Utilities Rebate 2024 On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit About Home Energy Rebates On Aug 16 2022 President Biden signed the landmark Inflation Reduction Act The law includes nearly 400 billion to support clean energy and address climate change including 8 8 billion in Home Energy Rebates which will provide two separate rebates to consumers The Home Efficiency Rebates will provide 4 3 billion to discount the price of energy saving

Utilities Rebate 2024

Utilities Rebate 2024

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

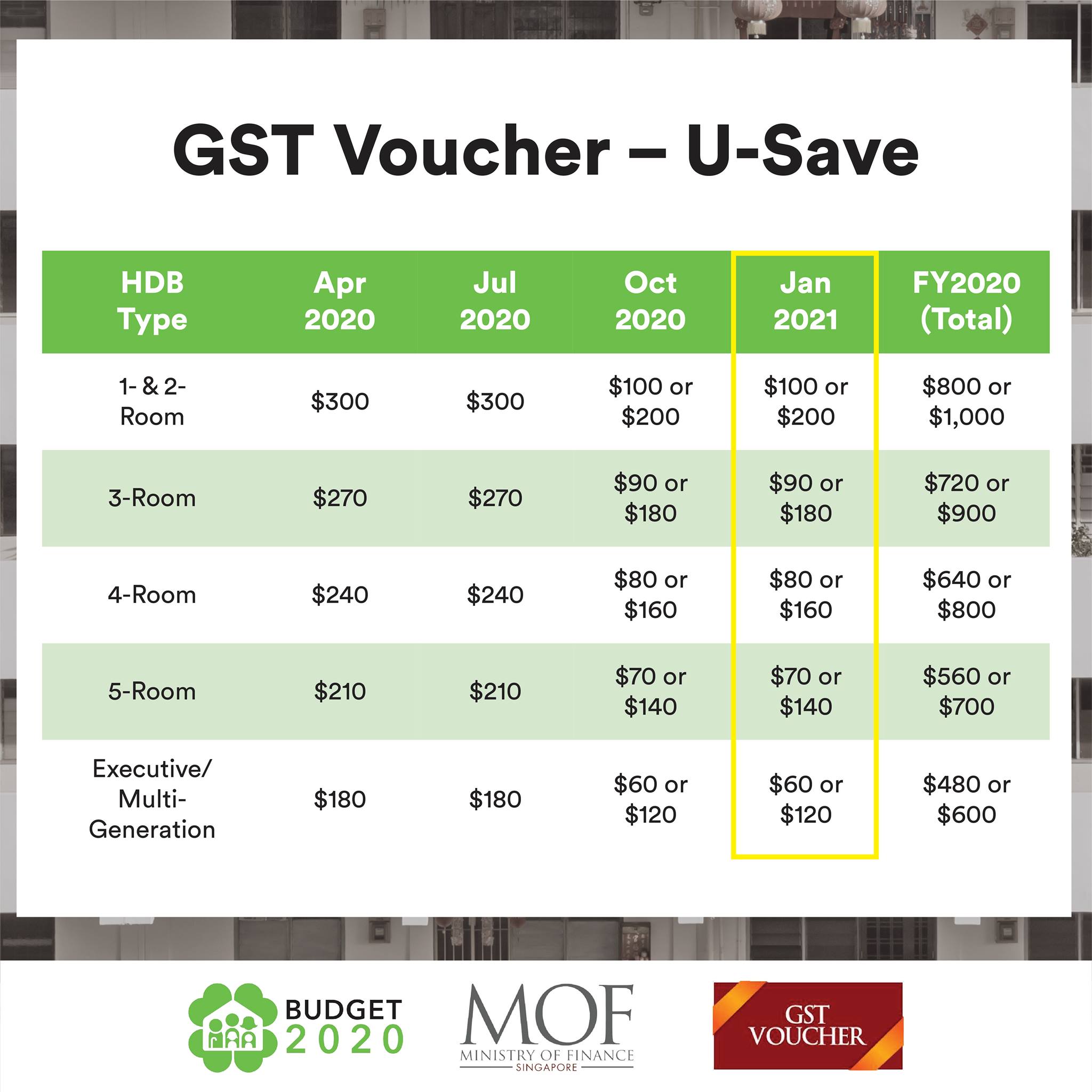

840 000 Households To Receive October Utilities Rebate TODAY

https://onecms-res.cloudinary.com/image/upload/s--Q6Qb4-Ob--/c_fill,g_auto,h_676,w_1200/f_auto,q_auto/v1/tdy-migration/ezxhomesale0115web1_read-only.jpg?itok=B6UXz_g4

940 000 Households In S pore Will Receive Double Their Regular GST Voucher U Save Rebates For FY

https://static.mothership.sg/1/2021/01/133593294_3660223357349496_274809169011631261_o.jpg

Home Energy Rebates together authorize 8 8 billion in funds for the benefit of U S households and home upgrades 2024 By signing this document the State Energy Office signifies its understanding that its allocation will be redistributed to other State Energy Offices What Is a Heat Pump What Are the Benefits of Installing a Heat Pump What Is the Heat Pump Tax Credit How to Qualify for the Heat Pump Tax Credit Related Tax Credits Heat Pump Tax Rebate State

