Us Ev Tax Credit 2024 We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new clean vehicle Looking to claim a credit for a new clean vehicle you already bought Planning to buy or already bought a used clean vehicle Buying a vehicle for

2024 Stellantis FCA US LLC Jeep Wrangler PHEV 4xe Yes 80 000 3 750 Bolt EV Yes 55 000 7 500 2024 General Motors LLC Chevrolet Equinox EV Yes 80 000 7 500 Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Placed into Service on or after April 18 2023 The EV tax credit is a federal tax benefit for those who purchase qualifying new or used electric vehicles Here s how much it s worth which cars qualify and how to claim it

Us Ev Tax Credit 2024

Us Ev Tax Credit 2024

https://cleantechnica.com/files/2020/10/US-EV-BEV-PHEV-Share-of-New-Vehicle-Sales-2015-2021.png

A Complete Guide To The New EV Tax Credit

https://techcrunch.com/wp-content/uploads/2022/09/math-calculation-ev.jpg

Here s What You Need To Know About The New EV Tax Credit For 2023 Ars

https://cdn.arstechnica.net/wp-content/uploads/2023/01/ev-tax-explainer.jpg

We ve done the due diligence of gathering each EV that s currently eligible to earn the full 7500 credit and listed them below While plug in hybrid models are also eligible for government 2024 and After EV Tax Credits The federal government recognizes the critical role an electrified transportation industry must play in combating climate change Thanks to the Inflation Reduction Act you can get up to 7 500 tax credit instantly when you buy or lease a new EV

How to Claim the New Clean Vehicle Tax Credit Starting on Jan 1 2024 eligible consumers will have the option to transfer the value of the tax credit to dealers that meet certain requirements in exchange for an equivalent reduction in the vehicle s purchase price Just 19 different electric vehicle and plug in hybrid variations qualify for tax credits in 2024 down from 43 last year See below for the full list including all the model variations

Download Us Ev Tax Credit 2024

More picture related to Us Ev Tax Credit 2024

New US EV Tax Credit Everything We Know So Far Inflation Reduction

https://i.ytimg.com/vi/J-WpPZqu9v0/maxresdefault.jpg

The New Federal Tax Credit For EVs

https://blog.greenenergyconsumers.org/hubfs/Federal Tax Credit Blog header.png

New EV Tax Credits The Details Virginia Automobile Dealers Association

https://vada.com/wp-content/uploads/2022/08/EV-Tax-Credits-Facebook-Post.png

Here s a practical plain English guide to how the electric vehicle tax credit will work in 2024 including why you may also consider leasing a car EV buyers no longer have to wait until Federal EV tax credits in 2024 top out at 7 500 if you re buying a new car and 4 000 if you re buying a used car while the bank or the automaker s finance company can take a 7 500 tax

The 2024 electric vehicle tax credit part of the Inflation Reduction Act brings a renewed boost for EV buyers including those interested in fuel cell electric vehicle options also known as fuel cell vehicles The Inflation Reduction Act IRA offers eligible buyers in 2024 a 7 500 tax credits for purchasing a new EV or PHEV or 4 000 for a used EV or PHEV In previous years the tax credit was only available after buyers filed their taxes and proved they earned an adjusted gross income under 150 000

EV Tax Credit 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2021/11/EV-Tax-Credit.jpg

EV Tax Credit 2023 2024 How It Works What Qualifies NerdWallet

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/08/GettyImages-1252669337-ev-tax-credit-electric-vehicle-tax-credit-2400x1440.jpg

https://www.irs.gov › clean-vehicle-tax-credits

We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new clean vehicle Looking to claim a credit for a new clean vehicle you already bought Planning to buy or already bought a used clean vehicle Buying a vehicle for

https://www.irs.gov › pub › irs-sbse

2024 Stellantis FCA US LLC Jeep Wrangler PHEV 4xe Yes 80 000 3 750 Bolt EV Yes 55 000 7 500 2024 General Motors LLC Chevrolet Equinox EV Yes 80 000 7 500 Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Placed into Service on or after April 18 2023

