Vermont Renters Rebate 2024 The Renter Credit is a refundable tax credit available to eligible Vermont residents who rented during the prior calendar year Renters may be eligible even if they are not required to file a tax return The Renter Credit Program replaced the Renter Rebate Program in 2020 under Act 160 of 2020

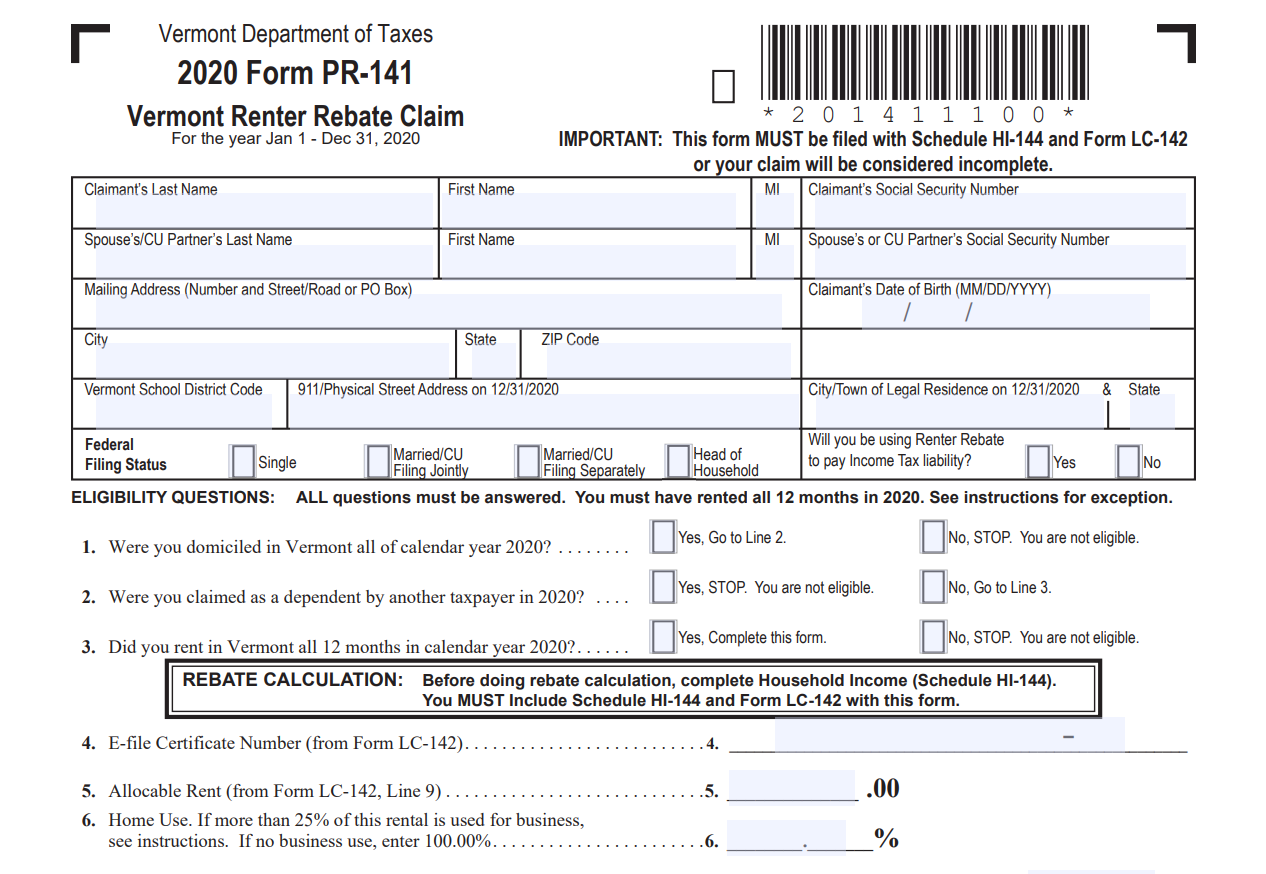

The Property Tax Credit Claim for 2024 is due on April 15 There is a 15 00 late fee after April 16 Generally claims cannot be accepted after October 15 2024 In order to file a Vermont Property Tax Credit Claim you must meet all of the following eligibility requirements In 2024 your Renter Credit claim is due on April 15 You can file a claim late but only up to October 15 If you file after the first due date a late filing fee will be taken out of your Renter Credit How do VERAP rent payments affect my renter credit rebate

