Vat Tax In China Rebate Web 25 mars 2022 nbsp 0183 32 China scales up VAT rebates to boost market entities Updated March 25 2022 21 39 Xinhua BEIJING China is set to boost its value added tax VAT credit refunds in the country s latest tax and fee reduction efforts to ease the burden on

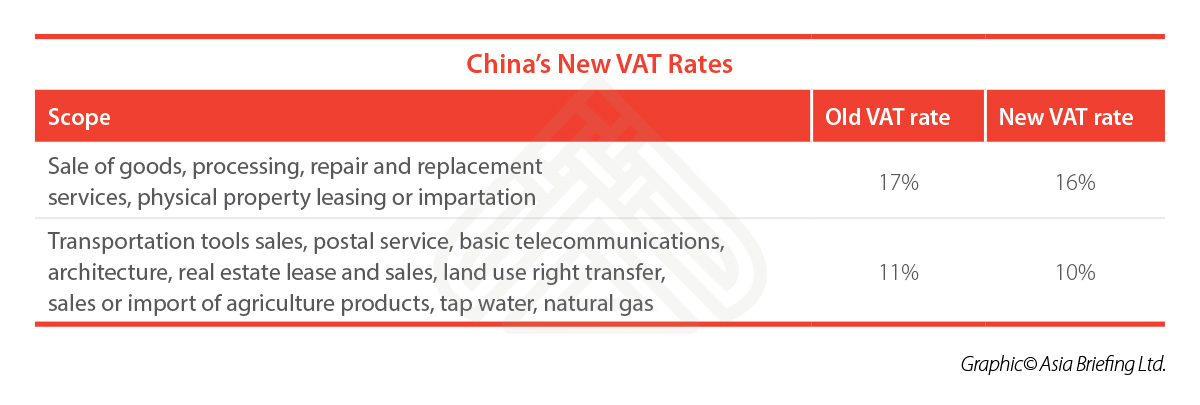

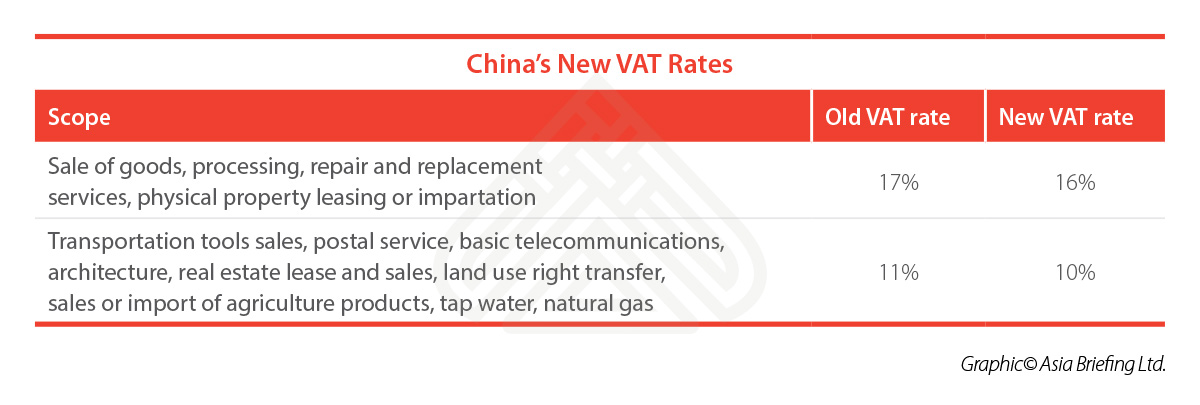

Web 21 mars 2022 nbsp 0183 32 Updated March 21 2022 22 18 Xinhua BEIJING China will implement value added tax VAT credit refund on a large scale to provide strong underpinnings for keeping the operations of market entities stable and maintaining job security as part of Web 12 mars 2022 nbsp 0183 32 Companies previously paying VAT rates of 16 and 10 will now pay 13 and 9 respectively The previous rate of 10 on agricultural products underwent a modest decrease to 9 Furthermore agricultural products bought for the use in production or

Vat Tax In China Rebate

Vat Tax In China Rebate

http://www.china-briefing.com/news/wp-content/uploads/2018/04/CB-Chinas-New-VAT-Rates.jpg

