Vat Return Submission Deadline Home Money and tax VAT payment deadline calculator Work out the VAT payment deadline for your accounting period You can t use this calculator if you make payments on account or use the

VAT Return deadline There are 12 months in your VAT accounting period Your VAT Return is due once a year 2 months after the end of your accounting period Most businesses now need to keep Get clarity on UK VAT due dates and deadlines to help you plan your VAT filings payments better whether you submit returns quarterly monthly or annual returns You ll also find out how to change your VAT return dates using a VAT 484 form known as a VAT484 so you can change your VAT payment deadlines to something that might better suit

Vat Return Submission Deadline

Vat Return Submission Deadline

https://i.ytimg.com/vi/vi7qtclG6DQ/maxresdefault.jpg

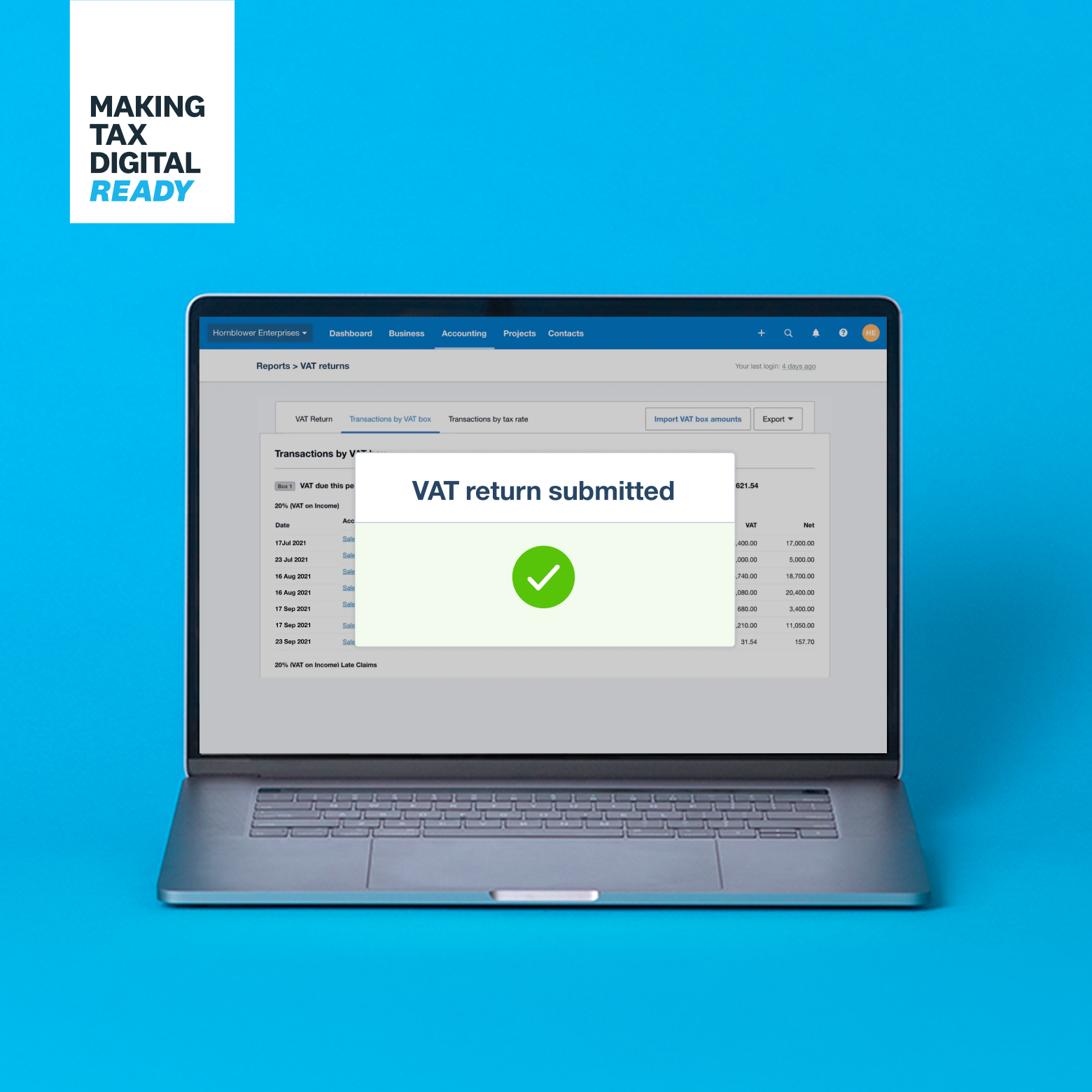

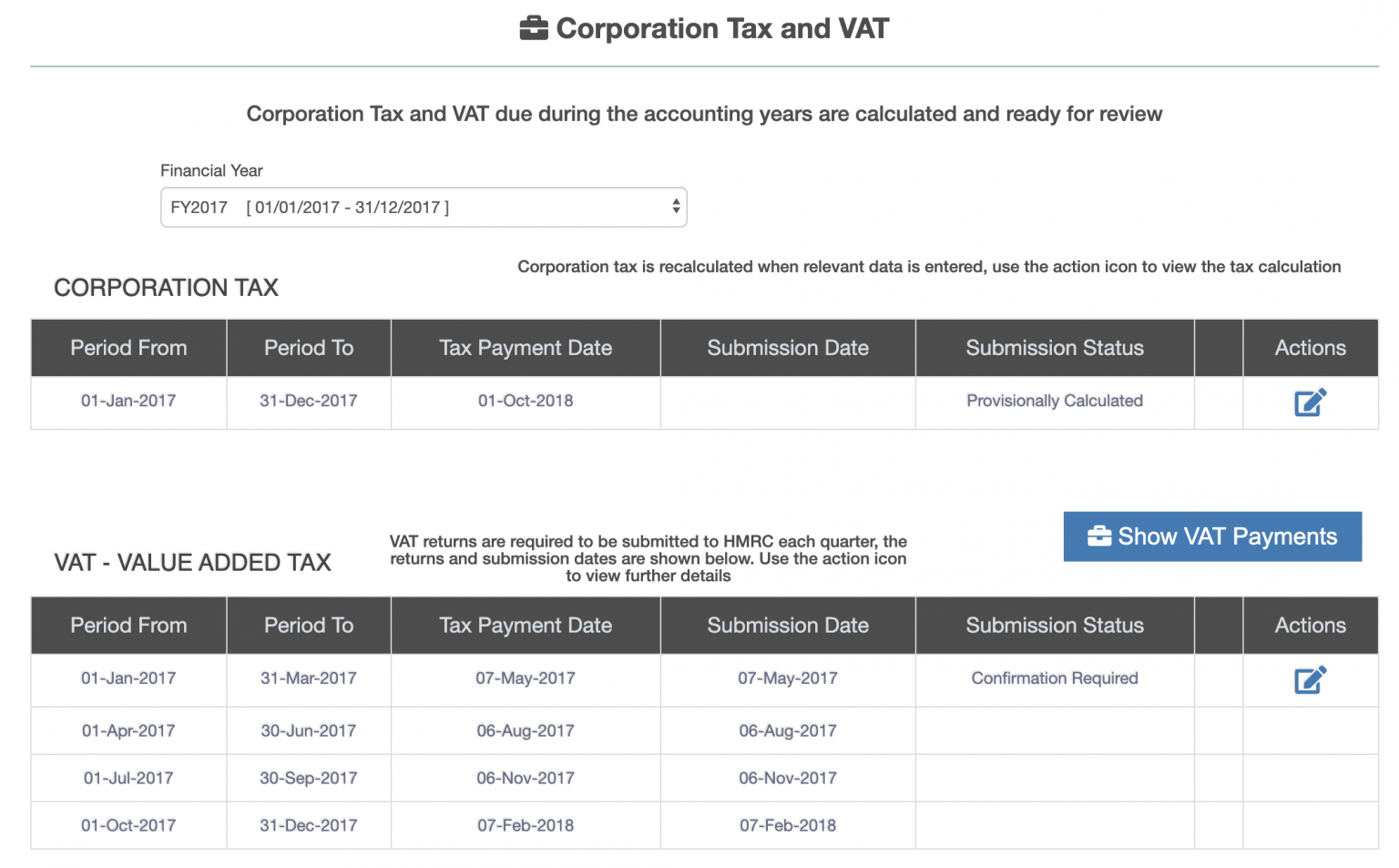

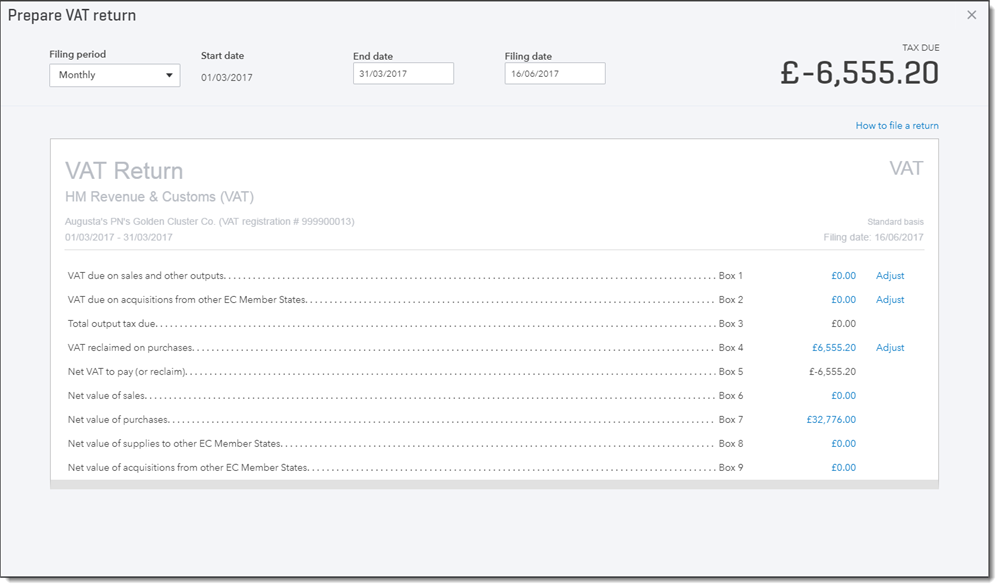

FreeAgent VAT Online Submission 1Stop Accountants

https://1stopaccountants.co.uk/wp-content/uploads/2014/10/freeagent-vat-return-example-1150x673.png

VAT Return Submission Change Quarterly Monthly VAT Returns Clear

https://clearvisionaccountancygroup.co.uk/wp-content/uploads/2022/09/AI-VAT-return-software-1280x256.png

