Value Added Tax And Partial Rebate Web 23 mars 2022 nbsp 0183 32 VAT is deductible at a rate of 50 percent for liquefied petroleum 80 percent for diesel and 100 percent for other fuels Car parking VAT is not deductible

Web 1 ao 251 t 2023 nbsp 0183 32 France Corporate Other taxes Last reviewed 01 August 2023 Value added tax VAT VAT is due on goods sold and services rendered in France The standard VAT Web Today s modern equivalent is the value added tax or VAT It has become a major source of revenue for the more than 160 countries that impose it raising on average over 30

Value Added Tax And Partial Rebate

Value Added Tax And Partial Rebate

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/value-added-tax.jpg

How To Differentiate Between Allowable Disallowable Expenses When

https://certifiedbusinesssolutions.co.ke/wp-content/uploads/2021/01/Value-Added-Tax.png

Goods And Services Tax Indian Economy UPSCFEVER

http://upscfever.com/upsc-fever/en/economy/economy/images/value added tax1.jpg

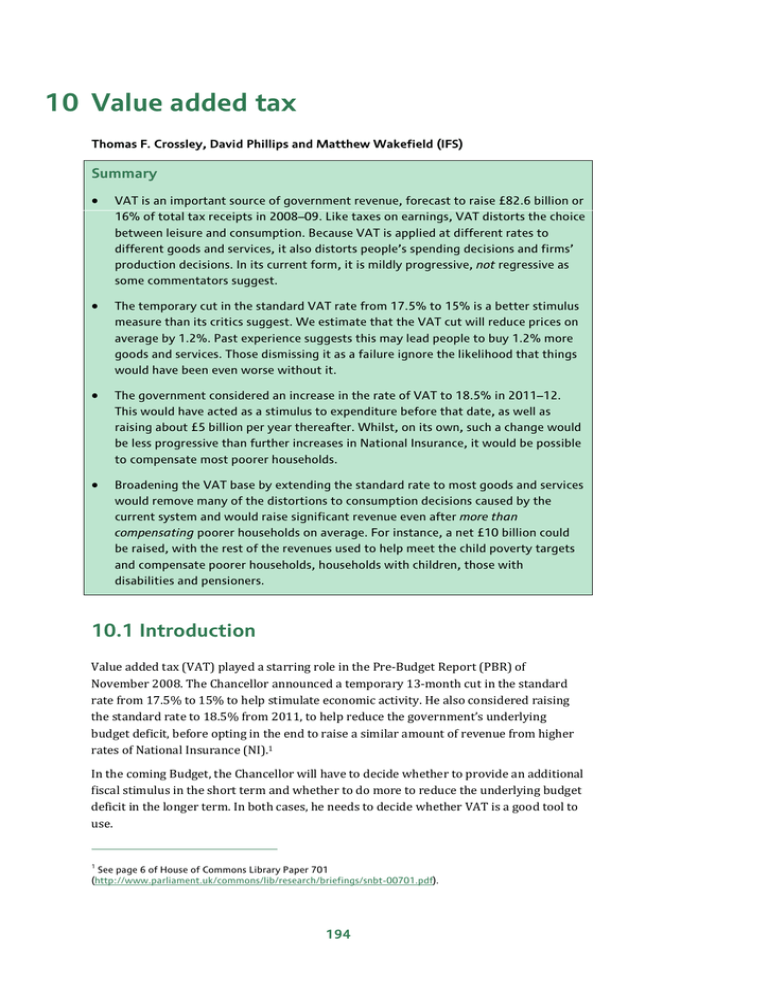

Web 1 oct 2020 nbsp 0183 32 This shows that a partial rebate on VAT makes the non refunded VAT i e RVAT RVATRs act as an export tax as in Feldstein and Krugman 1990 The lower Web Rebates around the world in relation to value Added Tax VAT Countries such as United Kingdom UK and South Africa understand the importance of volume discounts to

Web China has applied a partial VAT refund which varies by sector and commodity The Chinese VAT system thus imposes an additional tax on exporters whose goods receive Web rate income tax to a value added tax go a long way toward solving our balance of payments problem Under the present arrangements governments may re bate to

Download Value Added Tax And Partial Rebate

More picture related to Value Added Tax And Partial Rebate

Amount Due To Director In Balance Sheet Kimberly King

https://centralafricataxguide.com/wp-content/uploads/2020/10/balance-sheet-example.jpg

Value Added Tax Example Ppt Powerpoint Presentation Infographics

https://www.slideteam.net/media/catalog/product/cache/960x720/v/a/value_added_tax_example_ppt_powerpoint_presentation_infographics_slideshow_cpb_slide01.jpg

Top Mass Save Rebate Form Templates Free To Download In PDF Format

https://i0.wp.com/www.masssaverebate.net/wp-content/uploads/2022/10/top-mass-save-rebate-form-templates-free-to-download-in-pdf-format-101.png?fit=530%2C749&ssl=1