Vermont Renters Rebate 2024

Vermont Renters Rebate 2024

https://printablerebateform.net/wp-content/uploads/2023/08/Vermont-Renters-Rebate-Form-1536x690.png

Vermont Renters Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/08/Vermont-Renters-Rebate-Form.png

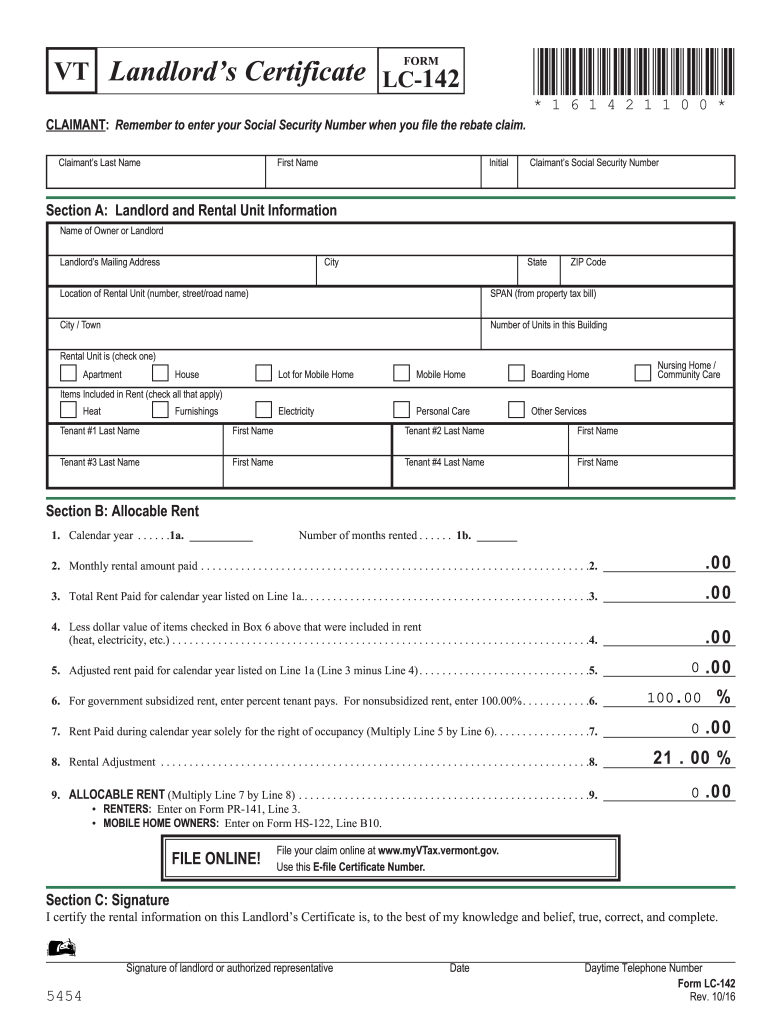

Vermont Renters Rebate Laws RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/vermont-landlord-certificate-lc-142-ez-landlord-forms-12.gif

