Vpf Tax Benefit 2 5 Lakh Once your total investment in EPF and VPF reaches Rs 2 5 lakh go for PPF where you will get high interest than the post tax return of EPF If you still want to invest more after

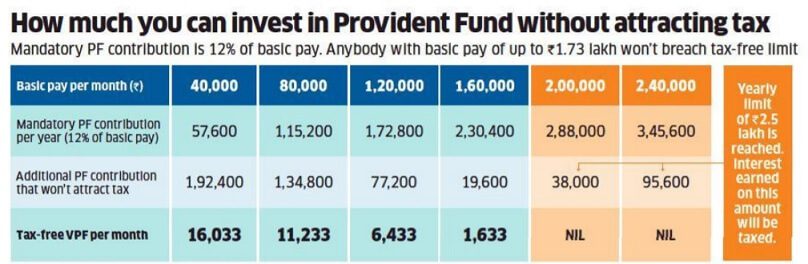

The Rs 2 5 lakh threshold is meant for non government employees It was announced in Budget 2021 that interest on Employees Provident Fund EPF and Voluntary Other than government employees tax exemption limit is 2 5 lakh for one year if EPF contribution exceeds the limit of 2 5 lakh interest earned on EPF contribution above 2 5 lakh is taxable from FY 2021 22

Vpf Tax Benefit 2 5 Lakh

Vpf Tax Benefit 2 5 Lakh

https://www.fisdom.com/wp-content/uploads/2021/08/72.jpg

PPF Vs VPF Which One Is A Good Tax Savings Investment Namita

https://i.ytimg.com/vi/5n5zUqbzq7w/maxresdefault.jpg

Tax On EPF VPF Contribution Above 2 5 Lakhs

http://bemoneyaware.com/wp-content/uploads/2021/03/epf-contribution-tax-free.jpg

As per the provisions of the Income tax Act 1961 if EPF contribution by employee exceeds 2 5 lakh during the financial year interest accrued during the year on such excess The government will tax the interest earned on Provident Fund PF contributions exceeding 2 50 lakh yearly This comes at a time when the Employees Provident Fund Organisation EPFO has

Now an employee can earn tax free interest on contributions of up to Rs 2 5 lakh A limit of 5 lakh will be applicable to cases where employers do not make contributions to the provident fund Finance Minister Nirmala It was proposed by the government in Budget 2021 that interest on Employees Provident Fund EPF and Voluntary Provident Fund VPF contributions above 2 5 lakh in a financial year will be

Download Vpf Tax Benefit 2 5 Lakh

More picture related to Vpf Tax Benefit 2 5 Lakh

How To Select Mutual Funds India 5 Point Checklist

https://weinvestsmart.com/wp-content/uploads/2020/03/Mutual-funds.jpg

Voluntary Provident Fund VPF Interest Rate Benefits Rules

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/10/What-is-VPF.jpg

EPF Vs VPF

https://images.tv9kannada.com/wp-content/uploads/2023/04/epfo-2.jpg

The maximum amount that you can invest via VPF will be Rs 2 06 800 Rs 2 5 lakh less of Rs 43 200 in a financial year This is the maximum amount you can invest while ensuring that interest earned from it remains tax An employee can however contribute up to Rs 2 5 lakh in a year towards VPF without attracting extra taxes There is also no tax on withdrawals and maturity amount from the provident fund

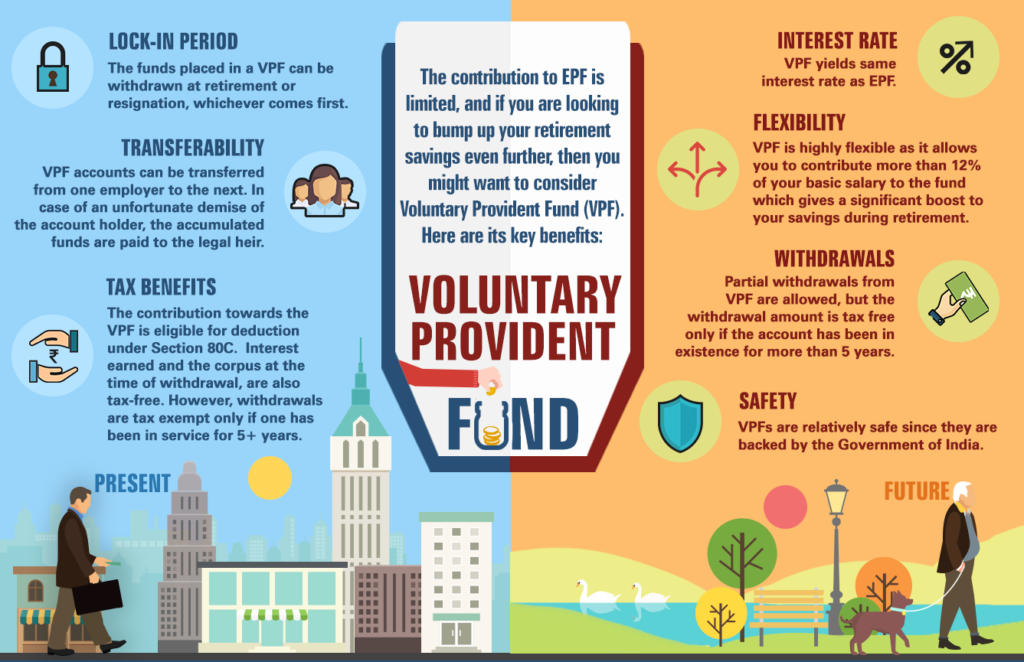

VPF Tax Benefits As mentioned previously a Voluntary Provident Fund enjoys all the benefits of EPF including tax benefits Contributions made to an EPF account in a specific year are The move is aimed at encouraging the lower middle and middle income salaried classes to save more via EPFO and enable them to build a reasonable retirement kitty The

NPS Vs ELSS Vs VPF Which One Should You Choose For Higher Tax Benefit

https://imgk.timesnownews.com/story/money_stacks.png

VPF In Hindi

https://www.indiareviews.com/wp-content/uploads/2020/05/vpf-account.jpg

https://www.timesnownews.com › business-economy › ...

Once your total investment in EPF and VPF reaches Rs 2 5 lakh go for PPF where you will get high interest than the post tax return of EPF If you still want to invest more after

https://economictimes.indiatimes.com › wealth › invest

The Rs 2 5 lakh threshold is meant for non government employees It was announced in Budget 2021 that interest on Employees Provident Fund EPF and Voluntary

VPF Vs EPF In Hindi VPF Kya Hota Hai Vpf Voluntary Provident Fund

NPS Vs ELSS Vs VPF Which One Should You Choose For Higher Tax Benefit

VPF Interest Rate Voluntary Provident Fund Calculation

NPS Income Tax Benefits FY 2020 21 Old New Tax Regimes

Best Highest Dividend Paying Stocks In India 2023

Will There Be A Recession In 2020

Will There Be A Recession In 2020

VPF Interest Rate Eligibility Withdrawal Rules And Tax Benefits

What Is VPF Voluntary Provident Fund Tax Benefit In VPF VPF Vs EPF

VPF A Good Tax Saving Retirement Option

Vpf Tax Benefit 2 5 Lakh - The government will tax the interest earned on Provident Fund PF contributions exceeding 2 50 lakh yearly This comes at a time when the Employees Provident Fund Organisation EPFO has