Tuition Fee Rebate On Income Tax Web 16 f 233 vr 2023 nbsp 0183 32 Frais de scolarit 233 au coll 232 ge au lyc 233 e 233 tudiant quel avantage fiscal pour la d 233 claration de revenus 2023 Une r 233 duction d imp 244 t pour frais de scolarit 233 est accord 233 e

Web 14 avr 2017 nbsp 0183 32 In this article we will explore the tax benefits offered on children s tuition fee the eligibility criteria and how to claim them The tax benefits offered on children s Web 13 mai 2022 nbsp 0183 32 The maximum amount you could claim for the tuition and fees adjustment to income was 4 000 per year The deduction was further limited by income ranges

Tuition Fee Rebate On Income Tax

Tuition Fee Rebate On Income Tax

http://www.gov.mb.ca/asset_library/en/tuition/header-tuition-fee.jpg

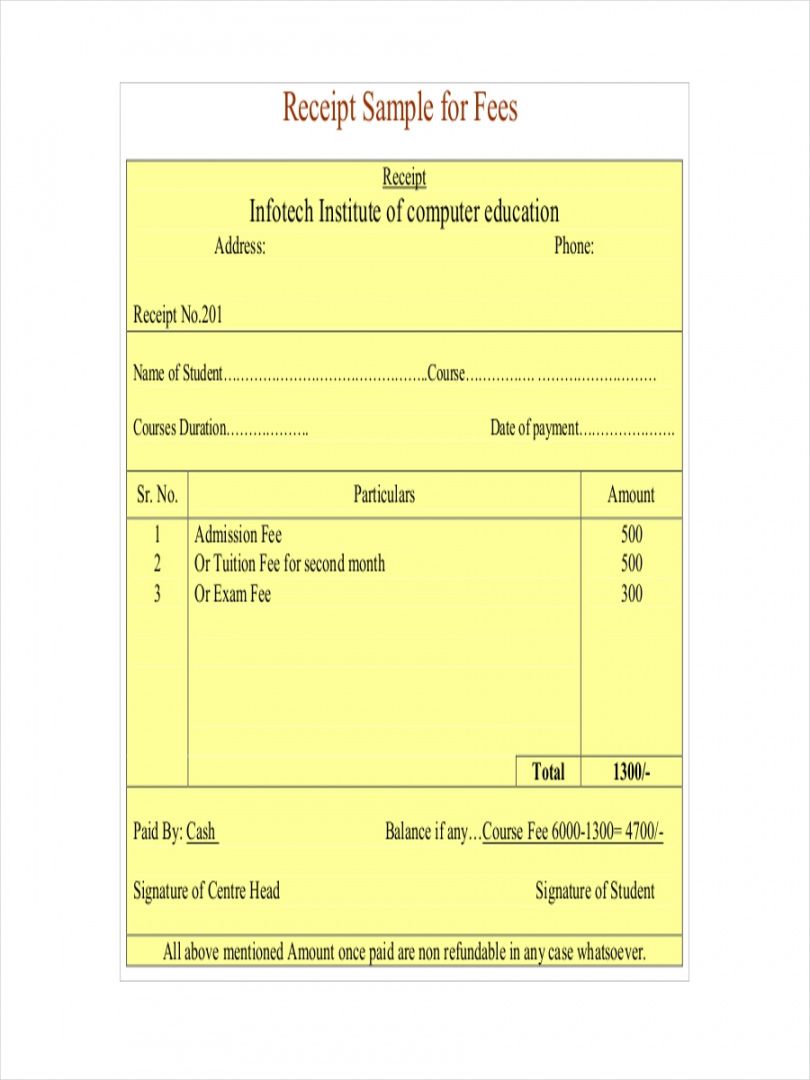

Printable Free Professional Fee Receipt Templates At

https://i.pinimg.com/originals/b5/8d/91/b58d9127751a3ec09910dd46c3257e99.jpg

Manitoba Tuition Fee Income Tax Rebate Deschenes Regnier

https://deschenesregnier.com/wp-content/uploads/2015/05/Tuition_Ad-1024x1024.jpg

Web 15 mai 2023 nbsp 0183 32 sign into myAccount click the Manage your tax 2023 link select Add new credits select You and your family and Tuition fees If you do not have access to Web 17 f 233 vr 2017 nbsp 0183 32 This is because tuition fee qualifies for tax benefit under Section 80C of the Income tax Act 1961 The amount of tax benefit is within the overall limit of the section