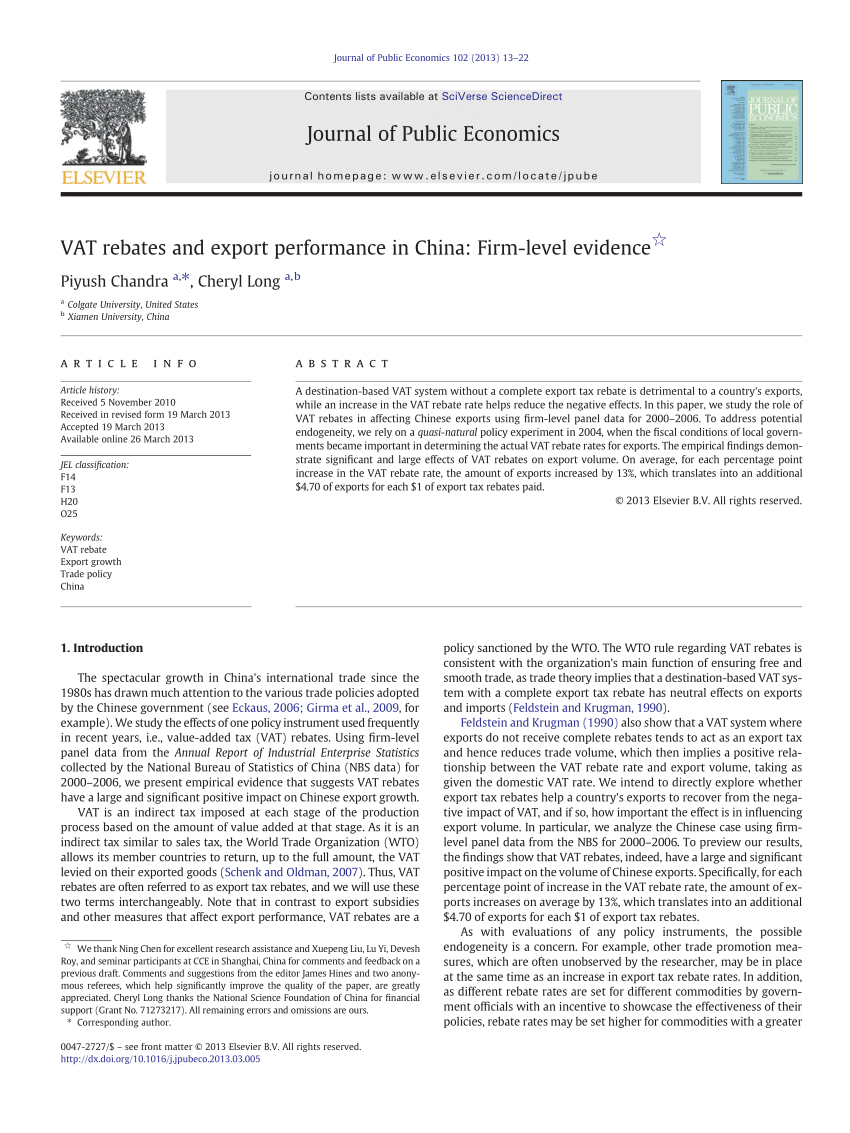

PDF VAT Rebates And Export Performance In China Firm level Evidence

https://i1.rgstatic.net/publication/256920177_VAT_rebates_and_export_performance_in_China_Firm-level_evidence/links/5e8b2edfa6fdcca789f84dfd/largepreview.png