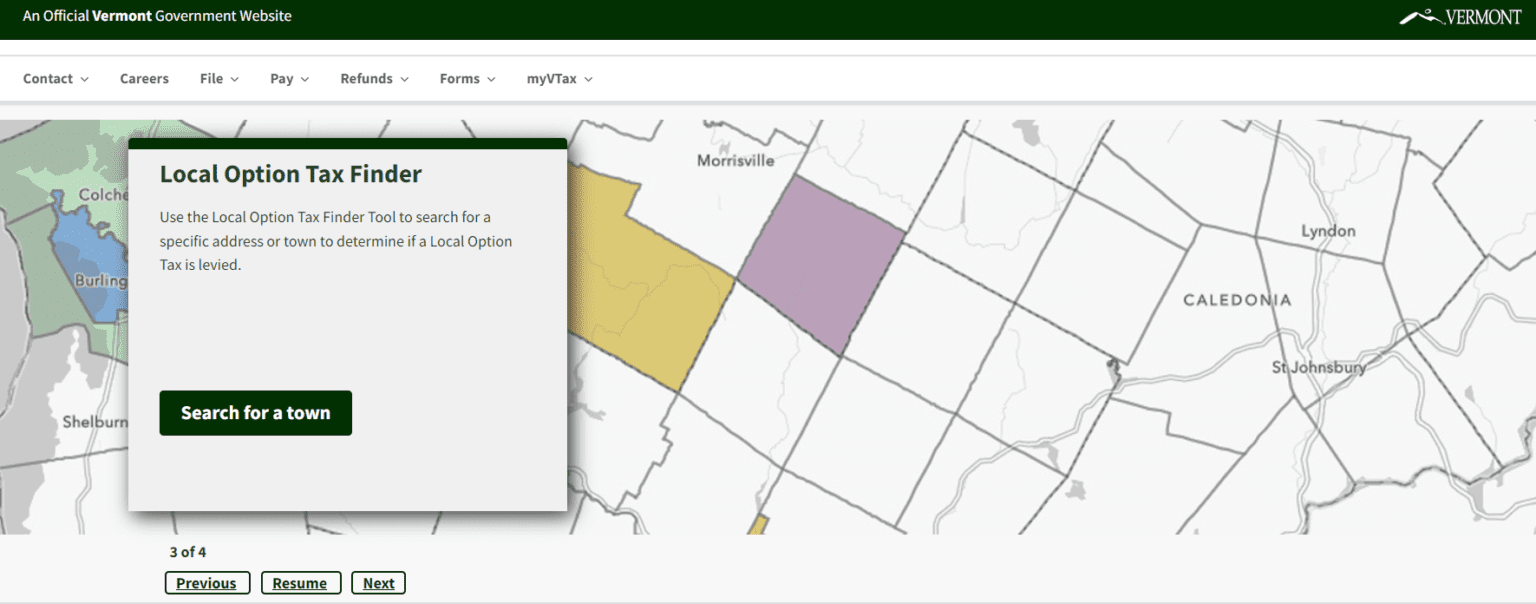

Vermont Department of Taxes FY 2024 Budget Current Initiatives Implement New Policies including Act 138 Tax Reforms Corporate Income Tax Reforms Cannabis Taxes New Local Option Tax Towns Maintain historically high processing efficiency this tax season Complete the Vermont Property Information Exchange VTPIE If you rent apply for Vermont s Renter Credit tax credit Formerly called the renter rebate Formerly called the renter rebate First check the requirements which include being a Vermont resident for all of the year and renting in Vermont for six of those months even if you moved and even if you did not pay all your rent

The Renter Credit is a refundable tax credit available to eligible Vermont residents who rented during the prior calendar year Renters may be eligible even if they are not required to file a tax return FREQUENTLY ASKED QUESTIONS Do I have to live in Vermont for the whole year BURLINGTON Vt WCAX Monday is the first day you can file your taxes for last year and the Vermont Department of Taxes has a few tips you should know about First wait until all your tax

Download Vermont Renters Rebate 2024

More picture related to Vermont Renters Rebate 2024

Renters Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Vermont-Renters-Rebate-Form-2021-784x1024.jpg

Renters Rebate Vt 2022 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/06/Renters-Rebate-Vt.png

