Tuition Fees Rebate In Income Tax India Web 17 f 233 vr 2017 nbsp 0183 32 This is because tuition fee qualifies for tax benefit under Section 80C of the Income tax Act 1961 The amount of tax benefit is within the overall limit of the section

Web 5 janv 2023 nbsp 0183 32 The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees that parents pay to educate their children Parents can claim up to Rs 1 5 lakh for a tax deduction Web 22 juil 2019 nbsp 0183 32 How to Claim the tax benefit on Tuition Fee paid for Children Frequently Asked Questions Allowances for Children s Education and Hostel Expenditure As per

Tuition Fees Rebate In Income Tax India

Tuition Fees Rebate In Income Tax India

http://www.formsbirds.com/formimg/tax-support-document/8339/form-8917-tuition-and-fees-deduction-2014-l1.png

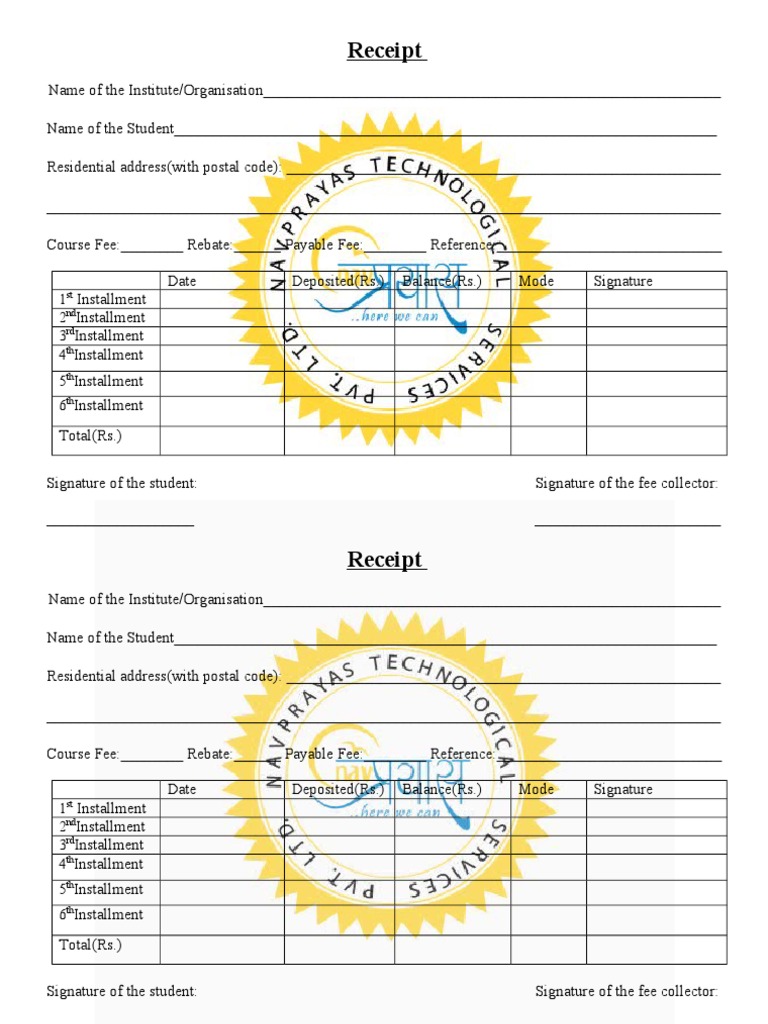

Receipts Archives DSF

https://discountschoolforms.com/wp-content/uploads/2015/04/Tuition-Fee-Receipt_E-116.png

Section 80C Child Tuition School Education Fees AY 2018 19 Meteorio

https://i.pinimg.com/564x/f2/57/d2/f257d20b625bae1a482187460086e071.jpg

Web Tuition fees deduction in India can be claimed by individuals employed in India under section 10 14 of the Income Tax Act as Children s Educational Allowance Section 10 Web 27 juin 2023 nbsp 0183 32 5 min read CONTENTS Show An education loan helps you not only finance your foreign studies but it can save you a lot of tax as well If you have taken an education loan and are repaying the same then the

Web 3 oct 2021 nbsp 0183 32 You can claim a deduction upto Rs 1 50 lakh every year for tuition fee paid for maximum of two children in respect of full time education in India This deduction is not exclusive but is Web 14 juil 2022 nbsp 0183 32 The amount paid as tuition fees qualifies for tax benefit under section 80C up to a maximum limit of Rs 1 5 lakh per annum It means under income tax rules you are allowed to deduct the fee

