Trust Income Tax Return Filing Requirements All companies including non resident soci t and trust are required to submit an annual return of income unless a declaration of not in operation has been submitted and effect payment of tax if any electronically

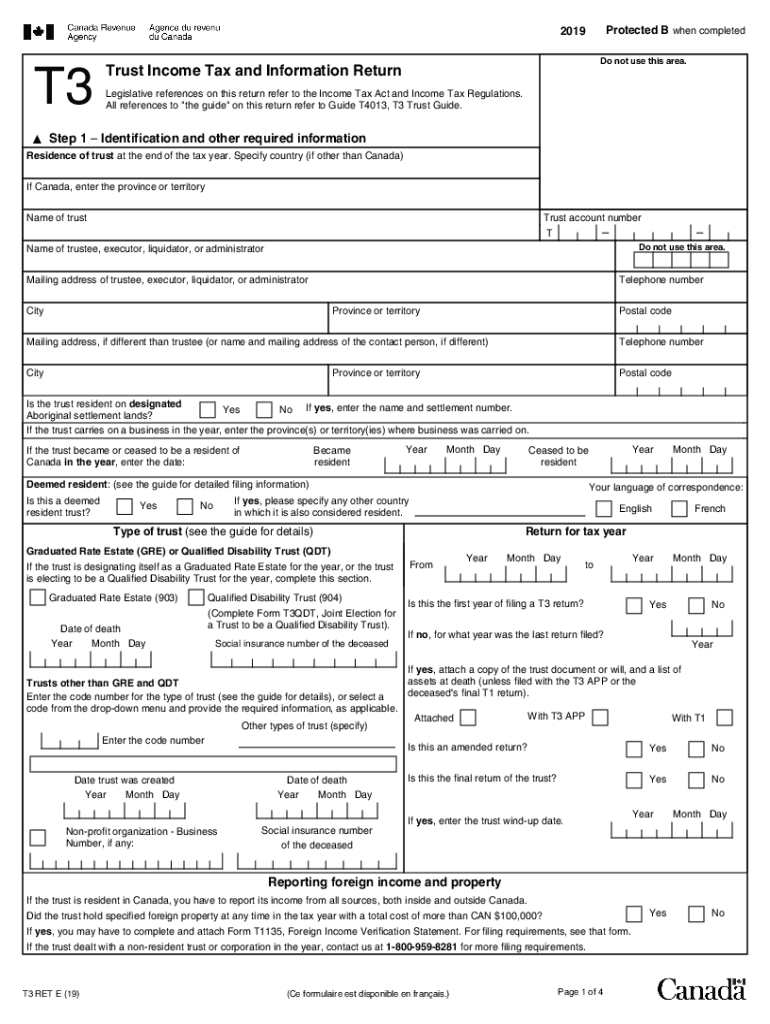

Information about Form 1041 U S Income Tax Return for Estates and Trusts including recent updates related forms and instructions on how to file Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or Trust Income Taxation Reporting Requirements Filing of Trust Income Tax Returns Form 1041 Non grantor trusts are required to file an annual income tax return using Form 1041 The form reports the trust s income deductions and credits as well as any income distributed to beneficiaries Schedule K 1 for Beneficiaries

Trust Income Tax Return Filing Requirements

Trust Income Tax Return Filing Requirements

https://pgaca.in/wp-content/uploads/2020/08/Untitled-design-3.jpg

Step by Step Guide To File Income Tax Return FY 2022 23

https://blog.saginfotech.com/wp-content/uploads/2023/04/income-tax-return-filing-guide.jpg

Update On New Trust Reporting And Filing Requirements Clearline

https://www.clearlinecpa.ca/wp-content/uploads/2022/03/Update-on-New-Trust-Reporting-and-Filing-Requirements.jpeg

Income Tax Returns for individuals An individual who is in receipt of emoluments pension or deriving income from trade business profession agriculture rents and other sources should fill in a return of income if he is registered at the MRA i e has been allocated a Tax Account Number You must file Form 1041 for a domestic trust that has Any taxable income for the tax year Gross income of 600 or more regardless of taxable income A beneficiary who is a non resident alien

Trust tax reporting involves filing annual tax returns and reporting the trust s income deductions credits and distributions to beneficiaries using Form 1041 and Schedule K 1 Accurate record keeping and adherence to filing deadlines are crucial for maintaining compliance with tax laws Form 1041 is an IRS income tax return filed by the trustee or representative of a decedent s estate or trust The form consists of three pages and requires basic information about the