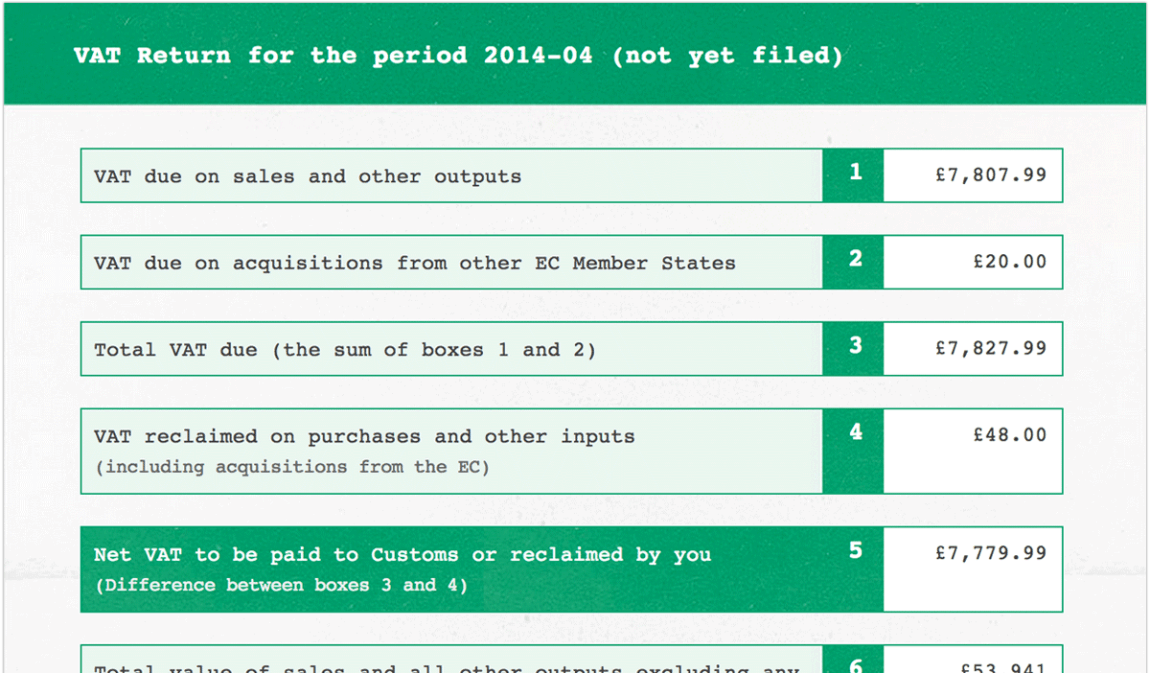

You should check your VAT return submission and payment deadline in your HMRC online account As a general rule the due date to submit and pay VAT returns in the UK is the 7 th day of the second month following the reporting period The deadline for submitting VAT returns and making payment is usually one calendar month and seven days after the end of your VAT accounting period The accounting period is the period covered by the VAT return and is ordinarily three months in length

The deadline for submitting your VAT return is usually one calendar month and seven days after the end of the accounting period This includes the time for your payment to reach HMRC so enough time needs to be allowed For example for a VAT quarter ending 30 September 2023 the return and VAT owing will be due for submission and payment by 7 November 2023 It s important to note that the VAT payment must have cleared through the HMRC s account by this date

Download Vat Return Submission Deadline

More picture related to Vat Return Submission Deadline

Run And Submit A VAT Return

https://help.iris.co.uk/accountancy/kashflow/projectfiles/images/vat/vat-return-summary.png