Download Tuition Fees Rebate In Income Tax India

More picture related to Tuition Fees Rebate In Income Tax India

Printable Free Professional Fee Receipt Templates At

https://i.pinimg.com/originals/b5/8d/91/b58d9127751a3ec09910dd46c3257e99.jpg

I Want Tuition Fee Certificate From School For Tax Deduction Brainly in

https://hi-static.z-dn.net/files/dbc/211b60e62b671c2debf731de99ef588c.jpg

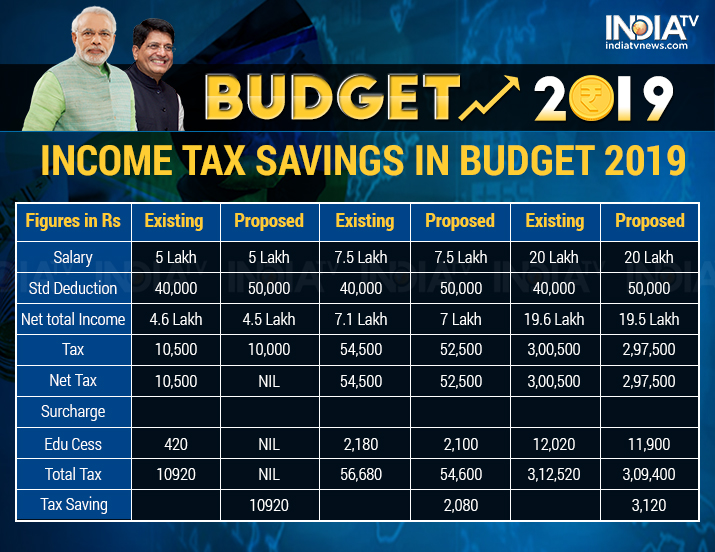

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Web 10 d 233 c 2018 nbsp 0183 32 The tuition fee paid qualifies for tax benefit under Section 80C and thus you are eligible to claim up to Rs 1 50 000 as tax deductions This will also apply to parents who are paying for Web Income Tax Tax Benefits on Tuition Fees Tax Benefits on Tuition Fees amp Education Fees Tuition and education fees are eligible for tax benefits in India Deductions of up

Web 27 f 233 vr 2023 nbsp 0183 32 Deduction Under Section 80C for Tuition Fees Payment Apart from the children education allowance you can also make tax deduction claims for the tuition Web 10 sept 2018 nbsp 0183 32 188 55 20 95 10 Jay Jalaram 338 75 37 6 9 99 KirloskarOil 479 4

Download Tuition Fee Receipt Template In Word Format

https://imgv2-1-f.scribdassets.com/img/document/166217327/original/72640b5764/1485219315

Interim Budget 2019 Check How Will Income Tax Rebate Announced By Fin

https://resize.indiatvnews.com/en/resize/newbucket/715_-/2019/02/income-tax-savings-in-budget-2019-1549027494.jpg

https://economictimes.indiatimes.com/wealth/tax/how-to-claim-tax...

Web 17 f 233 vr 2017 nbsp 0183 32 This is because tuition fee qualifies for tax benefit under Section 80C of the Income tax Act 1961 The amount of tax benefit is within the overall limit of the section

https://instafiling.com/tuition-fees-exemption …

Web 5 janv 2023 nbsp 0183 32 The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees that parents pay to educate their children Parents can claim up to Rs 1 5 lakh for a tax deduction

