Us Income Tax Rate The seven federal income tax brackets for 2024 are 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status

Let s say you re single and your 2024 taxable income is 75 000 your marginal or top tax rate is 22 But some of your income will be taxed in lower tax brackets 10 and 12 Personal income tax rates For individuals the top income tax rate for 2023 is 37 except for long term capital gains and qualified dividends discussed below P L 115 97 reduced both the individual tax rates and the number of tax brackets

Us Income Tax Rate

Us Income Tax Rate

https://files.taxfoundation.org/20210216163839/2021-state-income-tax-rates.-2021-state-individual-income-tax-rates.-States-with-no-income-tax.-2021-top-state-marginal-individual-income-tax-rates.png

Federal Taxable Income Table Brokeasshome

https://www.taxpolicycenter.org/sites/default/files/styles/original_optimized/public/publication/137756/01_6.png?itok=tNemzmEG

In This World Nothing Is Certain Except Death And Taxes R conspiracy

https://www.taxpolicycenter.org/sites/default/files/styles/original_optimized/public/book_images/3.1.5.2.png?itok=P1wdtomc

The U S currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37 If you re one of the lucky few to earn enough to fall into the 37 bracket that doesn t mean that the entirety of your taxable income will be subject to a 37 tax There are seven tax brackets for most ordinary income for the 2023 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

There are currently seven federal tax brackets in the United States with rates ranging from 10 to 37 The U S tax system is progressive with people in lower brackets taxed at lower The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523 600 and higher for single filers and 628 300 and higher for married couples filing jointly Help Us Learn More About How Americans Understand Their Taxes

