Tuition Fee Exemption In Income Tax Section 80C contains provisions for tax deduction incentives including tax incentives for tuition fees Learn more about tuition fees exemption in income tax in this article Who Is Eligible to Claim a Deduction for Tuition

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize your tax Answer Payment of tuition fee up to Rs 1 5 lakh can be claimed as deduction u s 80C of the I T Act But the payment of tuition fee for full time course must be for for any two children of individual It follows therefore one can not

Tuition Fee Exemption In Income Tax

Tuition Fee Exemption In Income Tax

https://image.isu.pub/190406191419-1753532d735beaa2eb69e3b1a053ad34/jpg/page_1.jpg

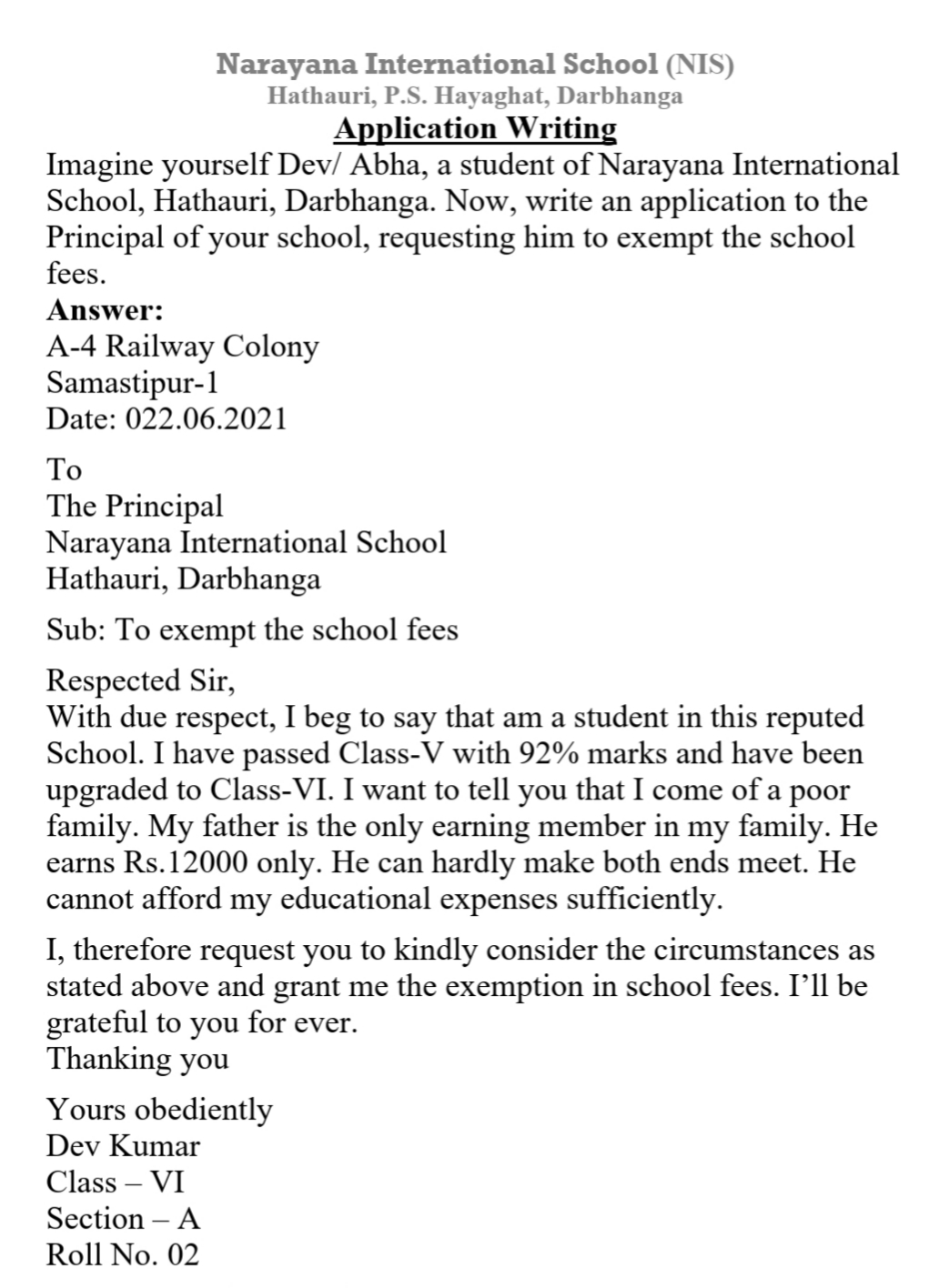

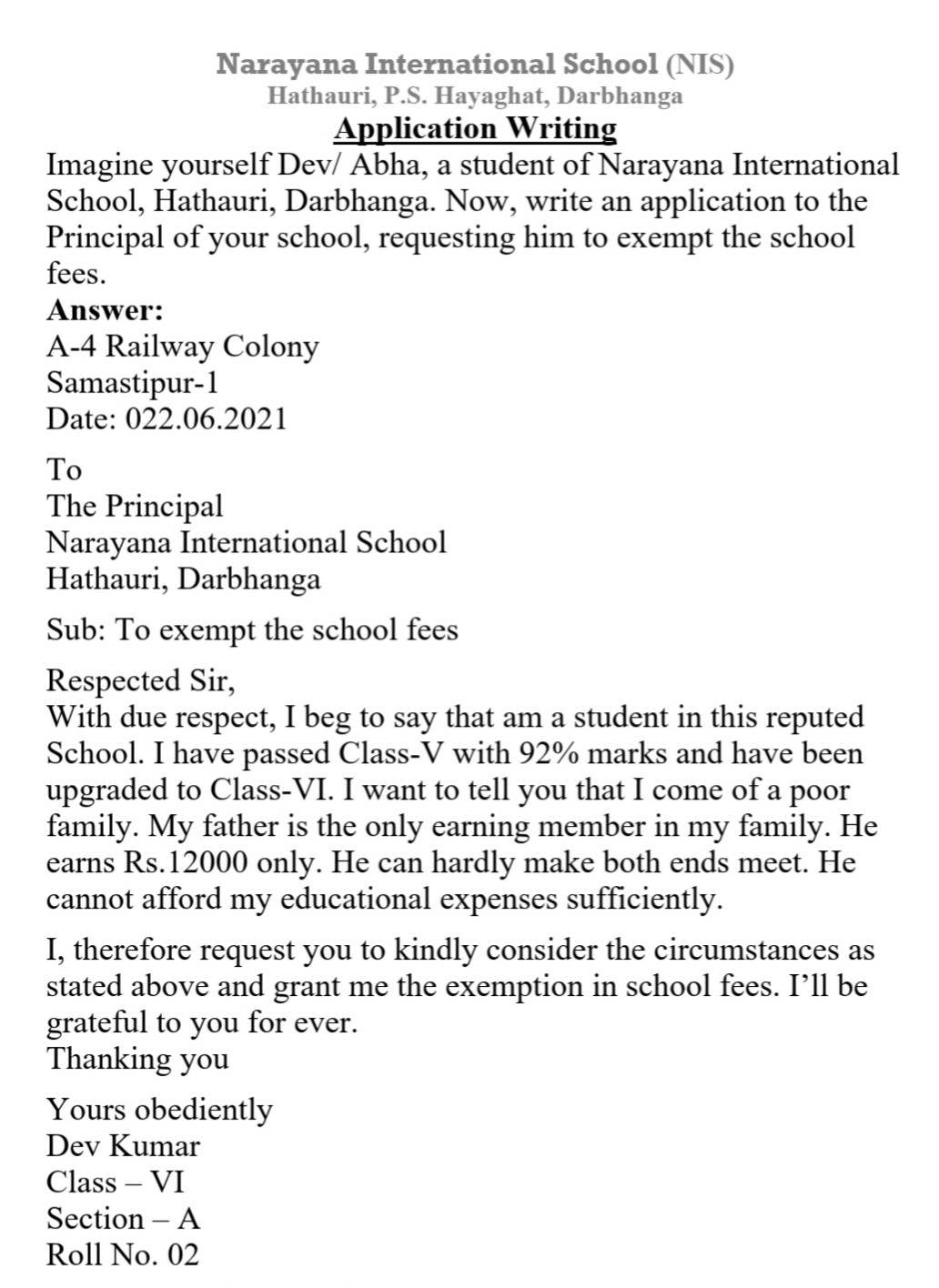

An Application To The Principal To Exempt The School Fees English

https://teachmint.storage.googleapis.com/public/722906116/StudyMaterial/b69c8eda-668b-4da3-b93a-8aec5b54a1bb.jpg