Student Tuition Fee Report Sample Templates Tuition Receipt Template

Download Tuition Fee Receipt Template In Word Format

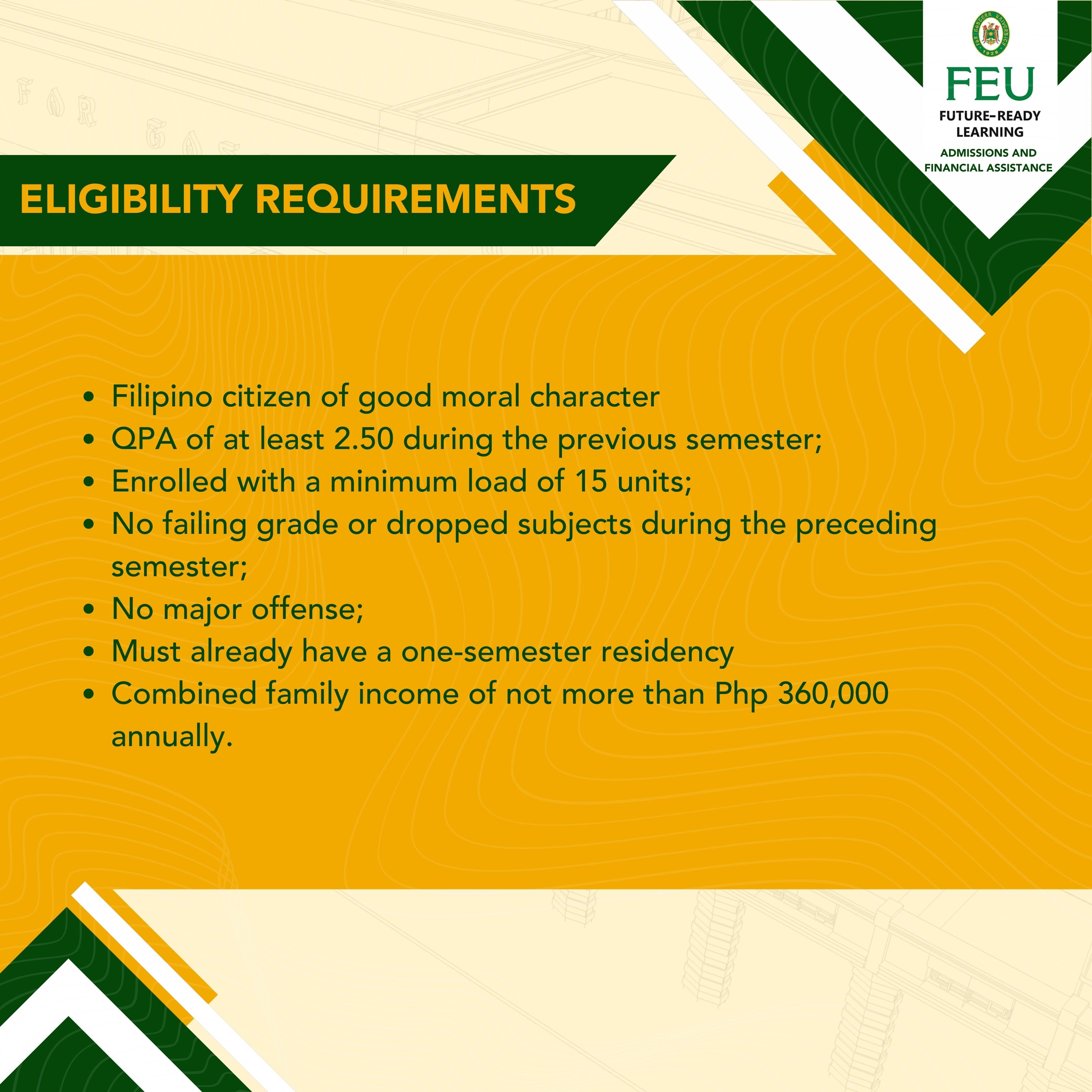

FEU TUITION DISCOUNT Far Eastern University

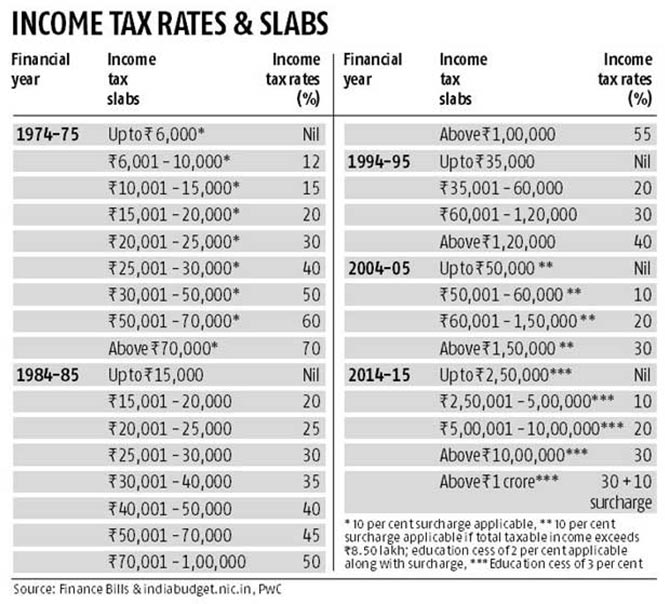

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Old Tax Rates Hot Sex Picture

Old Tax Rates Hot Sex Picture

Top Notch Income Tax Calculation Statement How To Prepare A Cash Flow

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

ALL ABOUT REBATE 87A EXEMPTION OF TAX UP TO 5 LAKH SIMPLE TAX INDIA

Tuition Fees Rebate In Income Tax India - Web 19 avr 2022 nbsp 0183 32 Income Tax Benefits on Tuition Fees in India Parents can claim the tuition fees paid for their children s education as deductions for a particular financial year They