Truck Driver Tax Deductions Meal Allowance The meal by meal amounts for employee long distance truck drivers are 24 70 28 15 and 48 60 per day for breakfast lunch and dinner respectively This determination

Meal and beverage expenses for long haul truck drivers are deductible at a rate higher than the 50 permitted for other transportation employees During eligible travel periods in You can deduct a higher percentage of your meal expenses while traveling away from your tax home if the meals take place during or incident to any period subject to the

Truck Driver Tax Deductions Meal Allowance

Truck Driver Tax Deductions Meal Allowance

https://www.alltruckjobs.com/blog/wp-content/uploads/2015/05/36744588_l.jpg

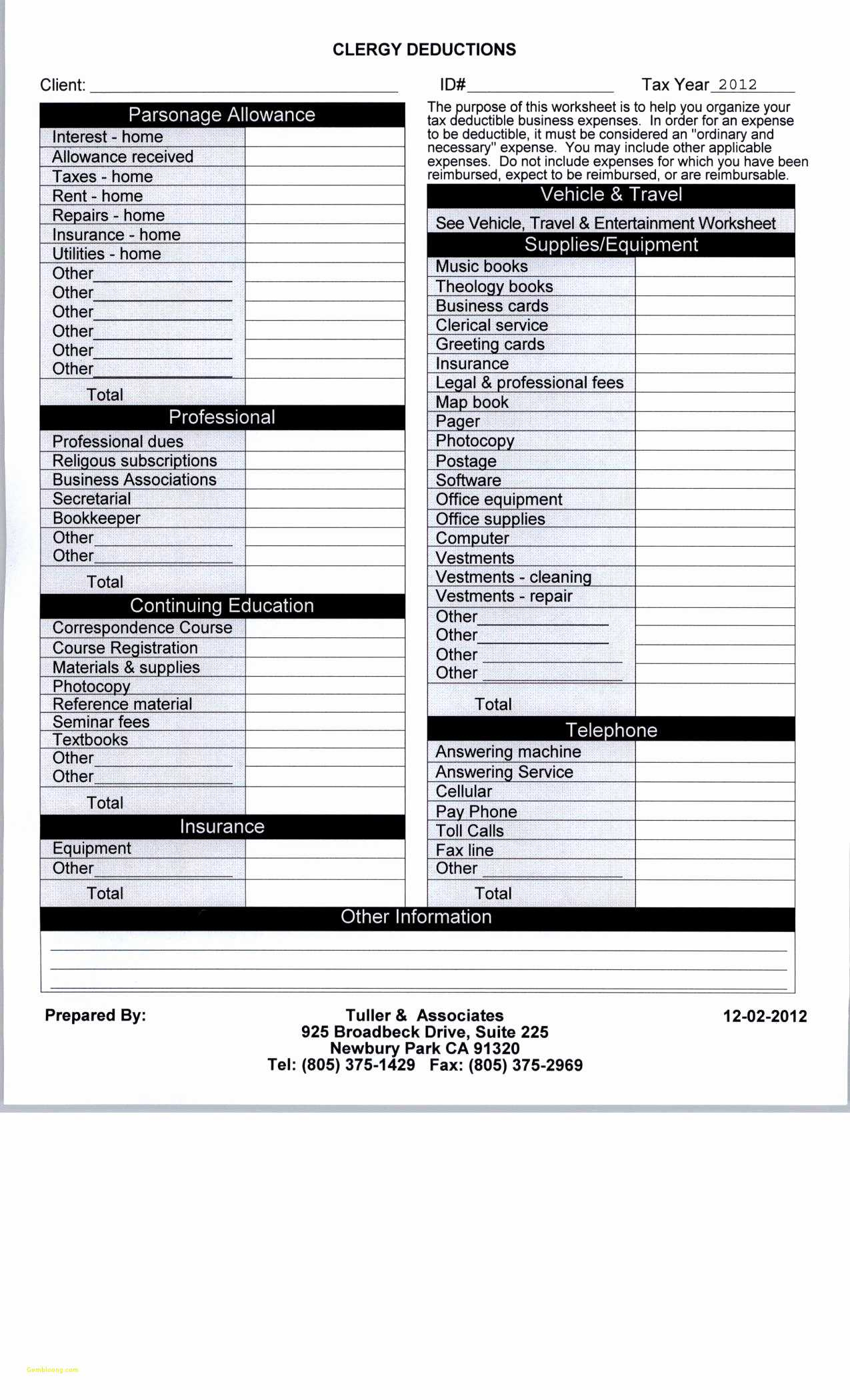

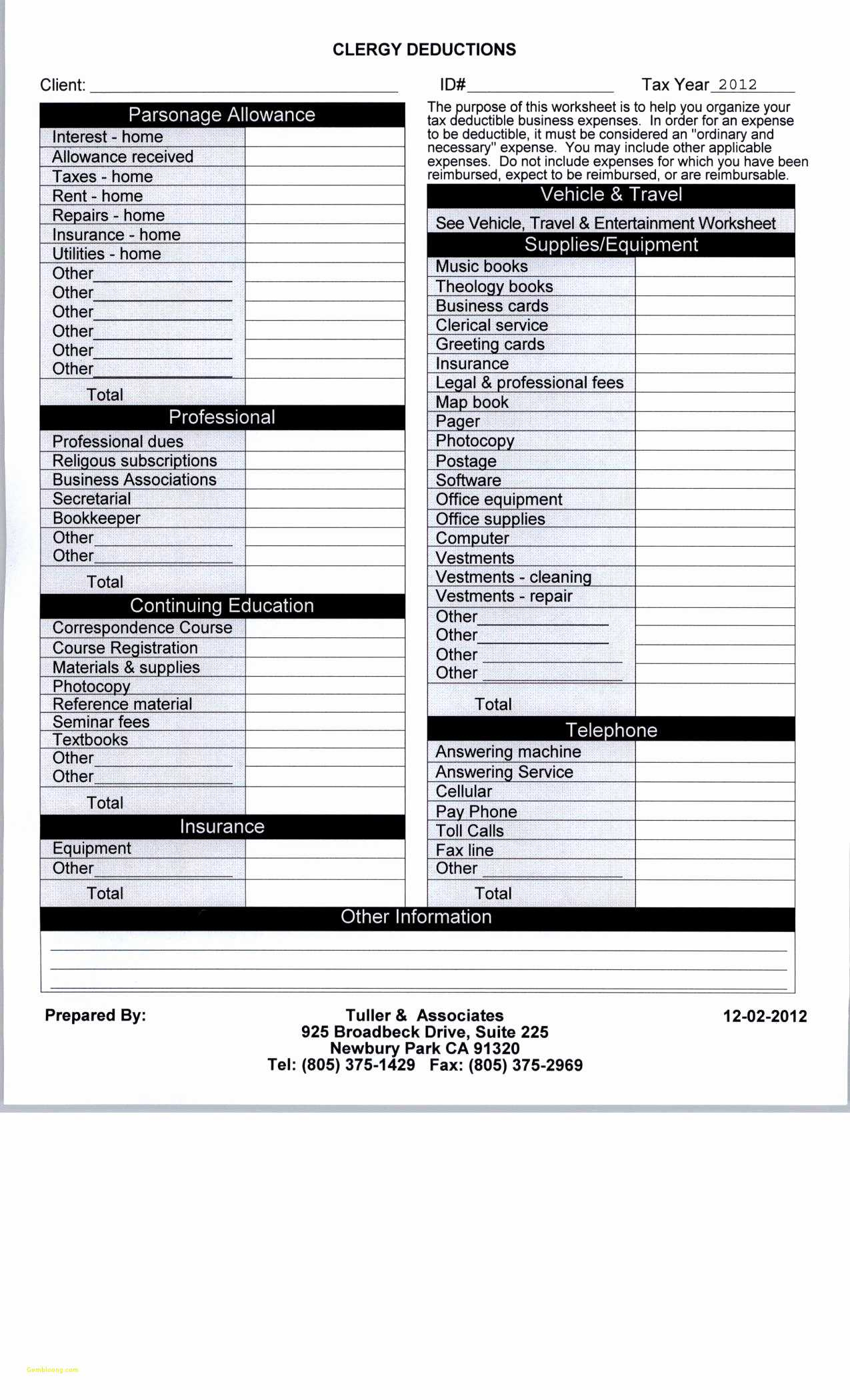

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

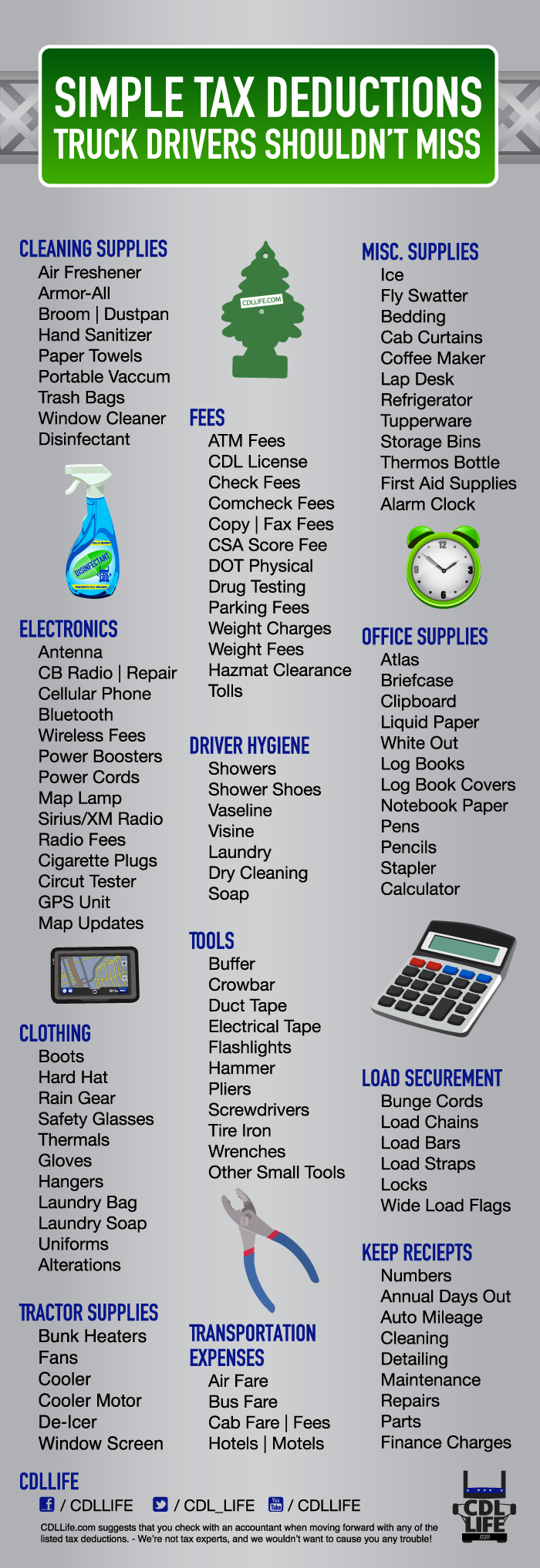

Tax Tips For Truck Drivers Liquid Trucking

https://liquidtrucking.com/wp-content/uploads/2015/03/Tax-Deductions-Drivers-Shouldnt-Miss-700x2034.png

Truck drivers can either deduct 80 of their actual meal expenses or the per diem rate As of January 2024 the per diem rate is 69 per day for travel within the continental U S or 74 outside the Avery travels directly from her job delivering bread in the morning to her second job as a meal kit delivery driver in the afternoon 3 days per week She can