Vt Dept Of Taxes Renters Rebate RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2023/05/form-pr-141-renter-rebate-claim-vermont-department-of-taxes-1999.png?resize=786%2C1024&ssl=1

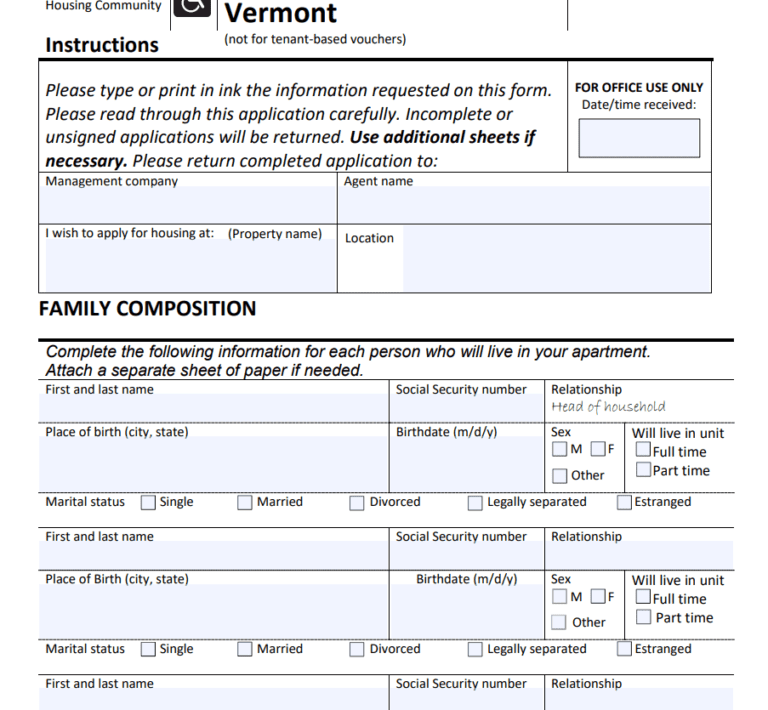

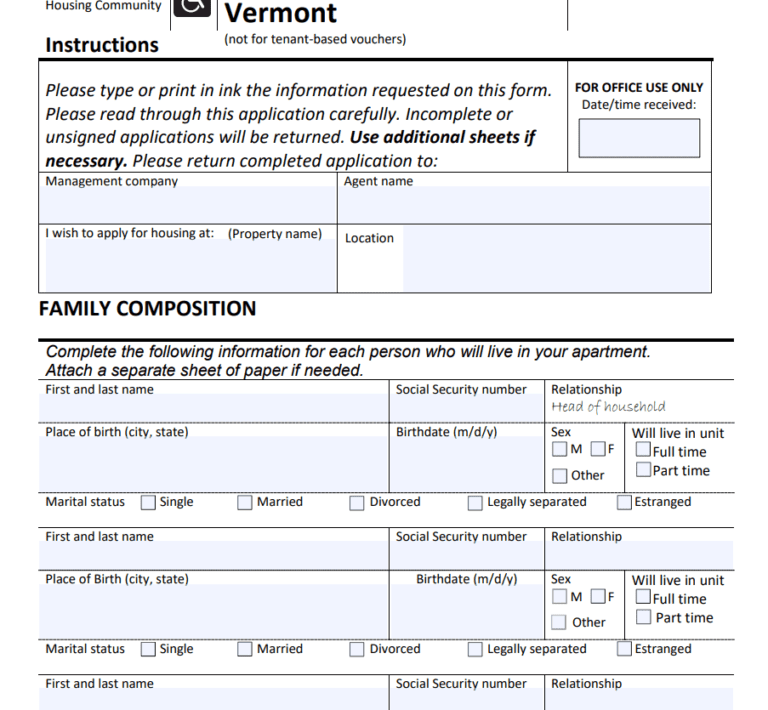

household income definition eligibility at 47 000 of household income available if a percentage of rent paid exceeded a percentage of household only one claimant per household and was not adjusted for family size renting for 12 calendar months different Landlord Certificate requirements 3 000 Act 160 Changes to Renter Credit Acts 160 of 2020 Use form RCC 146 from the Vermont Department of Taxes to claim the renter credit formerly called the renter rebate