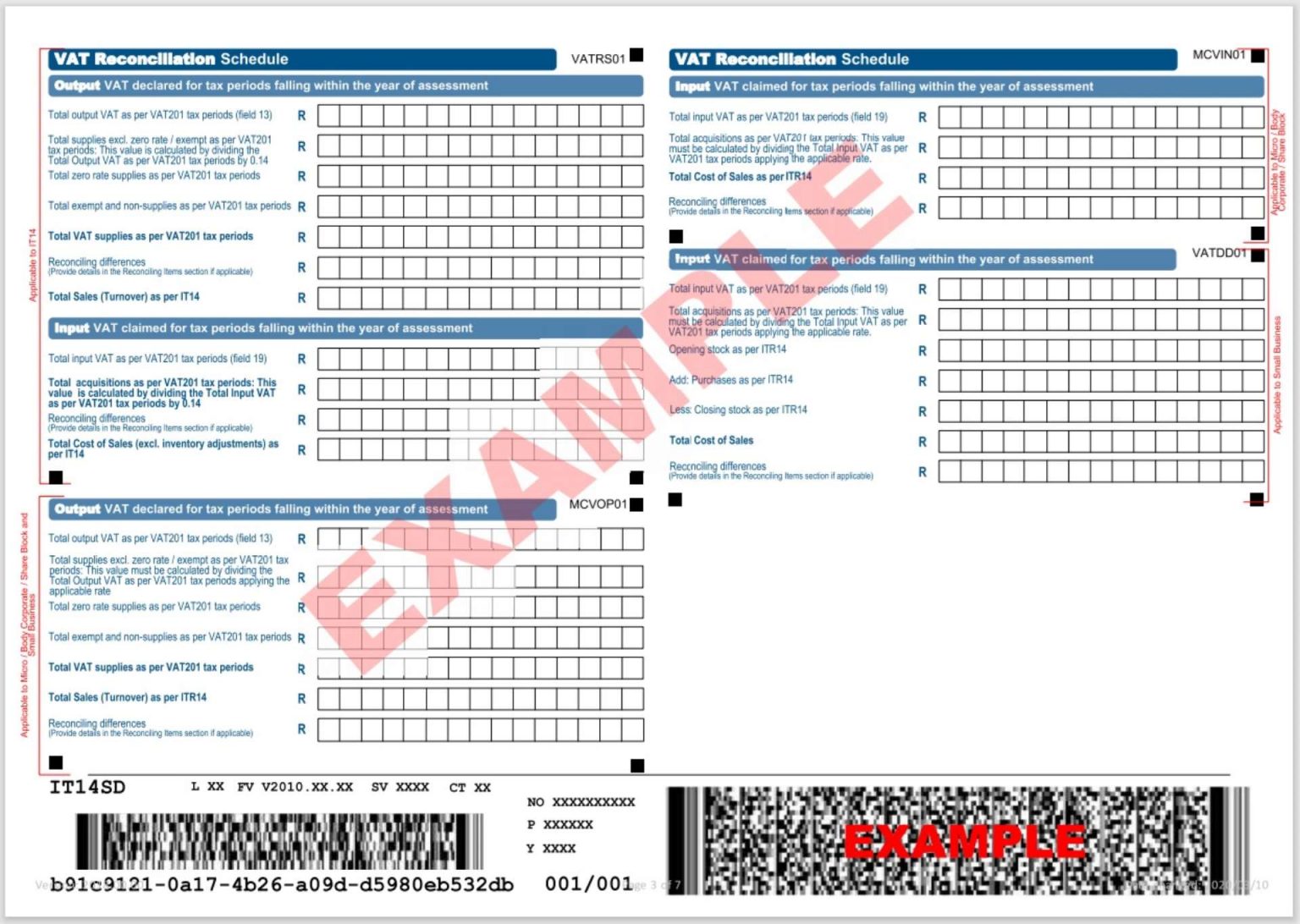

Understanding SARS IT14SD VATSolve

https://www.vatsolve.co.za/wp-content/uploads/2020/09/IT14SD-Blog-Image-1536x1092.jpg

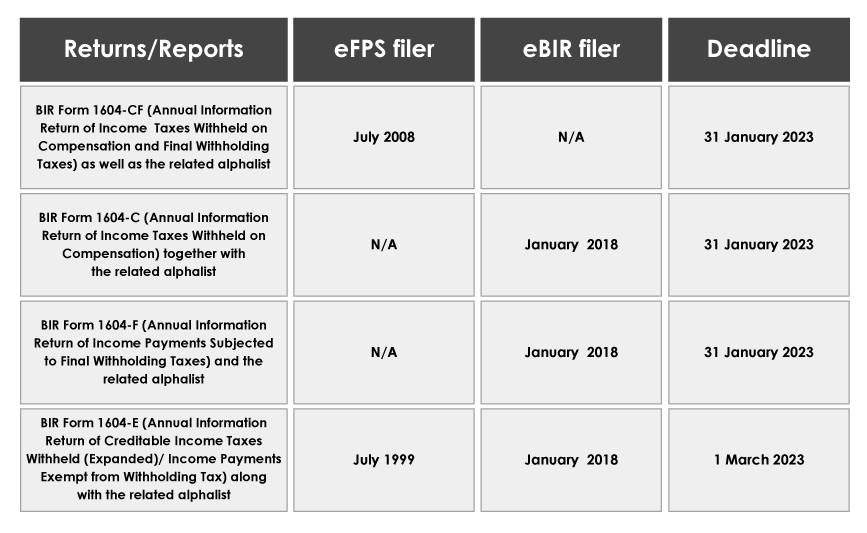

A Guide To The Year End Tax Compliance For Corporations

https://ahcaccounting.com/wp-content/uploads/2022/12/SSPUBS_YEAREND-TAX-TABLE1-min.png

If your VAT quarter ends on 30 September 2024 you must submit the VAT return by 7 November 2024 along with the VAT owed This deadline is one month and seven days after the end of the accounting period for that specific quarter Submitting Final VAT Return Deadline Your business must submit a final VAT Return any time you cancel VAT registration As a rule you can complete this process online using a Government Gateway account What is the final VAT Return deadline if you deregister HMRC give you two 2 months to submit the final return after deregistering

[desc-10] [desc-11]

Online VAT Return Submission Starts Wednesday

https://thefinancialexpress.com.bd/uploads/1509198877.jpg

Tax Return Submission Deadline In Bangladesh Tax Deadline 2021 BD

https://i.ytimg.com/vi/cRFbHFVaCWg/maxresdefault.jpg

https://www.gov.uk/vat-payment-deadlines

Home Money and tax VAT payment deadline calculator Work out the VAT payment deadline for your accounting period You can t use this calculator if you make payments on account or use the

https://www.gov.uk/.../return-and-payment-deadlines

VAT Return deadline There are 12 months in your VAT accounting period Your VAT Return is due once a year 2 months after the end of your accounting period Most businesses now need to keep

Healthy Business Xero UK

Online VAT Return Submission Starts Wednesday

How Do I Submit My VAT Return To HMRC ZotaBooks Knowledge Base

Form B Income Tax Malaysia Natalie Metcalfe

Submitting The Group VAT Return

Deadline WEBTOON

Deadline WEBTOON

Post Submission Protocol EAG Blog

Download UK VAT Invoice Format In Excel

VAT Online Submission Direct To HMRC QuickBooks Community

Vat Return Submission Deadline - [desc-13]