Umbrella Company Tax Rebate Web 18 nov 2021 nbsp 0183 32 Home Tax avoidance Guidance Check your payslip if you work through an umbrella company Find out how to check your payslip to make sure you are not involved in a tax avoidance scheme

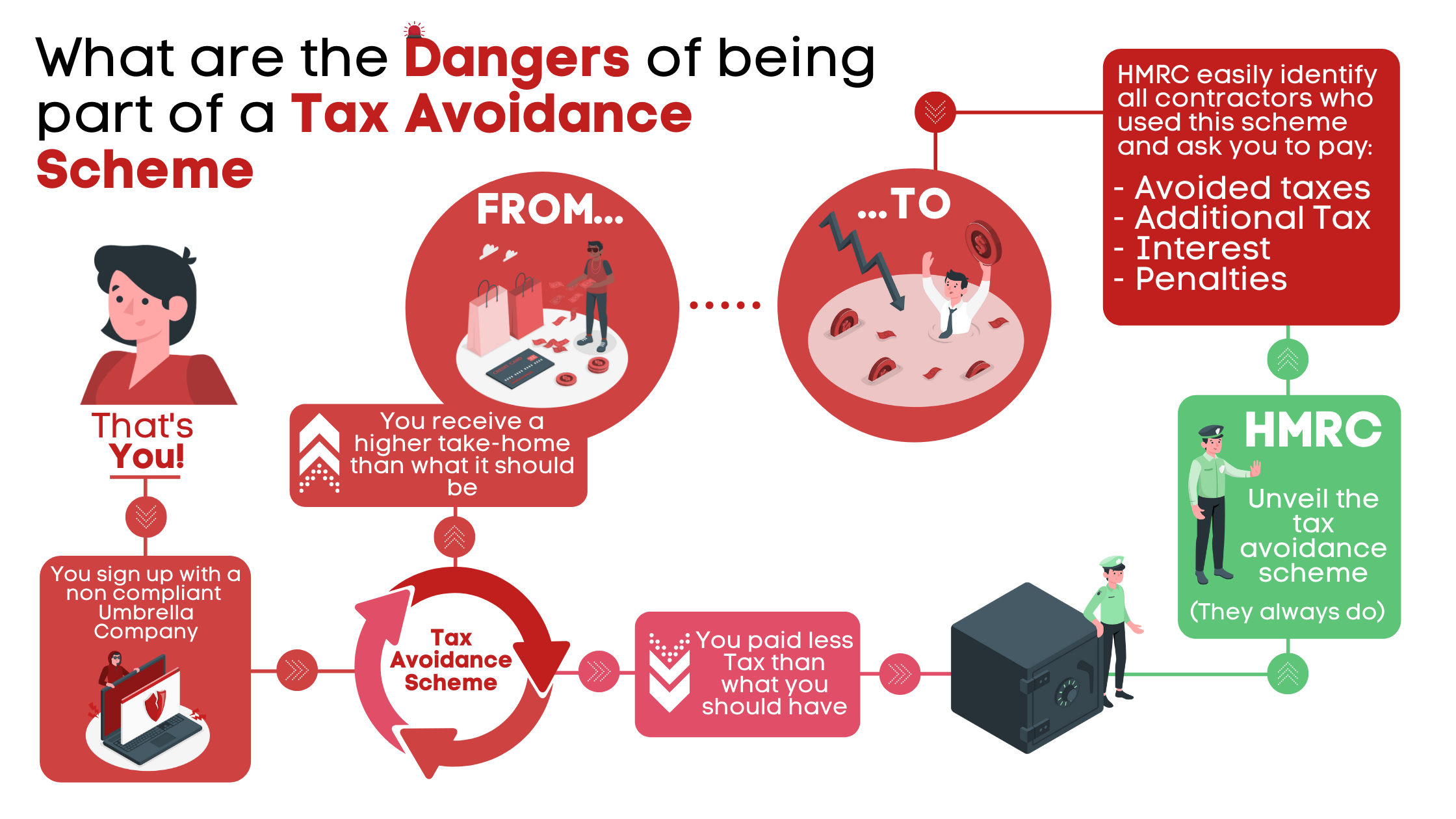

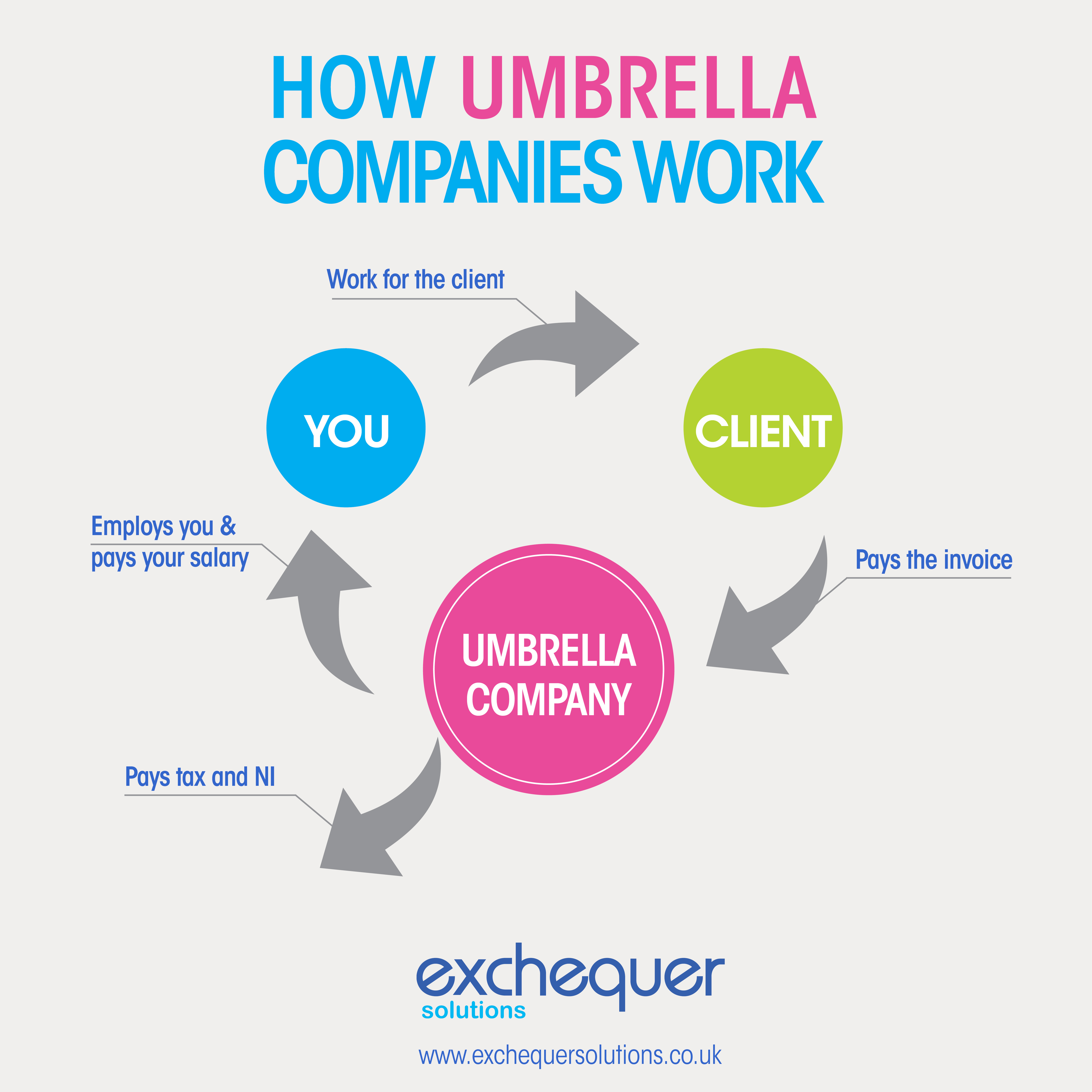

Web 20 d 233 c 2021 nbsp 0183 32 In many cases umbrella company employees won t need to submit a tax return because they are taxed similarly to those in permanent employment PAYE However any additional income may need to be disclosed to HMRC by submitting a Web 25 ao 251 t 2022 nbsp 0183 32 They do not achieve tax savings and Income Tax and National Insurance contributions remain due on any loan or other non taxed payments made to you by an umbrella company either directly

Umbrella Company Tax Rebate

Umbrella Company Tax Rebate

https://evolvecs.co.uk/wp-content/uploads/2022/11/alarm-clock-tax-time.jpg

Take Home Umbrella Company Tax Calculator 2022 2023 Full Breakdown

https://payslipbuddy.co.uk/assets/img/share/umbrella-company-calculator.jpg

Free Download Umbrella Company Tax Service Limited Company Payment

https://p7.hiclipart.com/preview/668/13/290/umbrella-company-tax-service-limited-company-payment-others.jpg

