Us Tax Rebate On Indian Education Loan Web 28 juin 2019 nbsp 0183 32 For example You have taken an education loan in FY 2022 23 and started paying interest in the same year In this case you can claim a deduction u s 80E for AY

Web Tax benefits in India Section 80E of the Income Tax Act 1961 allows some tax benefits for a loan taken for higher education Since the entire interest can be deducted the Web To encourage borrowers to take an education loan there is a tax benefit on repayment of the education loan Once you avail of an education loan the interest paid which is a component of your EMI on the education

Us Tax Rebate On Indian Education Loan

Us Tax Rebate On Indian Education Loan

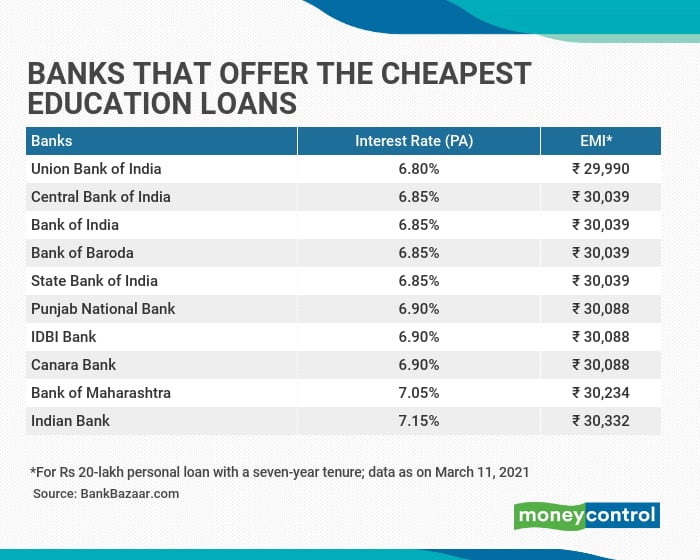

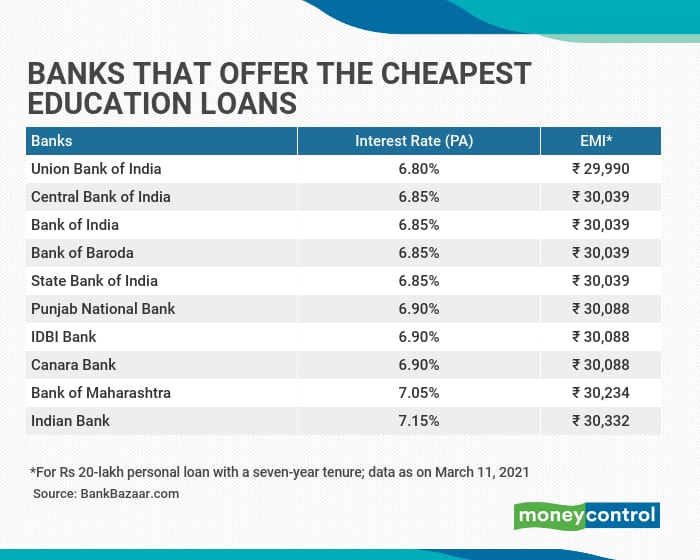

https://images.moneycontrol.com/static-mcnews/2021/03/Edu-loan-Mar-18.png

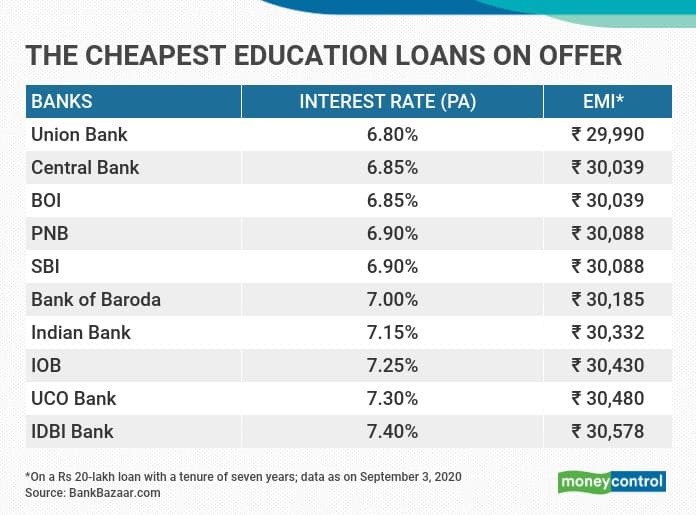

Bank Of India Education Loan Interest Rate 2018 Loan Walls

https://qph.fs.quoracdn.net/main-qimg-910f623c7943bf54aecb7026973d4fae

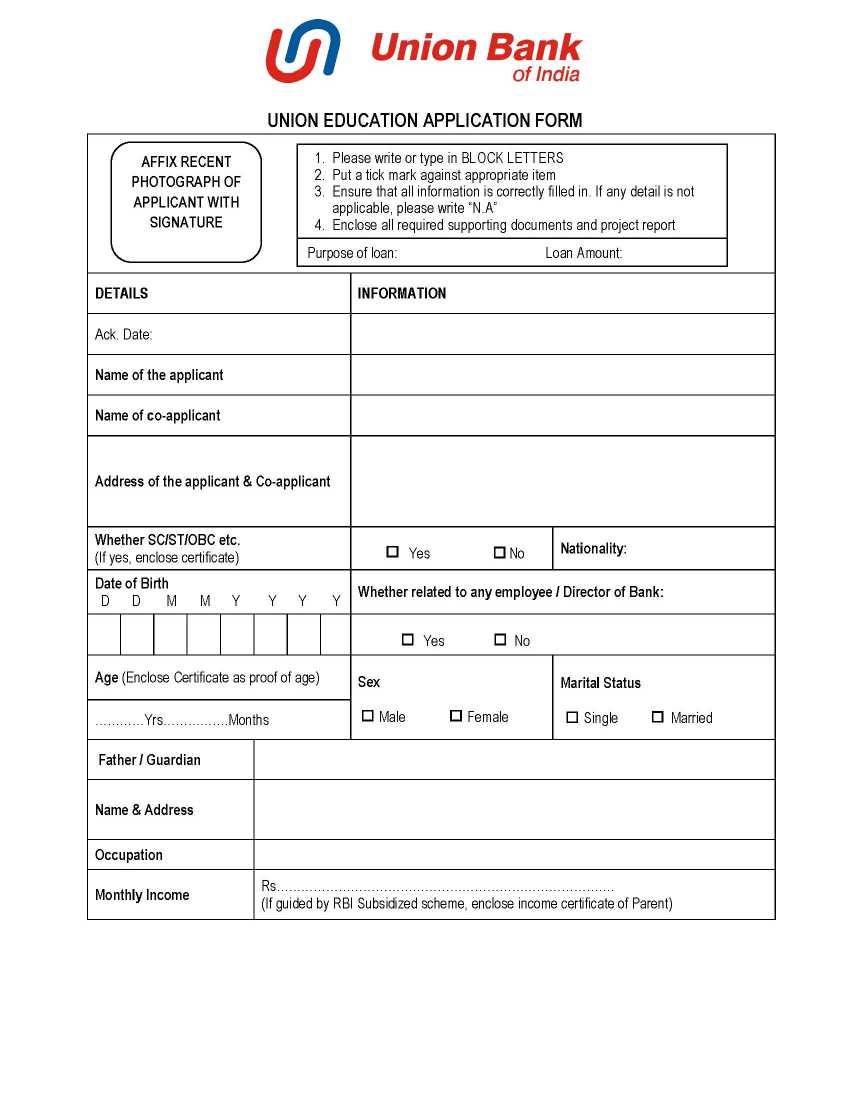

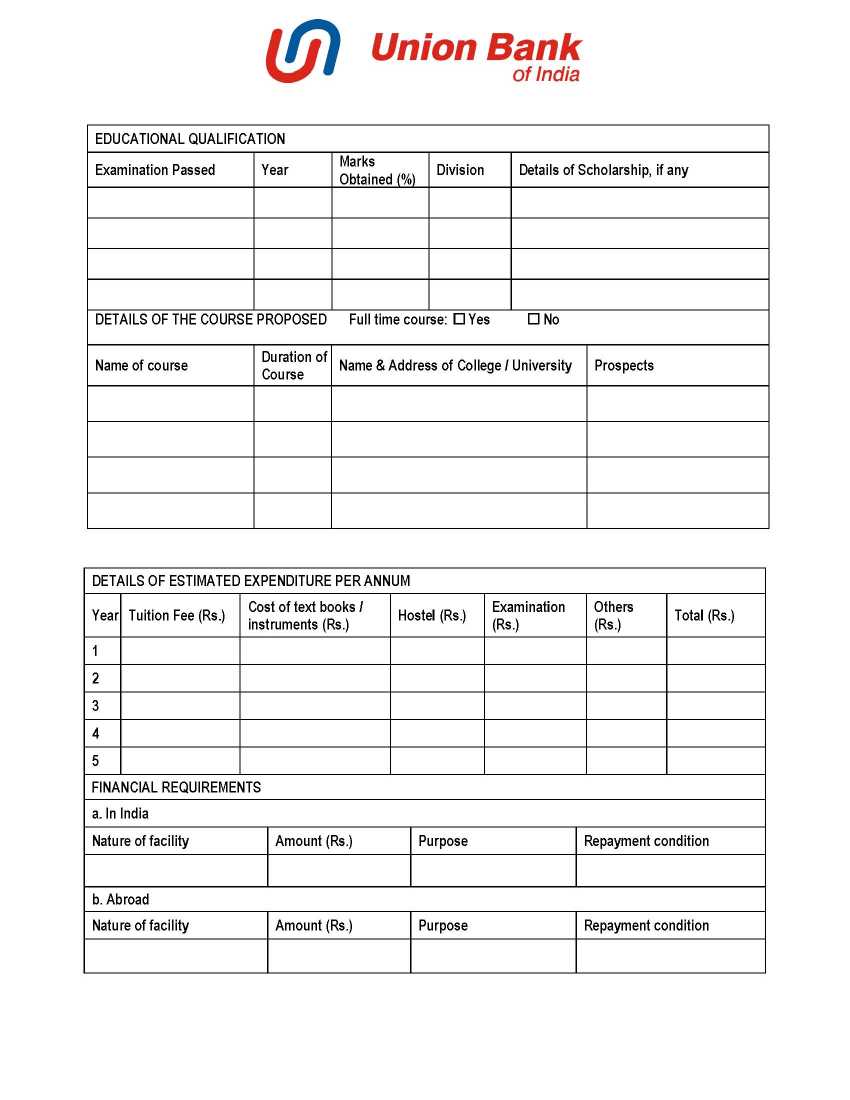

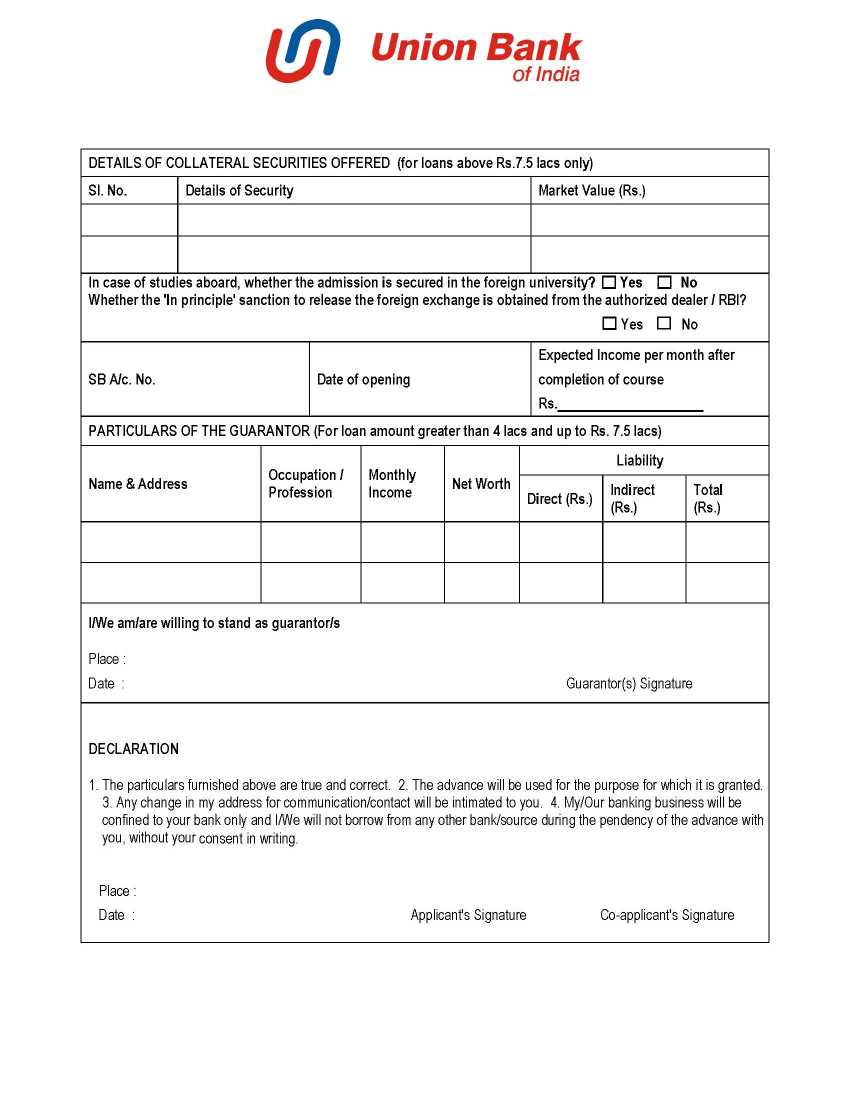

