Vermont Property Tax Return Here is what you need to know Property Transfer Tax Learn how to file and pay Property Transfer Tax read our FAQs and other helpful guides Land Gains Tax Find out what tax

Your Vermont Property Tax Bill Tax bills are generally mailed to property owners 30 days prior to the property tax due date Contact your town to find out the tax due date If the tax due date falls on a weekend or a holiday taxes are The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes You may be eligible for a property tax credit on your property taxes if your property

Vermont Property Tax Return

Vermont Property Tax Return

https://ic-cdn.flipboard.com/vtdigger.org/126b529a60b7201a690c79683937e2657de5c164/_medium.jpeg

Minnesota Property Tax Refunds MNbump

https://mnbump.com/wp-content/uploads/2022/04/Housing-Tax-Credit.jpg

CA Parent Child Transfer California Property Tax NewsCalifornia

https://i0.wp.com/propertytaxnews.org/wp-content/uploads/2021/10/California-Property-Taxes-scaled.jpg?resize=2048%2C1192&ssl=1

File online Visit the Vermont Department of Taxes website to file your homestead declaration and property tax credit form online Get help You can find free help to The property tax credit assists Vermont residents to pay property tax and is based on a percentage of household income Homeowners eligible for a credit are those who

Pay Taxes Online File and pay individual and business taxes online Tax Return or Refund Status Check the status on your tax return or refund Find forms and documents from the Treasurer s Office listed by division

Download Vermont Property Tax Return

More picture related to Vermont Property Tax Return

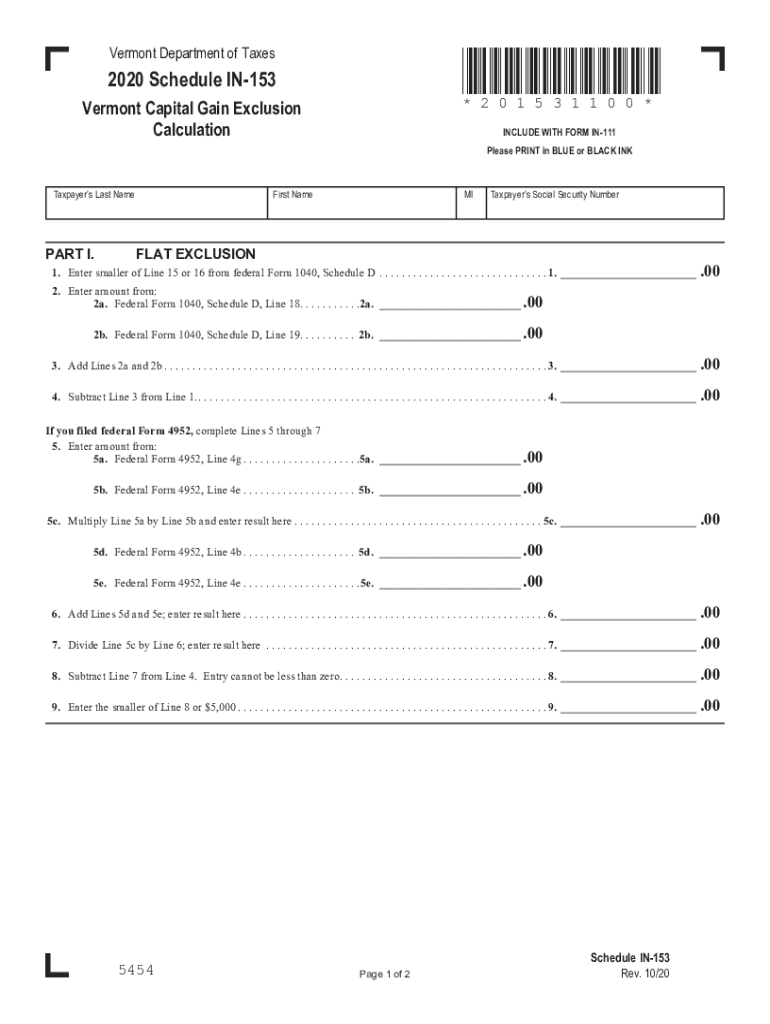

Vermont Income Tax 2020 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/563/640/563640679/large.png

Vermont Tax Forms And Instructions For 2022 Form IN 111

https://www.incometaxpro.net/images/forms/2022/vermont-tax-forms.png

Property Tax Increase Is Cause For Concern In DeKalb County

https://www.fair-assessments.com/hubfs/property tax increase-2.jpg?t=1536096074778#keepProtocol

Property Transfers and Land Gains Tax Return Submissions When is the best time to submit a PTT return How do I make changes to a PTT return after submitting it to the town The Department of Taxes Use myVTax the department s online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Credit Renter Rebate Claim and Estimated Payments

Homestead Declaration Form HS 122 The Homestead Declaration must be filed each year by Vermont residents for purposes of the state education tax rate The Declaration If you have questions about your Homestead or Property Tax Credit Claim Call the State of Vermont Tax Department at 866 828 2865 or 802 828 2865 Or visit the VT Department of Taxes website and click the Individual Income Taxes link to email an inquiry

Vermont Homestead Declaration AND Property Tax Credit Claim

https://myvtax.vermont.gov/WebFiles/image/VT_Banner.png

What To Expect And How To Resolve Vermont Back Taxes

https://images.taxcure.com/uploads/tmp/1684168972-536301316307595-0030-1267/Vermont_Back_Taxes.png

https://tax.vermont.gov/property

Here is what you need to know Property Transfer Tax Learn how to file and pay Property Transfer Tax read our FAQs and other helpful guides Land Gains Tax Find out what tax

https://tax.vermont.gov/property/tax-bill

Your Vermont Property Tax Bill Tax bills are generally mailed to property owners 30 days prior to the property tax due date Contact your town to find out the tax due date If the tax due date falls on a weekend or a holiday taxes are

Withholding Tax Return

Vermont Homestead Declaration AND Property Tax Credit Claim

Property Tax Chandigarh Municipal Corporation Issued Exemption Offer

Understanding Your Property Tax Bill Department Of Taxes

How Do Pa s Property Taxes Stack Up Nationally This Map Will Tell You

These Three Property Tax Forecasting Methods Will Get You To The Most

These Three Property Tax Forecasting Methods Will Get You To The Most

Did Your Property Tax Recently Increase

Top 10 Vermont Veteran Benefits

Understanding Your Property Tax Bill Department Of Taxes

Vermont Property Tax Return - Pay Taxes Online File and pay individual and business taxes online Tax Return or Refund Status Check the status on your tax return or refund