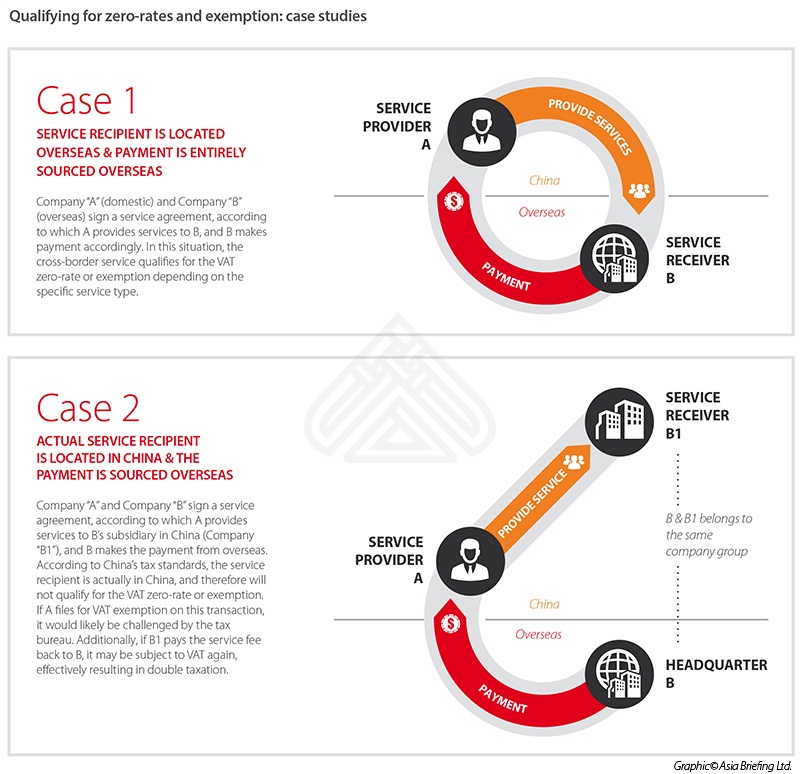

Asiapedia Case Studies Qualifying For China s VAT Zero Rates And VAT

https://resource.dezshira.com/Resources/6578/2016_-_Qualifying_for_Chinas_Zero-Rates_and_Exemption_-_Case_Studies_-_CB.jpg

Web 14 ao 251 t 2023 nbsp 0183 32 Previously during the period from April 1 2022 to December 31 2022 small scale VAT taxpayers that are subject to a VAT levy rate of 3 percent will be exempted from VAT payment or prepayment The VAT Web 20 avr 2022 nbsp 0183 32 BEIJING April 20 Reuters China s finance ministry and tax regulator on Wednesday said they will accelerate Value Added Tax VAT credit rebates for small firms Medium sized

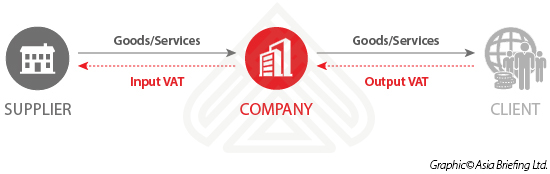

Web China maintains a multiple VAT rate system 3 percent 6 percent 9 percent and 13 percent though the prospect of further rationalisation of these rates cannot be discounted in the near future Most exported services are exempted from VAT not zero rated Web 1 oct 2020 nbsp 0183 32 Value added tax VAT rebates are a commonly used export promoting policy This paper exploits China s frequent adjustments of VAT rebates and large scale data on export transactions to estimate the effects of VAT rebates on exports

Download Vat Tax In China Rebate

More picture related to Vat Tax In China Rebate

PDF Trade And Welfare Effects Of Export Tax Theory And Evidence From

https://www.researchgate.net/profile/Ting-Ji-7/publication/353060778/figure/fig1/AS:1043106933792768@1625707481724/Chinas-Tariff-Rate-and-Export-Tax-Equivalents-of-VAT-Rebate-1996-2014_Q640.jpg

Asiapedia Import Export Taxes In China Dezan Shira Associates

https://resource.dezshira.com/Resources/4509/CB-2015-6-issue_inforgraphic2.jpg

How Does The VAT Rebate For Exports Out Of China Work

https://qualityinspection.org/wp-content/uploads/2018/08/ChinaVATRebateSimple-768x407.png