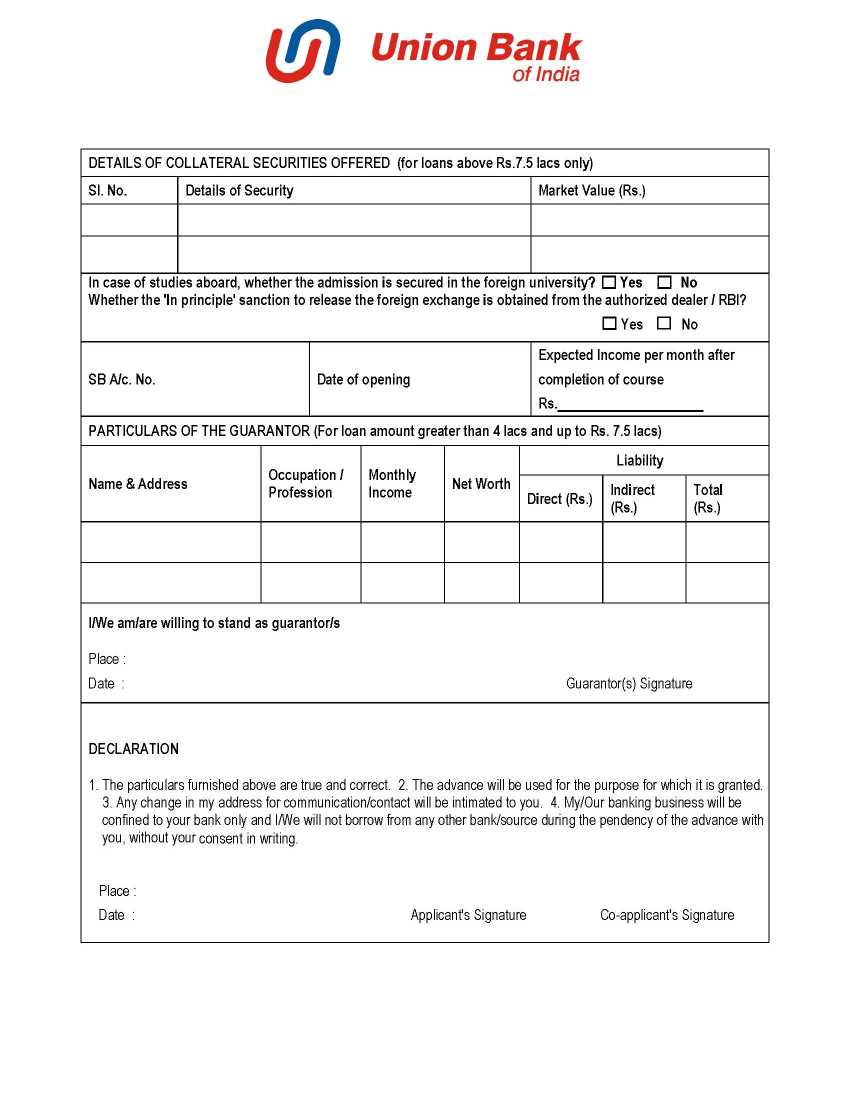

Union Bank Of India Education Loan Online Application Form 2023 2024

https://eduvark.com/img/d/Union-Bank-Of-India-Education-Loan-Online-Application-Form-1.jpg

Web 16 f 233 vr 2021 nbsp 0183 32 Here are the ins and outs to know before you can claim tax benefits Who Can Claim Education Loan Tax Benefits When you avail education loan for higher Web 25 ao 251 t 2022 nbsp 0183 32 The income tax rebate on education loan is available only for the repayment of the interest component of the loan No tax benefits are available for the

Web 31 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law Web For a given year you can reduce your taxable income by as much as 2 500 by claiming the student loan interest deduction Aside from simple interest on the loan capitalized interest and interest on refinanced and

Download Us Tax Rebate On Indian Education Loan

More picture related to Us Tax Rebate On Indian Education Loan

Union Bank Of India Education Loan Online Application Form 2023 2024

https://eduvark.com/img/d/Union-Bank-Of-India-Education-Loan-Online-Application-Form-2.jpg

