Vehicle Sales Tax Deduction Texas 2 min read There is a general sales tax deduction available if you itemize your deductions You will have to choose between taking a deduction for sales tax or for your state and local income tax You can deduct sales

On your tax return you can deduct the state and local general sales tax you paid during the year or you can deduct the state Statewide Texas car sales tax is 6 25 of the purchase price Local counties or cities in Texas may also charge car sales tax of up to 2 New residents bringing a vehicle to Texas from another state

Vehicle Sales Tax Deduction Texas

Vehicle Sales Tax Deduction Texas

https://blog.carvana.com/wp-content/uploads/2020/02/022120-How-to-qualify-for-the-vehicle-sales-tax-deduction_Blog6.png

What Is The Vehicle Sales Tax Deduction

https://blog.relaycars.com/wp-content/uploads/2022/03/Are-There-Tax-Credits-for-Vehicles-768x432.jpg

What Is The Vehicle Sales Tax Deduction

https://blog.relaycars.com/wp-content/uploads/2022/03/Vehicle-Sales-Tax-Deduction.jpg

For more information regarding rental companies and the FMVD refer to Publication 96 143 Motor Vehicle Rental Tax Guide 96 254 09 2021 TABLE OF CONTENTS The sales tax for cars in Texas is 6 25 of the final sales price The Texas Comptroller states that payment of motor vehicle sales taxes has to be sent to the local county s tax

How To Qualify For The Vehicle Sales Tax Deduction Dustin Hawley Dec 11 2022 Purchasing a car gets expensive fast especially when browsing for a sports Vehicle Sales Tax Deduction While there is a general sales tax deduction you could use if you itemize deductions there s also a deduction for your state and local

Download Vehicle Sales Tax Deduction Texas

More picture related to Vehicle Sales Tax Deduction Texas

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

https://blog.carvana.com/wp-content/uploads/2020/02/022120-How-to-qualify-for-the-vehicle-sales-tax-deduction_Blog1.png

Do You Qualify For A Vehicle Sales Tax Deduction

https://www.toptaxdefenders.com/hubfs/Depositphotos_138271860_s-2019.jpg

Use The Sales Tax Deduction Calculator Simple Accounting

https://simple-accounting.org/wp-content/uploads/2021/09/603e8923-3ad2-46a9-932d-fa75cdb7e2e3.jpg

The state sales tax in Texas is 6 25 Local tax can t exceed 2 which means that 8 25 is the maximum combined sales tax that can be collected in Texas Texas law imposes motor vehicle sales and use tax on the total consideration paid or to be paid for a motor vehicle Total consideration includes anything given as payment and

You can deduct the sales tax you pay on a new vehicle if you buy it between February 17 and December 31 2009 And you get this tax break even if you Motor homes Keep all receipts so you have them at tax time How to Qualify for and Claim a Vehicle Sales Tax Deduction You must itemize to consider doing this To qualify for

Expiring Tax Deductions Could Mean Less Revenue For States

https://erepublic.brightspotcdn.com/dims4/default/04be6ba/2147483647/strip/true/crop/578x352+0+0/resize/1680x1024!/quality/90/?url=http:%2F%2Ferepublic-brightspot.s3.amazonaws.com%2F99%2F13%2F9be867ea0e2e604dfd131c7ecdf6%2Fpew-salestax-chart.jpg

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

https://www.hrblock.com/tax-center/fili…

2 min read There is a general sales tax deduction available if you itemize your deductions You will have to choose between taking a deduction for sales tax or for your state and local income tax You can deduct sales

https://www.nerdwallet.com/.../sales-ta…

On your tax return you can deduct the state and local general sales tax you paid during the year or you can deduct the state