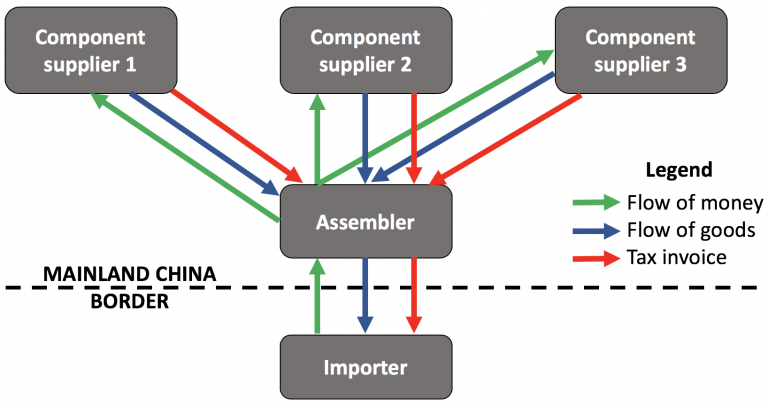

Web 11 mai 2021 nbsp 0183 32 Moreover the pre declarations on export tax rebate and VAT exemption has been scrapped and the requirement that export companies must submit VAT tax returns import declarations export tax rebate Web 1 ao 251 t 2022 nbsp 0183 32 Export tax refund or export tax rebates refer to refunds of value added tax VAT and consumption tax CT paid by exporting enterprises on exported goods during the production and circulation process

Web 30 ao 251 t 2023 nbsp 0183 32 Visitors who have bought products at tax free stores in China can withdraw value added tax VAT before leaving It s expected that in the near future the policy will come into effect in more and more China regions Tax Refund Process Conditions for Web 3 d 233 c 2014 nbsp 0183 32 The VAT rate that applies to manufacturing activities is 17 in China And the Chinese government give a VAT rebate to exporters by the way this is not unique to China and many other countries collect no VAT on sales to foreign companies China

