Turbo Tax Economic Recovery Rebate Web 30 d 233 c 2020 nbsp 0183 32 The Recovery Rebate Credit is a credit that was authorized by the

Web 11 janv 2021 nbsp 0183 32 If you have an adjusted gross income AGI of up to 75 000 112 500 Head of Household 150 000 married filing jointly you could Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form

Turbo Tax Economic Recovery Rebate

Turbo Tax Economic Recovery Rebate

https://cdn.abcotvs.com/dip/images/9476384_recoery-rebate.jpg?w=1600

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.usatoday.com/gcdn/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?width=1320&height=990&fit=crop&format=pjpg&auto=webp

Recovery Rebate Credit David A Santini CPA LLC Warren County CPA

https://warrencountycpa.com/wp-content/uploads/2021/02/economy.jpg

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 Web 22 mars 2021 nbsp 0183 32 If you missed the third stimulus payment and were otherwise eligible you can claim the recovery rebate credit on your tax year 2021 return to recover that money

Web Step 2 After you ve entered in all your tax information go to the tab Federal Review Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021

Download Turbo Tax Economic Recovery Rebate

More picture related to Turbo Tax Economic Recovery Rebate

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

https://media.cbs19.tv/assets/KYTX/images/3ca89be7-1360-4b18-a5ba-3c6279cb9539/3ca89be7-1360-4b18-a5ba-3c6279cb9539_1140x641.png

T20 0132 Alternative Definitions Of An Eligible Dependent For Senate

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/t20-0132.png

The Recovery Rebates And Economic Stimulus For The American People Act

https://digital.library.unt.edu/ark:/67531/metadc821641/m1/1/high_res/

Web 18 mars 2021 nbsp 0183 32 The stimulus check rebate will completely phase out at 80 000 for single filers with no qualifying dependents and 160 000 for those married filing jointly with no dependents Once again mixed status Web 5 d 233 c 2022 nbsp 0183 32 The Recovery Rebate Credit amount is figured just like the third economic

Web 20 d 233 c 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 Web 1 d 233 c 2022 nbsp 0183 32 The IRS says the vast majority of people who qualify for a tax rebate or

The Recovery Rebate Credit Explained Expat US Tax

https://www.expatustax.com/wp-content/uploads/2021/03/Recovery-Rebate.jpg

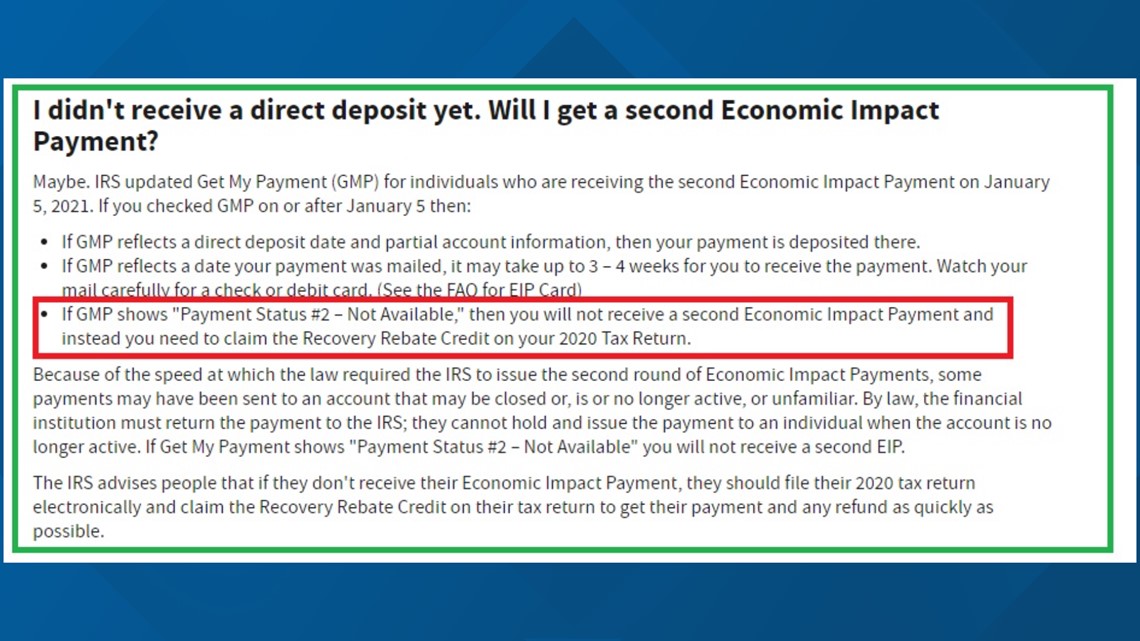

Payment Status 2 Not Available How To Get Your Stimulus Check Wthr

https://media.tegna-media.com/assets/WFMY/images/bba22e9a-fd2d-4b39-a871-cf9c2564cf39/bba22e9a-fd2d-4b39-a871-cf9c2564cf39_1140x641.jpg

https://blog.turbotax.intuit.com/tax-deductions-and-credits-2/what-is...

