Travel Allowance Deduction Income Tax Act Web 12 Aug 2022 nbsp 0183 32 A maximum of 4 500 euros per year can be deducted unless you meet one of the following two exceptions If you commute to work in your own personal or business vehicle and exceed 4 500 euros per year with the commuter allowance the excess amount may be deducted

Web Travel allowances are taxed at a flat rate of 15 wage tax What to look out for The allowance can only be paid to employees who regularly commute to work and in many cases there is an annual cap of 4 500 euros the same cap as Web The Income Tax Act 1961 offers salaried individuals several tax exemptions beyond deductions like LIC premiums and housing loan interest While deductions reduce your total taxable income exemptions exclude specific types of

Travel Allowance Deduction Income Tax Act

Travel Allowance Deduction Income Tax Act

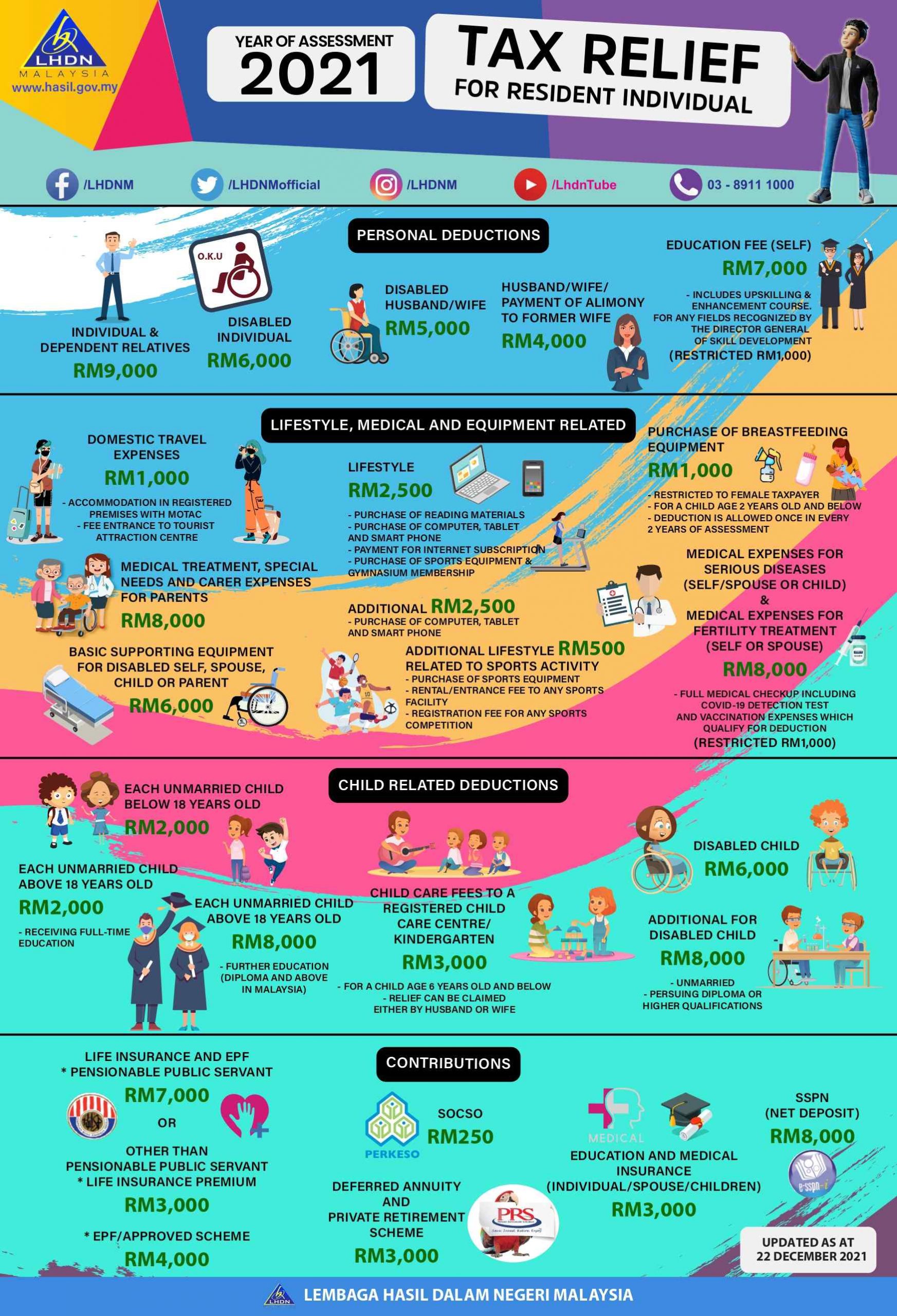

https://soyacincau.com/wp-content/uploads/2022/03/220324-efiling-tax-relief-scaled.jpeg