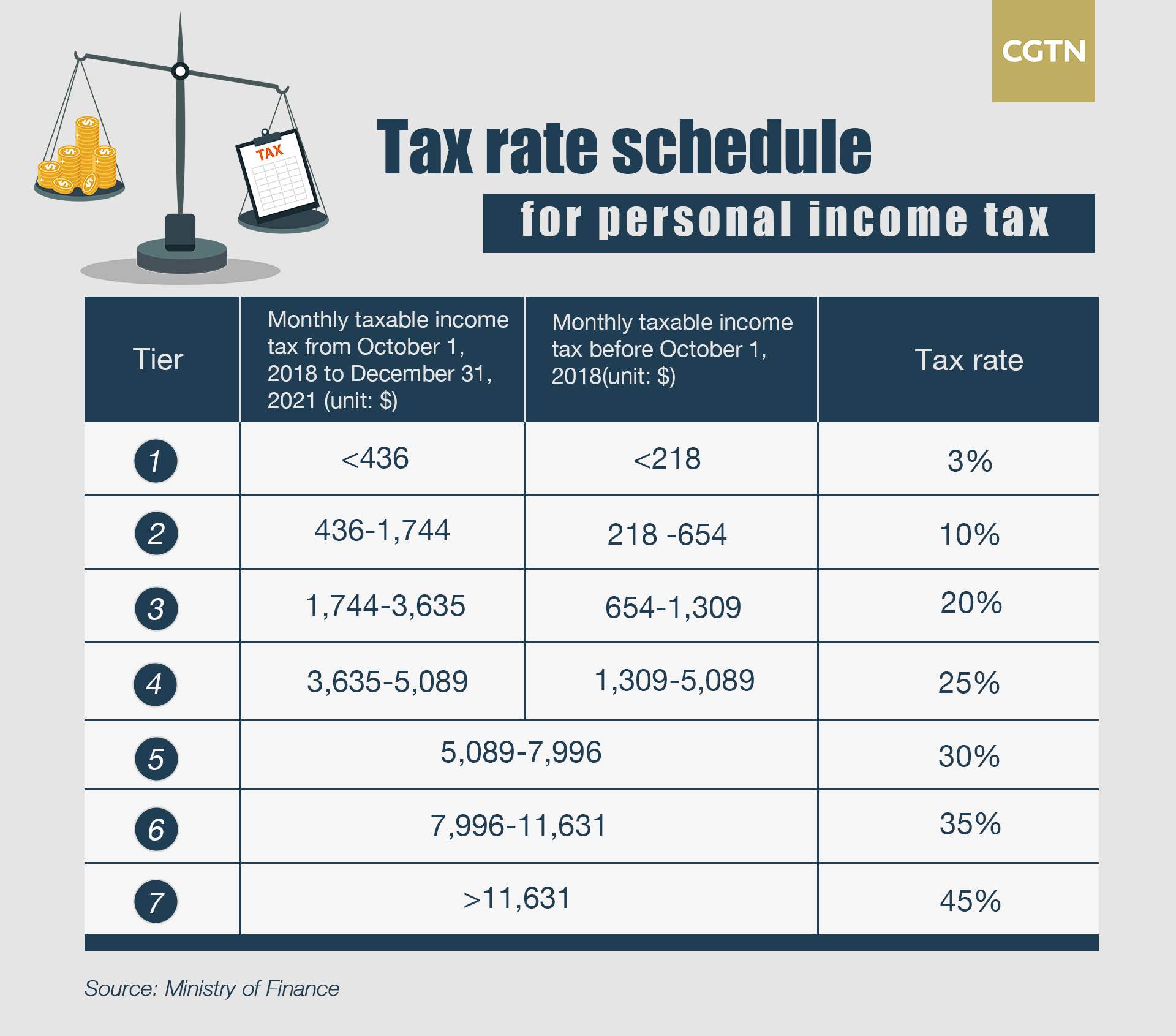

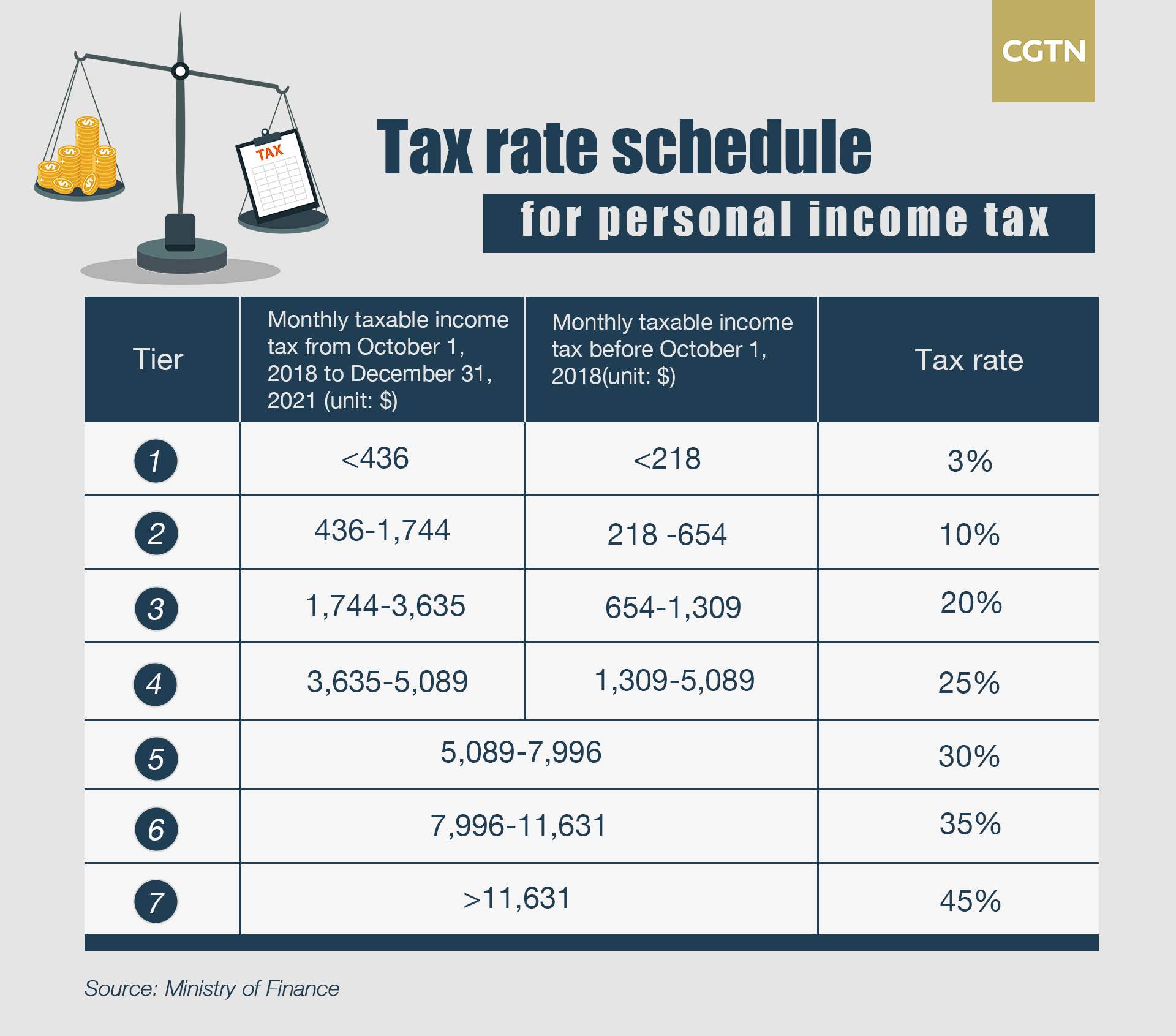

China Releases Tax Rate Schedule For Year end Bonuses CGTN

https://news.cgtn.com/news/3d3d414e784d6a4e31457a6333566d54/img/8e605c90778c47f3b531e5cd2b9a5502/8e605c90778c47f3b531e5cd2b9a5502.jpg

China VAT Overview Blog China Legal Express

http://www.chinalegalexpress.com/Content/ue/net/upload1/Other/102352/6361291289440760937446076.jpg

https://english.www.gov.cn/policies/policywatch/202203/25/content_WS...

Web 25 mars 2022 nbsp 0183 32 China scales up VAT rebates to boost market entities Updated March 25 2022 21 39 Xinhua BEIJING China is set to boost its value added tax VAT credit refunds in the country s latest tax and fee reduction efforts to ease the burden on

https://english.www.gov.cn/premier/news/202203/21/content_WS6238894…

Web 21 mars 2022 nbsp 0183 32 Updated March 21 2022 22 18 Xinhua BEIJING China will implement value added tax VAT credit refund on a large scale to provide strong underpinnings for keeping the operations of market entities stable and maintaining job security as part of

