Uk Rental Tax Allowance The first 1 000 of your income from property rental is tax free This is your property allowance Contact HM Revenue and Customs HMRC if your income from property rental is more than

Understand UK rental income tax including tax free allowances allowable expenses rates and recent changes to help landlords maximize profits legally If you re a landlord earning rental income from your property you can get up to 1 000 rental income tax free each year this is called the Property Income Allowance Basically If you earn less than 1 000 from rental income

Uk Rental Tax Allowance

Uk Rental Tax Allowance

https://cdn.sharechat.com/2b0d0eef_1588734670621.jpeg

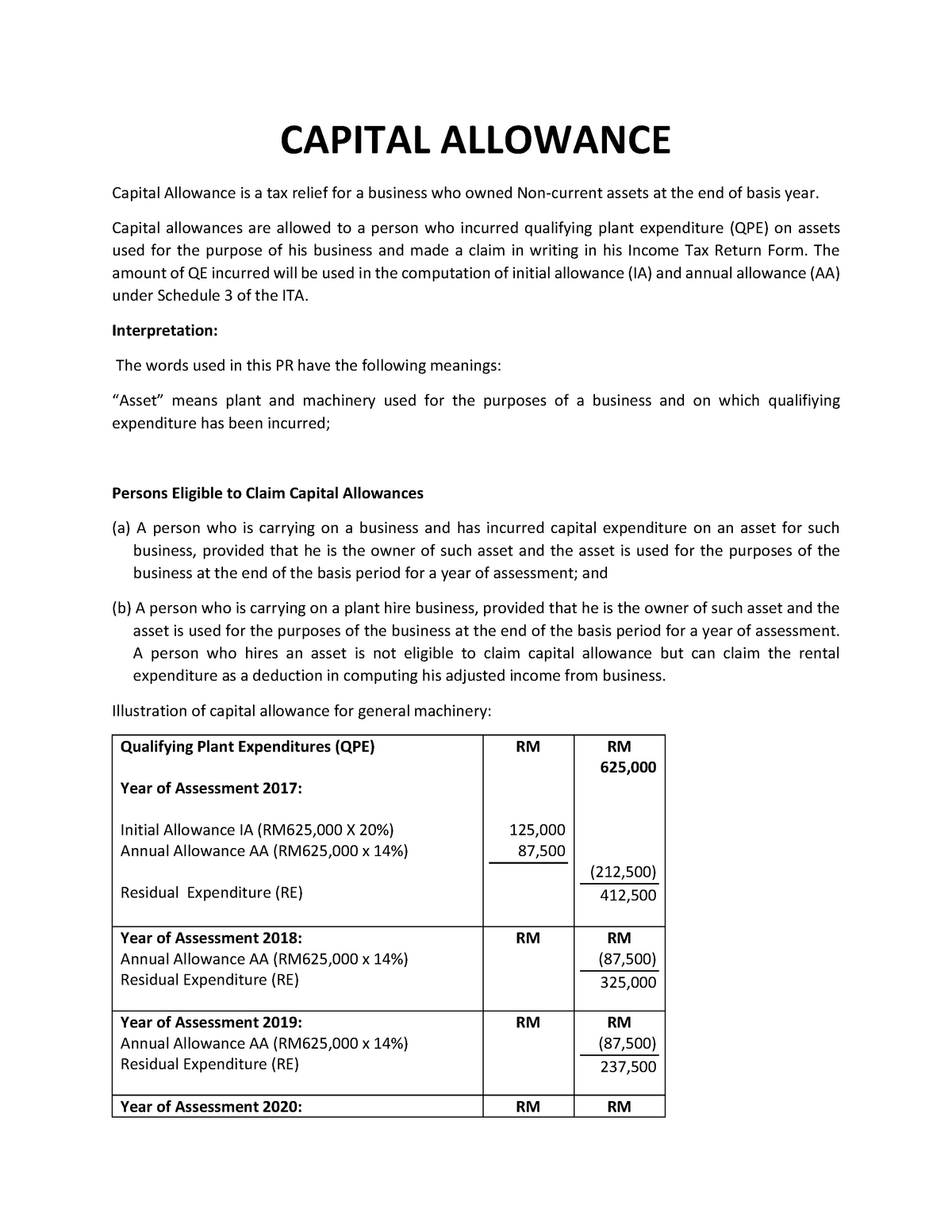

Notes Capital Allowance CAPITAL ALLOWANCE Capital Allowance Is A

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/6a43238f0298d997b7fcaec474d886f5/thumb_1200_1553.png

