Tuition Fee Rebate Under Income Tax Web 14 avr 2017 nbsp 0183 32 Tax deduction on tuition fees Exemption for Childrens education and Hostel Expenditure The following exemption is provided to a salaried taxpayer in India

Web 5 janv 2023 nbsp 0183 32 The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees that parents pay to educate their children Parents can Web 13 f 233 vr 2023 nbsp 0183 32 You may be able to cut your tax bill by up to 2 500 if you re paying college tuition and you may even be eligible for tax credits that can help cover the cost of

Tuition Fee Rebate Under Income Tax

Tuition Fee Rebate Under Income Tax

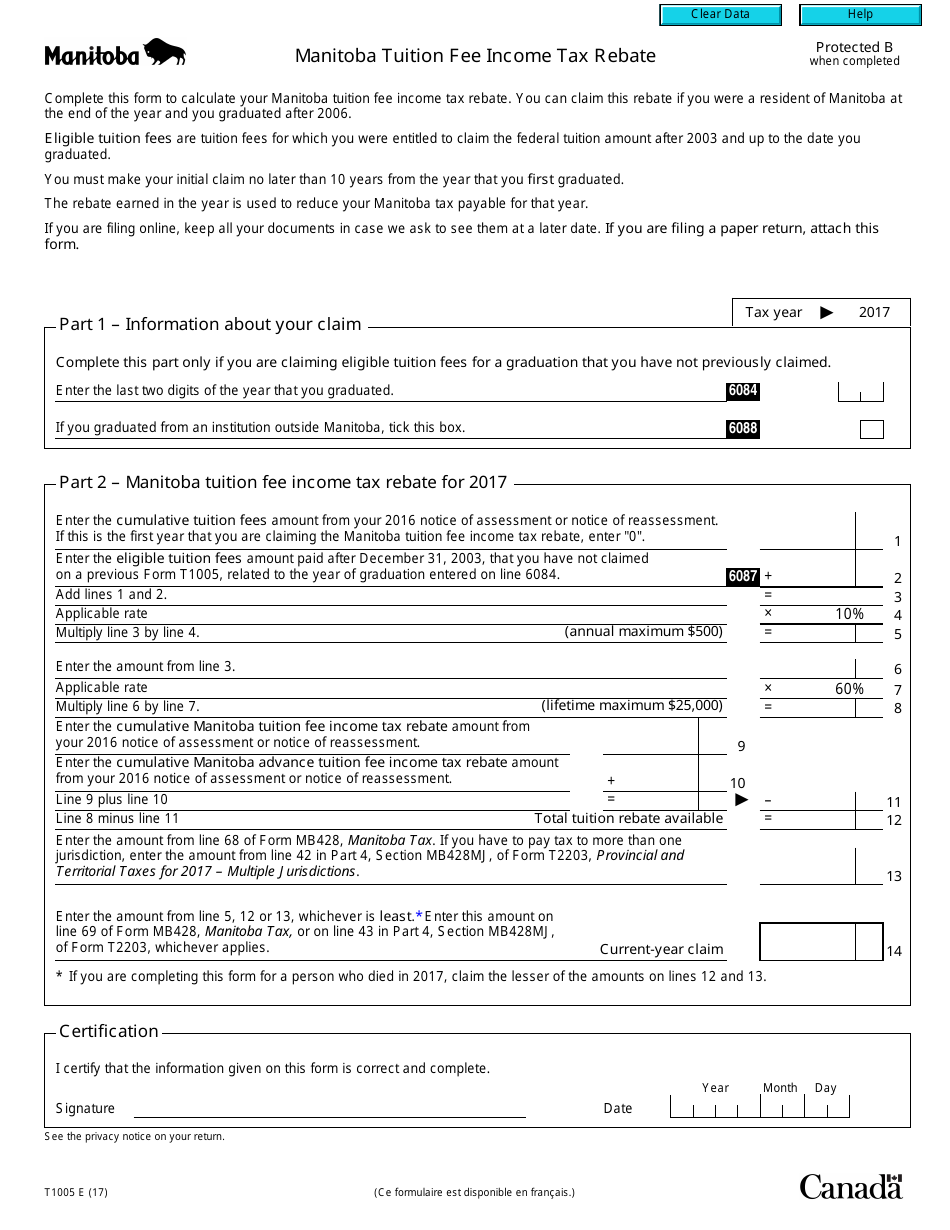

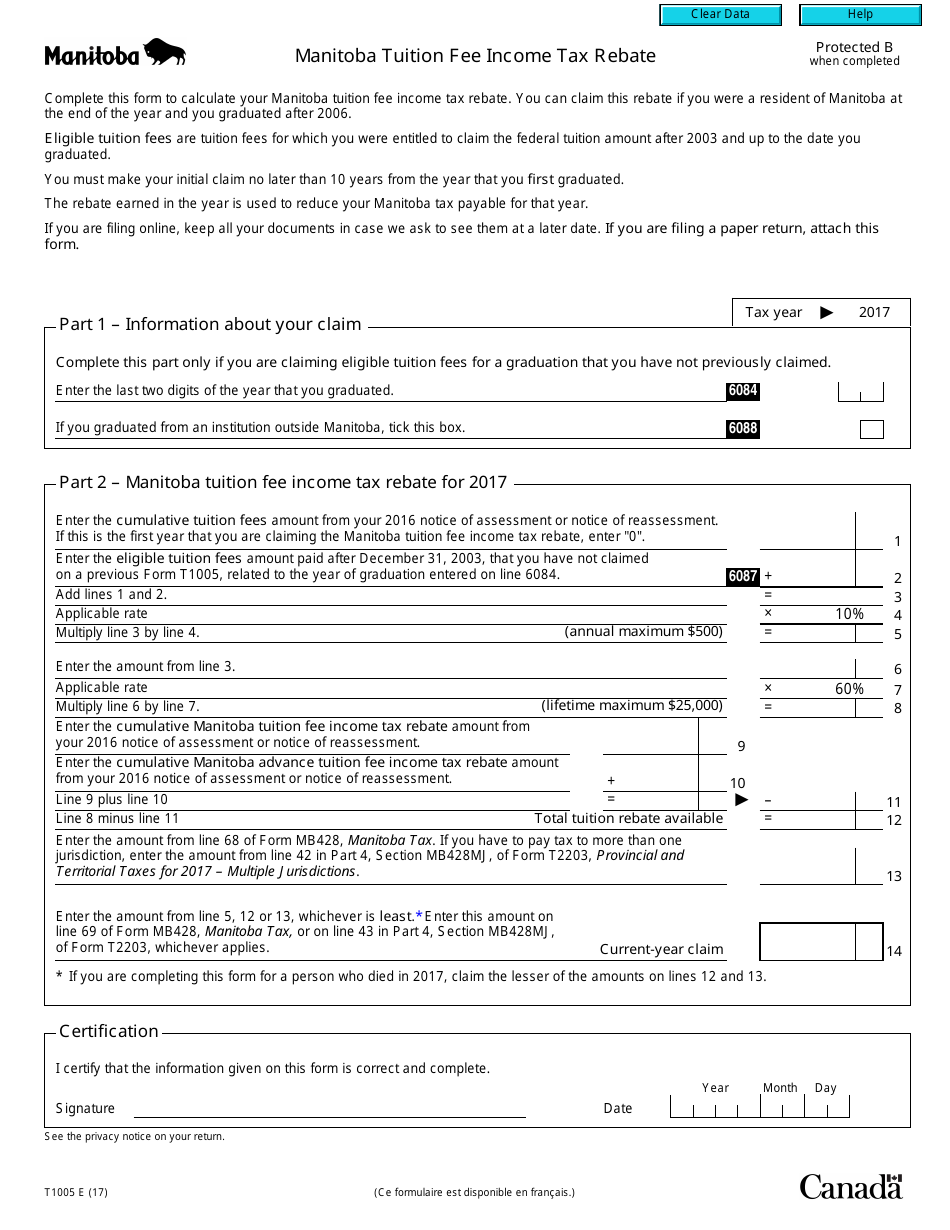

https://data.templateroller.com/pdf_docs_html/1868/18689/1868960/form-t1005-manitoba-tuition-fee-income-tax-rebate-canada_print_big.png