Section 80gg Of Income Tax Act Deduction 80gg 80gg 2020 YouTube

https://i.ytimg.com/vi/8HNLhtLpIbA/maxresdefault.jpg

Income Tax Deductions UpVey

https://upvey.com/wp-content/uploads/2021/12/Income-Tax-Deductions-1.jpg

Web 20 Sept 2022 nbsp 0183 32 The tax office will only accept deductions for the shortest possible route As of January 2021 the commuter allowance was increased to 35 cents from the 21st kilometre of one way travel for long distance commuters and from 2022 to 2026 it will be increased again to 38 cents from the 21st kilometre of one way travel Web 10 Juli 2023 nbsp 0183 32 From the financial year 2019 2020 the standard deduction is Rs 50 000 which covers the transport and medical allowance Thus employees can claim the deduction of Rs 50 000 while filing their ITR without producing any bills or documents

Web 20 Apr 2023 nbsp 0183 32 Commuter costs for business trips work commutes trips to job interviews etc can all be claimed as income related expenses on your tax return You can take advantage of various lump sums such as the commuter allowance amp kilometer lump sum and sometimes even deduct the actual costs of your expenses Web As per Section 10 14 and rule 2BB of the Income Tax Act 1961 individuals can get an exemption on travel allowance Take a quick glance at the following table to learn about the exemption limit of travel allowance specified under the Income Tax Act Allowance Type

Download Travel Allowance Deduction Income Tax Act

More picture related to Travel Allowance Deduction Income Tax Act

Income Tax Act POCKET Edition Finance Act 2023 By Taxmann s

https://ttpl.imgix.net/9789356226982L.jpg?w=1200

44ae Of Income Tax Act Everything You Need To Know

https://housing.com/news/wp-content/uploads/2023/01/Provisions-under-Section-44AE-of-the-Income-Tax-Act-that-you-must-know.jpg

Section 27 Of The Income Tax Act Sorting Tax

https://sortingtax.com/wp-content/uploads/2023/03/Screenshot-2023-03-21-at-4.50.42-PM.png

Web 9 Feb 2023 nbsp 0183 32 Finance Act 2018 introduced a standard deduction of INR 40 000 which was revised to INR 50 000 in Finance Act 2019 in lieu of a transport allowance of INR 1600 per month and a medical allowance of INR 15 000 Web 27 Juli 2023 nbsp 0183 32 Leave travel allowance The Income Tax Act 1961 provides a Leave Travel Allowance LTA exemption to salaried employees limited to travel expenses incurred during their leaves However it s important to note that this exemption does not cover expenses related to the entire trip such as shopping food entertainment and

Web 27 Sept 2022 nbsp 0183 32 Keep accurate records determine the nature of your travel allowance calculate the allowable deduction exemption claim deduction exemption in tax return and keep supporting documents ready Can I carry forward the unclaimed LTA of a block year to the next block year Web 27 M 228 rz 2023 nbsp 0183 32 Leave Travel Allowance or LTA also known as Leave Travel Concession is a salary benefit that employers offer to employees covering their travelling expenses up to a limit when they are on leave from work The Income Tax Act 1961 provides a deduction against the LTA received and claimed by the employee under the old tax

Income Tax TDS Deducted But ITR Not Filed Here s What Professionals

https://cdn.zeebiz.com/sites/default/files/2017/07/19/21907-tax3-pixabay.png

Section 194M Of Income Tax Act 1961 Sorting Tax

https://sortingtax.com/wp-content/uploads/2022/08/blogimg1.png

https://germantaxes.de/tax-tips/travel-expenses-tax-declaration

Web 12 Aug 2022 nbsp 0183 32 A maximum of 4 500 euros per year can be deducted unless you meet one of the following two exceptions If you commute to work in your own personal or business vehicle and exceed 4 500 euros per year with the commuter allowance the excess amount may be deducted

https://www.navit.com/resources/travel-allowance-taxes-germany-e…

Web Travel allowances are taxed at a flat rate of 15 wage tax What to look out for The allowance can only be paid to employees who regularly commute to work and in many cases there is an annual cap of 4 500 euros the same cap as

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Income Tax TDS Deducted But ITR Not Filed Here s What Professionals

