Vermont Corporate Tax Return Extension Due Date If you cannot file and pay through myVTax you may still use the paper form File an Extension An extension of time to file a federal return automatically extends the time

Application for Extension to File Business Corporate Income Tax Business and Corporate Due Dates Wednesday March 15 2023 23 59 Read more Vermont Credit for Income Tax Paid to Other State or Canadian Province 2022 IN 119 2022 Instructions 2022 Vermont Tax Adjustments and Nonrefundable Credits 2022

Vermont Corporate Tax Return Extension Due Date

Vermont Corporate Tax Return Extension Due Date

https://uploads-ssl.webflow.com/5f9a1900790900e2b7f25ba1/6254776336f3f437f693e6db_62547502a2486c6ddefbf6e3_personalTaxExtension.png

Corporate Tax Filing Deadline For The 2021 Tax Season

https://s36394.pcdn.co/wp-content/uploads/2020/11/Tax-Deadlines-2022-Calendar-3.jpg

Blog Should You File An Extension For Your Federal Tax Return

https://www.mymcmedia.org/wp-content/uploads/2023/04/Tax-Extensions-graphic.jpg

Application for Extension of Time to File Vermont Corporate Business Income Tax Returns BA 404 Instructions Tax Credits Earned Applied Expired and Carried An extension of time to file a Vermont corporate or business income tax return does not extend the time for paying the tax Any tax due and unpaid by the original due date will

The IRS has announced that it will begin accepting income tax returns related to tax year 2023 beginning Monday January 29 2024 The due date for returns and tax payments is April 15 2024 By Vermont In brief Signed on May 31 S B 53 makes several changes to Vermont s corporate income tax applicable to tax years beginning on or after January 1 2023 These include 1 the

Download Vermont Corporate Tax Return Extension Due Date

More picture related to Vermont Corporate Tax Return Extension Due Date

A Guide To Filing An Extension For Corporate 1120 Tax Returns Blog

https://blog.expressextension.com/wp-content/uploads/2022/04/Blog1-04-3-1024x581.jpg

Corporate Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

https://www.taxproadvice.com/wp-content/uploads/business-tax-return-due-date-by-company-structure.jpeg

When Are 2019 Tax Returns Due Every Date You Need To File Business

https://www.indinero.com/wp-content/uploads/2019/09/TaxDeadlineCalendar-2.png

File Your Tax Extension Now Vermont business tax returns are due by the 15 th day of the 3 rd month following the close of the tax year For calendar year filers this date is General Instructions Vermont Filing Due Date Business tax returns are due by March 15 or by the 15 th day of the 3 rd month following the end of the taxable year for fiscal

If a federal extension is not filed request a state extension by filing Vermont Form BA 403 Application for Extension of Time to File Vermont Corporate Business Income Vermont allows an automatic extension of the income tax filing deadline for both individual and corporate taxpayers upon extension at the federal level and gives corporations