Looking For Sample Letter For Tax Amnesty For Motor Vehicle Taxes In

https://www.signnow.com/preview/497/332/497332572/large.png

When you pay your kids tuition fees it qualifies for income deduction and also helps in reducing your tax liability Here is how you can claim this tax benefit under section 80C of the Income tax Act 1961 Under Section 80C of the Income Tax Act 1961 individuals can claim deductions of up to Rs 1 5 lakh for various investments and expenditures including tuition fees These tax benefits can

Tuition fees is allowed a deduction under the Income Tax Act This article provides detailed information regarding education tax works for higher education As per Section 80C education fees deduction in income tax you can get a maximum of Rs 1 5 lakh as tuition fee tax exemption for expenses of up to two children Under this section the tuition fee exemption for your adopted

Download Tuition Fee Exemption In Income Tax

More picture related to Tuition Fee Exemption In Income Tax

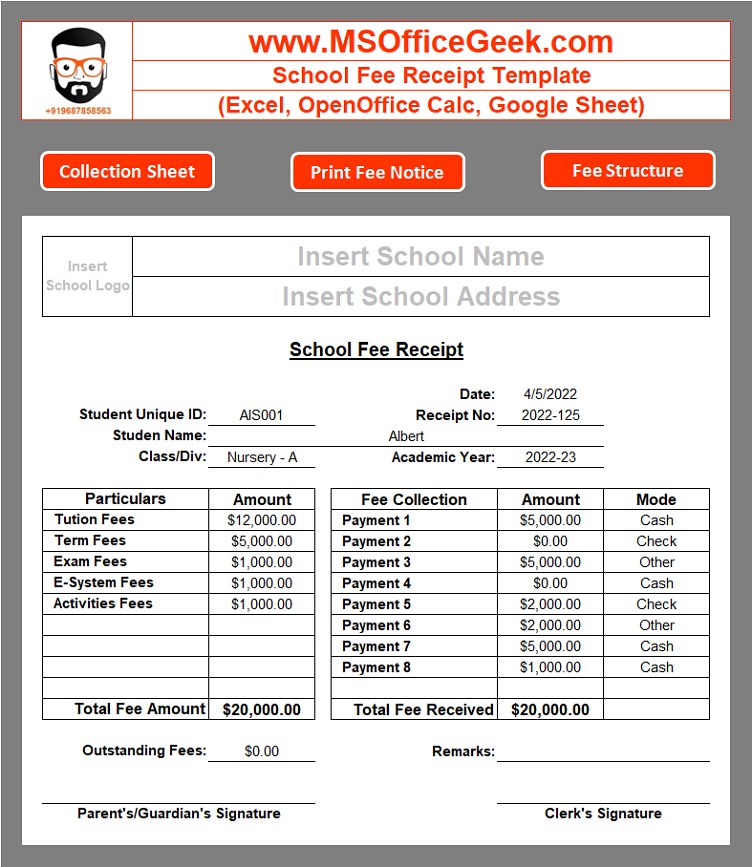

Explore Our Sample Of Tuition Fee Receipt Template Receipt Template

https://i.pinimg.com/736x/d7/9d/74/d79d742fab5f887770333e681cfe8fad.jpg

Ncua Letter Exemption Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/100/589/100589137/large.png