Master Income Tax ACT 2023 Inklogy

How To File Withholding Tax Return As Per New Income Tax Act 2023 FM

Penalty Chart Under Income Tax Act 1961 Ebizfiling

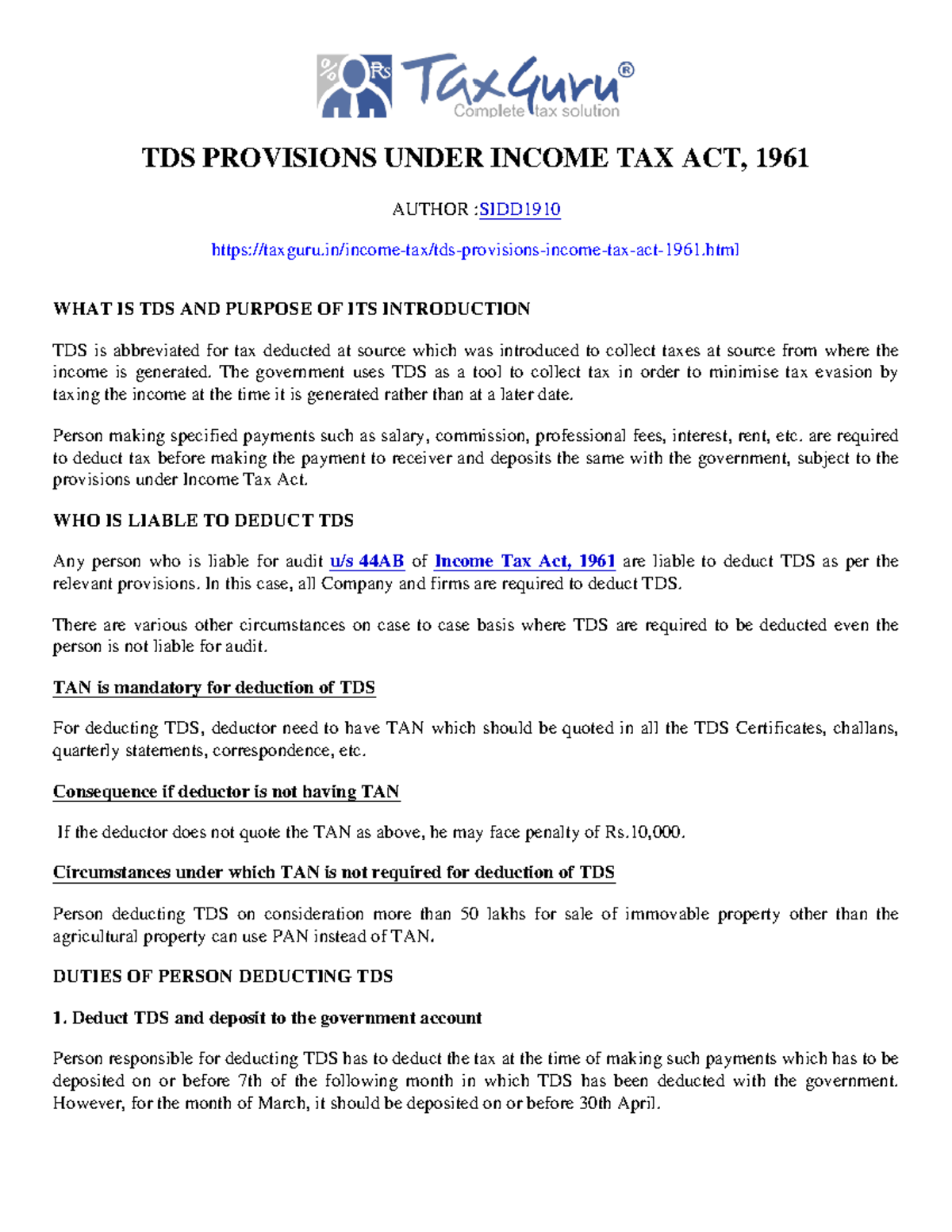

TDS Provisions Under Income Tax Act 1961 Taxguru in TDS PROVISIONS

TDS Provisions Under Income Tax Act 1961 Taxguru in TDS PROVISIONS

Deduction U s 80IA Of Income Tax Act Cannot Be Disallowed On The

All You Need To Know On How To Save Income Tax Ebizfiling

Section 115A Of Income Tax Act A Comprehensive Guide Thetaxmaster in

Travel Allowance Deduction Income Tax Act - Web 20 Apr 2023 nbsp 0183 32 Commuter costs for business trips work commutes trips to job interviews etc can all be claimed as income related expenses on your tax return You can take advantage of various lump sums such as the commuter allowance amp kilometer lump sum and sometimes even deduct the actual costs of your expenses