Officials say they actually haven t been giving out all the money that was set aside for rebates only 8 5 million of the 9 5 million they have budgeted They estimate their changes will Home purchasing assistance Drawing from the Governor s proposals the FY20 revenue bill increases available tax credits supporting first time homebuyers and affordable housing by 250 000 helping to bridge the gap for those searching for housing that s affordable in Vermont Renter rebate reform Proposed and the Legislature passed via

Blog Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/11/Vermont-Renters-Rebate-Form-2022-768x710.png

Missouri Renters Rebate 2024 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/02/Missouri-Renters-Rebate-2023.jpg

https://tax.vermont.gov/property/landlord-certificates

The Renter Credit is a refundable tax credit available to eligible Vermont residents who rented during the prior calendar year Renters may be eligible even if they are not required to file a tax return The Renter Credit Program replaced the Renter Rebate Program in 2020 under Act 160 of 2020

https://tax.vermont.gov/sites/tax/files/documents/FS-1038.pdf

The Property Tax Credit Claim for 2024 is due on April 15 There is a 15 00 late fee after April 16 Generally claims cannot be accepted after October 15 2024 In order to file a Vermont Property Tax Credit Claim you must meet all of the following eligibility requirements

Renters Rebate Form PrintableRebateForm

Blog Printable Rebate Form

Span Number For Renters Rebate Fill Out Sign Online DocHub

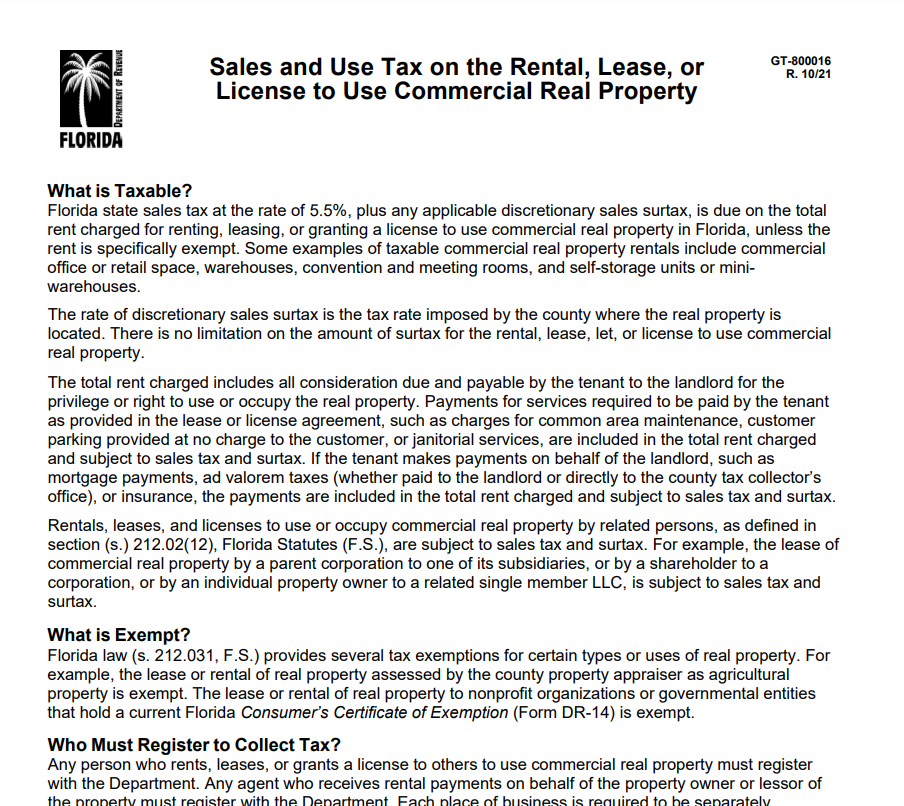

Florida Renters Rebate 2023 PrintableRebateForm

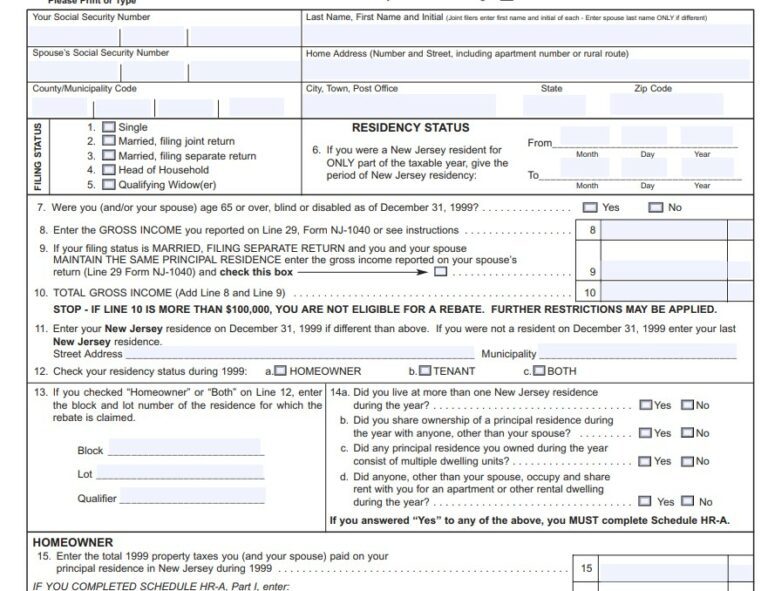

New Jersey Renters Rebate 2023 Printable Rebate Form

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

New Mexico Renters Rebate 2023 Printable Rebate Form

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

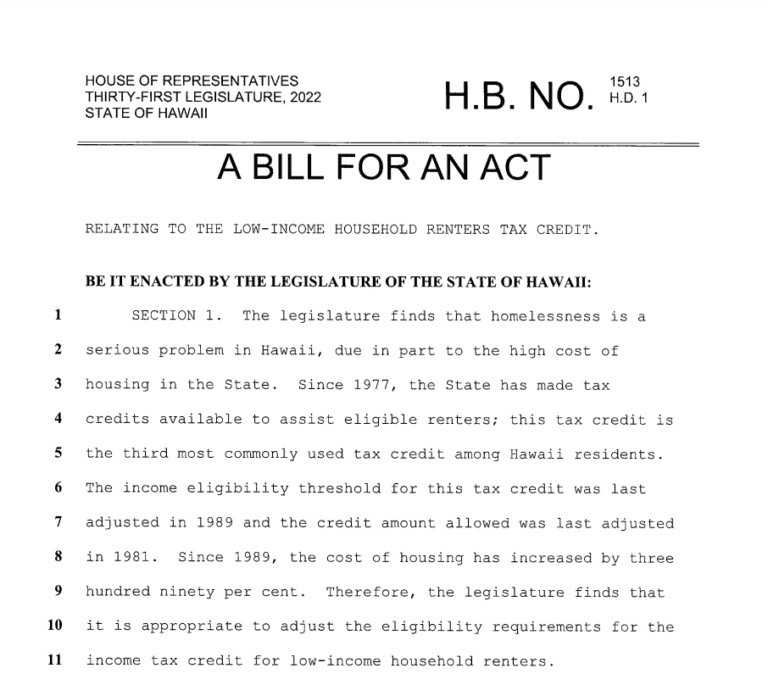

Hawaii Renters Rebate 2023 PrintableRebateForm

Vermont Renters Rebate 2024 - Renter Rebate Claim Form Department of Taxes Use myVTax the department s online portal to e file a Renter Rebate Claim Related Services Check Return or Refund Status Pay Your Taxes S Search all Secretary of State Databases by Name