Vat Returns Explained The purpose of this guide is to assist vendors tax practitioners to complete the Value Added Tax VAT201 return accurately and honestly Included this guide are the steps to on how to request complete and submit the VAT201 return and make payments INTRODUCTION

The VAT scheme selected determines the frequency of filing the deadlines for filing returns and the form required for submitting an online VAT return This article will cover all of the details on how to file your VAT return on time and without any penalties A VAT Return calculates how much VAT you owe HMRC or how much they owe you by looking at Your total sales and purchases across a three month accounting period The amount of VAT you owe for sales The amount of VAT you can reclaim for purchases made by your business

Vat Returns Explained

Vat Returns Explained

https://www.saint.co.uk/wp-content/uploads/2015/06/spider-diagram-VAT.jpg

Infographic UK VAT Explained Sage Advice UK

https://www.sage.com/en-gb/blog/wp-content/uploads/sites/10/2017/08/BlagdonCheeseFarm_GL_080713-977.jpg

Learn How VAT Returns Can Help You Predict The Future

https://uk.meruaccounting.com/wp-content/uploads/2022/02/VAT-Return.jpeg

How to submit a VAT return All VAT registered businesses are required to submit VAT returns electronically There are some exceptions to this in certain circumstances however prior approval must have been granted by HMRC Businesses must sign up for HMRC s VAT online service before electronic VAT returns can be VAT returns In a VAT return or declaration a taxable person business gives the tax authorities in the EU country where they are registered information about their taxable taxed exempt transactions the VAT they have charged their customers output tax and been charged by their suppliers input tax

A VAT return is an official tax document that contains the facts and figures relating to your business transactions detailing all of your purchases sales and expenses It s specifically focused on your VAT eligible transactions and other applicable taxes and calculates what VAT your business owes and is due The term value added tax VAT refers to a consumption tax on goods and services levied at each stage of the supply chain where value is added As such a VAT is added from the initial

Download Vat Returns Explained

More picture related to Vat Returns Explained

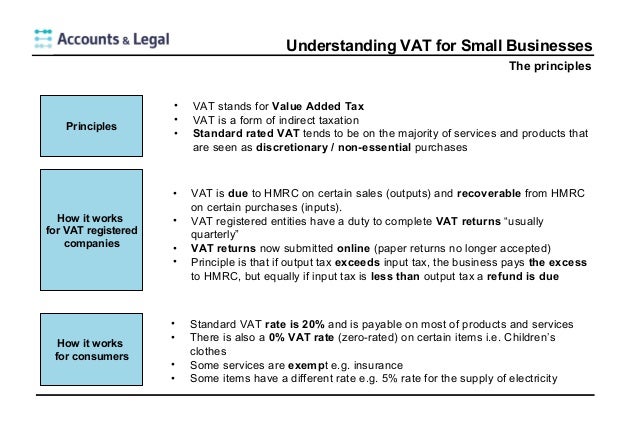

Understanding VAT For Small Businesses

https://image.slidesharecdn.com/understanding-vat-for-small-business-130815044402-phpapp01/95/understanding-vat-for-small-businesses-2-638.jpg?cb=1376547711

VAT FOR BUSINESS EXPLAINED YouTube

https://i.ytimg.com/vi/82wUl7szBPI/maxresdefault.jpg

DEADLINE For VAT Return In UAE Accounting Audit Firms In Dubai UAE

https://agxauditors.com/wp-content/uploads/2022/01/DEADLINE-for-VAT-return-1880x1200.jpg

Demystifying VAT Returns How It Works VAT Returns Explained Learn the ins and outs of VAT returns from calculating total sales to understanding refund eligibility Stay on top of What is a VAT return If you are VAT registered you will have to complete a VAT return each year This will detail your total sales and purchases and how much tax is on them Your return will be used to calculate How much VAT you owe to the HMRC This is the amount that you have charged your customers How much VAT you can claim from the

[desc-10] [desc-11]

Process For VAT Returns Including The Paperwork Checklist

https://outbooks.co.uk/wp-content/uploads/2021/08/17-2.png

VAT Return Template

https://www.easybooksapp.com/hubfs/VAT-Return-LP_2x.png#keepProtocol

https://www.sars.gov.za/wp-content/uploads/Ops/...

The purpose of this guide is to assist vendors tax practitioners to complete the Value Added Tax VAT201 return accurately and honestly Included this guide are the steps to on how to request complete and submit the VAT201 return and make payments INTRODUCTION

https://stripe.com/resources/more/how-to-declare-vat

The VAT scheme selected determines the frequency of filing the deadlines for filing returns and the form required for submitting an online VAT return This article will cover all of the details on how to file your VAT return on time and without any penalties

How To Avoid Misappropriating The VAT With These Compliance Guidelines

Process For VAT Returns Including The Paperwork Checklist

Completion Of VAT Return VAT201 YouTube

VAT Exempt Sales Explained Goselfemployed co

Run And Submit A VAT Return

Changes To VAT Assessments For Overseas Online Marketplace Traders HW

Changes To VAT Assessments For Overseas Online Marketplace Traders HW

VAT Returns Account Me In

VAT On Delivery Charges In The UK VAT Rates Rules And Exemptions

VAT Returns The Cheap Accountants

Vat Returns Explained - A VAT return is an official tax document that contains the facts and figures relating to your business transactions detailing all of your purchases sales and expenses It s specifically focused on your VAT eligible transactions and other applicable taxes and calculates what VAT your business owes and is due