ELIGIBILITY This offer is valid for Consumers Energy residential natural gas and or electric customers applying only through the Consumers Energy HPwES program Participants must be Consumers Energy electric customers who have either electric heat or central air conditioning or natural gas customers with central gas furnaces or gas boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Download Utilities Rebate 2024

More picture related to Utilities Rebate 2024

840 000 Households To Receive October Utilities Rebate TODAY

https://onecms-res.cloudinary.com/image/upload/s--luj1hCT2--/f_auto,q_auto/c_fill,g_auto,h_622,w_830/v1/tdy-migration/gstvoucher.jpg?itok=iPL2OMDu

Mobil One Offical Rebate Printable Form Printable Forms Free Online

https://printablerebateform.net/wp-content/uploads/2021/07/Trifexis-Rebate-Form-2021-768x506.jpg

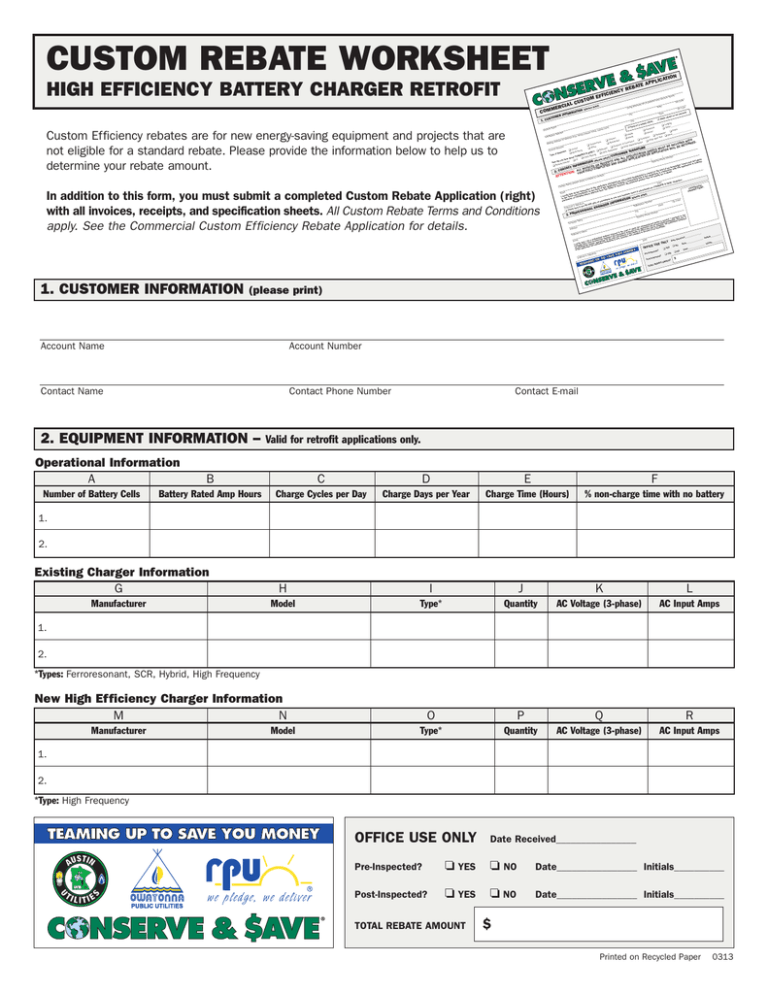

Custom Rebate Worksheet Owatonna Public Utilities

https://s2.studylib.net/store/data/018791466_1-e9336789639963f954e1c036820be70d-768x994.png

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 You may be able to take the credit if you Soaring prices for natural gas electricity and home heating oil in recent years have resulted in a record number of Americans falling behind on their utility bills and applying for help from the

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings Many Inflation Reduction Act rebates on green technology such as heat pumps and induction stoves being installed in homes in this Riverside subdivision went into effect Jan 1 but homeowners

Lensrebates Alcon Com

https://www.royacdn.com/unsafe/Site-88a5128c-aaae-4122-b1ad-472be343579c/rebate/2022_1H_Existing_Wearer_Rebate_page_001.jpg

PPL Electric Utilities Commercial Rebate Notice

https://docs.solarmason.com/thumbs/og_image/B1a1W9PN1bUkvaCHeAmw5d.jpg?ts=1658781463

https://www.energy.gov/scep/home-energy-rebates-programs

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Lensrebates Alcon Com

Alcon Rebate Form 2023 Printable Rebate Form

Comprehensive Guide To Elanco Trifexis Rebate Form How To Claim Your Rebate Elanco Rebate

Fl Utility System Purchase And Sale Law Firm Fl Utility Permitting Law Firm

Printable Alcon Rebate Form 2023 Printable Forms Free Online

Printable Alcon Rebate Form 2023 Printable Forms Free Online

Seresto Rebate Form PrintableRebateForm

GSTV U Save And S CC Rebates 950 000 Eligible Households To Receive Payouts Starting April

Tolminator 2024

Utilities Rebate 2024 - Home Energy Rebates together authorize 8 8 billion in funds for the benefit of U S households and home upgrades 2024 By signing this document the State Energy Office signifies its understanding that its allocation will be redistributed to other State Energy Offices