Us Law Tax Rebate Web In a tax context rebates also referred to as refunds are a return of a taxpayer s excess taxes when they paid more than they owed For example the Internal Revenue Code

Web 1 janv 2021 nbsp 0183 32 In the case of any individual who at the time of any determination made pursuant to paragraph 3 has filed a tax return for neither the year described in Web 9 sept 2022 nbsp 0183 32 Under the law the HOMES rebate should be available to whole house energy saving retrofits that begin after the Inflation Reduction Act became law on August

Us Law Tax Rebate

Us Law Tax Rebate

https://enterslice.com/learning/wp-content/uploads/2019/06/Tax-Rebate-under-Section-87-A.jpg

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A.jpg?ssl=1

Increase The Threshold For Qualifying For Tax Forgiveness PennLive

https://www.pennlive.com/resizer/m4KwUD7bWaXPCpyOB7MZ4BmTwYs=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/U5MVCZVZI5COTCDGVU3MWDQABQ.png

Web 22 ao 251 t 2022 nbsp 0183 32 Tax Credit Available for 2022 Tax Year Updated Tax Credit Available for 2023 2032 Tax Years Home Clean Electricity Products Solar electricity 30 of cost Fuel Cells Wind Turbine Battery Storage N A Web 15 ao 251 t 2022 nbsp 0183 32 The bill restructures the existing 7 5000 new EV tax credit and creates a new 4 000 rebate for used EVs It also includes tens of billions of dollars in new loan tax credit and grant programs

Web 8 sept 2023 nbsp 0183 32 WASHINGTON Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue Service Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