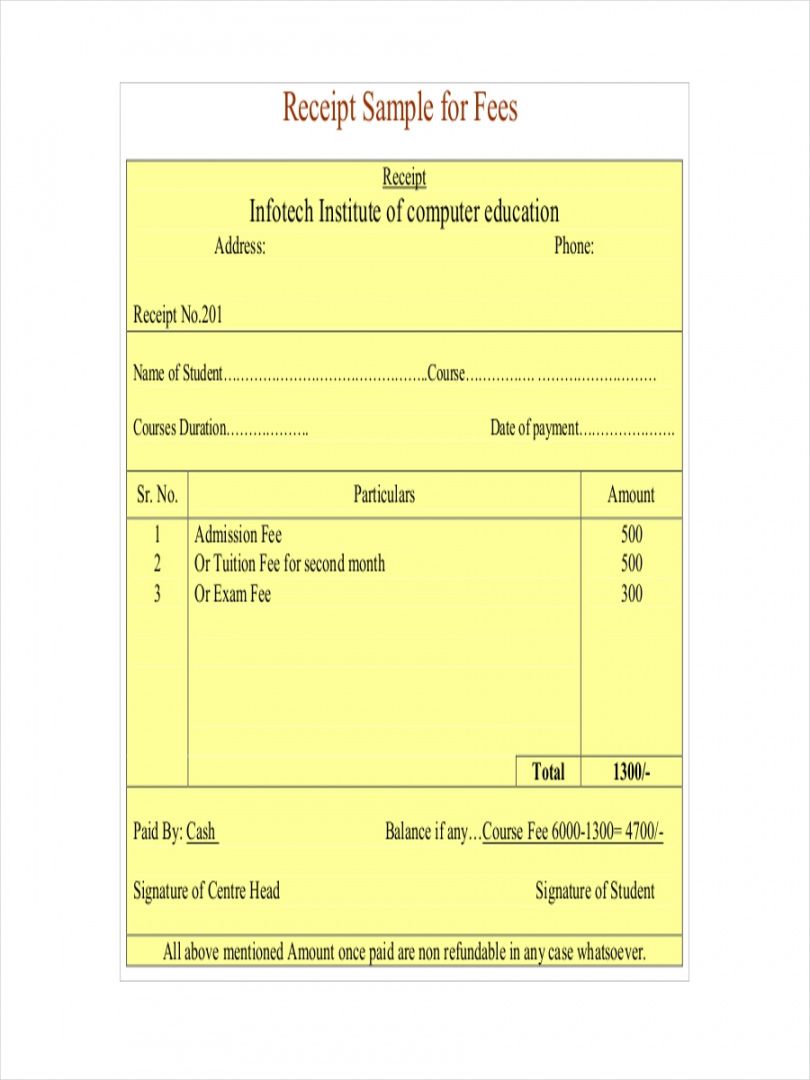

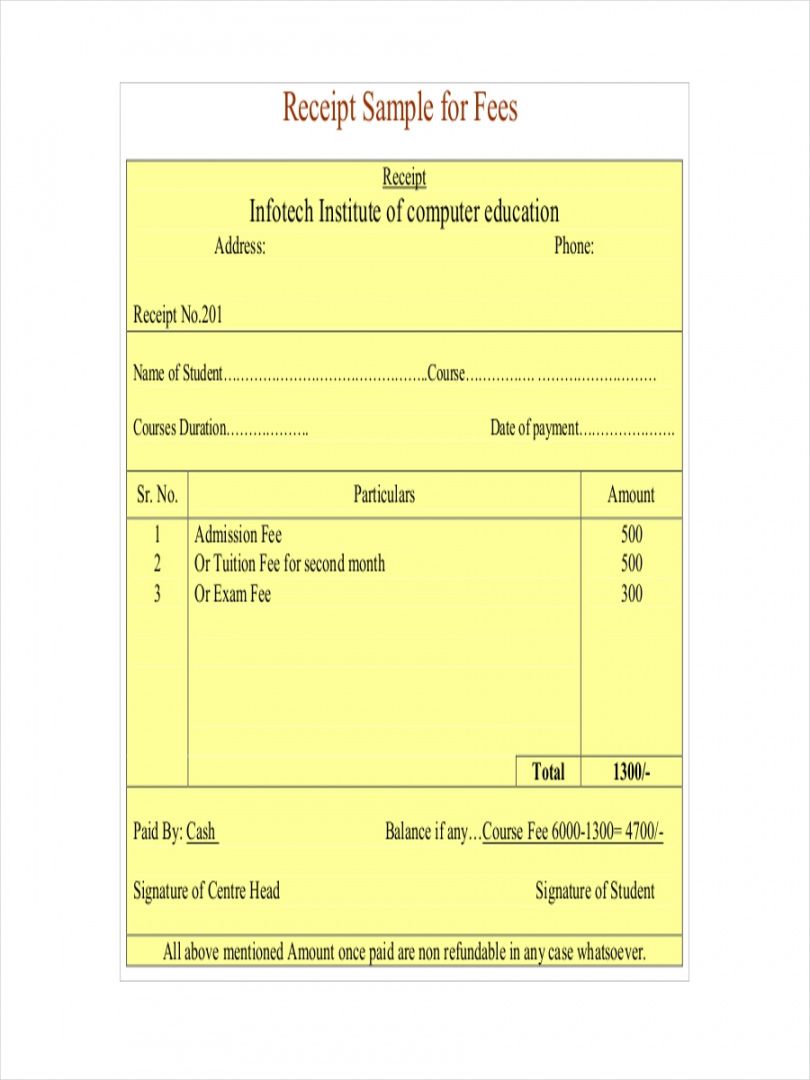

Editable 5 Tuition Receipt Templates Pdf Free Premium Templates

https://i.pinimg.com/originals/bf/12/39/bf1239938e99faa94fedc6d2c10fc3f6.jpg

Province Of Manitoba Tuition Fee Income Tax Rebate

http://www.gov.mb.ca/asset_library/en/tuition/header-tuition-fee.jpg

Web 13 mai 2022 nbsp 0183 32 The maximum amount you could claim for the tuition and fees adjustment to income was 4 000 per year The deduction was further limited by income ranges Web 10 sept 2018 nbsp 0183 32 An individual is eligible to claim a tax deduction for tuition fees paid to any university college or other educational institution in India for two children It is important

Web 3 oct 2021 nbsp 0183 32 In case you take education loan for full time education in India you can claim deduction for interest for such loan under Section 80E as well as for tuition fee paid Web 14 juil 2022 nbsp 0183 32 Tuition fees paid by parents for their kid s education come with tax benefits The amount paid as tuition fees qualifies for tax benefit under section 80C up to a

Download Tuition Fee Rebate Under Income Tax

More picture related to Tuition Fee Rebate Under Income Tax

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

I Want Tuition Fee Certificate From School For Tax Deduction Brainly in

https://hi-static.z-dn.net/files/dbc/211b60e62b671c2debf731de99ef588c.jpg

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Web 11 sept 2015 nbsp 0183 32 Find out how you can receive a tax rebate for up to 60 of your tuition as much as 2 500 a year Web Save income tax by claiming for tax exemption under Section 10 14 and Section 80C for tuition fee and hostel fees for up to two children