Llc Tax Return Extension 2020 QATAX

https://www.irs.gov/pub/xml_bc/33588001.gif

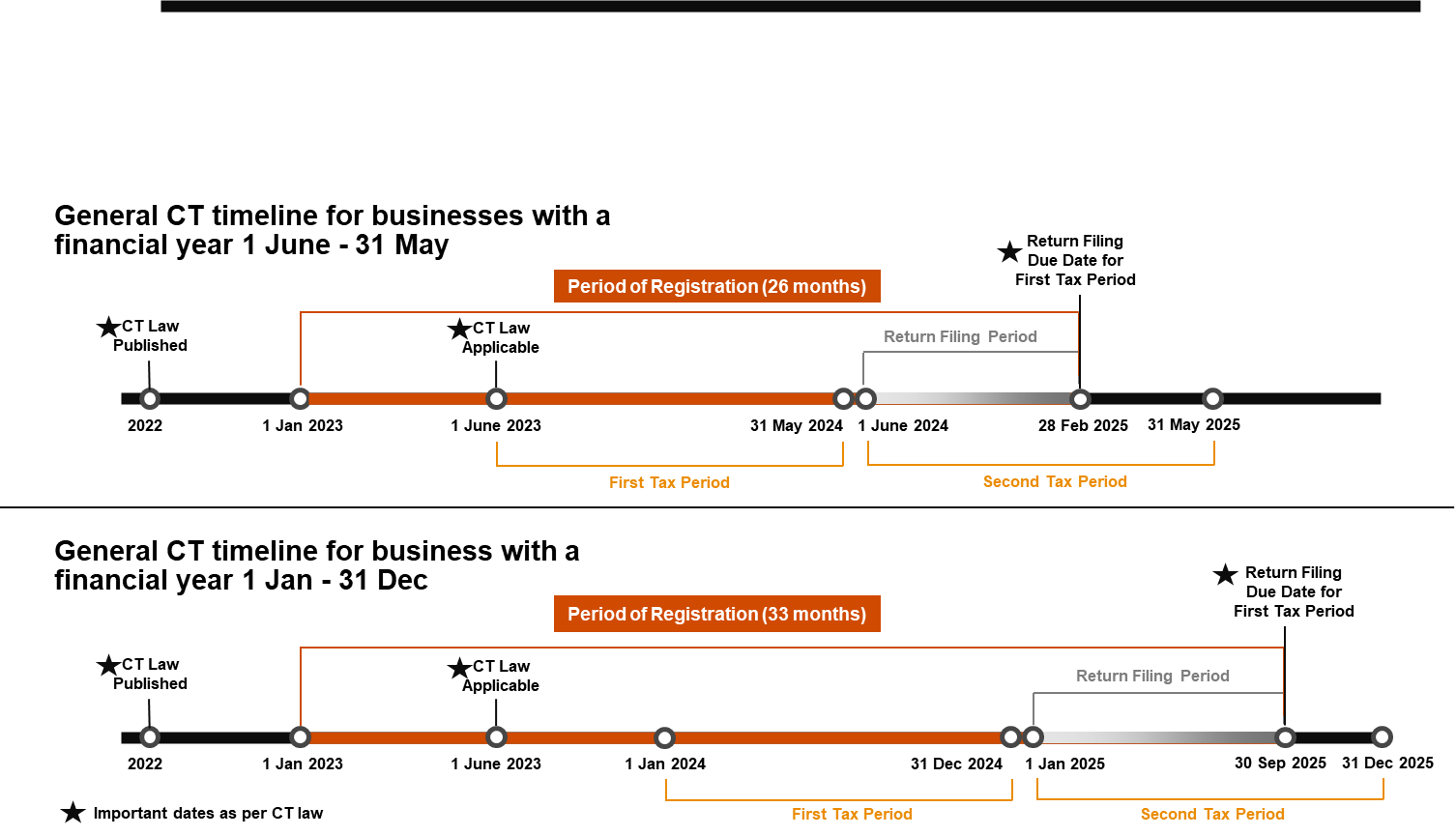

Federal Tax Authority Corporate Tax Topics

https://tax.gov.ae/Datafolder/Images/2022/CT/PAR 8.png

https://tax.vermont.gov/business/business-entity-income-tax

If you cannot file and pay through myVTax you may still use the paper form File an Extension An extension of time to file a federal return automatically extends the time

https://tax.vermont.gov/event-types/business-and...