Download Us Income Tax Rate

More picture related to Us Income Tax Rate

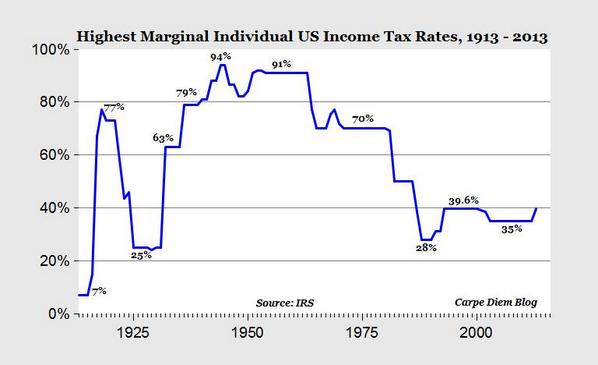

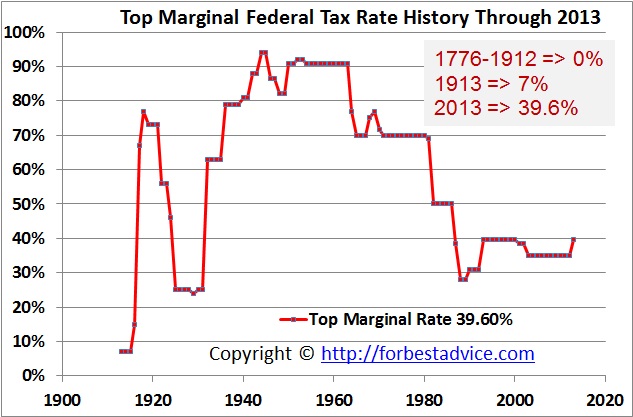

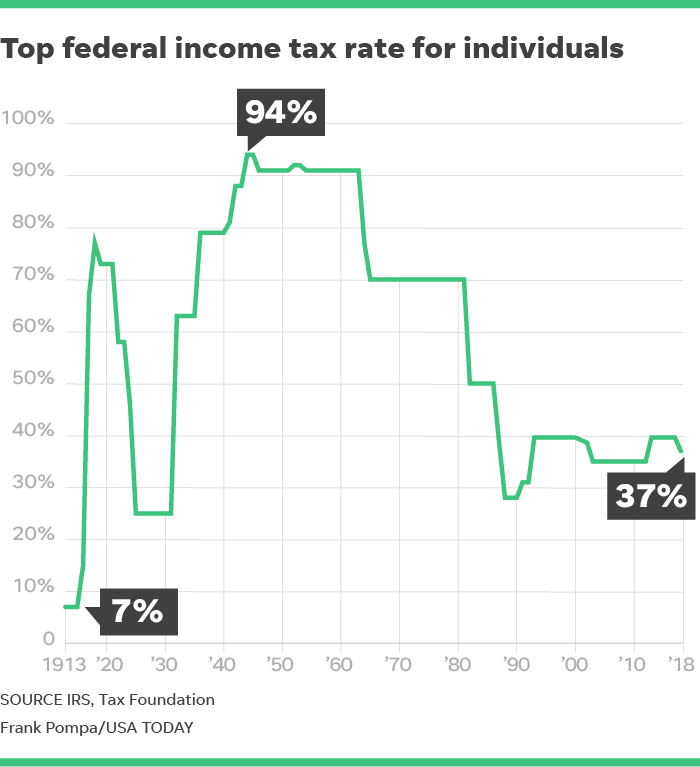

Historical Chart Of Income Tax Rates

https://pbs.twimg.com/media/B0PhTUnCcAAOxxU.jpg

Our Tax Structure Used To Be Much More Progressive Than It Is Today 99

https://2.bp.blogspot.com/-NbAzw1SjuCk/TpO1gyZIJ9I/AAAAAAAAACU/q9Qhy04L1H8/s1600/Federal+Tax+Rates.jpg

US Top Marginal Tax Rates Data

http://forbestadvice.com/Money/Taxes/Federal-Tax-Rates/Historical_Federal_Top_Marginal_Tax_Rates_History.jpg

The Internal Revenue Service adjusts federal income tax brackets annually to account for inflation and the new brackets can help you estimate your tax obligation based on your income and filing status for the year The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518 400 and higher for single filers and 622 050 and higher for married couples filing jointly Stay informed on the tax policies impacting you Subscribe to get insights from our trusted experts delivered straight to your inbox

[desc-10] [desc-11]

Income

https://thecollegeinvestor.com/wp-content/uploads/2022/10/TCI_-_2023_Federal_Tax_Brackets_1600x974.png

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

http://4.bp.blogspot.com/-4cLQaqI0jYM/TkmIL611lAI/AAAAAAAAPlc/z5MYhmcnqd0/s1600/taxrate.jpg

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

The seven federal income tax brackets for 2024 are 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status

https://www.forbes.com/advisor/taxes/taxes-federal

Let s say you re single and your 2024 taxable income is 75 000 your marginal or top tax rate is 22 But some of your income will be taxed in lower tax brackets 10 and 12

Tax Brackets 2024 Ca Sissy Ealasaid

Income

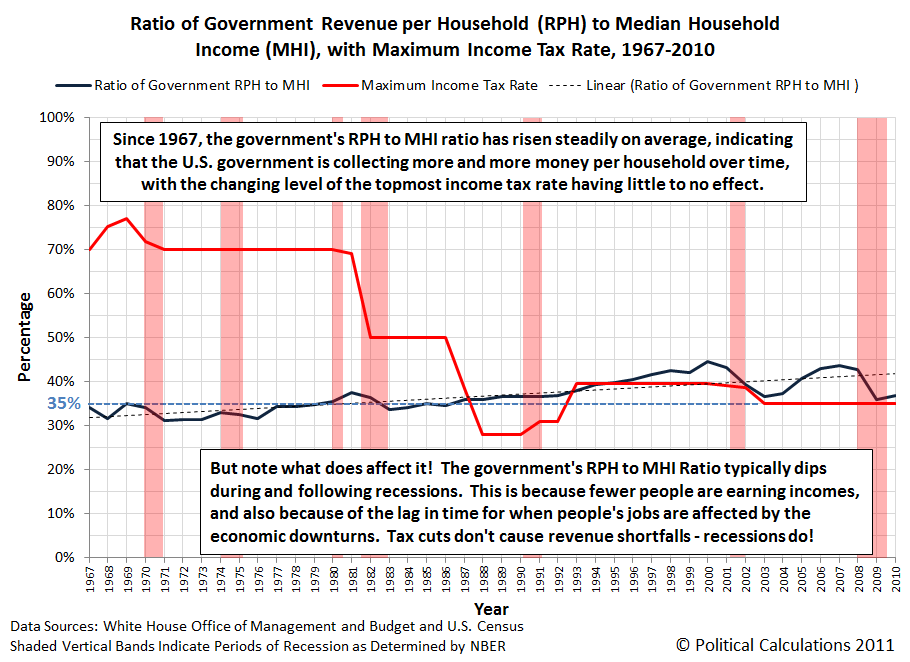

Political Calculations Why Hiking The Top Income Tax Rate Won t Fix

Corporate Income Tax Rate CIT In Indonesia

Top State Income Tax Rates In 2014 Tax Foundation

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Taxes On The Rich Were Not Much Higher In The 1950s Tax Foundation

Foolish Take How Tax Rates On Rich Have Changed Over Time

State Corporate Income Tax Rates And Key Findings What You Need To

Us Income Tax Rate - The U S currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37 If you re one of the lucky few to earn enough to fall into the 37 bracket that doesn t mean that the entirety of your taxable income will be subject to a 37 tax