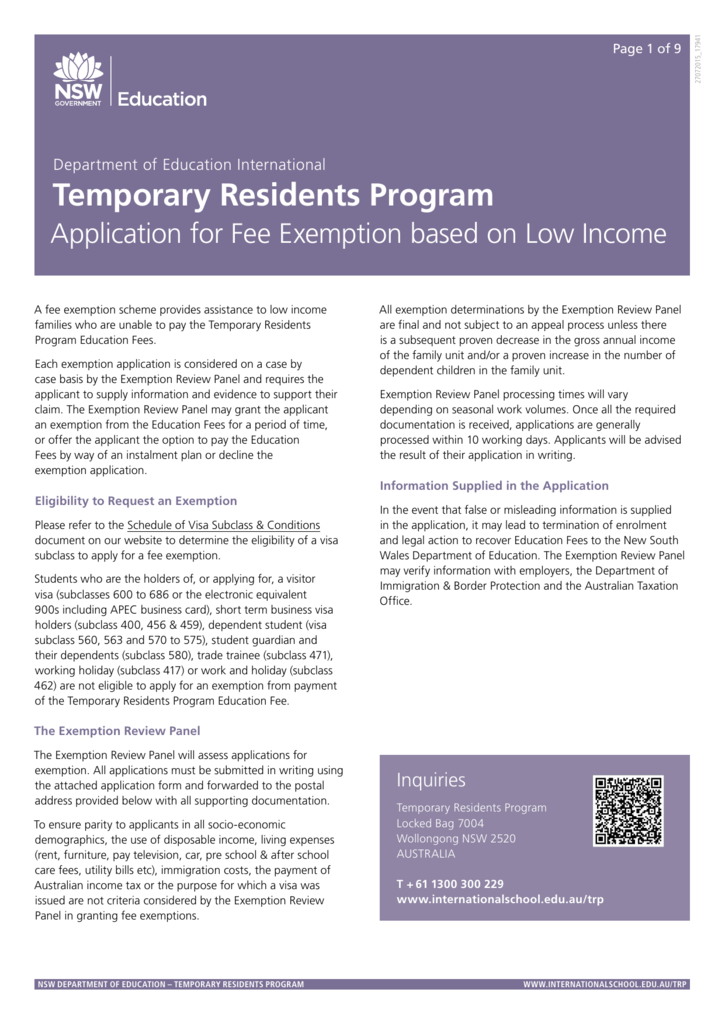

Application For Fee Exemption Based On Low Income

https://s3.studylib.net/store/data/008441288_1-947c97ec913c52f86d674336eedb92b6.png