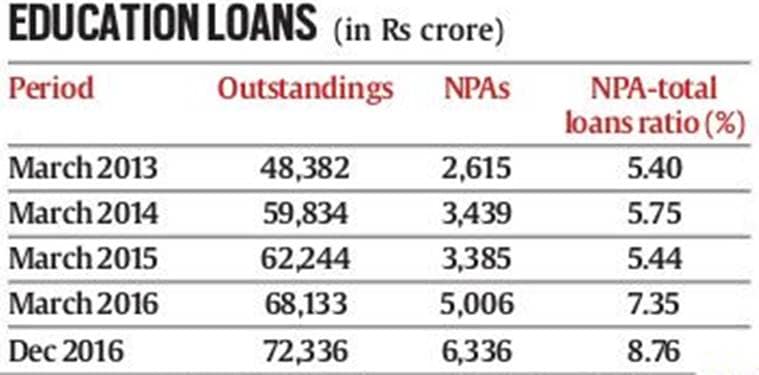

142 Per Cent Rise In Bad Education Loans In 3 Years Business News

https://images.indianexpress.com/2017/07/education-loan.jpg

Banks That Offer The Lowest Rates On Education Loans Forbes India

http://images.moneycontrol.com/static-mcnews/2020/09/Loans-Sep-17.jpg

Web Tax Benefits of Education Loan Under Section 80E Any individual who has applied for a loan for higher education can avail the benefits of tax saving provided by Section 80E Web 29 mars 2019 nbsp 0183 32 Student Education Loans qualify for tax deduction benefits under Section 80E of the Income Tax Act of India 1961 This tax deduction benefit is applicable to the Education Loan interest you pay and not the

Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is Web 12 avr 2019 nbsp 0183 32 Education Loan Repayment Tax Benefit A guide on tax benefits of Student Loans Learn the benefits of paying off student loans and how you can avail rebate on

Union Bank Of India Education Loan Online Application Form 2023 2024

https://eduvark.com/img/d/Union-Bank-Of-India-Education-Loan-Online-Application-Form-3.jpg

What Does Rebate Lost Mean On Student Loans

https://studentloanhero.com/wp-content/uploads/f21d66bc-bb4b-4eb4-8ba2-066e3aa6040a_pasted20image200.png

https://tax2win.in/guide/sec-80e-deduction-interest-on-education-loan

Web 28 juin 2019 nbsp 0183 32 For example You have taken an education loan in FY 2022 23 and started paying interest in the same year In this case you can claim a deduction u s 80E for AY

https://leapfinance.com/education-loan-tax-benefits

Web Tax benefits in India Section 80E of the Income Tax Act 1961 allows some tax benefits for a loan taken for higher education Since the entire interest can be deducted the

Central Bank Of India Student Loan Interest Rate Loan Walls

Union Bank Of India Education Loan Online Application Form 2023 2024

2007 Tax Rebate Tax Deduction Rebates

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

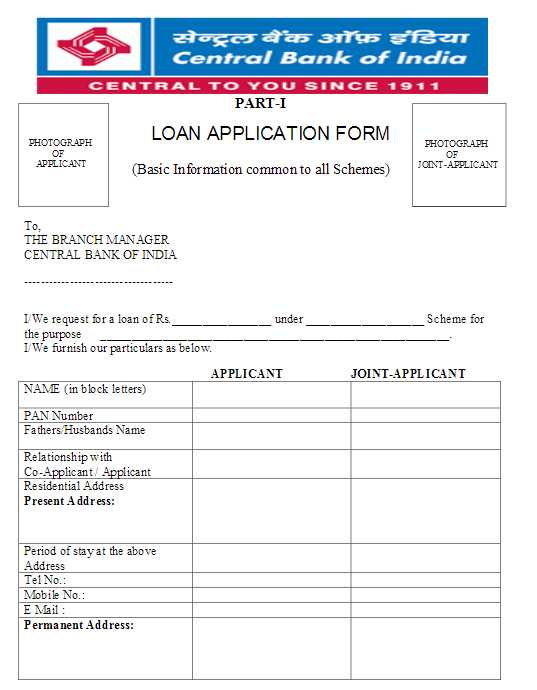

Education Loan Application Form Of Central Bank Of India 2022 2023

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

How To Calculate Tax Rebate On Home Loan Grizzbye

United Bank Of India Education Loan Interest Rate Eligibility

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Us Tax Rebate On Indian Education Loan - Web You can claim a deduction of Interest paid on a loan taken for pursuing higher education from taxable income under Section 80E of the Income Tax Act 1961 According to