Uniform Tax Rebate Contact Number Web 3 mars 2016 nbsp 0183 32 You can claim tax relief by phone if you ve already claimed the same expense type in a previous year and your total expenses are less than either 163 1 000

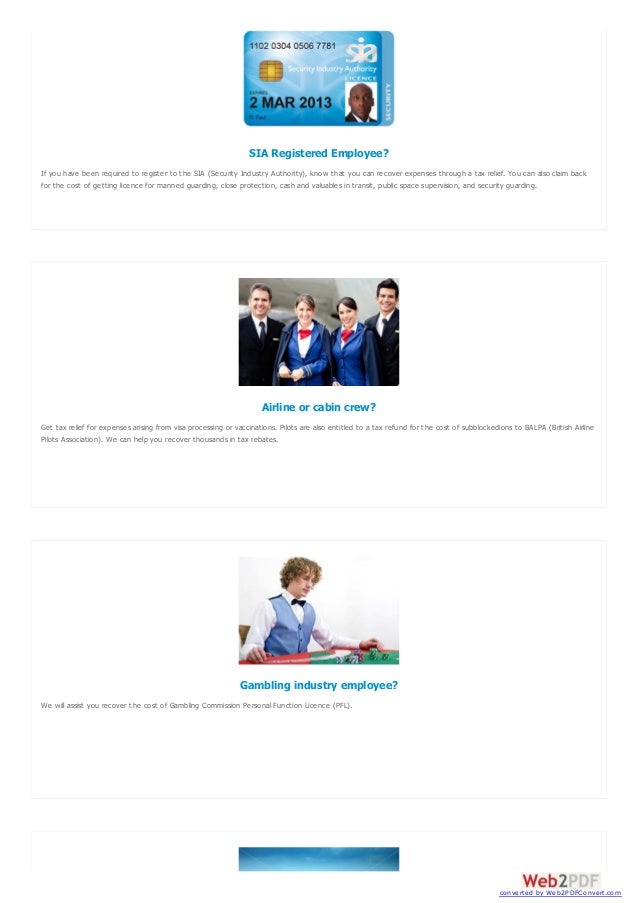

Web Updated 6 April 2023 If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 163 100s of tax for Web If you re paying to clean repair or replace your work uniform you re entitled to claim a uniform tax rebate Discover how Rift can help you claim Discover how Rift can help

Uniform Tax Rebate Contact Number

Uniform Tax Rebate Contact Number

https://www.rmt.org.uk/public/news/large_2uniform.jpeg

Pin On Uniform Tax Rebates

https://i.pinimg.com/originals/b4/e8/28/b4e828bae7623ff0f2d30901a322b027.jpg

Uniform Tax Rebates Claim Your Tax Relief Today

https://cheap-accountants-in-london.co.uk/wp-content/uploads/2021/10/Uniform-Tax-Rebates-1024x576.png