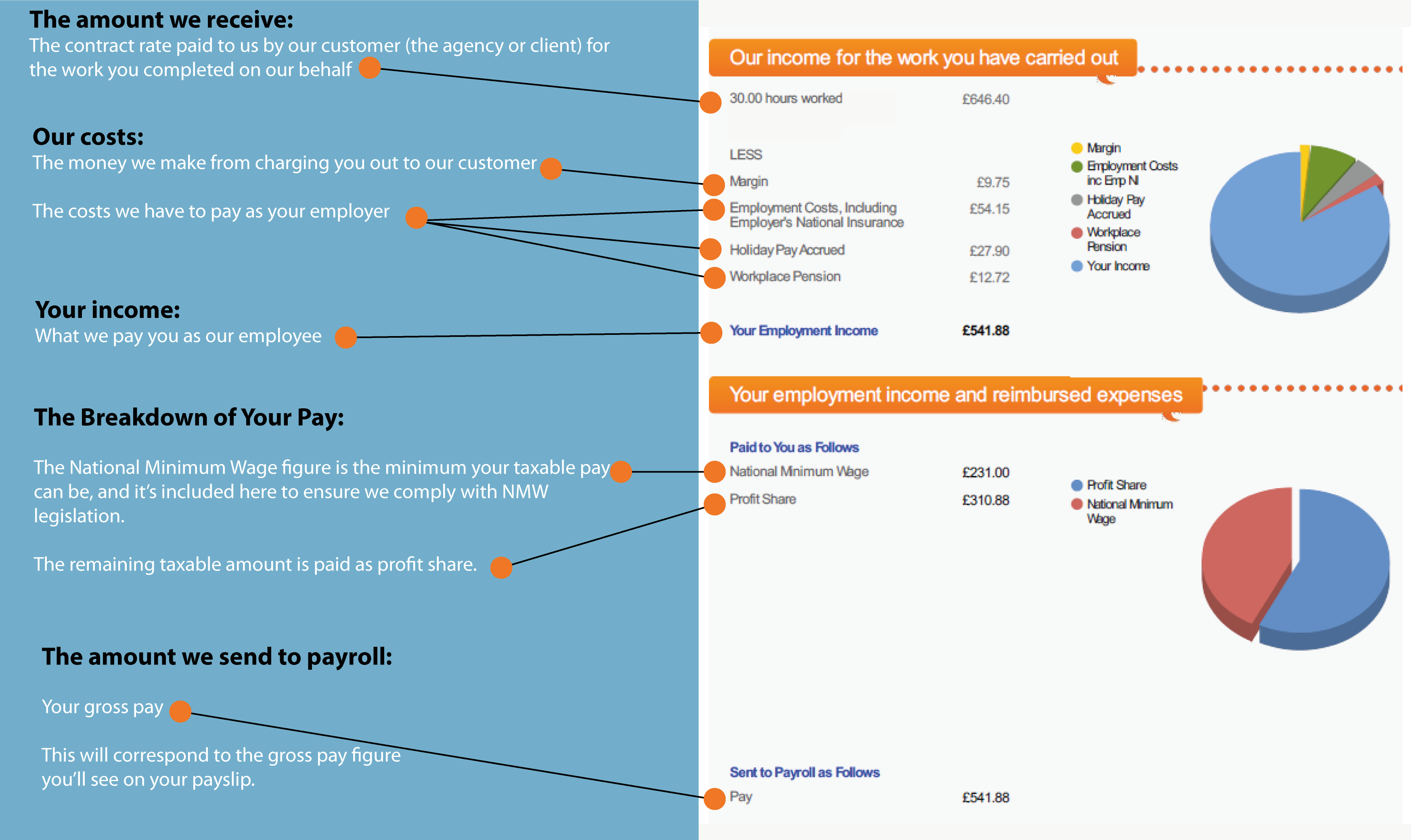

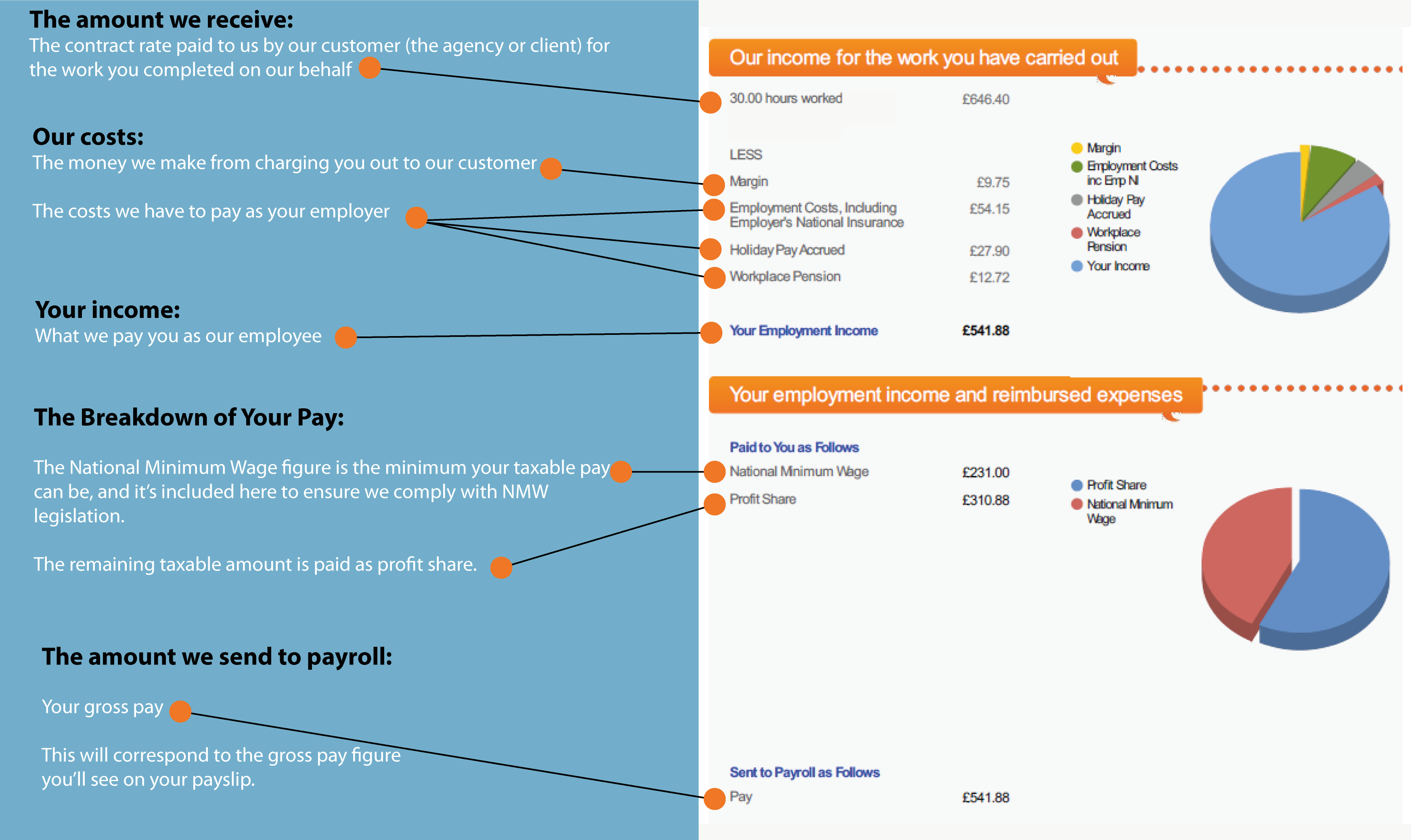

Web If you come across an umbrella company actively promoting that they ll allow tax relief on expenses run like mad The law is the law and as we ve mentioned above if you re using an umbrella you re almost certainly subject to SDC and legally are not entitled to them Can you claim expenses through an umbrella company UmbrellaCompanies uk Web 5 mai 2021 nbsp 0183 32 No longer than a 10 minute read the information explains how umbrella companies work including who pays the temporary worker how the process works what workers should expect to be paid net salary

Web You think you ve overpaid tax you might be entitled to a tax rebate in this case You run a limited company and take money as dividends You receive money for renting property You receive foreign money income You access untaxed money such as capital gains or Web Most umbrella companies advertise a weekly margin between 163 15 and 163 25 per week If you find a weekly margin under 163 15 we d say that s very low cost On the other hand any weekly margin that exceeds 163 25 is expensive unless additional extras are included that are valuable to you