Web Every taxpayer can avail of tax deductions up to 1 5 lakhsunder the provisions made by section 80C Taxpayers can claim benefits for their two children and the tuition fee tax Web 1 d 233 c 2022 nbsp 0183 32 The deduction is 0 2 000 or 4 000 depending on your Modified Adjusted Gross Income MAGI 4 000 deduction for MAGI of 65 000 or less 130 000 or less

Tuition Fee Receipt Template EmetOnlineBlog

http://www.emetonlineblog.com/wp-content/uploads/2019/03/6-school-receipt-examples-samples-examples-tuition-fee-receipt-template-pdf.jpg

Tuition Fee Receipt School Forms

https://discountschoolforms.com/wp-content/uploads/2015/04/Tuition-Fee-Receipt_E-116.png

https://cleartax.in/s/tuition-fees-deduction-under-section-80c

Web 14 avr 2017 nbsp 0183 32 Tax deduction on tuition fees Exemption for Childrens education and Hostel Expenditure The following exemption is provided to a salaried taxpayer in India

https://instafiling.com/tuition-fees-exemption-in-income-tax-2022-23

Web 5 janv 2023 nbsp 0183 32 The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees that parents pay to educate their children Parents can

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Tuition Fee Receipt Template EmetOnlineBlog

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Fees Receipt Format 8 Fee School Tuition For Income Tax Seminar Free

How To Solve For Income Tax Amy Fleishman s Math Problems

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Tuition Fee Rebate Under Income Tax - Web 3 oct 2021 nbsp 0183 32 In case you take education loan for full time education in India you can claim deduction for interest for such loan under Section 80E as well as for tuition fee paid