Application for Extension to File Business Corporate Income Tax Business and Corporate Due Dates Wednesday March 15 2023 23 59 Read more

Search Publication

Llc Tax Return Extension 2020 QATAX

What Is The Due Date For A 1065 Tax Return Cycledarelo

Search Publication

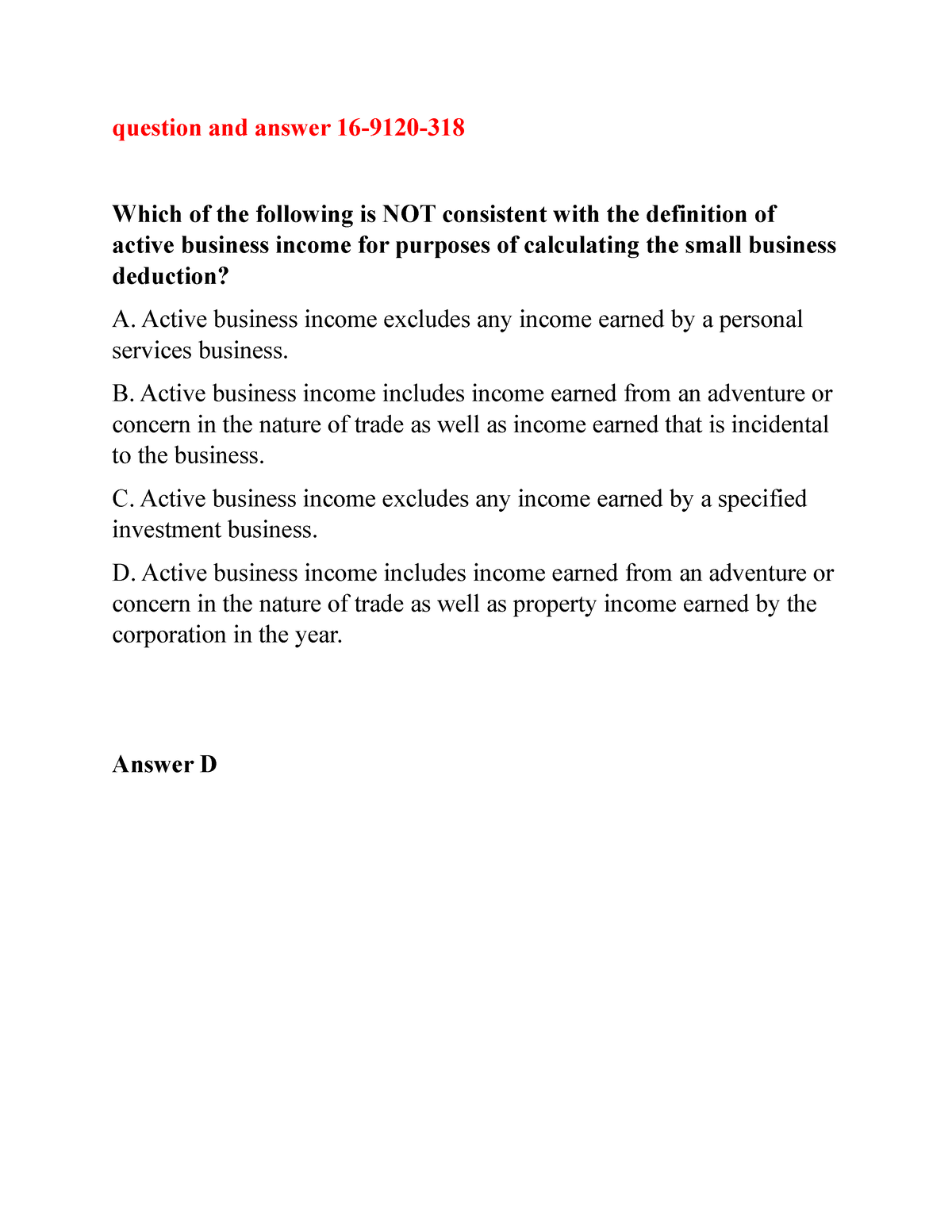

Question And Answer 16 9120 318 Canadian Tax Principles 2020 2021 Byrd

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Do It Yourself Online Tax Return Prepare Taxes On The Internet And E

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Do It Yourself Online Tax Return Prepare Taxes On The Internet And E

