Turbotax 2021 Recovery Rebate Credit If you did not receive the additional 1 400 per qualifying in your third stimulus check you can claim the additional stimulus amounts in the form of a Recovery Rebate Credit on your 2021 tax return filed in 2022

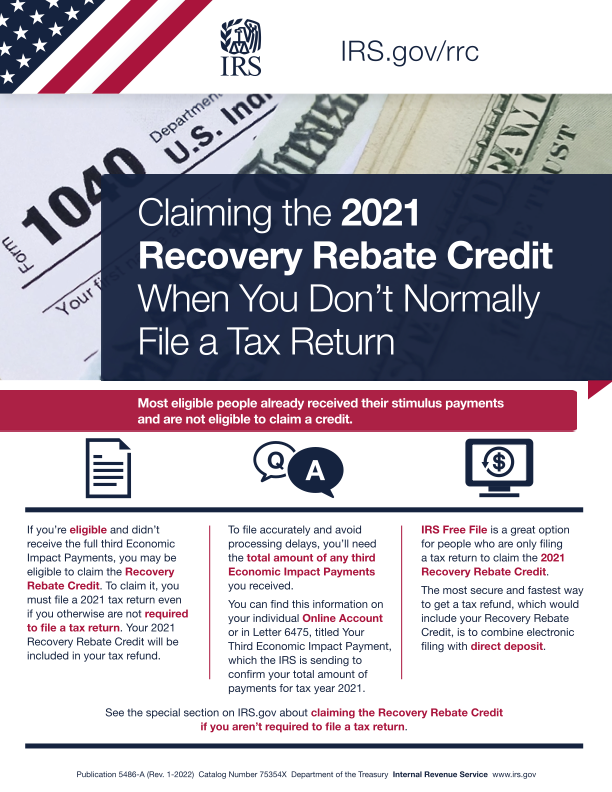

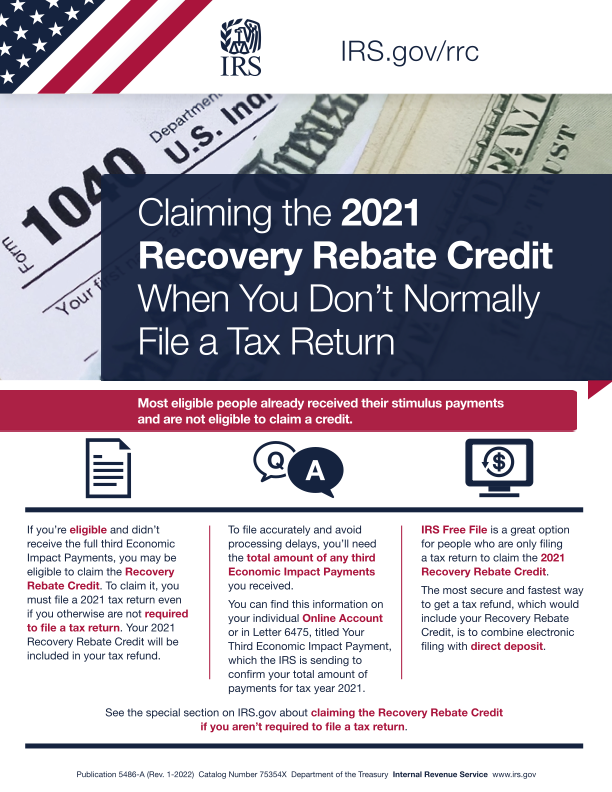

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program You can get to the Recovery Rebate Credit in TurboTax for 2021 by typing stimulus without the quotes in the Search box then clicking the link that says Jump to stimulus

Turbotax 2021 Recovery Rebate Credit

Turbotax 2021 Recovery Rebate Credit

https://blog.taxact.com/wp-content/uploads/10-FAQs-About-Claiming-the-2021-RRC_333504091_Blog-768x382.jpg

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/how-to-claim-stimulus-recovery-rebate-credit-on-turbotax-7.png?w=1003&ssl=1

The Recovery Rebate Credit Calculator ShauntelRaya

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/de418507-0277-4b17-89a7-765557117ca4.default.png

People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help Qualified taxpayers can also find free one on one tax preparation help nationwide through the Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs Use the VITA Locator Tool or call 800 906 9887 to locate the nearest site

Learn how to claim the Recovery Rebate Credit on your tax return using TurboTax This tutorial provides step by step instructions on checking eligibility re The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction is needed the IRS will calculate the correct amount of the Recovery Rebate Credit make the correction to the tax return and continue processing it

Download Turbotax 2021 Recovery Rebate Credit

More picture related to Turbotax 2021 Recovery Rebate Credit

9 Easy Ways What Is The Recovery Rebate Credit 2021 Alproject

https://i1.wp.com/www.gannett-cdn.com/presto/2022/01/31/PDTF/ed4d450c-c21d-4e0c-8df6-4637a89241b9-Lett_6475.jpg

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Should You Claim The Recovery Rebate Credit On Your 2021 Tax Return

https://alloysilverstein.com/wp-content/uploads/2022/01/Tax-Tip-1.26.png

If you met the income limits for the stimulus payments for 2020 and 2021 and you didn t receive one or more of the payments or if you received only a partial payment you may be eligible to file for the Recovery Rebate Credit Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Before you entered your third stimulus payment TurboTax was most likely giving you the Recovery Rebate Credit Generally if taxpayers did not get a third stimulus payment and now they qualify due to a change in circumstance then they would get a For tax year 2021 your clients may be eligible to claim the Recovery Rebate Credit on their tax returns This credit is available for clients who didn t previously receive the full third economic impact payment sometimes referred to as EIP 3 or stimulus that they were entitled to under the American Rescue Plan Act

Recovery Rebate Credit Turbotax 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/where-to-enter-recovery-rebate-credit-in-turbotax-recovery-rebate-6.jpg

How To Claim The Recovery Rebate Credit Stimulus Checks On TurboTax

https://i.ytimg.com/vi/sI85dvHfsnc/maxresdefault.jpg

https://blog.turbotax.intuit.com › ...

If you did not receive the additional 1 400 per qualifying in your third stimulus check you can claim the additional stimulus amounts in the form of a Recovery Rebate Credit on your 2021 tax return filed in 2022

https://www.irs.gov › newsroom

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Recovery Rebate Credit Turbotax 2023 Recovery Rebate

Bravecto Online Rebate 2022 Rebate2022 Recovery Rebate

Recovery Rebate Credit On The 2022 Tax Return Turbotax Recovery Rebate

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

Claiming The 2021 Recovery Rebate Credit When You Don t Normally File A

Claiming The 2021 Recovery Rebate Credit When You Don t Normally File A

How To File Recovery Rebate Credit Turbotax Recovery Rebate

IRS Letters Explain Why Some 2020 Recovery Rebate Credits Are Different

Recovery Rebate Credit 2021 Tax Return

Turbotax 2021 Recovery Rebate Credit - People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return