Download Us Law Tax Rebate

More picture related to Us Law Tax Rebate

Tax Rebates Made Simple YouTube

https://i.ytimg.com/vi/EFZn93RDFJI/maxresdefault.jpg

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/image-91.png

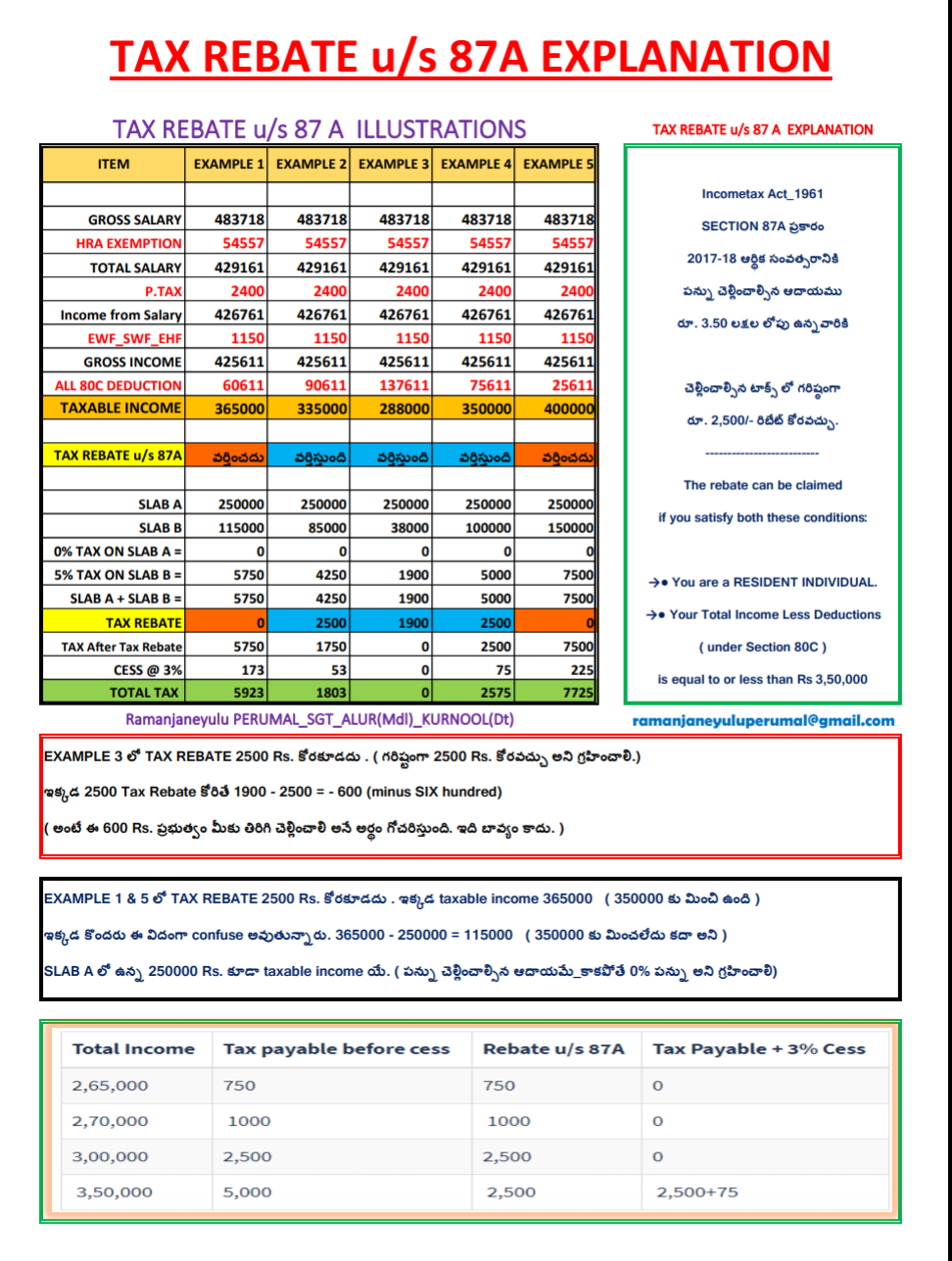

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New

https://i.ytimg.com/vi/Yo8nxqN-uJg/maxresdefault.jpg

Web 12 avr 2023 nbsp 0183 32 It includes rebates worth 500 for single filers and 1 000 for married couples heads of household and surviving spouses To be eligible you must be over the age of Web 8 sept 2023 nbsp 0183 32 Oregon s popular quot kicker quot law will send taxpayers a record 5 6 billion next spring But a dogged handful of kicker opponents hope to revise or even end the

Web 18 oct 2022 nbsp 0183 32 IR 2022 182 October 18 2022 The Internal Revenue Service today announced the tax year 2023 annual inflation adjustments for more than 60 tax Web 19 ao 251 t 2022 nbsp 0183 32 69 State Filing Fee 59 1 TurboTax Deluxe Learn More On Intuit s Website Federal Filing Fee 54 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Individuals What You Need To Know About The CAA DMLO CPAs

https://dmlo.com/wp-content/uploads/2021/02/Tax-Rebate.png

https://www.law.cornell.edu/wex/rebate

Web In a tax context rebates also referred to as refunds are a return of a taxpayer s excess taxes when they paid more than they owed For example the Internal Revenue Code

https://www.law.cornell.edu/uscode/text/26/6428B

Web 1 janv 2021 nbsp 0183 32 In the case of any individual who at the time of any determination made pursuant to paragraph 3 has filed a tax return for neither the year described in

PDF The Effect Of Tax Rebates On Consumption Expenditures Evidence

2007 Tax Rebate Tax Deduction Rebates

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Rebates And Reliefs Of Income Tax Law

Tips To Finding Tax Rebates Without The Hassle

Tips To Finding Tax Rebates Without The Hassle

Did You Get Your 2022 Illinois Tax Rebates Less Than A Month Left To

TAX REBATE 2017 18 Clarification Under Section 87 A MANNAMweb

Tax Rebates 2022 IRS To Send Up To 750 To Each Eligible Taxpayer In

Us Law Tax Rebate - Web Il y a 10 heures nbsp 0183 32 An issue widely discussed outside of the tax arena in the last decade has been the retreat of democracy in a number of countries But as we re fond of saying