Virginia State Tax Exemption For 100 Disabled Veterans Certain disabled veterans may be eligible for a Sales and Use Tax SUT exemption on purchased vehicles Veterans of the United States Armed Forces or the Virginia

Active Duty Pay Up to 15 000 of military basic pay may be exempted from Virginia income tax For every 1 00 of income over 15 000 the maximum subtraction is reduced by 1 00 For The veteran shall also provide documentation from the U S Department of Veterans Affairs or its successor agency indicating that the veteran has a 100 percent service

Virginia State Tax Exemption For 100 Disabled Veterans

Virginia State Tax Exemption For 100 Disabled Veterans

https://cck-law.com/wp-content/uploads/2023/05/Top-15-States-for-100-Disabled-Veteran-Benefits-1.jpg

Property Tax Exemption For Disabled Veterans Esper Aiello Law Group

https://www.esperaiellolawgroup.com/wp-content/uploads/property-tax-exemption-for-disabled-veterans.jpg

NJ Election Expand Tax Aid For Veterans What You Need To Know

https://www.gannett-cdn.com/presto/2020/07/01/PNJM/42c0dc60-6b77-4e54-94f0-6bec302209e9-070120_Montclairvoterrally_10.JPG?crop=5181,2915,x0,y266&width=3200&height=1801&format=pjpg&auto=webp

A Pursuant to subdivision a of Section 6 A of Article X of the Constitution of Virginia and for tax years beginning on or after January 1 2011 the General Assembly hereby exempts from On March 31 2021 legislation was approved by the Virginia General Assembly exempting qualified Disabled Veterans and their spouses from local personal property taxes on one motor

Veterans may be entitled to property tax exemption for their primary residence Eligibility and the exemption amount typically depend on disability rating state county and city For Should an automobile or pickup truck that is owned and used primarily by or for a veteran of the United States armed forces or the Virginia National Guard who has a one hundred percent

Download Virginia State Tax Exemption For 100 Disabled Veterans

More picture related to Virginia State Tax Exemption For 100 Disabled Veterans

100 Percent Disabled Veterans Qualify For The Veterans Property Tax

https://i.ytimg.com/vi/I6ctvDSp2Ck/maxresdefault.jpg

Tax Exemption Form For Veterans ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/veterans-property-tax-exemption-application-form-printable-pdf-download-1.png

State Lodging Tax Exempt Forms ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/ny-hotel-tax-exempt-fill-online-printable-fillable-blank-pdffiller-8.png

Veterans with a Department of Veterans Affairs 100 permanent and total disability are exempt from property taxes on their home The surviving spouse may also be eligible Veterans 100 Disabled Veterans Our research and analysis uncovered 20 states with no property tax for 100 disabled veterans meaning eligible veterans are completely exempt from paying property taxes on their primary residence

In Virginia disabled veterans may receive a property tax exemption on their primary residence if they are 100 disabled as a result of service This exemption is made in accordance with Retired military with 100 permanent and total disability rating or an individually unemployable rating from service are eligible for a real property tax exemption In addition un

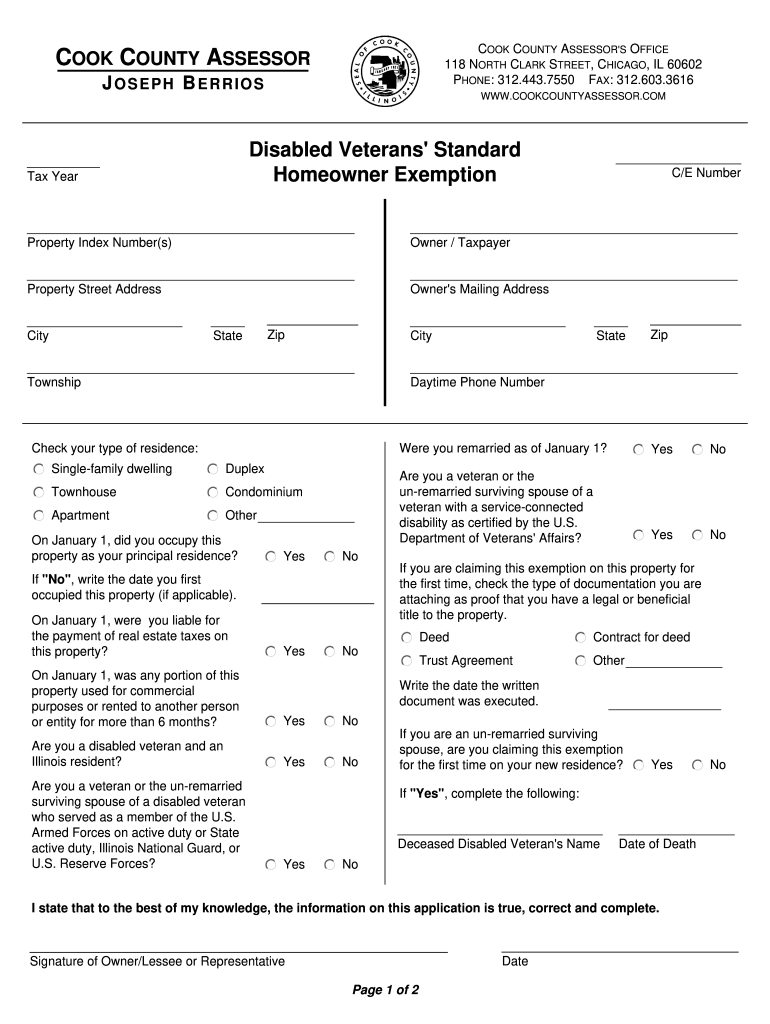

Property Tax Exemption For Illinois Disabled Veterans

https://www.homesteadfinancial.com/app/uploads/2023/05/VA-TAX-EXCEMPTION2-600x371.jpg

2023 Disabled Veteran Property Tax Exemption Lake County Veterans And

https://www.lcvetsfoundation.org/wp-content/uploads/2023/01/veteran-tax-exemptions1-1024x683.jpg

https://www.dmv.virginia.gov › vehicles › title › ...

Certain disabled veterans may be eligible for a Sales and Use Tax SUT exemption on purchased vehicles Veterans of the United States Armed Forces or the Virginia

https://vadisabilitygroup.com

Active Duty Pay Up to 15 000 of military basic pay may be exempted from Virginia income tax For every 1 00 of income over 15 000 the maximum subtraction is reduced by 1 00 For

18 States With Full Property Tax Exemption For 100 Disabled Veterans

Property Tax Exemption For Illinois Disabled Veterans

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

State Tax Exemption Map National Utility Solutions

Illinois Disabled Veterans Exemption Form Fill Out And Sign Printable

VA Disability And Property Tax Exemptions Common Misconception For A

VA Disability And Property Tax Exemptions Common Misconception For A

18 States With Full Property Tax Exemption For 100 Disabled Veterans

18 States With Full Property Tax Exemption For 100 Disabled Veterans

Texas Disabled Veteran Benefits Explained The Insider s Guide

Virginia State Tax Exemption For 100 Disabled Veterans - Virginia VA benefits include a full exemption of property tax for veterans with a 100 percent permanent and total P T disability rating as well as for unremarried spouses of