Download Trust Income Tax Return Filing Requirements

More picture related to Trust Income Tax Return Filing Requirements

Income Tax Return Filing Requirements Explained How To Know When To

https://i.ytimg.com/vi/f99735nYVm0/maxresdefault.jpg

ITR Filing Checklist Documents Required To File Income Tax Returns For

https://d6xcmfyh68wv8.cloudfront.net/blog-content/uploads/2022/07/Document-Checklist-1.png

T3ret Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/535/269/535269134/large.png

The 2024 Form 1041 isn t available by the time the estate or trust is required to file its tax return However the estate or trust must show its 2024 tax year on the 2023 Form 1041 and incorporate any tax law changes that are effective for tax years beginning after 2023 E file for estates and trusts Form 1041 U S Income Tax Return for Estates and Trusts PDF is used by the fiduciary of a domestic decedent s estate trust or bankruptcy estate to report Income deductions gains losses etc of the estate or trust

[desc-10] [desc-11]

Income Tax Return Efiling Online Salaried Employees Guide Insurance

https://i1.wp.com/insurancefunda.in/wp-content/uploads/2016/06/income-tax-returns-e-filing.png?resize=800%2C1146

Your In depth Guide To Income Tax Returns And E filing Your ITR

https://wp.sqrrl.in/wp-content/uploads/2018/11/E-FILING-ITR.png

https://www.mra.mu/.../corporate/company-trust-return

All companies including non resident soci t and trust are required to submit an annual return of income unless a declaration of not in operation has been submitted and effect payment of tax if any electronically

https://www.irs.gov/forms-pubs/about-form-1041

Information about Form 1041 U S Income Tax Return for Estates and Trusts including recent updates related forms and instructions on how to file Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or

U S Income Tax Return For Estates And Trusts Form 1041

Income Tax Return Efiling Online Salaried Employees Guide Insurance

Income Tax Return Filing Benefits Due Dates Types Of ITR Filing

Documents Required For ITR Filing L Who Should File Income Tax

Charitable Trust Income Tax Exemptions Registration Return Filing

Income Tax Return ITR Filing Aapka Consultant

Income Tax Return ITR Filing Aapka Consultant

Income Tax Return Filing Details Required For Income Tax Return Filings

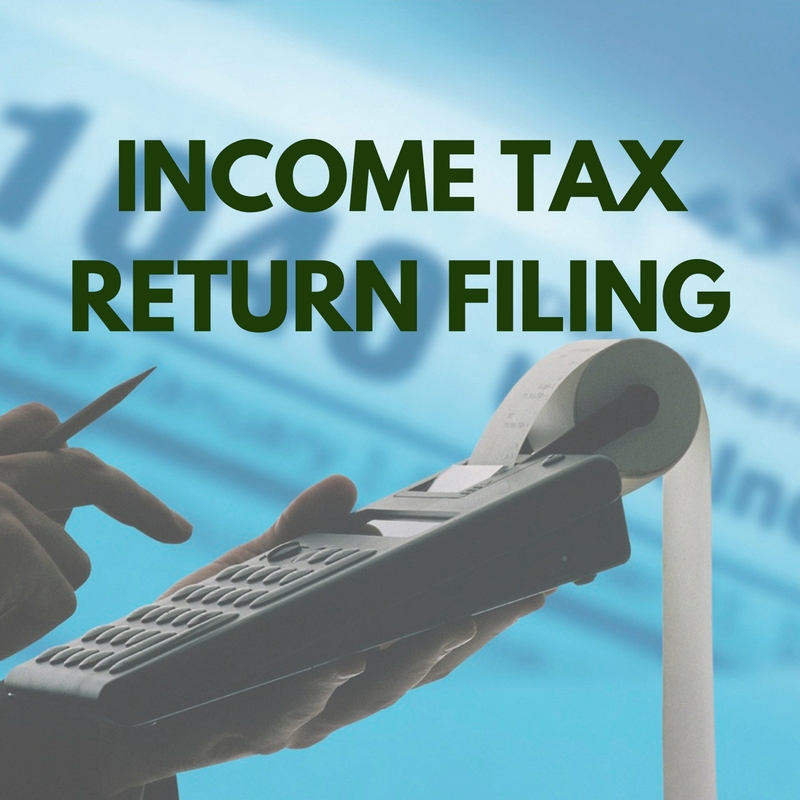

Form 3f Income Tax Return Of Corporate Trust 2000 Printable Pdf

Income Tax Return Assessment Year 22 23 Taxzona

Trust Income Tax Return Filing Requirements - [desc-14]