Voluntary Cpf Contribution Tax Relief CPF Cash Top up Relief is given to encourage Singaporeans and Permanent Residents to set aside money for retirement needs either in their own CPF accounts or those of family members To qualify for the tax

Learn how to make voluntary contributions to your employees CPF accounts and get tax relief for cash top ups to their retirement savings Find out the types limits and There is a personal income tax relief cap of 80 000 which applies to all tax reliefs including tax relief on cash top ups made to your CPF accounts The tax relief cap will

Voluntary Cpf Contribution Tax Relief

Voluntary Cpf Contribution Tax Relief

https://www.jcprojectfreedom.com/wp-content/uploads/2019/12/JC-Project-Freedom-Income-Tax-Relief-using-SRS-and-CPF.jpg

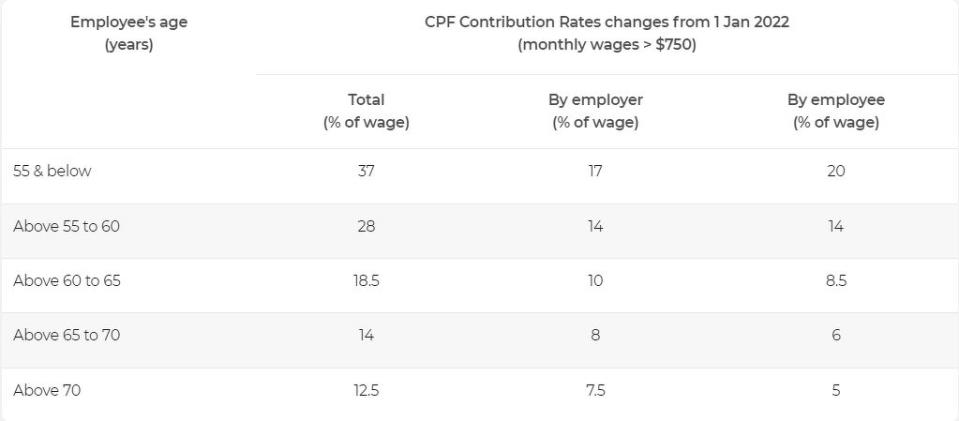

CPF Contribution Rate Current CPF Contribution Rates For Employee

https://quickhr.co/assets/images/webp/cpf_contribution_rate_n.webp

.png?sfvrsn=66124015_0)

Increase In CPF Contribution Rates In 2022

https://stoneforest.com.sg/images/librariesprovider7/default-album/increase-in-cpf-contribution-rates-from-1-january-2022-(2).png?sfvrsn=66124015_0

Voluntary CPF contributions If your total compulsory CPF contributions as an employee and your compulsory MediSave contributions as a self employed person is less than the Learn more about how you can make voluntary contributions to your three CPF accounts to build up your CPF savings Scheduled Maintenance CPF digital services will not be

One of the biggest benefits of voluntary contributions to your CPF is that you can receive tax relief for it For contributions to yourself you can receive the equivalent Every dollar a member contributes yields a dollar in tax relief up to 16 000 a year The top ups must be made by Dec 31 The tax relief comprises 8 000 for top ups

Download Voluntary Cpf Contribution Tax Relief

More picture related to Voluntary Cpf Contribution Tax Relief

The Case For Restoring CPF Contribution Rates Of Older Workers TODAY

https://onecms-res.cloudinary.com/image/upload/s--XEga4gBW--/f_auto%2Cq_auto/c_fill%2Cg_auto%2Ch_622%2Cw_830/v1/tdy-migration/cpf_4_0.jpg?itok=ybSDXit6

CPF BRS To Be Raised By 3 5 Per Year From 2023 To 2027 Older Workers

https://s.yimg.com/ny/api/res/1.2/pIcuUt9xZSJj0ggZiROLew--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTQyMQ--/https://media.zenfs.com/en/the_edge_961/a2c23e7f493e583121c8412fd8bf1a7c

CPF Allocation Rates How They Change As You Grow Older Endowus SG

https://assets-global.website-files.com/60c843c7a86d865e99ca8b67/60dad5d7187bb476a00c7e53_Pandemics%2C recessions and retirement.gif

While you may already be working and making monthly contributions to your CPF account you can still boost your CPF savings with cash top ups These are known as CPF Voluntary Contributions There is no need to file or claim tax relief for your cash top up as CPF will inform the Inland Revenue Authority of Singapore IRAS if you meet all the eligibility criteria for tax

For YA2023 meant for contributions done in 2022 the maximum tax relief for making cash top ups to our CPF accounts is 16 000 8 000 for either RSTU or MediSave top ups to self and You can enjoy an equivalent amount of tax relief for cash top ups made in each calendar year of up to 8 000 if you make a top up to yourself and an additional 8 000 if you

Calculating Employer CPF Contribution CPF Deduction In Singapore

https://linksinternational.com/wp-content/uploads/2021/12/image-1.png

Are CPF Contributions By Employers Taxable

https://www.singaporesecretaryservices.com/wp-content/uploads/2022/04/Are-CPF-contributions-by-Employers-taxable-800x600-1.jpg

https://www.iras.gov.sg/taxes/individual …

CPF Cash Top up Relief is given to encourage Singaporeans and Permanent Residents to set aside money for retirement needs either in their own CPF accounts or those of family members To qualify for the tax

https://www.cpf.gov.sg/employer/making-voluntary-contributions

Learn how to make voluntary contributions to your employees CPF accounts and get tax relief for cash top ups to their retirement savings Find out the types limits and

Last Chance To Lower Your Taxes 3 Tips For The End Of The Year

Calculating Employer CPF Contribution CPF Deduction In Singapore

Singapore CPF Contribution Rates Eligibility Process And Other Details

Significant Changes To CPF MediSave Cash Top Ups And Tax Relief

What The Self employed Should Know About CPF Contributions Endowus SG

Quick Tips On Relief Using SRS Contribution CPFSA Top Up And Voluntary

Quick Tips On Relief Using SRS Contribution CPFSA Top Up And Voluntary

CPF Sous traitance Et Qualiopi Le Projet De D cret

YA2023 Reducing Your Personal Income Tax In Six Ways SG Financial Advice

CPF Contribution Rates Question HardwareZone Forums

Voluntary Cpf Contribution Tax Relief - Every dollar a member contributes yields a dollar in tax relief up to 16 000 a year The top ups must be made by Dec 31 The tax relief comprises 8 000 for top ups