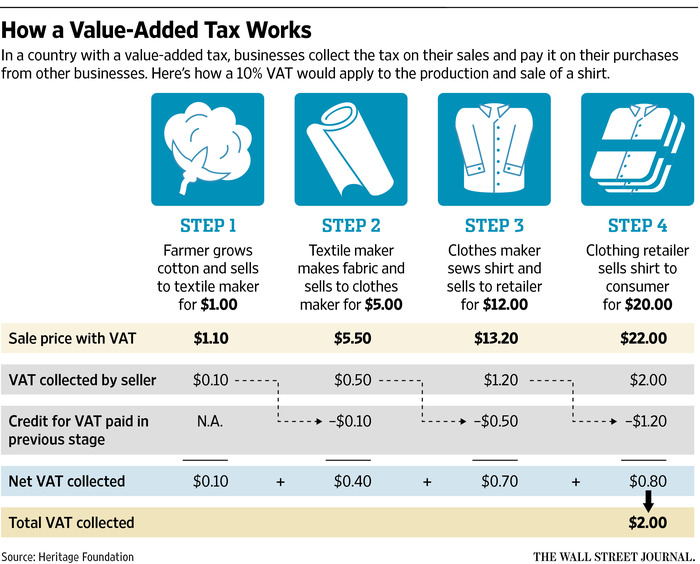

Web 25 mars 2022 nbsp 0183 32 Updated March 25 2022 21 39 Xinhua BEIJING China is set to boost its value added tax VAT credit refunds in the country s latest tax and fee reduction efforts Web 21 mars 2023 nbsp 0183 32 To sum up increasing VAT income through increasing the tax base reducing tax exemptions or adopting a more uniform tax rate assembly fewer tax rate

Web 10 mai 2021 nbsp 0183 32 Summary The value added tax VAT has the potential to generate significant government revenue Despite its intrinsic self enforcement capacity many tax Web 19 juin 2023 nbsp 0183 32 For example if a product costs 100 and there is a 15 VAT the consumer pays 115 to the merchant The merchant keeps 100 and remits 15 to the

10 Value Added Tax Summary

https://s2.studylib.net/store/data/012811716_1-10fddc4632f5c927cf9766abc748cf3c-768x994.png

Know What Is Value Added Tax VAT And How Does It Work Succinct FP

http://www.succinctfp.com/wp-content/uploads/2012/11/How-VAT-Works.jpg

https://www.roedl.com/insights/vat-guidelines/france-rate-registration...

Web 23 mars 2022 nbsp 0183 32 VAT is deductible at a rate of 50 percent for liquefied petroleum 80 percent for diesel and 100 percent for other fuels Car parking VAT is not deductible

https://taxsummaries.pwc.com/france/corporate/other-taxes

Web 1 ao 251 t 2023 nbsp 0183 32 France Corporate Other taxes Last reviewed 01 August 2023 Value added tax VAT VAT is due on goods sold and services rendered in France The standard VAT

Value Added Tax System Abstract Concept Vector Illustration Stock

10 Value Added Tax Summary

Image Result For Format For Vat Invoice Invoice Template Word

FIRS Appoints Telcos Banks As VAT Collectors Business Post Nigeria

Indonesia VAT Everything You Need To Know Cekindo Indonesia

6 Rules Related To Value Added Tax VAT Every Saudi Resident Should

6 Rules Related To Value Added Tax VAT Every Saudi Resident Should

Annexure For Value Added Tax

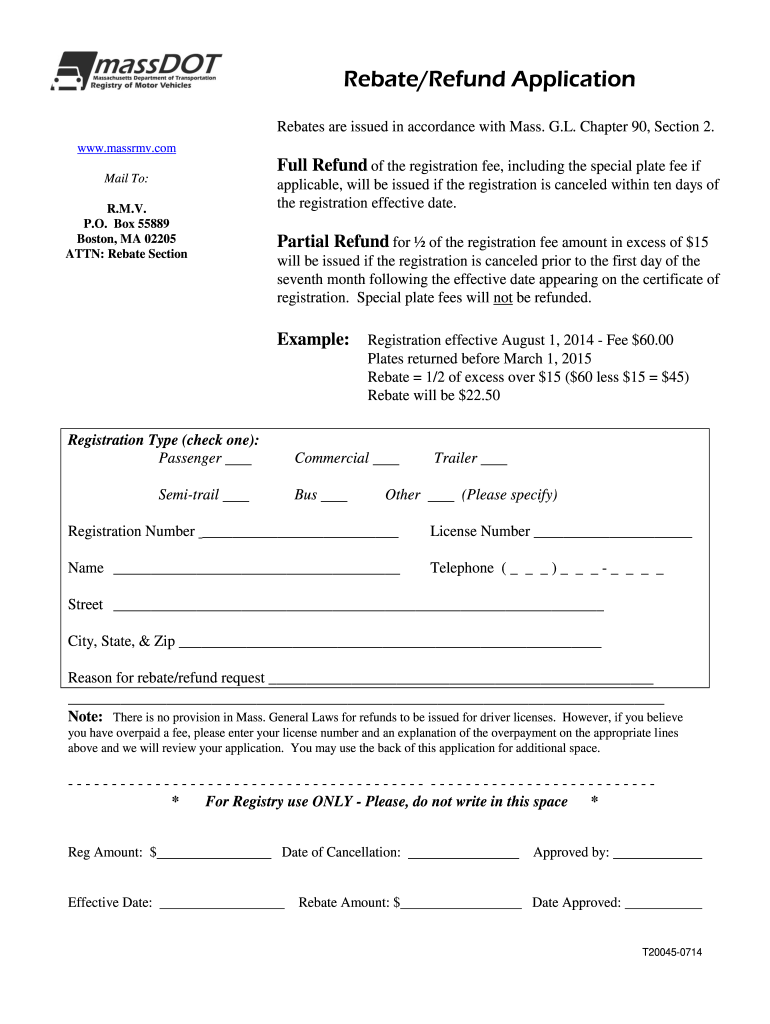

2014 2021 Form MA T20045 Fill Online Printable Fillable Blank

Volume 1 No 2 February 2003 Central Value Added Tax CENVAT ICRIER

Value Added Tax And Partial Rebate - Web Rebates around the world in relation to value Added Tax VAT Countries such as United Kingdom UK and South Africa understand the importance of volume discounts to