Tuition Tax Credit Uk Students in universities and colleges of higher education may be able to get help with tuition fees the costs of their course and their living expenses by getting student support

What counts as income Usually what you re entitled to is based on your income for the last tax year 6 April 2023 to 5 April 2024 Income includes money from employment before tax and You could get a Tuition Fee Loan of up to 9 250 if you re studying at an eligible uni or college If you re studying an accelerated degree course you could get up to 11 100 If

Tuition Tax Credit Uk

Tuition Tax Credit Uk

https://media.valuethemarkets.com/img/Whatisataxcredit__685660f27b96fbc6e0edb67eb5c59039.jpg

Tuition Tax Credit In Canada How It Works NerdWallet

https://www.nerdwallet.com/ca/wp-content/uploads/sites/2/2022/01/GettyImages-936987292-e1643665970419.jpg

Everything You Need To Know About The College Tuition Tax Credit

https://cdn.collegereaction.com/who_should_claim_the_tuition_credit.png

You can usually get Child Tax Credits for each child or young person you re responsible for until the 31 August after they turn 16 The amount of money you get depends on how many Eligible tuition fees Generally a course taken in 2023 at an institution in Canada will qualify for a tuition tax credit if it was either taken at a post secondary education institution

Universities and colleges in England that receive a TEF award are allowed to charge a maximum tuition fee of 9 250 per year for full time undergraduate courses Those without a TEF award If you re responsible for any children or young people born before 6 April 2017 you can get up to 3 780 a year in child tax credits for your first child and up to 3 235 a year for each of your

Download Tuition Tax Credit Uk

More picture related to Tuition Tax Credit Uk

What Are Tuition Tax Credits Gallo LLP Chartered Professional

https://gallollp.ca/wp-content/uploads/2021/09/pexels-pixabay-261909-1024x731.jpg

Tuition Tax Credit PDF

https://cdn.slidesharecdn.com/ss_thumbnails/1293067-thumbnail.jpg?width=640&height=640&fit=bounds

What Happens To Unused Tuition Tax Credits Leftover Tuition Tax

https://www.liuandassociates.com/wp-content/uploads/2021/11/tuition-tax-credits-834x480.jpg

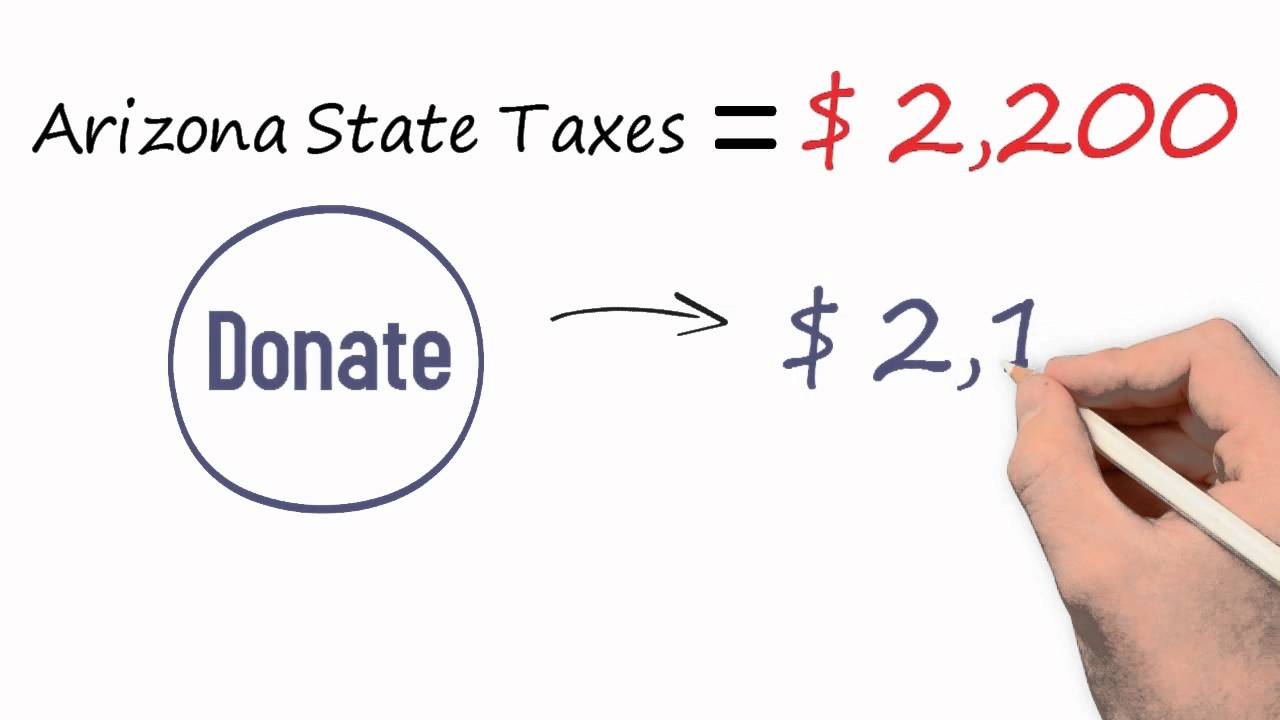

For example can you claim tax relief on private school fees Do private schools get government funding in the UK Is a donation to a private school tax deductible That s where we can help Child Tax Credit usually stops on 31 August after your child turns 16 but can continue for children under 20 in approved education training or registered with a careers service What you need

Unfortunately no private school fees are not specifically deductible from your self assessment tax return However there are several tax efficient steps you can take to reduce Income Tax on student earnings funding your children through university or purchasing a student house are three tax planning points of which you should be aware if your

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

Tuition Tax Credit YouTube

https://i.ytimg.com/vi/MPgnNc-QRwQ/maxresdefault.jpg

https://www.turn2us.org.uk/get-support/information...

Students in universities and colleges of higher education may be able to get help with tuition fees the costs of their course and their living expenses by getting student support

https://www.gov.uk/claim-tax-credits/what-counts-as-income

What counts as income Usually what you re entitled to is based on your income for the last tax year 6 April 2023 to 5 April 2024 Income includes money from employment before tax and

Working Tax Credit 500 Payment How To Claim And Who Is Eligible The

Tax Accounting Services Lee s Tax Service

Everything About Canada Tuition Tax Credits Blueprint Accounting

Tuition Fee Tax Credit QualiVests

Daycare Tax Statement Tuition Receipt Child Care Forms Daycare Studio

Daycare Tax Statement Tuition Receipt Child Care Forms Daycare Studio

How To Get Tuition Tax Credit QATAX

Contribution Information Arizona Tuition Organization

2022 Education Tax Credits Are You Eligible

Tuition Tax Credit Uk - Universities and colleges in England that receive a TEF award are allowed to charge a maximum tuition fee of 9 250 per year for full time undergraduate courses Those without a TEF award