Web 30 d 233 c 2020 nbsp 0183 32 The Recovery Rebate Credit is a credit that was authorized by the

https://blog.turbotax.intuit.com/tax-news/whe…

Web 11 janv 2021 nbsp 0183 32 If you have an adjusted gross income AGI of up to 75 000 112 500 Head of Household 150 000 married filing jointly you could

IRS Letters Explain Why Some 2020 Recovery Rebate Credits Are Different

The Recovery Rebate Credit Explained Expat US Tax

Recovery Rebates Windward Private Wealth Management

Recovery Rebate Credit On The 2020 Tax Return

T20 0233 Additional 2020 Recovery Rebates For Individuals In Senate

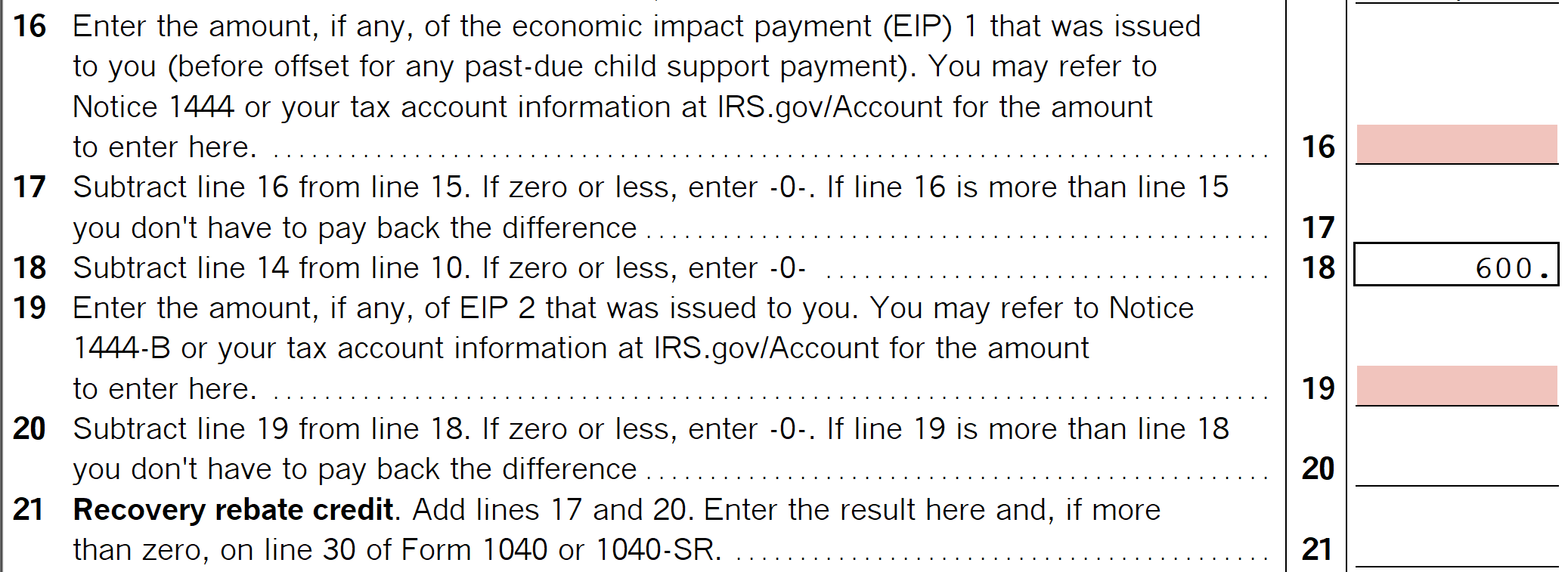

Recovery Rebate Credit Worksheet Explained Support

Recovery Rebate Credit Worksheet Explained Support

T08 0033 Individual Income Tax Measures In H R 5140 The Recovery

How To Enter Stimulus Payments And Figure The Reco Intuit

T20 0264 Expansion Of Economic Impact Payments And Additional 2020

Turbo Tax Economic Recovery Rebate - Web 2 f 233 vr 2023 nbsp 0183 32 How to enter stimulus payments and figure the Recovery Rebate Credit in