For more information see TD 2023 3 Income tax what are the reasonable travel and overtime meal allowance expense amounts for the 2023 24 income year Meals The cost of meals eaten during long haul trips can add up Truck drivers are entitled to a standard meal allowance or the actual cost deduction for meals This deduction acknowledges the

Download Truck Driver Tax Deductions Meal Allowance

More picture related to Truck Driver Tax Deductions Meal Allowance

9 Things To Claim For Truck Driver Tax Deductions Big Rig Pros

https://bigrigpros.com/wp-content/uploads/2023/05/Truck-Driver-Tax-Deductions.jpg

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Tax Deductions For Truckers Eligible Deductions You May Have Missed

https://static.wixstatic.com/media/3543b6_cbd44d14fc1a4c04bdc1d7783225f32a~mv2_d_5760_3840_s_4_2.jpg/v1/fill/w_1000,h_667,al_c,q_85,usm_0.66_1.00_0.01/3543b6_cbd44d14fc1a4c04bdc1d7783225f32a~mv2_d_5760_3840_s_4_2.jpg

Understand the tax deductions a truck driver can claim during tax time Includes information on what you can and cannot claim record keeping tips and tax return Meal Allowance Self employed truck drivers may also deduct 80 of the special standard meal allowance rate or their actual expenses The 2023 special standard meal

The Internal Revenue Service IRS allows truck drivers to claim a per diem deduction to cover the cost of meals and incidental expenses It simplifies record You can claim a deduction for the cost of a meal you buy and eat when you work overtime if all of the following apply you receive an overtime meal allowance