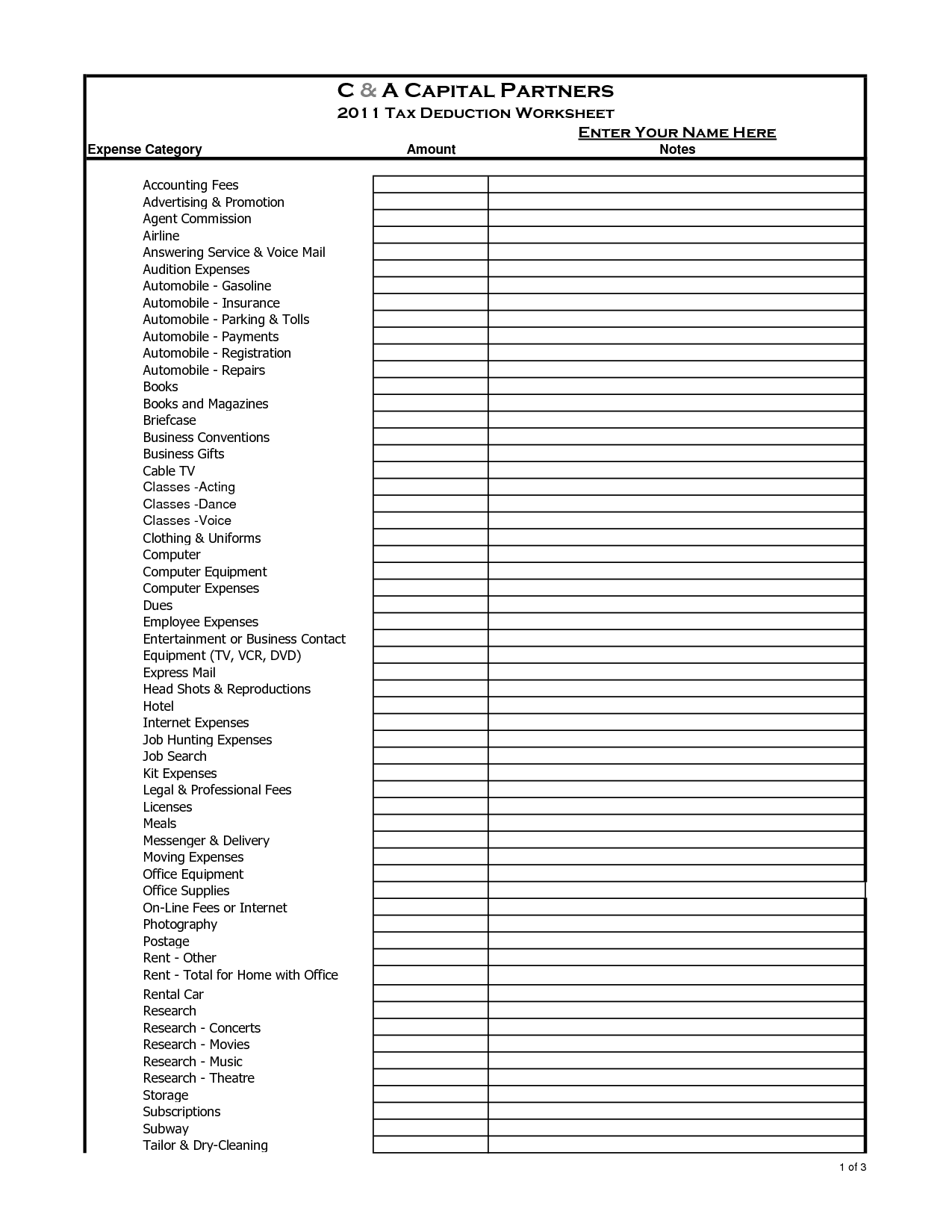

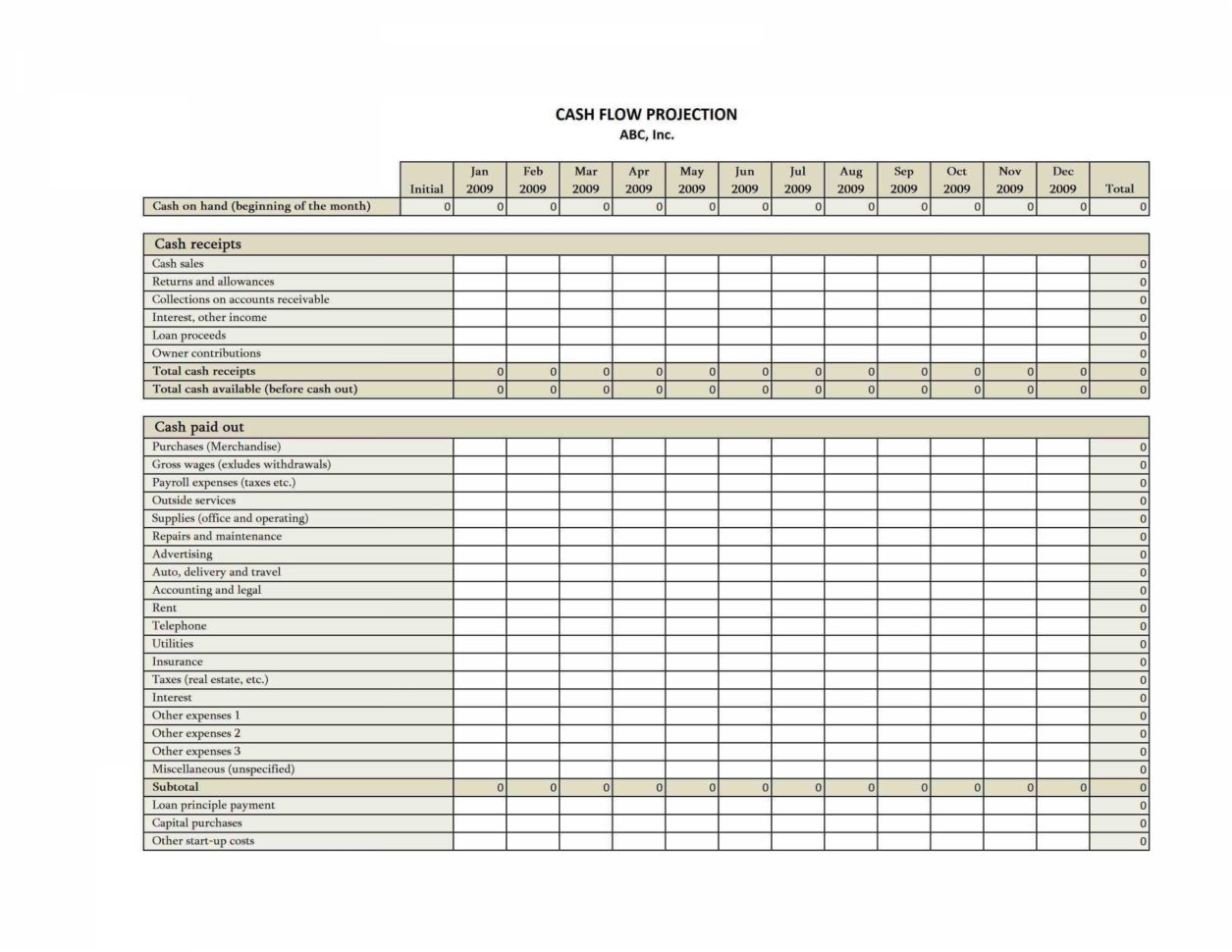

8 Tax Preparation Organizer Worksheet Worksheeto

Expiring Tax Deductions Could Mean Less Revenue For States

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

Car Tax Deduction

Vehicle Sales Tax Deduction H R Block

.jpg)

Illinois Vehicle Sales Tax Deduction Cap For Trade Ins Agile

.jpg)

Illinois Vehicle Sales Tax Deduction Cap For Trade Ins Agile

Sales Tax Is Calculated StuartKendall

Deductions For Sales Tax TurboTax Tax Tips Videos

Sales Tax Spreadsheet Templates Within 14 Fresh Free Tax Spreadsheet

Vehicle Sales Tax Deduction Texas - In addition H R Block explains that There is a limit of 10 000 5 000 if MFS on the amount of sales tax you can claim in 2018 to 2025 The 10 000 limit