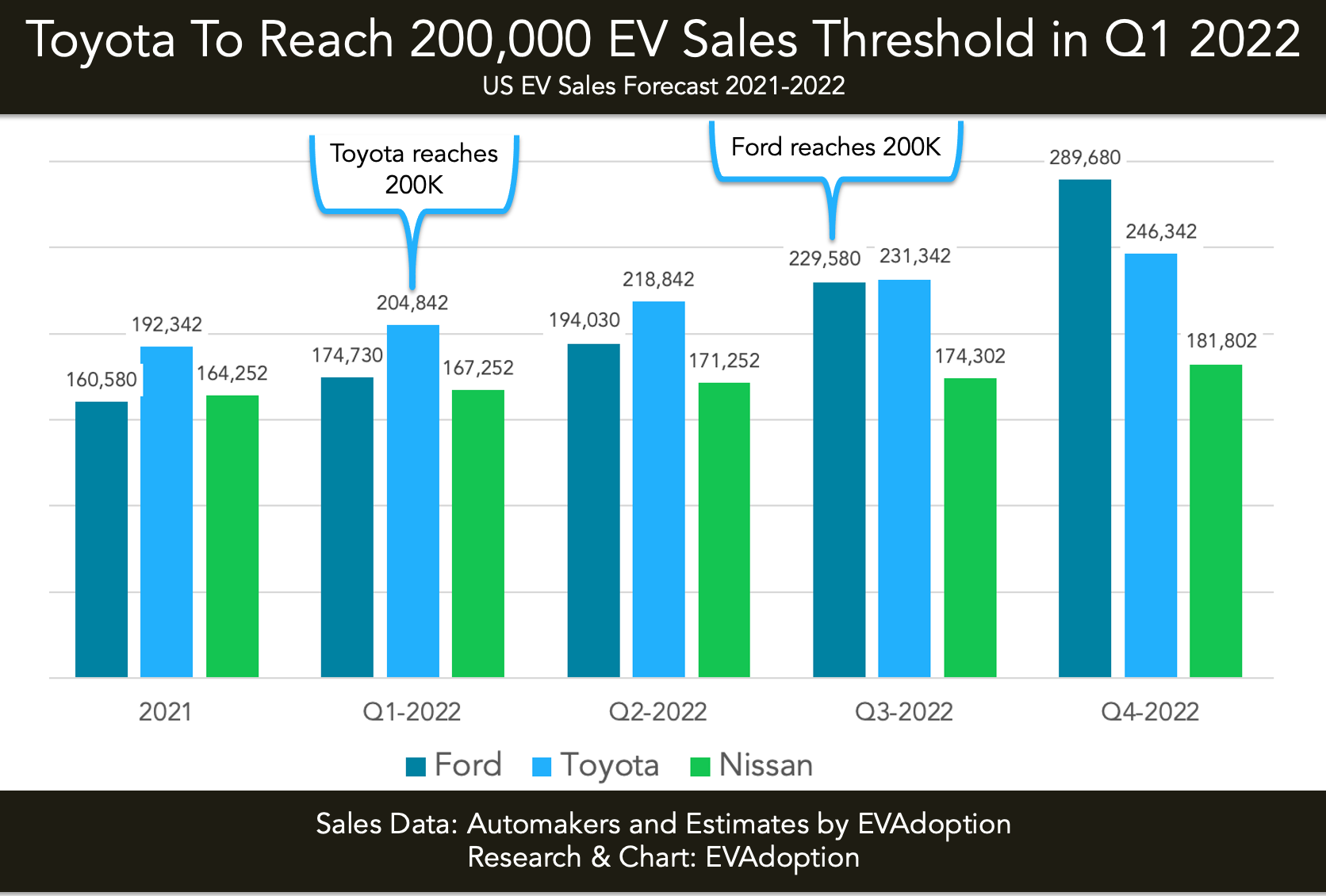

Federal EV Tax Credit Phase Out Tracker By Automaker EVAdoption

EV Tax Credit 2024 Credits Zrivo

How The Federal EV Tax Credit Can Save You 7 500 On A New Plug in Vehicle

Which Electric Cars Are Still Eligible For The 7 500 Federal Tax

These 5 Plugin Vehicle Models Would Benefit Most From Proposed US EV

VW Has The Biggest Portfolio Of EVs Qualifying For The Full US EV Tax

VW Has The Biggest Portfolio Of EVs Qualifying For The Full US EV Tax

New Electric Vehicles Would Qualify For Tax Credit With New Bill

Ev Tax Credit 2022 Retroactive Shemika Wheatley

U S EV Tax Credit Unlikely To Be Expanded Despite Push From Automakers

Us Ev Tax Credit 2024 - How to Claim the New Clean Vehicle Tax Credit Starting on Jan 1 2024 eligible consumers will have the option to transfer the value of the tax credit to dealers that meet certain requirements in exchange for an equivalent reduction in the vehicle s purchase price