Tax Deductions For Truck Drivers You Need To Know

https://taxsamaritan.com/wp-content/uploads/2022/09/portraitofatruckdriverwithcrossedarmsstandingin.jpg

Truck Driver Tax Deductions That You Need To Know Truckers Training

https://cdn-elcck.nitrocdn.com/RCJubXdnvRkWcyPIgCHuGacJBktaQfBE/assets/images/optimized/rev-52f994c/wp-content/uploads/2023/01/tax-return.jpg

https://atotaxrates.info/allowances/ato-reasonable-travel-allowances

The meal by meal amounts for employee long distance truck drivers are 24 70 28 15 and 48 60 per day for breakfast lunch and dinner respectively This determination

https://www.canada.ca/en/revenue-agency/services...

Meal and beverage expenses for long haul truck drivers are deductible at a rate higher than the 50 permitted for other transportation employees During eligible travel periods in

Tax Deductions For Truck Drivers YouTube

Tax Deductions For Truck Drivers You Need To Know

Tax Tips For Truck Drivers At FCC Fremont Contract Carriers

Truck Driver Deduction Worksheet

I Like Warez Blog TRUCK DRIVER MEAL ALLOWANCE 2011

Tax Deductions Worksheet 2023

Tax Deductions Worksheet 2023

What Owner Operators Should Know About With Tax Deductions In 2023

DoorDash Drive Payment Invoicing

Tax Deductions 101 The Ultimate Guide For Truck Drivers

Truck Driver Tax Deductions Meal Allowance - For more information see TD 2023 3 Income tax what are the reasonable travel and overtime meal allowance expense amounts for the 2023 24 income year