Vermont Homestead Tax Exemption Verkko The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes You may be eligible for a property tax credit on your property taxes if your property qualifies as a homestead and you meet the eligibility requirements The maximum property tax credit is 8 000 00

Verkko What Forms Are Needed to File You need the following two forms to file a claim Form HS 122 Section A Homestead Declaration and Section B Property Tax Credit Claim Schedule HI 144 Household Income Disclaimer The information provided here is intended to be an overview only Verkko 18 huhtik 2023 nbsp 0183 32 Homeowners eligible for a credit are those who 1 owned the property as a principal home on April 1 2 were Vermont resident s all of calendar year 2022 3 were not claimed as a dependent by another taxpayer for tax year 2022 and 4 household income is 134 800 or less in 2022

Vermont Homestead Tax Exemption

-1920w.jpg)

Vermont Homestead Tax Exemption

https://lirp.cdn-website.com/17d53756/dms3rep/multi/opt/Homestead+exemption+(2)-1920w.jpg

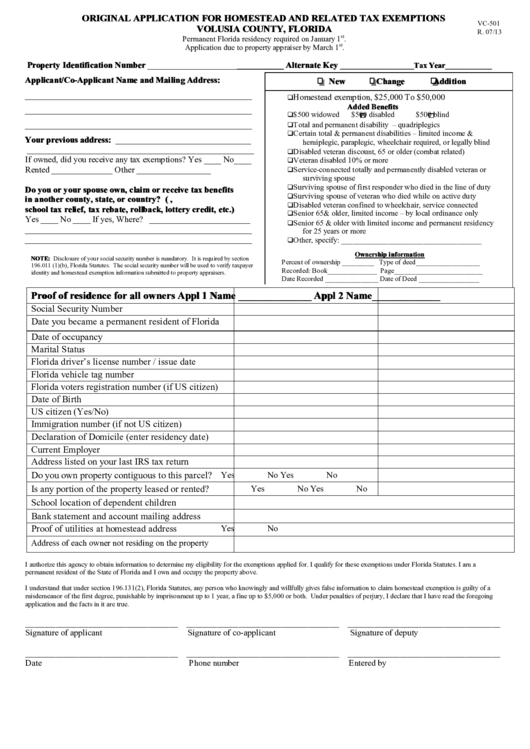

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

Texas Homestead Tax Exemption Guide New For 2024

https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg

Verkko 7 helmik 2023 nbsp 0183 32 What s Taxable and Exempt Free File Free Tax Preparation Available Tax Credits Power of Attorney File an Extension Filing Deadlines Renter Credit Landlord Certificates Homestead Declaration Property Tax Credit File W2 1099 WHT 434 Check Return Status Pay Online or by Mail Go to myVTax Estimated Income Verkko The Homestead Declaration for 2023 is due April 18 and no later than October 16 Your municipality may assess a penalty after the April due date What is the Vermont Homestead Declaration In Vermont all property is subject to education property tax to pay for the state s schools

Verkko Use myVTax the department s online portal to e file Form HS 122 Homestead Declaration and Property Tax Adjustment Claim and Schedule HI 144 Household Income with the Department of Taxes Homestead Declaration and Property Tax Adjustment Filing Vermont gov Verkko Vermont homeowners need to file a homestead declaration even if you are not required to file a tax return If you don t file this form you will have to pay the rate that people who do not live in property they own have to pay You may also miss out on help from the state to pay your property taxes

Download Vermont Homestead Tax Exemption

More picture related to Vermont Homestead Tax Exemption

Vermont Homestead Declaration AND Property Tax Credit Claim

https://myvtax.vermont.gov/WebFiles/image/VT_Banner.png

Texas Homestead Tax Exemption Cedar Park Texas Living

https://cedarparktxliving.com/wp-content/uploads/2020/12/Homestead-Tax-Exemption-1140x1140.jpg

Homestead Exemption

https://static.wixstatic.com/media/3a5a64_a2dc98c068b34d5ab0e28ba9d0cb98f7~mv2.png/v1/fit/w_1024,h_1024,al_c,q_80/file.png

Verkko 8 helmik 2023 nbsp 0183 32 The Homestead Declaration for 2023 is due April 18 and no later than Oct 16 Municipalities may assess a penalty after the April due date Vt Dep t of Taxes Fact Sheet FS 1051 02 07 23 Reference View Source Document The Vermont Department of Taxes Feb 7 published a fact sheet on the Homestead Declaration for Verkko Vermont Homestead Declaration AND Property Tax Credit Claim DUE DATE April 18 2023 You may file up to Oct 16 2023 but the town may assess a penalty For details on late filing see the instructions

Verkko 6 syysk 2023 nbsp 0183 32 Vermont tax on retirement benefits Social Security benefits are exempt for joint filers with an adjusted gross income AGI of 65 000 or less Additionally Vermont offers a deduction of up to Verkko 19 tuntia sitten nbsp 0183 32 Residents should be eligible based on their 2023 2024 property taxes if their property qualifies as a homestead and they meet other criteria The amount available depends on several factors but

Homestead Tax Exemption For Seniors Adams County Iowa

https://adamscounty.iowa.gov/images/news/homestead_tax_exemption_for_seniors_93413.png

VT Form HS 122 Download Fillable PDF Or Fill Online Vermont Homestead

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2023/05/vt-form-hs-122-download-fillable-pdf-or-fill-online-vermont-homestead.png

-1920w.jpg?w=186)

https://tax.vermont.gov/property/property-tax-credit

Verkko The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes You may be eligible for a property tax credit on your property taxes if your property qualifies as a homestead and you meet the eligibility requirements The maximum property tax credit is 8 000 00

https://tax.vermont.gov/sites/tax/files/documents/FS-1038.…

Verkko What Forms Are Needed to File You need the following two forms to file a claim Form HS 122 Section A Homestead Declaration and Section B Property Tax Credit Claim Schedule HI 144 Household Income Disclaimer The information provided here is intended to be an overview only

Florida Homestead Tax Exemption Form ExemptForm

Homestead Tax Exemption For Seniors Adams County Iowa

Texas Homestead Tax Exemption

Form 2583 Choices Information Transmittal Fill Out And Sign Printable

Montgomery County Homestead Exemption 2019 2024 Form Fill Out And

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Benefits Of Home Ownership And Tax Exemptions MSI Credit Solutions

Minnesota Homestead

Vermont Homestead Tax Exemption - Verkko Homestead Declaration Form HS 122 The Homestead Declaration must be filed each year by Vermont residents for purposes of the state education tax rate The Declaration identifies the property as the homestead of the Vermont resident