Your Guide To 2022 2023 Tax Allowances Magenta Financial Planning

https://magentafp.com/wp-content/uploads/2022/05/Tax-Allowances-980x366.png

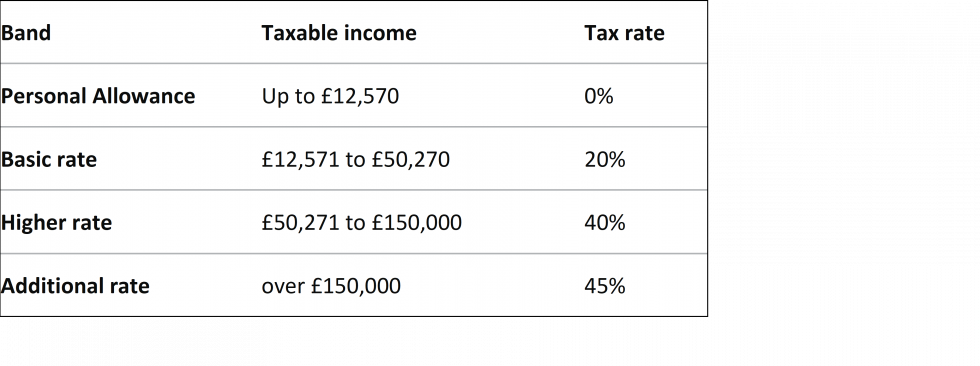

Rental income tax breakdown Your rental earnings are 18 000 You can claim 1 000 as a tax free property allowance As a result your taxable rental income will be 17 000 The first 12 270 will be taxed at 20 2 454 in rental The first 1000 you receive in rent from your tenants is tax free rental income otherwise known as your property allowance This means that landlords who earn less than 1000 don t have to worry about calculating

In the UK the first 1 000 you earn from rental income annually is tax free this is known as your property allowance So if you re a landlord earning less than 1 000 in rental income you receive full tax relief on this income You must pay taxes on rental income whether you rent a property as an individual or a business As a landlord you must pay income tax on your rental property profits Your profit is your rental income minus any expenses or

Download Uk Rental Tax Allowance

More picture related to Uk Rental Tax Allowance

Ketentuan Tax Allowance Direvisi Proses Pengajuan Lebih Sederhana

https://www.mucglobal.com/storage/files/1596532664_IncomeTax.png

UK Rental Tax Return Did I Miss The Deadline In 2023

https://www.ptireturns.com/blog/wp-content/uploads/2020/11/uk-self-assessed-tax-returns-assistance.jpg

Personal Income Tax Services LLC Warrendale PA

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100063620346462

Work out your taxable rental income from when you let property by using our helpful guide to understanding which tax bracket you fall into as a landlord The amount of tax you pay will depend on your individual circumstances the type of income which you receive and any tax reliefs which you claim For a taxpayer who is under 65 and has no other income or reliefs the rates of tax on his her

For property you personally own the first 1 000 of your income from property rental is tax free This is your property allowance After that any rental profit between 2 500 to 9 999 after allowable expenses or 10 000 or Discover the intricacies of rental income tax in the UK through our comprehensive guide In this guide What is considered UK rental income How much tax will I pay on my

Freelance Accounting Personal Tax Services

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100057362743633

British Expats Living In The US IRS Tax Filing

https://www.optimiseaccountants.co.uk/wp-content/uploads/2021/08/shutterstock_204844387-scaled.jpg

https://www.gov.uk › renting-out-a-property › paying-tax

The first 1 000 of your income from property rental is tax free This is your property allowance Contact HM Revenue and Customs HMRC if your income from property rental is more than

https://felixaccountants.com › understandin…

Understand UK rental income tax including tax free allowances allowable expenses rates and recent changes to help landlords maximize profits legally

Agriculture Allowance Sep 02 2022 Johor Bahru JB Malaysia Taman

Freelance Accounting Personal Tax Services

Tax Reduction Company Inc

UK Personal Allowance 2023 2024 Everything You Need To Know

Tax Holiday Vs Tax Allowance Taxvisory

Marriage Tax Allowance How To Combine Your Tax free Allowance YouTube

Marriage Tax Allowance How To Combine Your Tax free Allowance YouTube

Jey Tax And Services Allentown PA

National Income Tax Service Newark DE

Best UK Rental Yield Hotspots For 2023 Provestor

Uk Rental Tax Allowance - If your income from property is less than 1 000 the property allowance allows you to receive that income free from tax Here s how it works