Uk Income Tax Rates 2023 24 Increase Here are the current tax bands rates and thresholds for England Wales and Northern Ireland for the tax year 2023 24 and 2024 25 Those earning more than 100 000 will see their personal allowance reduced by 1

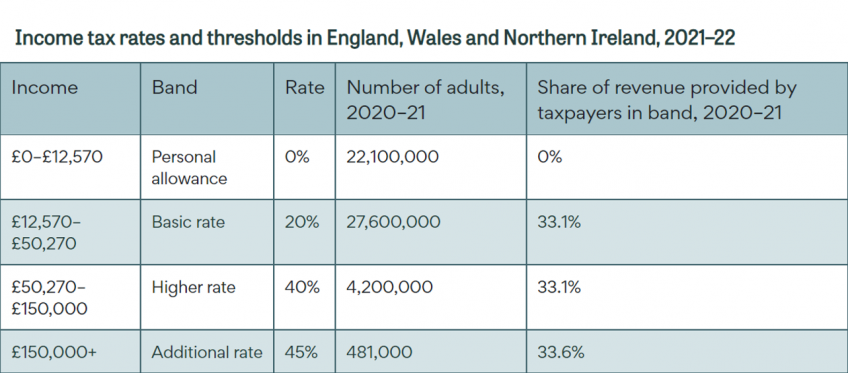

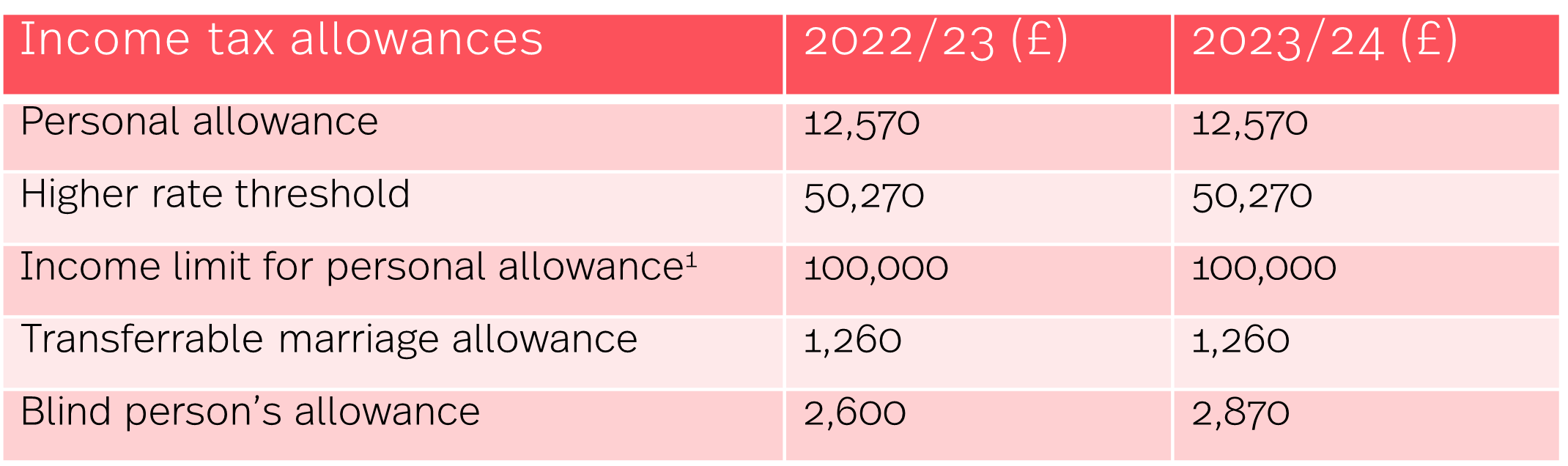

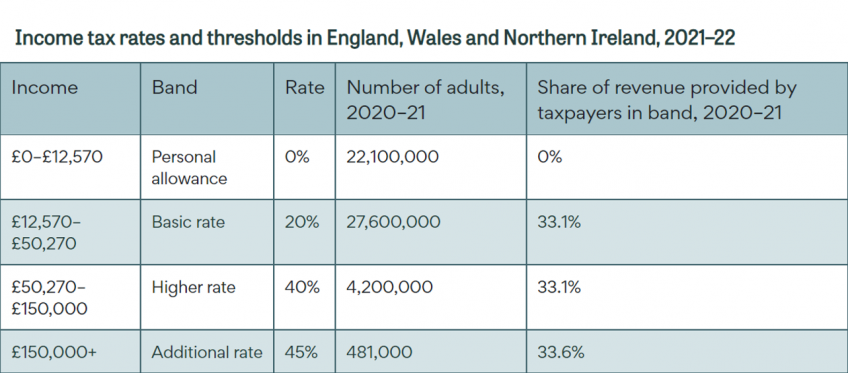

This briefing sets out direct tax rates and principal tax allowances for the 2023 24 tax year as confirmed in the Spring Budget 2023 on 15 March 2023 It also includes changes Income Tax Bands and Percentages 0 starting rate is for savings income only if your non savings income is above the starting band level the 0 rate will NOT apply and the basic rate