Web 5 janv 2023 nbsp 0183 32 The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees that parents pay to educate their children Parents can Web 27 f 233 vr 2023 nbsp 0183 32 Further you can also make tax deduction claims on tuition fee payment of your child under section 80C of the Income Tax Act 1961 The IT Act allows claiming

Download Tuition Fee Rebate On Income Tax

More picture related to Tuition Fee Rebate On Income Tax

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Tuition Fee Receipt School Forms

https://discountschoolforms.com/wp-content/uploads/2015/04/Tuition-Fee-Receipt_E-116.png

Web Eligible tuition fees Generally a course taken in 2022 at an institution in Canada will qualify for a tuition tax credit if it was either taken at a post secondary education institution Web August 25 2023 West Nile Virus Bulletin 2 August 15 2023 Province Issues High Wind Effect Warning for South Shores of Lake Manitoba and Lake Winnipeg August 4 2023

Web 3 oct 2021 nbsp 0183 32 In case you take education loan for full time education in India you can claim deduction for interest for such loan under Section 80E as well as for tuition fee paid Web So if the employer provides 6 000 in tuition reimbursement then the first 5 250 will be tax free while the remaining 750 will be taxed If the employee is enrolled in graduate

Fillable Online Drake Drake Tuition Rebate Form Fax Email Print PdfFiller

https://www.pdffiller.com/preview/16/197/16197361/large.png

I Want Tuition Fee Certificate From School For Tax Deduction Brainly in

https://hi-static.z-dn.net/files/dbc/211b60e62b671c2debf731de99ef588c.jpg

https://www.toutsurmesfinances.com/impots/frais-de-scolarite-quel-a...

Web 16 f 233 vr 2023 nbsp 0183 32 Frais de scolarit 233 au coll 232 ge au lyc 233 e 233 tudiant quel avantage fiscal pour la d 233 claration de revenus 2023 Une r 233 duction d imp 244 t pour frais de scolarit 233 est accord 233 e

https://cleartax.in/s/tuition-fees-deduction-under-section-80c

Web 14 avr 2017 nbsp 0183 32 In this article we will explore the tax benefits offered on children s tuition fee the eligibility criteria and how to claim them The tax benefits offered on children s

