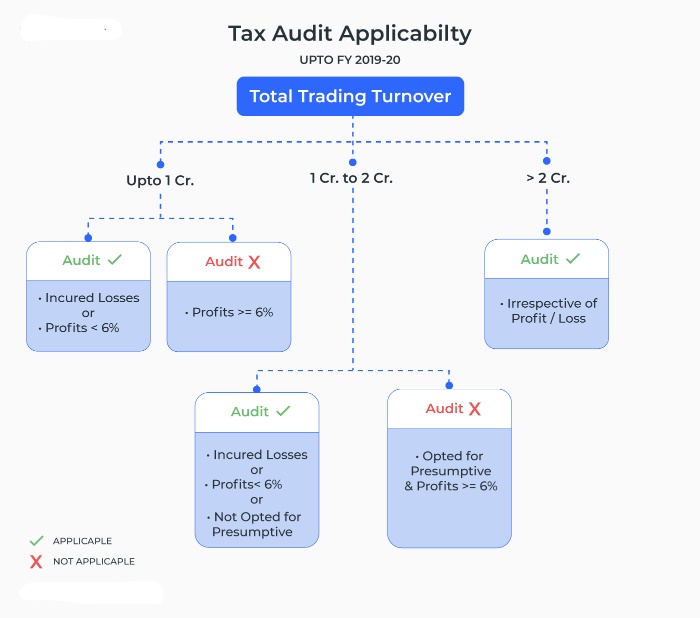

Tax Audit Ceiling U S 44ab From Rs 1 To Rs 5 Cr CA Rajput

Transport Allowance Exemption Meaning Is Transport Allowance Taxable

Budget 2015 Transport Allowance Exemption Doubled

Special Allowance Calculation In India Exemptions Taxations

Special Allowance Calculation In India Exemptions Taxations

Leave Travel Allowance LTA Claim Rule Eligibility Tax Exemptions

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

Conveyance Allowance Exemption Conveyance Allowance

Transport Allowance Exemption Limit For Ay 2022 23 - Under the New tax regime you can claim tax exemption for the following Salary Transport allowances in case of a specially abled person Conveyance allowance received to