Uk Income Tax Rates 2023 24 Increase

Uk Income Tax Rates 2023 24 Increase

https://images.contentstack.io/v3/assets/blt3de4d56151f717f2/blt8743826b67930bd8/63767939ac59ed1089b31054/table_1.png

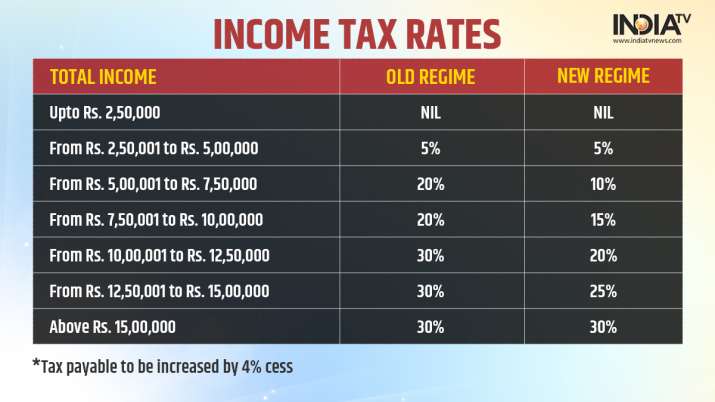

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-12.jpg

State Corporate Income Tax Rates And Brackets For 2023 CashReview

https://files.taxfoundation.org/20230123172533/2023-state-corporate-income-tax-rates-and-brackets-see-state-corporate-tax-rates-by-state.png