Download Umbrella Company Tax Rebate

More picture related to Umbrella Company Tax Rebate

FindYourUmbrella Umbrella Company How To Choose Beginner Guide 2021

https://findyourumbrella.co.uk/assets/img/blog/umbrella-company-how-to-choose-beginner-guide-2021/dangers_of_being_part_of_a_tax_avoidance_scheme.png

Why Recruiters Won t Find An International Umbrella Company 6 Cats

https://www.6catsint.com/wp-content/uploads/2020/12/luke-jones-RrvEjANGRIM-unsplash.jpg

.png)

Being Paid By An Umbrella Company Tax Avoidance Vetro Recruitment

https://www.vetrorecruitment.co.uk/rails/active_storage/representations/eyJfcmFpbHMiOnsibWVzc2FnZSI6IkJBaHBBNG9pSXc9PSIsImV4cCI6bnVsbCwicHVyIjoiYmxvYl9pZCJ9fQ==--c585b72f03c59b03252e914aa82af2cdf7aedc2a/eyJfcmFpbHMiOnsibWVzc2FnZSI6IkJBaDdCam9MY21WemFYcGxTU0lOT0RBd2VEWTFNRHdHT2daRlZBPT0iLCJleHAiOm51bGwsInB1ciI6InZhcmlhdGlvbiJ9fQ==--63084d8e69e9a10abc38b54bbf8cc5ec3580de48/Blog graphics (1).png

Web 26 avr 2016 nbsp 0183 32 A claim for a tax rebate can still be made for many of the costs previously covered by the umbrella scheme Tax Rebate Services has experts on hand to help both employed and self employed construction workers We can help you reclaim everything you are entitled to and make sure you only pay the tax you need to Published on Web Umbrella V Limited Company How Much Will I Take Home Claiming Your Expenses Umbrella Costs Umbrella Company FAQs Umbrella Services Testimonials Antreprenori rom 226 ni i polonezi Polscy i rumu scy pracownicy kontraktowi Accountancy Services CIS Payroll Services Join Online What is CIS How can we Help Is it the right option for

Web 9 mai 2021 nbsp 0183 32 How much is paid This rate paid to the employee is after the costs for the umbrella company which include administration costs employer National Insurance contributions employer workplace pension Web Income Tax Just like a permanent employee you will be required to pay income tax on your earnings above the personal allowance of 163 12 500 per annum Employees National Insurance This is calculated at 12 of your salary and will be paid to HMRC by your umbrella company

Umbrella Company Tax Calculator 2023 4 IT Contracting

https://www.itcontracting.com/wp-content/uploads/2023/07/it-contracting-umbrella-company-calculator-V2.jpg

Choosing Between A Leveraging An Umbrella Company Service Or A Limited

http://3.bp.blogspot.com/-MUXW9ODi5OE/Uar6ws4N6-I/AAAAAAAAAGI/Zmt7iF3bYFg/s1600/sole+trading+contractor.jpg

https://www.gov.uk/guidance/check-your-payslip-if-you-work-through-an...

Web 18 nov 2021 nbsp 0183 32 Home Tax avoidance Guidance Check your payslip if you work through an umbrella company Find out how to check your payslip to make sure you are not involved in a tax avoidance scheme

https://www.churchill-knight.co.uk/.../2021/12/tax-return-umbrella-company

Web 20 d 233 c 2021 nbsp 0183 32 In many cases umbrella company employees won t need to submit a tax return because they are taxed similarly to those in permanent employment PAYE However any additional income may need to be disclosed to HMRC by submitting a

Umbrella Company Umbrella Company Tax Consulting Accounting

Umbrella Company Tax Calculator 2023 4 IT Contracting

What Is An Umbrella Company Exchequer Solutions

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

800 000 Comptes De L Agence Du Revenu Du Canada Ont t Compromis

Umbrella Payroll Calculator TomasRinrada

Umbrella Payroll Calculator TomasRinrada

5 Reasons To Use An Umbrella Company Healthchart Ltd

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Tax Knowledge Hub

Umbrella Company Tax Rebate - Web 2 List of named tax avoidance schemes promoters enablers and suppliers This list is presented in alphabetical order and will be updated regularly The most recent update was on 31 August 2023