Uk Tax Rebate On Film Investment Web For all British qualifying films of any budget level the Film Production Company FPC can claim a payable cash rebate of up to 25 on UK qualifying expenditure The Tax Relief

Web UK Film Tax Relief FTR is available for all British qualifying films of any budget level the film production company can claim a payable cash rebate of up to 25 of UK qualifying Web Films HETV animation and children s television programmes must have at least 10 of costs spent on UK qualifying production expenditure Video games must have at least

Uk Tax Rebate On Film Investment

Uk Tax Rebate On Film Investment

https://www.taxagility.com/wp-content/uploads/2022/11/tax-return-shutterstock_2168909045.jpg

Tax Rebate RM20 000 X 3 Years On Investment Holding Company Apr 20

https://cdn1.npcdn.net/image/1618905210e3b8bb075144f9faf8856b273237113c.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1600&new_height=1600&w=-62170009200

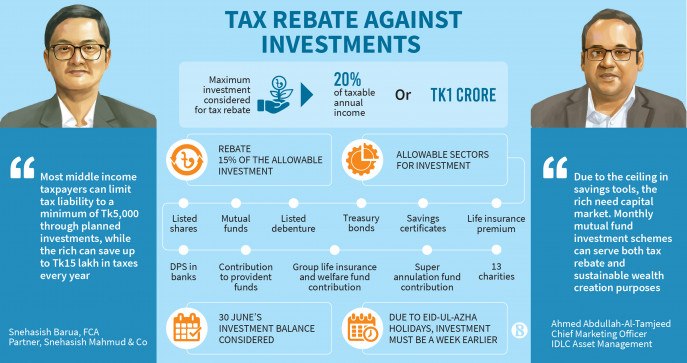

How To Maximise Tax Rebates Through Planned Investments The Business

https://www.tbsnews.net/sites/default/files/styles/infograph/public/images/2023/05/27/p7_info_tax-rebate-against-investments.jpg

Web 23 d 233 c 2015 nbsp 0183 32 The government s film tax relief generates almost 163 12 50 for every 163 1 spent and provides crucial support for UK films and Web 13 d 233 c 2021 nbsp 0183 32 Financial Times estimates based on BFI figures show film and high end TV productions alone have been eligible for about 163 4 4bn in rebates since 2016 including

Web 29 juin 2023 nbsp 0183 32 There are no tax holidays and no foreign investment incentives in the United Kingdom Web 15 f 233 vr 2021 nbsp 0183 32 Co productions The UK has many international co production agreements If registered as a co production then the UK production company may be eligible for Film Tax Reliefs even if the

Download Uk Tax Rebate On Film Investment

More picture related to Uk Tax Rebate On Film Investment

How To Claim and Increase Your P800 Refund Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/P800_Calculation.jpeg

Law Proposes Cutting Tax Rebate By A Third For Investments In

https://tfe-bd.sgp1.cdn.digitaloceanspaces.com/posts/11189/dse-june-13.jpg

Millions Of Pounds To Be Claimed In Tax Rebates Building Products News

https://www.buildingproducts.co.uk/wp-content/uploads/2023/01/pic-50.jpg

Web For qualifying films or TV projects the Film Production Company FPC or TV Production Company TPC can claim a payable cash rebate of up to 25 on UK core expenditure The Tax Relief is capped at 80 of the Web 10 nov 2011 nbsp 0183 32 This was published under the 2010 to 2015 Conservative and Liberal Democrat coalition government The Prime Minister has today announced the extension

Web 15 mars 2023 nbsp 0183 32 Jeremy Hunt the British Chancellor of the Exchequer said he would reform the film and TV relief from a rebate of 25 to a new expenditure credit of 34 from Web 17 nov 2022 nbsp 0183 32 Film amp HETV Tax relief of up to 25 For all British qualifying films amp HETV of any budget level the UK production company can claim a payable cash rebate of up

LTCG ON LISTED EQUITIES ENTITLED TO TAX REBATE Planning For Shares

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/08/thumb-E-6-7T.jpg

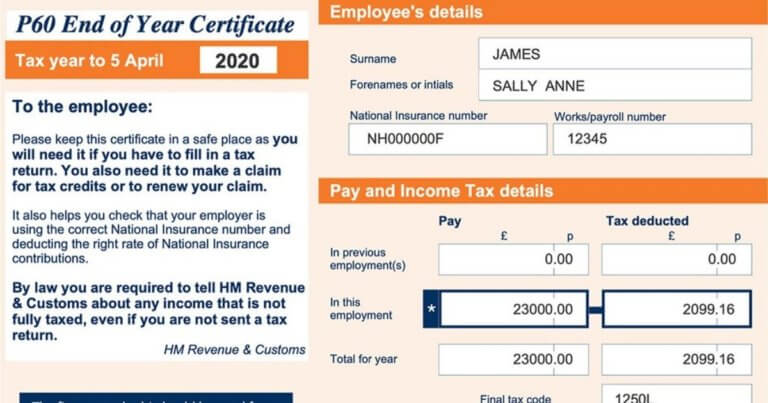

How To Get A Replacement P60 Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/p60-certificate-768x403.jpeg

https://britishfilmcommission.org.uk/plan-your-production/tax-reliefs

Web For all British qualifying films of any budget level the Film Production Company FPC can claim a payable cash rebate of up to 25 on UK qualifying expenditure The Tax Relief

https://www.alliotts.com/sectors/media/uk-film-tax-relief

Web UK Film Tax Relief FTR is available for all British qualifying films of any budget level the film production company can claim a payable cash rebate of up to 25 of UK qualifying

Understanding Your P800 Tax Calculation Tax Rebates

LTCG ON LISTED EQUITIES ENTITLED TO TAX REBATE Planning For Shares

Tax Rebate Uk Hi res Stock Photography And Images Alamy

High Income Child Benefit Charge Tax Rebates

Tax Rebate 150 Council Tax

HMRC Personal Tax Account Stops Using GOV UK Verify

HMRC Personal Tax Account Stops Using GOV UK Verify

Tax Codes For 2018 19 New Tax Code 1185L Tax Rebates

Claiming Tax Back When Working From Home Tax Rebates

Watch Out Lakshman Rekha To Celebrate With Tax Rebate Planning For

Uk Tax Rebate On Film Investment - Web 13 d 233 c 2021 nbsp 0183 32 Financial Times estimates based on BFI figures show film and high end TV productions alone have been eligible for about 163 4 4bn in rebates since 2016 including