Tuition Fee Rebate In Income Tax India Web 22 juil 2019 nbsp 0183 32 Apart from Children s Education fee a separate Tax Deduction can be claimed on the Tuition Fee paid by parents for their children s education This deduction

Web 5 janv 2023 nbsp 0183 32 Tuition fee Eligibility Taxpayers seeking tuition fees exemption in income tax 2022 23 must ensure they meet the following criteria Individual Assesse The tuition fee tax deduction is only Web 3 oct 2021 nbsp 0183 32 You can claim a deduction upto Rs 1 50 lakh every year for tuition fee paid for maximum of two children in respect of full time

Tuition Fee Rebate In Income Tax India

Tuition Fee Rebate In Income Tax India

https://i.pinimg.com/originals/b5/8d/91/b58d9127751a3ec09910dd46c3257e99.jpg

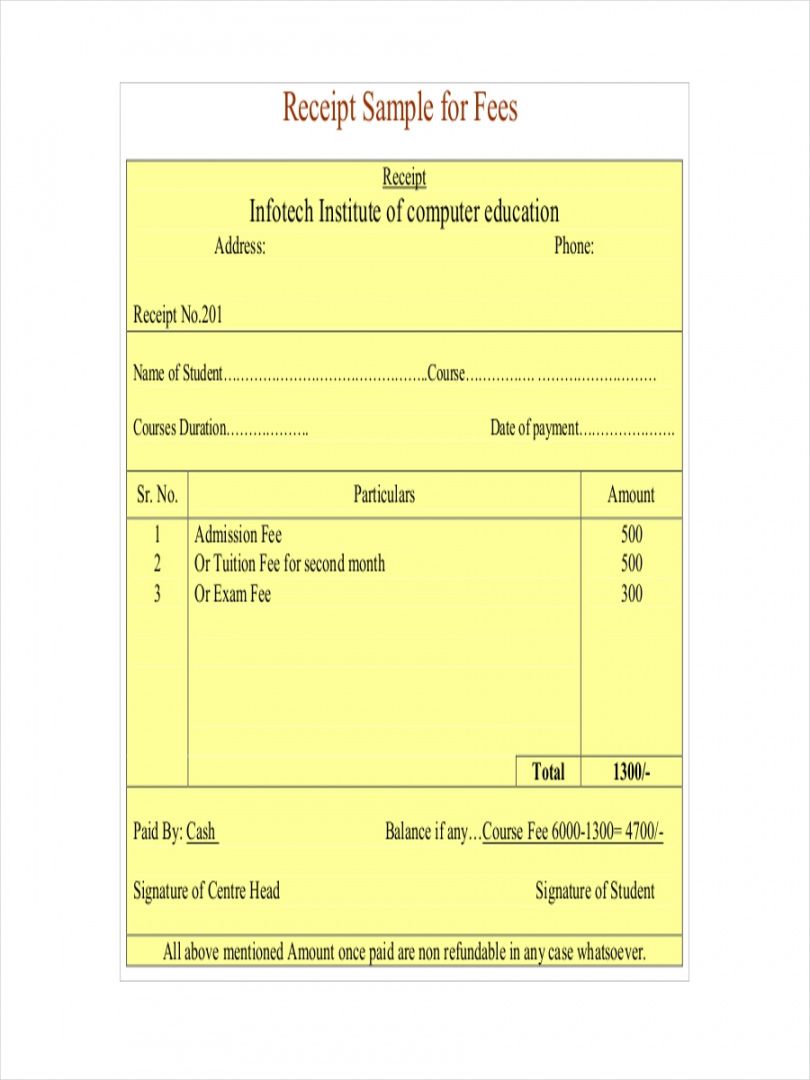

Tuition Fee Receipt School Forms

https://discountschoolforms.com/wp-content/uploads/2015/04/Tuition-Fee-Receipt_E-116.png

I Want Tuition Fee Certificate From School For Tax Deduction Brainly in

https://hi-static.z-dn.net/files/dbc/211b60e62b671c2debf731de99ef588c.jpg

Web 17 f 233 vr 2017 nbsp 0183 32 This is because tuition fee qualifies for tax benefit under Section 80C of the Income tax Act 1961 The amount of tax benefit is within the overall limit of the section Web Tuition fees deduction in India can be claimed by individuals employed in India under section 10 14 of the Income Tax Act as Children s Educational Allowance Section 10

Web Tuition fee deduction in income tax is a provision for parents to claim tax deductions on education fees paid by them for educating their wards A maximum of 1 5 lakhs can be Web 14 juil 2022 nbsp 0183 32 The amount paid as tuition fees qualifies for tax benefit under section 80C up to a maximum limit of Rs 1 5 lakh per annum It means under income tax rules you are allowed to deduct the fee

Download Tuition Fee Rebate In Income Tax India

More picture related to Tuition Fee Rebate In Income Tax India

Daily current affairs

http://www.benevolentacademy.com/wp-content/uploads/2023/03/budget-2023-income-tax-india-tv-4-1675237269.jpg