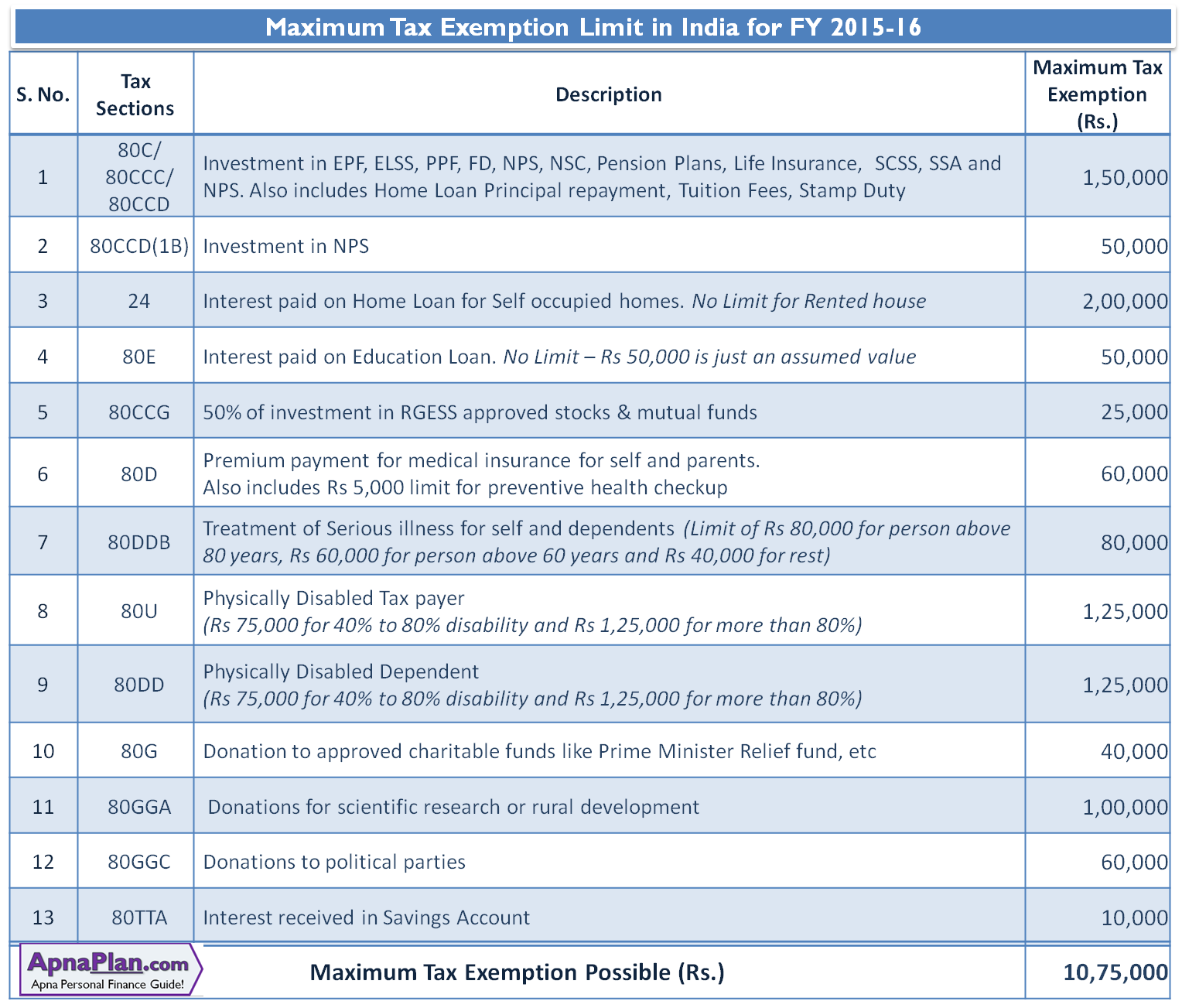

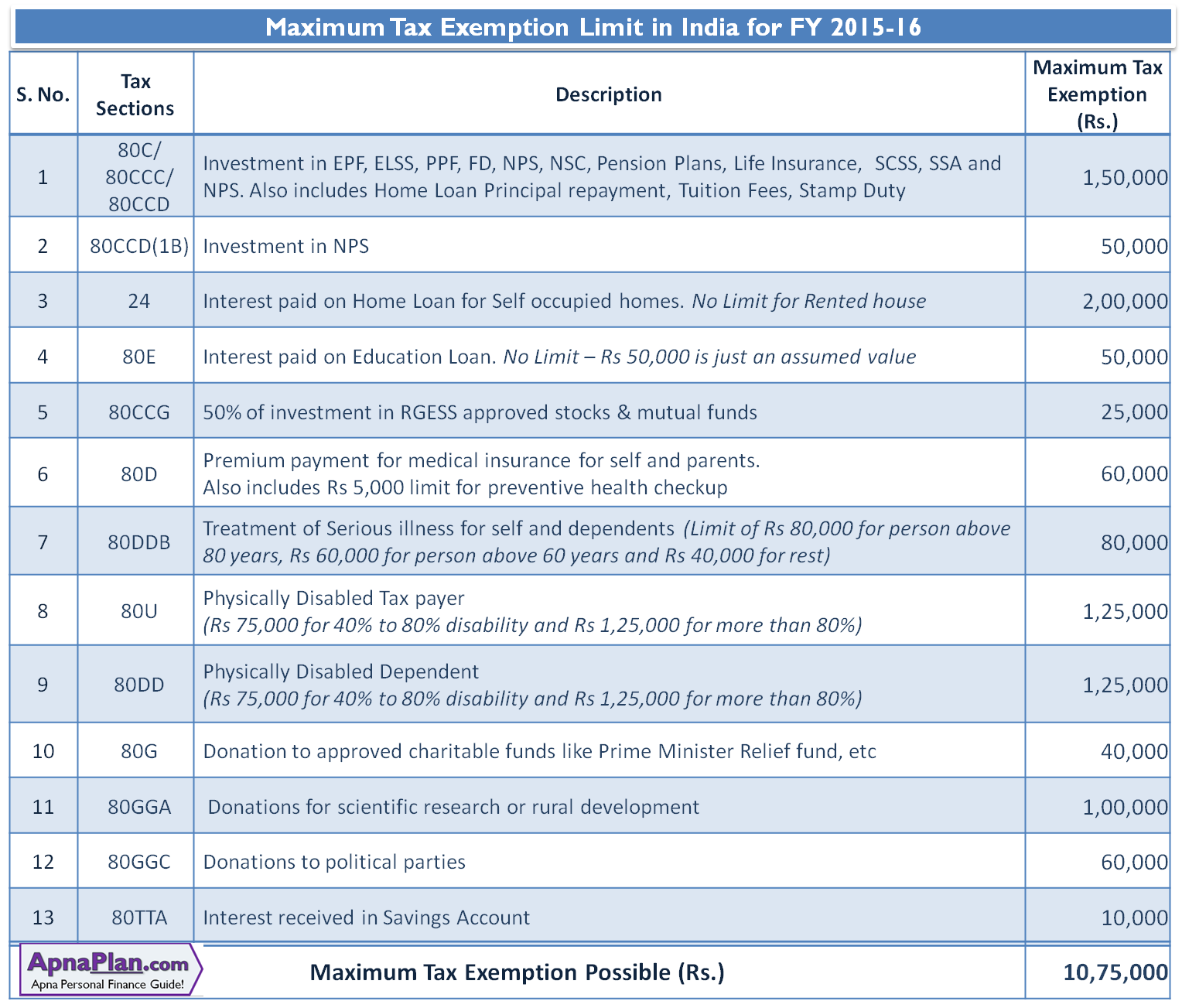

Two provisions facilitate tax exemptions on tuition fees namely Section 80C and Section 10 14 These provisions serve to assist taxpayers in lowering their taxable income The Indian government permits individuals to Save income tax by claiming for tax exemption under Section 10 14 and Section 80C for tuition fee and hostel fees for up to two children Section 10 14 of the Income Tax allows exemption from taxable income in respect of Children

Salaried individuals can fill out the form 12BB to avail their tuition fee tax exemption For self employed or non salaried employees Section 6 of the Income Tax Return offers the same benefits If you have proof of the paid Further you can also make tax deduction claims on tuition fee payment of your child under section 80C of the Income Tax Act 1961 The IT Act allows claiming tax

Tuition Fees Exemption In Income Tax 2023 Guide

http://instafiling.com/wp-content/uploads/2023/01/Topic-58-Tuition-fees-exemption-in-income-tax-2022-23.png

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

https://instafiling.com

Section 80C contains provisions for tax deduction incentives including tax incentives for tuition fees Learn more about tuition fees exemption in income tax in this article Who Is Eligible to Claim a Deduction for Tuition