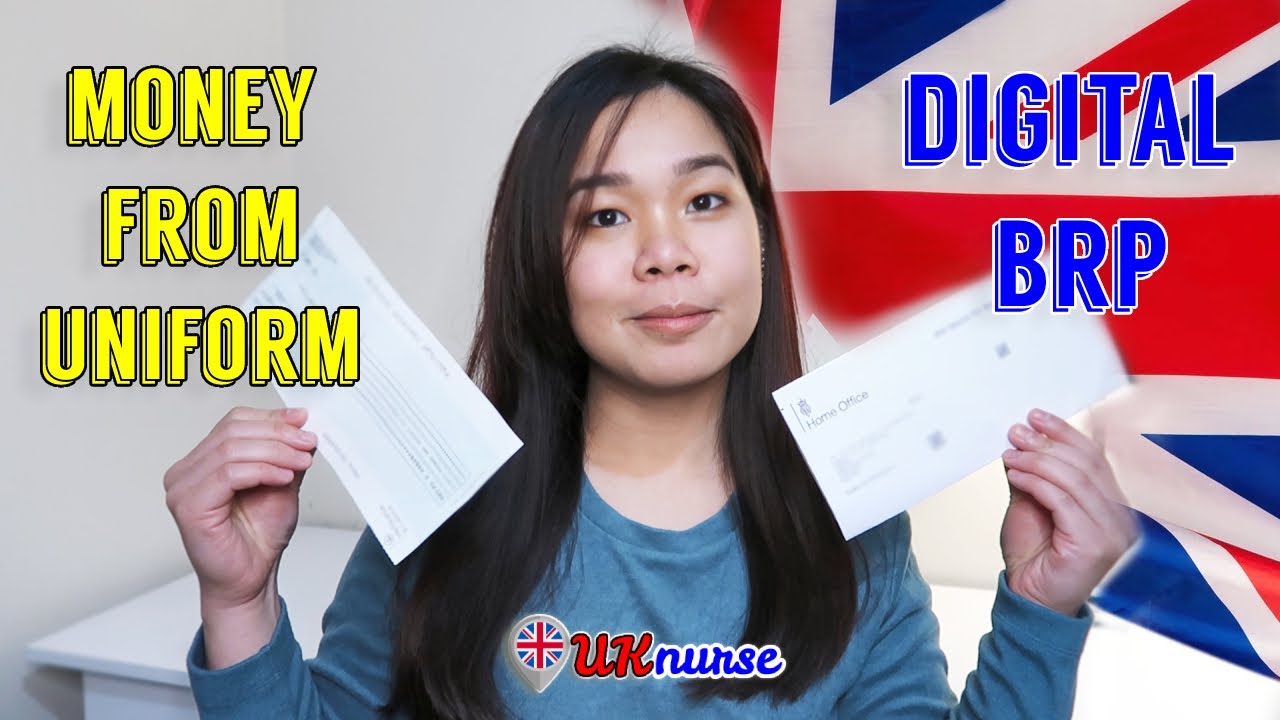

Web 29 d 233 c 2022 nbsp 0183 32 You can make your uniform tax rebate claim at any time but it must be for a year in which you have already paid or are currently paying tax You can choose to Web The amount you re able to claim tax relief on depends on your industry The standard flat rate expense allowance for uniform maintenance is 163 60 2021 22 Most people can

Web Contacter l Urssaf Caisse nationale 36 rue de Valmy 93108 Montreuil cedex 01 77 93 65 00 Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund The fastest way to get your tax refund is to file

Download Uniform Tax Rebate Contact Number

More picture related to Uniform Tax Rebate Contact Number

How Does Uniform Tax Rebate Work Tax Refund Tax Rebates

https://i.pinimg.com/originals/2c/22/92/2c22924c724898c314be2c631dcef679.png

Flybe Uniform Tax Rebate Uniform Tax Rebate

https://api.onlinetaxrebates.co.uk/content/images/Cheque1.jpg

NEW DIGITAL BRP UNIFORM TAX REBATE FOR NHS NURSES Filipino Nurse In

https://i.ytimg.com/vi/EkEAqlPW3As/maxresdefault.jpg

Web 5 oct 2022 nbsp 0183 32 The uniform tax return is a tax relief you can claim if you re responsible for washing repairing and replacing your work uniform without any reimbursement from your employer The government will refund the Web 0 806 803 232 service gratuit prix d appel Avance imm 233 diate employeurs et clients du secteur des services 224 la personne 0 806 806 028 service gratuit prix d appel

Web See if you re eligible contact us now it s free UNIFORM TAX REBATE CALCULATOR Find out how much tax you could be owed with our uniform rebate calculator This way Web 13 avr 2022 nbsp 0183 32 Please do not call the IRS Topic A General Information Topic B Claiming the Recovery Rebate Credit if you aren t required to file a 2021 tax return Topic C

Do You Wear A Fast Food Uniform At Work Claim Your Tax Rebate Online

https://i.pinimg.com/originals/6c/d1/5c/6cd15ca21a9042c81b523eb74a35a592.jpg

Uniform Tax Allowance Rebate My Tax Ltd

https://www.rebatemytax.com/wp-content/uploads/2020/09/work-wear-1.jpg

https://www.gov.uk/guidance/claim-income-tax-relief-for-your...

Web 3 mars 2016 nbsp 0183 32 You can claim tax relief by phone if you ve already claimed the same expense type in a previous year and your total expenses are less than either 163 1 000

https://www.moneysavingexpert.com/reclaim/…

Web Updated 6 April 2023 If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 163 100s of tax for

Uniform Tax Refund How To Claim A Uniform Tax Rebate From HMRC

Do You Wear A Fast Food Uniform At Work Claim Your Tax Rebate Online

Complete Guide To Uniform Tax Rebates Money Back Helpdesk

Uniform Tax Rebate My Tax Rebate

Download Form P87 For Claiming Uniform Tax Rebate DNS Accountants

Uniform Tax Rebates Claim Your Tax Relief Today

Uniform Tax Rebates Claim Your Tax Relief Today

Uniform Archives Skippy s Random Ramblings

How To Calculate Uniform Tax Rebate PROFRTY

Uniform Tax Rebate

Uniform Tax Rebate Contact Number - Web 29 d 233 c 2022 nbsp 0183 32 You can make your uniform tax rebate claim at any time but it must be for a year in which you have already paid or are currently paying tax You can choose to