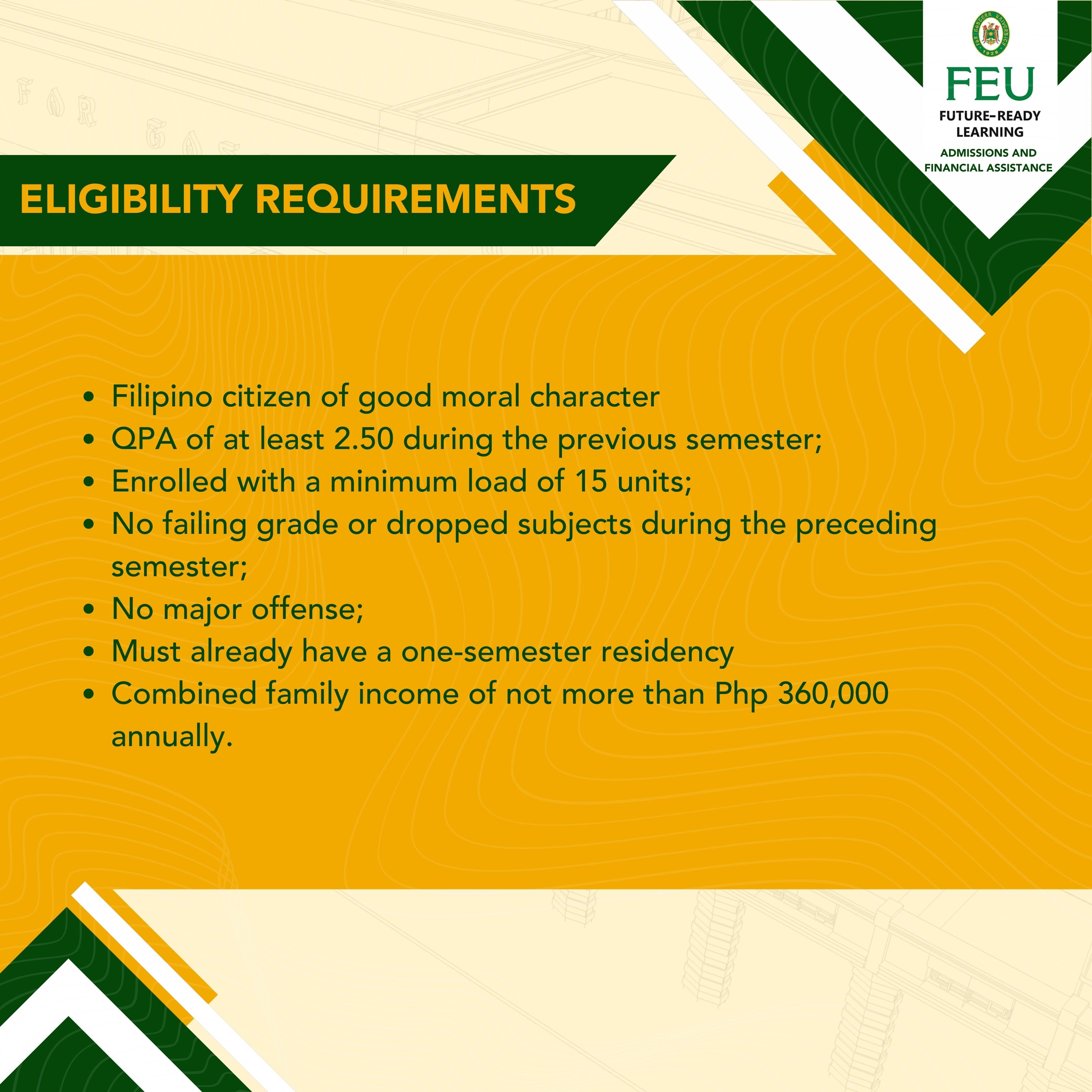

FEU TUITION DISCOUNT Far Eastern University

https://www.feu.edu.ph/wp-content/uploads/2023/05/FTD-1st-Sem-SY-2023-2024-2.jpg

Section 80C Child Tuition School Education Fees AY 2018 19 Meteorio

https://i.pinimg.com/564x/f2/57/d2/f257d20b625bae1a482187460086e071.jpg

Web 10 sept 2018 nbsp 0183 32 188 55 20 95 10 Jay Jalaram 338 75 37 6 9 99 KirloskarOil 479 4 Web 27 f 233 vr 2023 nbsp 0183 32 Updated 27 02 2023 10 21 02 AM If your employer provides you children education allowance as a part of your salary structure for the payment of education or

Web Taxpayers can avail deductions to a tune of Rs 1 5 lakh under Section 80C as per 2020 21 tax slabs with other investments also eligible for this rebate Parents can claim the Web 17 ao 251 t 2022 nbsp 0183 32 The tuition fee paid qualifies for tax benefit under Section 80C and thus you are eligible to claim up to Rs 1 50 000 as tax deductions This will also apply to

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

How To Solve For Income Tax Amy Fleishman s Math Problems

https://i.pinimg.com/736x/b5/1d/a1/b51da136da3645c53e1d0b5dea60983c.jpg

https://tax2win.in/guide/tution-fees-deduction-under-section-80c

Web 22 juil 2019 nbsp 0183 32 Apart from Children s Education fee a separate Tax Deduction can be claimed on the Tuition Fee paid by parents for their children s education This deduction

https://instafiling.com/tuition-fees-exemption-i…

Web 5 janv 2023 nbsp 0183 32 Tuition fee Eligibility Taxpayers seeking tuition fees exemption in income tax 2022 23 must ensure they meet the following criteria Individual Assesse The tuition fee tax deduction is only

What Is Rebate U s 87A For AY 2023 24

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Tuition Fee Receipt Template EmetOnlineBlog

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

Tax Rebate For Individual Deductions For Individuals reliefs

Tax Rebate For Individual Deductions For Individuals reliefs

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

Fees Receipt Format 8 Fee School Tuition For Income Tax Seminar Free

Tuition Fee Rebate In Income Tax India - Web As of 2020 an individual can claim tax breaks on all sums paid as tuition fees deduction to schools colleges universities and other educational institutions Note that the