2016 Tax Extension Due Date Federal Polregeta

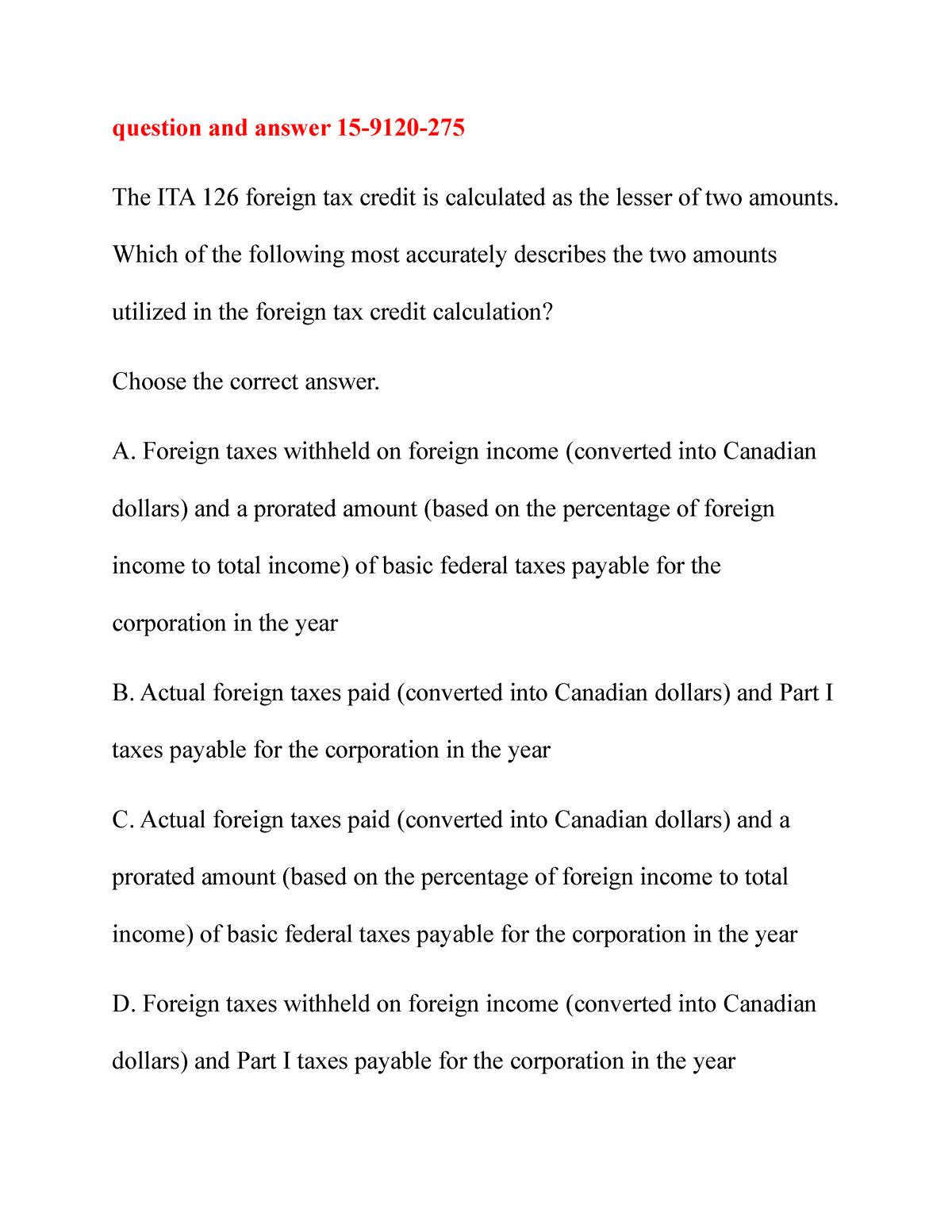

Question And Answer 15 9120 275 Canadian Tax Principles 2020 2021 Byrd

Public Benefits Are Key Working Families Tax Credit February 15th

Vermont Corporate Tax Return Extension Due Date - In brief Signed on May 31 S B 53 makes several changes to Vermont s corporate income tax applicable to tax years beginning on or after January 1 2023 These include 1 the