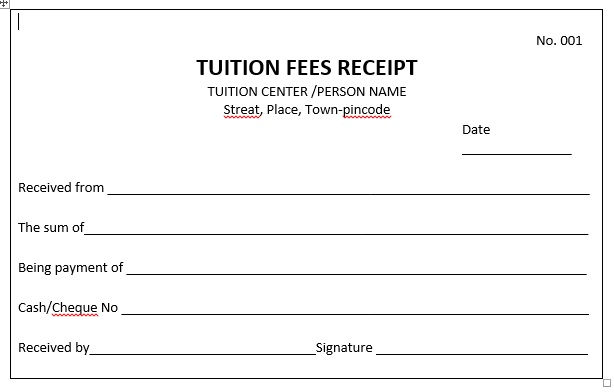

Editable 5 Tuition Receipt Templates Pdf Free Premium Templates

Fillable Online Drake Drake Tuition Rebate Form Fax Email Print PdfFiller

Tuition Fee Receipt Template EmetOnlineBlog

Get Our Sample Of School Tuition Receipt Template School Fees School

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

TUITION FEE RECEIPT SAMPLE SASTA STATION

TUITION FEE RECEIPT SAMPLE SASTA STATION

Professional Fee Receipt Allbusinesstemplates

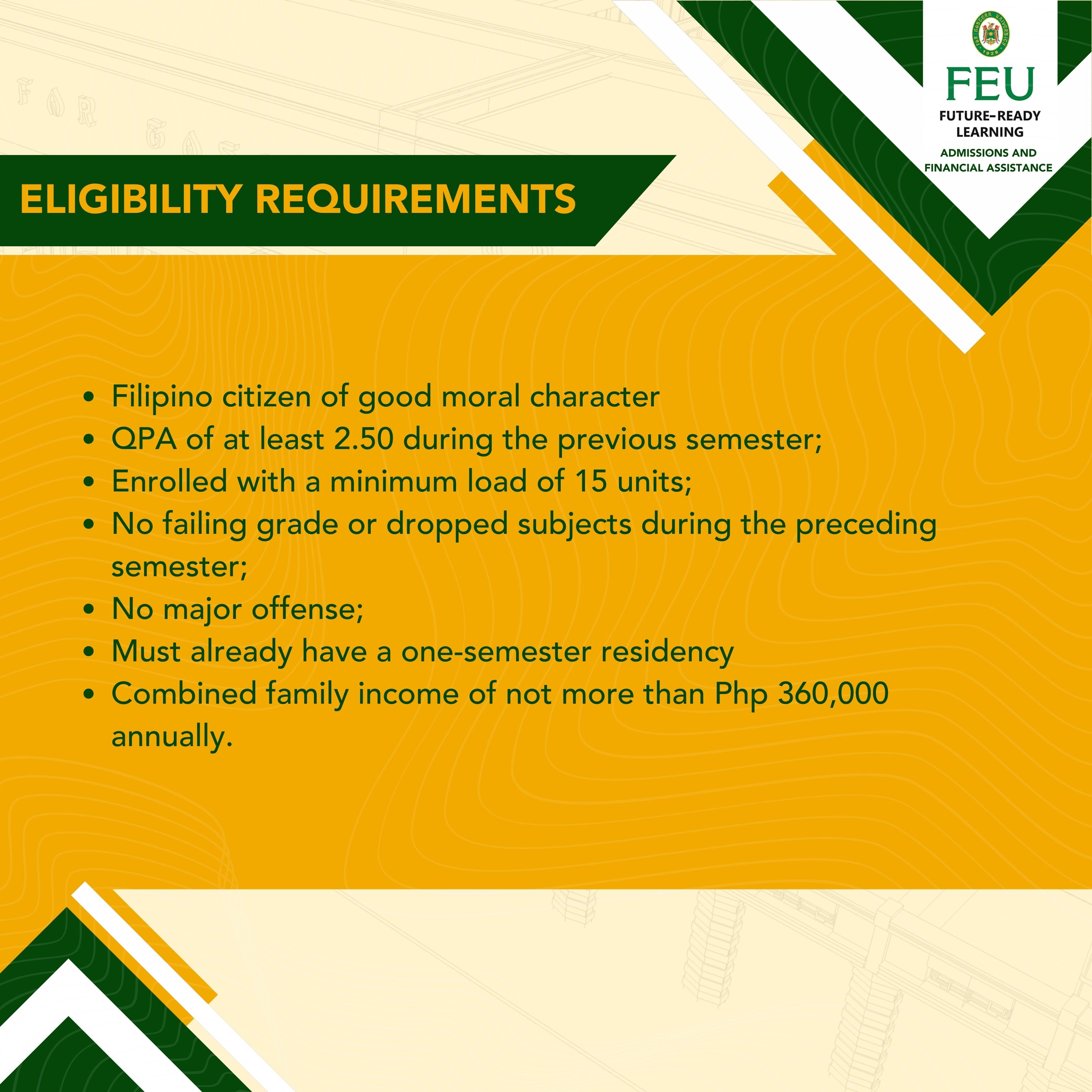

FEU TUITION DISCOUNT Far Eastern University

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Tuition Fee Rebate On Income Tax - Web 15 mai 2023 nbsp 0183 32 sign into myAccount click the Manage your tax 2023 link select Add new credits select You and your family and Tuition fees If you do not have access to