https://tax2win.in › guide

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize your tax

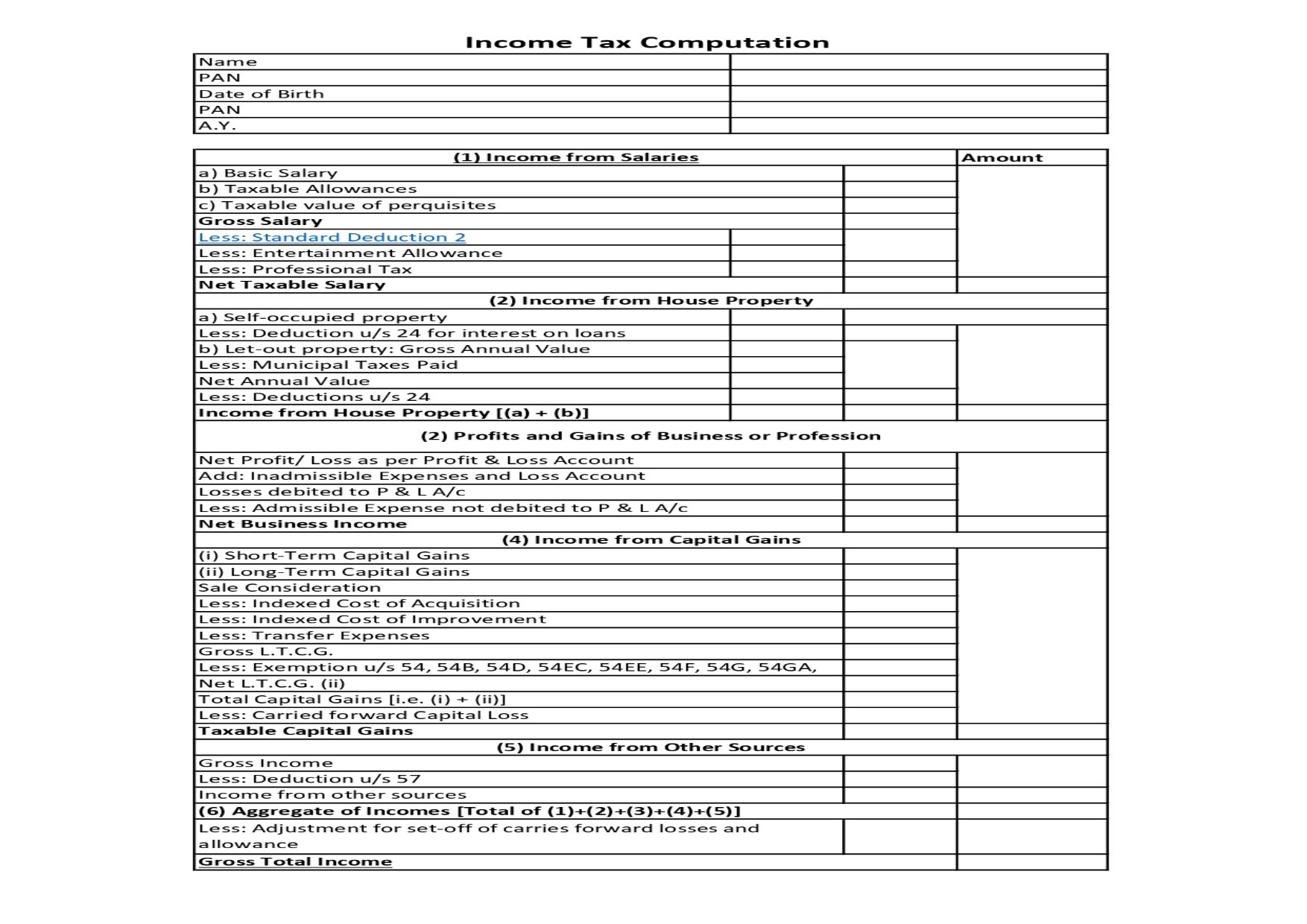

Income Tax Computation Format PDF A Comprehensive Guide

Tuition Fees Exemption In Income Tax 2023 Guide

How To Use Exemptions When Filing For Chapter 13 Bankruptcy

Fully Automated School Fee Collection System Template MSOfficeGeek

Request Letter For Tuition Fee Certificate Sample Letter Regarding

Maximum Income Tax You Can Save For FY 2015 16