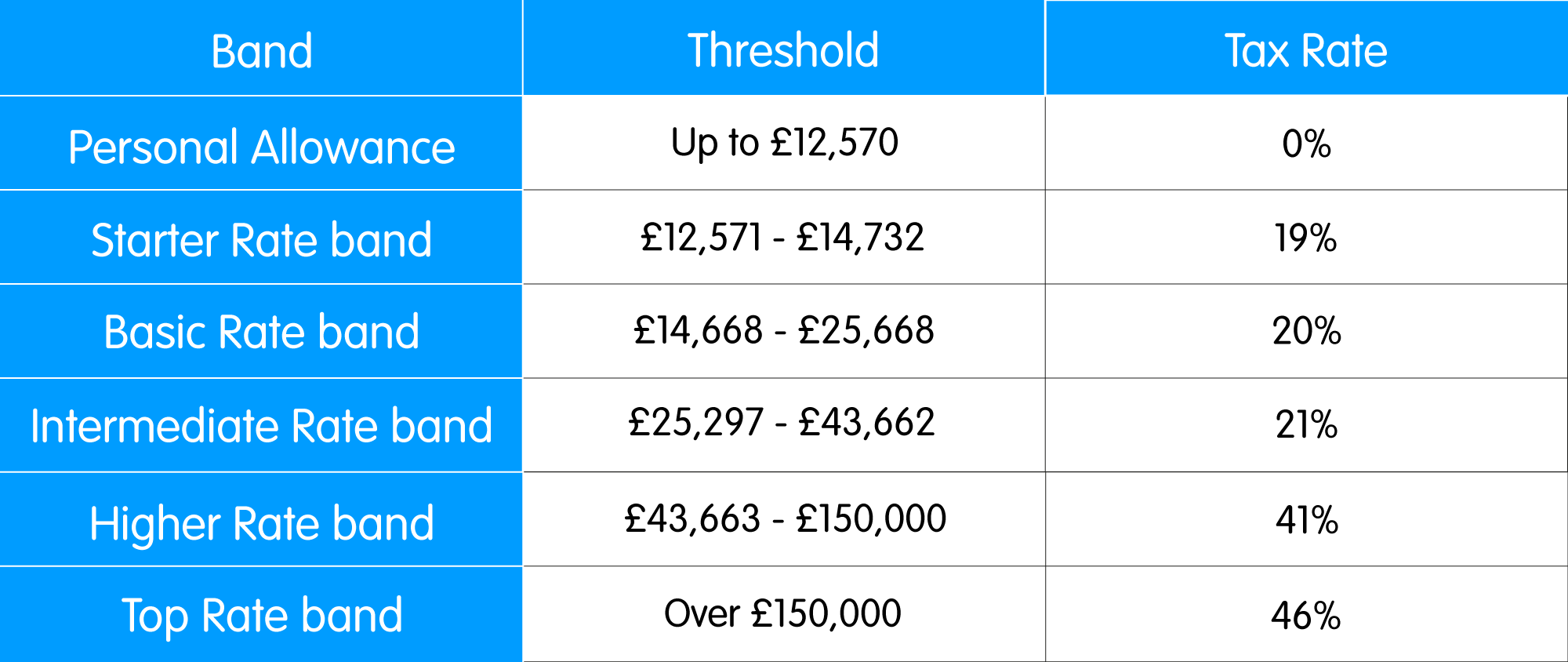

The table below shows the income tax rates and band thresholds for 2024 25 as well as for last year 2023 24 and next year 2025 26 in England Wales and Northern Ireland We explain the income tax bands and rates for 2023 24 and what you might be expected to pay for the current tax year

Companies with profits between 50 000 and 250 000 will pay tax at the main rate reduced by a marginal relief providing a gradual increase in the effective corporation tax rate This was set at 11 908 in 2022 to 2023 to align with the Lower Profits Limit and along with the Lower Profits Limit will increase to 12 570 for 2023 to 2024

Download Uk Income Tax Rates 2023 24 Increase

More picture related to Uk Income Tax Rates 2023 24 Increase

U K Income Tax Rates Guidelines Expat US Tax

https://www.expatustax.com/wp-content/uploads/2023/03/UK-income-tax-rates-2022-2023-1.jpg

60 000 After Tax 2023 2024 Income Tax UK

https://www.income-tax.co.uk/images/60000-after-tax-salary-uk-2020.png

Preparing For The Tax Year 2022 23 PayStream

https://static.paystream.co.uk/media/3848/tax-rates-and-thresholds-for-scotland.png

For 2024 25 and 2023 24 tax years as was the case in 2022 23 and 2021 22 most people are allowed to earn 12 570 per year before paying income tax for which there are variable rates depending on their annual salary The main corporation tax rate will increase to 25 from 1 April 2023 on profits over 250 000 The rate for diverted profits tax will increase to 31 from the same date

The UK income tax rates for 2023 24 have remained the same as 2022 23 at 20 for basic rate taxpayers 40 for higher rate taxpayers and 45 for additional rate taxpayers As each tax year comes around new tax rates and allowances are put in place This may mean you will be able to save on your income Below we have put together a summary of the new

Income Tax Explained IFS Taxlab

https://ifs.org.uk/sites/default/files/styles/wysiwyg_full_width_desktop/public/2021-06/Income tax rates and thresholds in England%2C Wales and Northern Ireland%2C 2021–22_0.png?itok=sAe2JxBC

Income Tax Rates Slab For FY 2022 23 Or AY 2023 24 Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/04/Income-Tax-Rates-Slab-2048x1072.png

https://www.which.co.uk › money › tax › income-tax › tax...

Here are the current tax bands rates and thresholds for England Wales and Northern Ireland for the tax year 2023 24 and 2024 25 Those earning more than 100 000 will see their personal allowance reduced by 1

https://commonslibrary.parliament.uk › research-briefings

This briefing sets out direct tax rates and principal tax allowances for the 2023 24 tax year as confirmed in the Spring Budget 2023 on 15 March 2023 It also includes changes

Highlights Of Tax Reform Law TRAIN See The Tax Rates For 2019

Income Tax Explained IFS Taxlab

2022 Tax Brackets Lashell Ahern

Income Tax Calculator Fy 2021 22 Major Changes In Income Tax Rules FY

Income Tax Rates For FY 2021 22 How To Choose Between Old Regime And

Graph Of The Week World s Highest Tax Rates

Graph Of The Week World s Highest Tax Rates

Ine Tax Brackets For 2020 21 Tutorial Pics

10 Calculate Tax Return 2023 For You 2023 VJK

2019 20 Tax Rates And Allowances Boox

Uk Income Tax Rates 2023 24 Increase - We explain the income tax bands and rates for 2023 24 and what you might be expected to pay for the current tax year