Planning For Value Added Tax Rebate Of VAT Leak In China Manufacturing

China Releases Tax Rate Schedule For Year end Bonuses CGTN

PDF Analysis Of The Tax Rebate Policy In China

Table 1 From Export Management And Incomplete VAT Rebates To Exporters

Calculating Value Added Tax In China China Briefing News

Welfare Effect From China s Tariff And VAT Rebate Policy Download

Welfare Effect From China s Tariff And VAT Rebate Policy Download

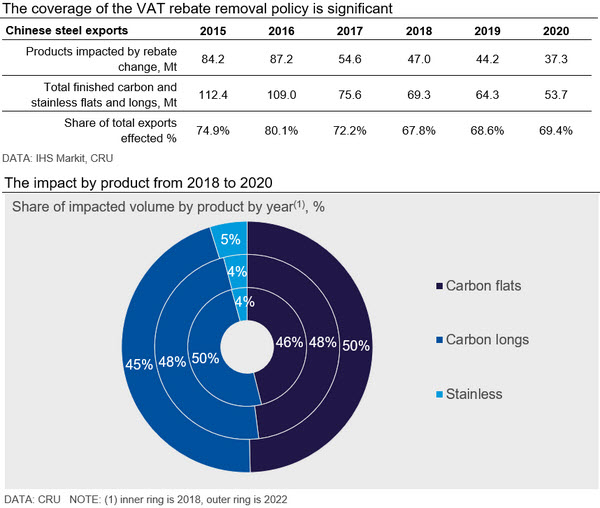

China Removes VAT Rebate On Steel Exports CRU

China s Value Added Tax System AsiaBridge Law

China Accounting 101 What Is VAT Tax In China

Vat Tax In China Rebate - Web 18 nov 2020 nbsp 0183 32 Utilizing the adjustments in the rates of VAT rebates in China our study thus provides new evidence on the labor market effects of an export tax In practice the rates of VAT rebates are set at the product level However the data of employment and wage is