Maximum Income Tax You Can Save For FY 2015 16

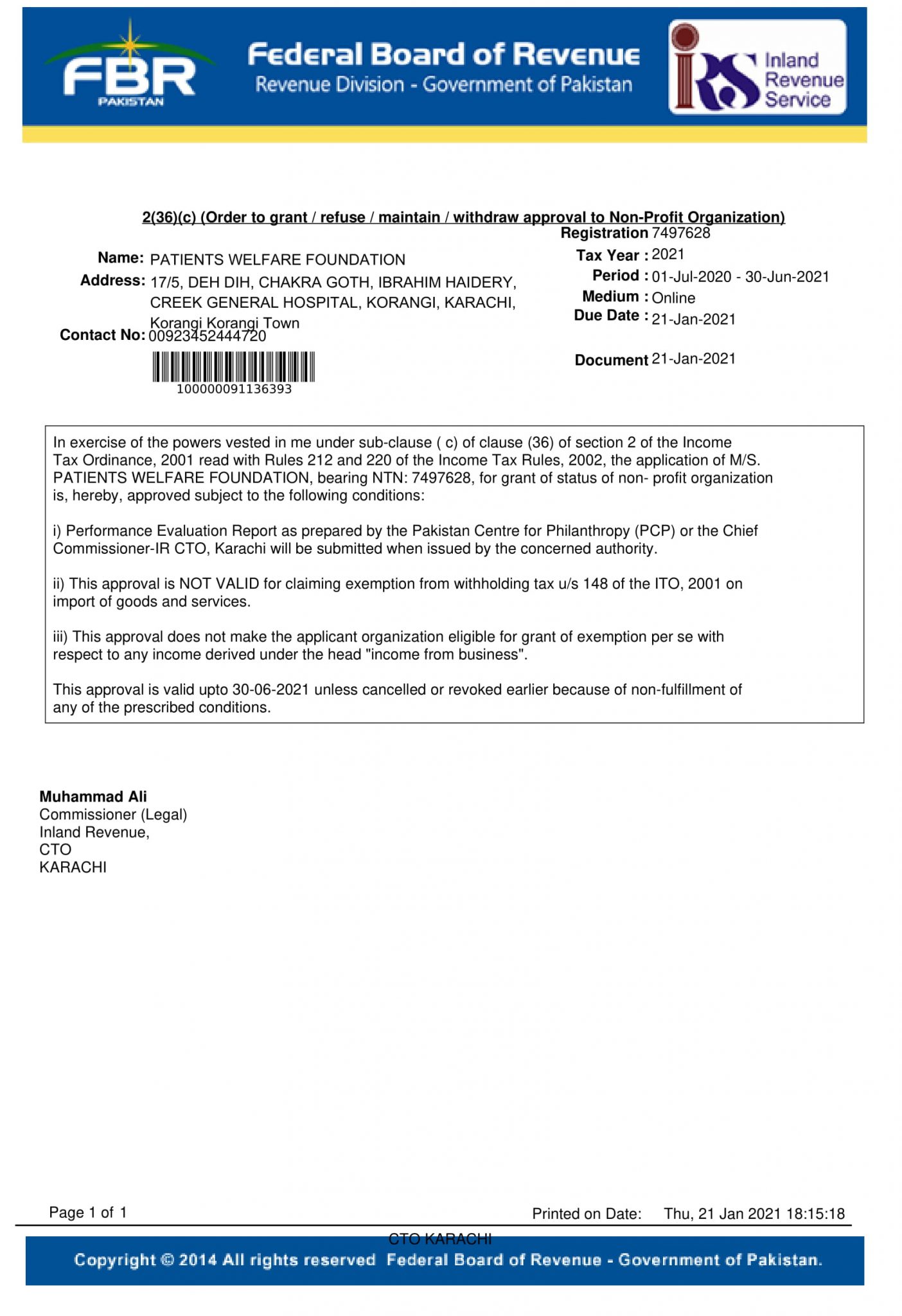

Tax Exemption Certificate PWF Pakistan

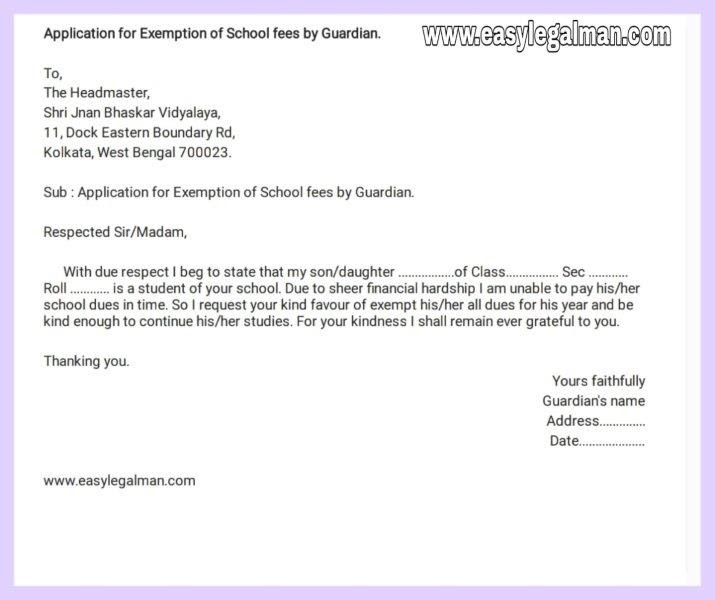

How To Write An Application For Exemption Of School Fees By Guardian

Tuition Fees Exemption In Income Tax 2023 Guide

Tuition Fee Exemption In Income Tax - When you pay your kids tuition fees it qualifies for income deduction and also helps in reducing your tax liability Here is how you can claim this tax benefit under section 80C of the Income tax Act 1961